Choosing the right compensation management software is essential for aligning sales performance with business goals while ensuring accurate and transparent payouts.

With a growing number of solutions available, businesses need tools that not only automate commission calculations but also provide flexibility, reporting, and seamless integrations.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesThis guide evaluates five leading platforms—QuotaPath, Xactly, Spiff, CaptivateIQ, and Performio—based on their usability, key features, and effectiveness in streamlining sales compensation processes. Whether you need real-time reporting, AI-powered intelligence, or intuitive commission tracking, this comparison will help you find the best fit for your organization.

| Tool | Rating | Description |

| QuotaPath | 4.7 out of 5 | QuotaPath is a user-friendly commission tracking and sales compensation management software. It automates and streamlines processes across RevOps, finance, and sales teams, integrates with CRM and finance systems, and provides resources for compensation plan design and implementation, making it ideal for any organization. |

| Xactly | 4.3 out of 5 | Xactly automates the design and management of incentive compensation plans that align seller behavior with revenue goals. It reduces administrative time, improves quota attainment, and increases payout accuracy. Seamlessly integrating with CRM, ERP, and other systems, it offers a complete view of program effectiveness and supports strategic decision-making. |

| Performio | 4.4 out of 5 | Performio software is an incentive compensation management platform, used for automating and managing sales commission calculations. It allows businesses to design complex compensation plans and track sales performance while streamlining the calculation and distribution of commissions to sales teams. |

| Spiff | 4.7 out of 5 | Spiff software merges the simplicity of spreadsheets with robust commission automation, enabling finance and sales operations teams to efficiently manage intricate incentive compensation plans. It fosters organizational trust, motivates sales teams, and offers performance visibility for organizations of all sizes. |

| CaptivateIQ | 4.7 out of 5 | CaptivateIQ is a versatile commission management solution that blends the ease of spreadsheets with advanced automation tools. It allows companies to efficiently design, calculate, and manage complex incentive compensation programs. This software helps teams adapt swiftly, minimize errors, and gain real-time insights, ensuring alignment with changing business goals. |

What Is Compensation Management Software?

Compensation management software is a tool used by organizations to plan, manage, and administer employee compensation packages. These packages may include salaries, bonuses, and other incentives. The software helps ensure fair and competitive pay structures aligned with organizational goals while adhering to compliance regulations. Compensation tools also help organizations make informed decisions about employee compensation based on data-driven insights.

What To Look For In A Compensation Management and Planning Tool

The global sales compensation tools sector is projected to triple in value by 2033 compared to 2022.

Although the market is becoming increasingly competitive, choosing the best salary benchmarking tools for your business can be straightforward if you know what factors to look for during the selection process.

Here’s what to consider when choosing the best compensation management software for your organization.

Sales Commission Reports in QuotaPath

QuotaPath’s sales compensation reporting helps you measure the business value and performance of the GTM team’s compensation plans and performance.

Take Me to BlogSales commission reporting

Your solution should produce executive- and rep-level revenue forecasts and quota attainment reports. Choose compensation analysis tools that automatically generate accurate estimates using CRM data, allowing leadership to view their sales team’s projections.

Compensation plan modeling

When it’s necessary to modify or develop new plans, your platform should enable you to outline a plan proposal and evaluate it using historical sales data.

Ensure that your chosen compensation tool gives you autonomy to build and edit plans without the need of Support. “I’m really impressed that we can build our comp plans ourselves in QuotaPath and have full ownership of the process. Having that understanding and control is a huge factor for us,” said Hadley Kornacki, VP of Operations at Edgility Consulting.

Plan effectiveness tracking

Adjusting incentive plans based on their effectiveness and market conditions is a standard practice. Choose a tool that supports compensation plan performance monitoring to assess a compensation plan’s success. This type of platform provides insights into team performance and displays sales metrics such as average effective rate, plan attainment, and total earnings by salesperson.

ASC-606 compliant

The compensation tool you select should enable your accounting team to monitor audit trails and recognize commission expenses to simplify compliance with the new ASC 606 regulations.

Easy support access

Choose a vendor that is easy to contact after you sign up.

Seek continual customer support services with short response times for creating and adding new plans, adjusting comp plans, or running payouts.

Rep motivation

Identify a solution that Finance, RevOps, and your Reps will enjoy using. The software you choose should have an intuitive interface that’s easy to navigate. It needs to help reps to understand their comp plans by providing them with reporting and dashboards to easily view goals, accelerators, and bonuses and monitor milestone achievement progress.

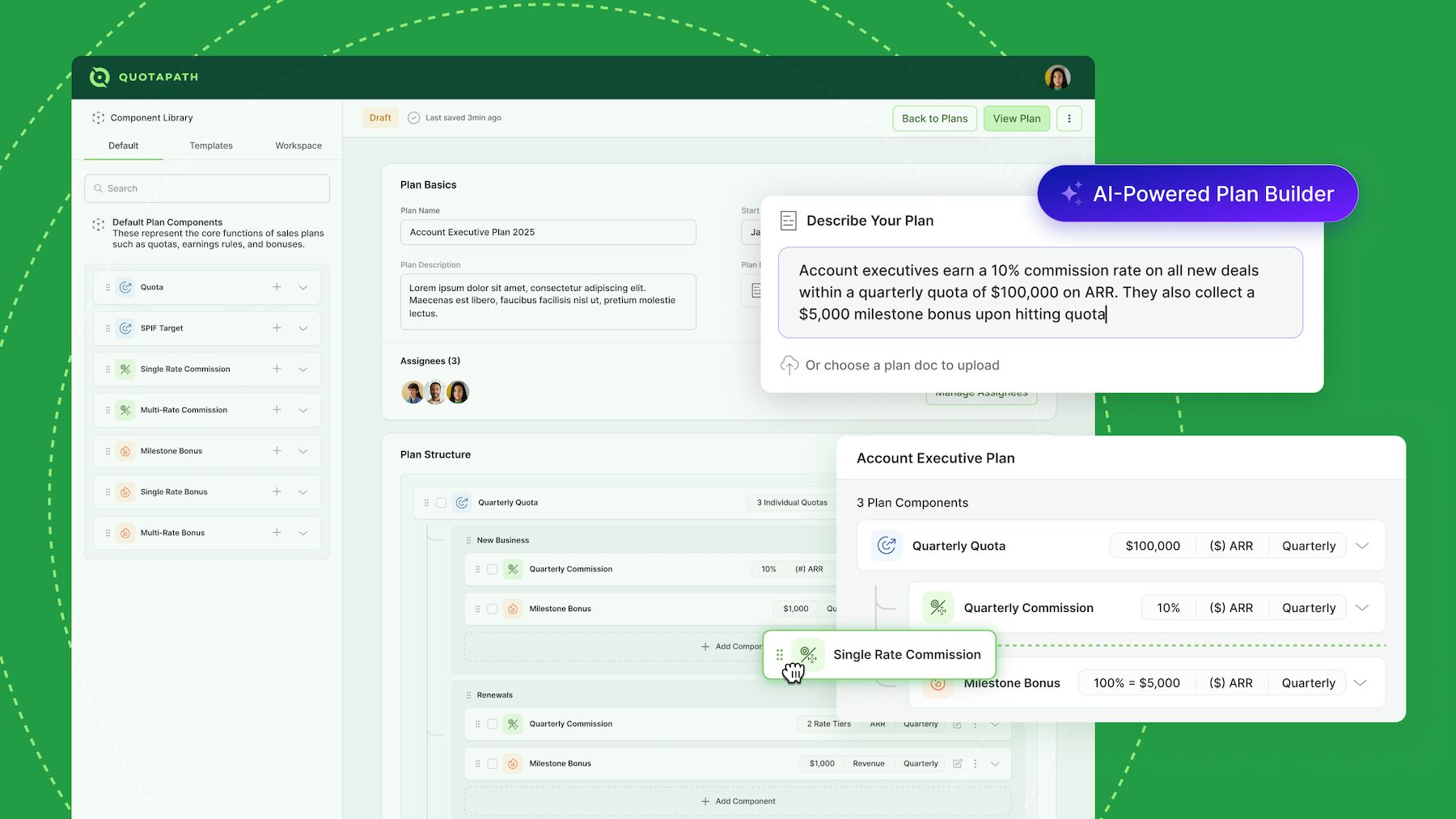

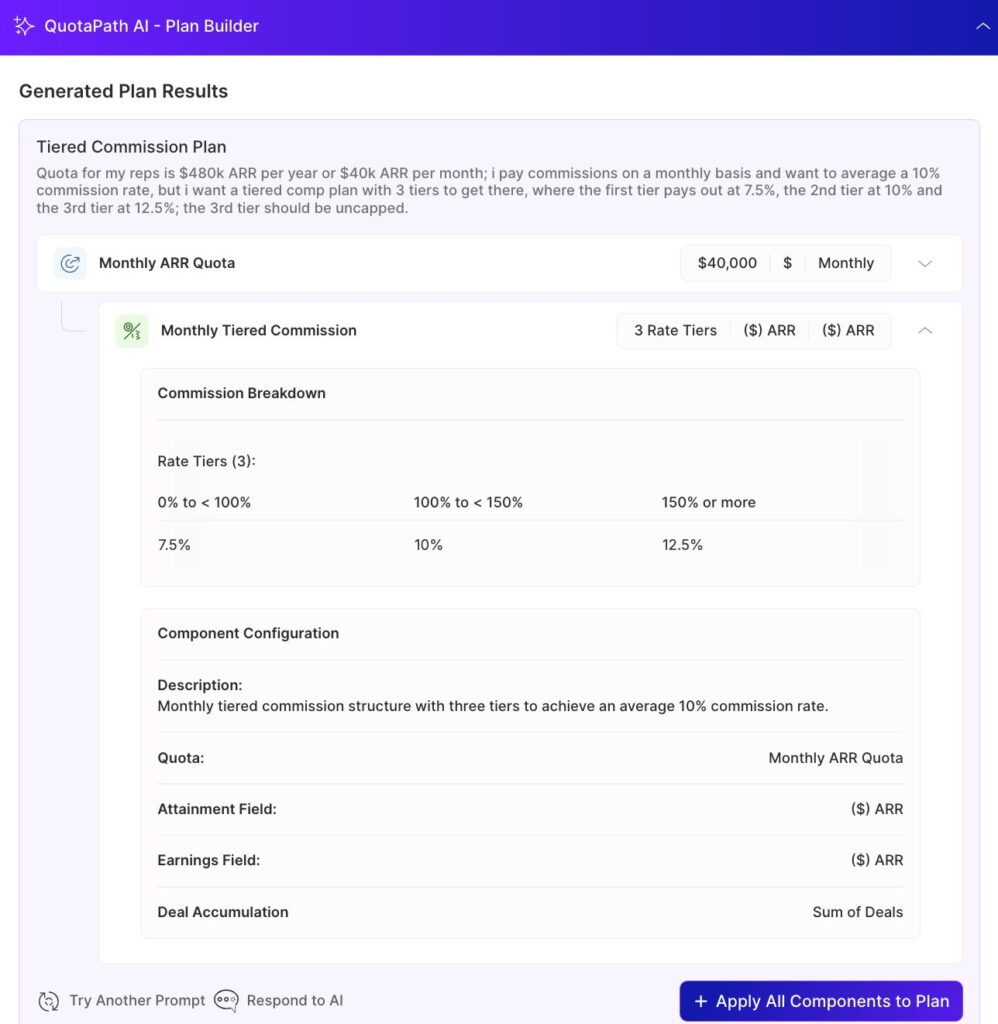

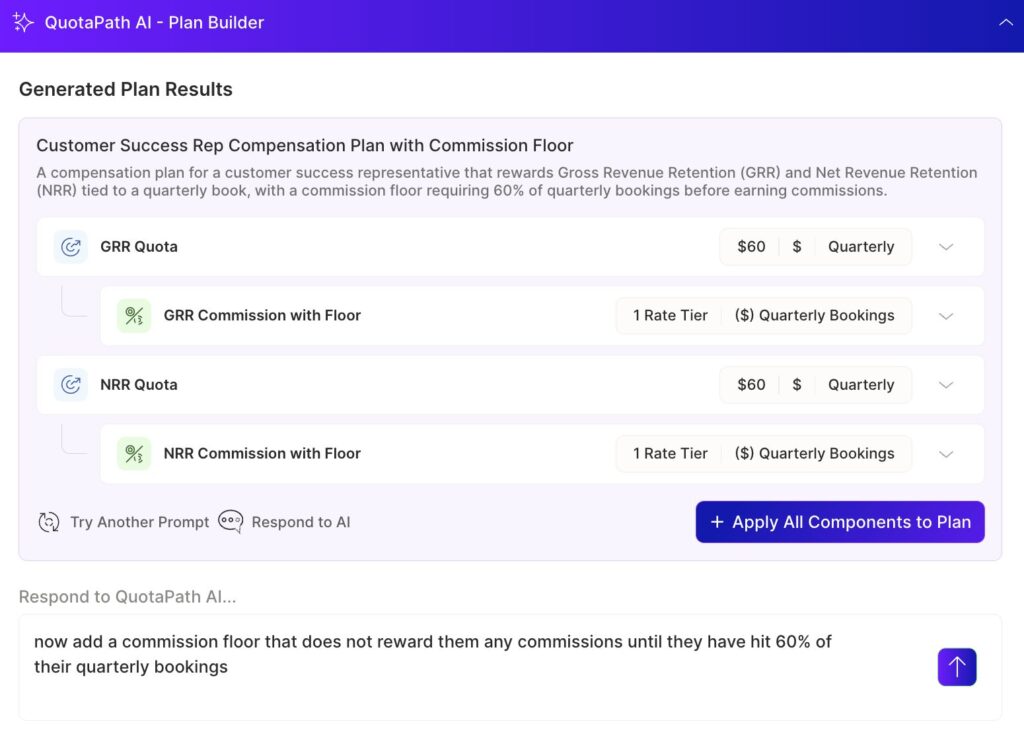

Meet the Industry’s First AI-Powered Compensation Plan Builder

Speaking of intuitive… have you heard about QuotaPath’s AI-Powered Plan Builder to configure your comp plans to QuotaPath with ease?

Take Me to BlogIn-app communication

Team collaboration features in your selected platform help streamline the compensation discrepancy dispute resolution process. For example, look for features that enable reps to escalate disputes through the software, where Finance and Accounting can quickly respond.

Top 5 Compensation Management Tools

We’ve gathered insights about the five best salary benchmarking tools to aid in your selection process.

QuotaPath

QuotaPath is a commission tracking and sales compensation management software. It simplifies and automates processes across RevOps, finance, and sales teams, integrates with CRM and finance systems, and offers resources for compensation plan design and implementation, suitable for various organizations.

Key Features:

- Performance Plan Modeling and Forecasting

- HubSpot and Salesforce visibility directly in those apps

- Multi-level payout approvals

Best Used for: cost-effectiveness, ease of use, and ability to improve commission visibility and confidence among sales teams, with strong customer support, seamless tech stack integration, and robust plan modeling and forecasting capabilities

G2 Rating: 4.7 out of 5

Xactly

Xactly streamlines incentive compensation plans to align sales rep behavior with revenue goals. It cuts admin time, boosts quota achievement, and ensures accurate payouts. Integrating with CRM, ERP, and other systems, it provides a full view of program effectiveness and aids strategic decisions.

Key Features:

- Compensation configurator

- Customized incentive statements

- Real-time reporting and dashboards

Best Used for: excellent customer support, ease of configuration, and accurate commission calculations.

G2 Rating: 4.3 out of 5

Spiff

Spiff software integrates the simplicity of spreadsheets with comprehensive commission automation, allowing finance and sales operations teams to effectively manage complex incentive compensation plans. It enhances organizational trust, motivates sales teams, and provides performance visibility for enterprises of various sizes.

Key Features:

- Advanced Reporting & Analytics

- Advanced Team Management

- Powerful Testing Capabilities

Best Used for: visibility into commissions, ease of use, and intuitive navigation

G2 Rating: 4.7 out of 5

CaptivateIQ

CaptivateIQ is an adaptable commission management solution that combines the simplicity of spreadsheets with sophisticated automation tools. It enables organizations to efficiently design, compute, and oversee intricate incentive compensation programs. This software facilitates teams to swiftly adapt, reduce errors, and obtain real-time insights, thereby ensuring alignment with evolving business objectives.

Key Features:

- SmartGrid™: ELT & Calculation Engine

- Assist: AI-Powered Intelligence

- Enterprise Workflow Automation

Best Used for: highly customizable, user-friendly, and effective for clear reporting and commission calculation transparency, supported by a strong customer service team

G2 Rating: 4.7 out of 5

Performio

Performio software is an incentive compensation management tool for automating and managing sales commission calculations. It enables businesses to create complex compensation plans, monitor sales performance, and simplify the calculation and distribution of commissions to sales teams.

Key Features:

- Native data integrations

- Pre-built incentive automation

- Robust reporting capabilities

Best Used for: Ease of use and navigation, plus commission tracking ease

G2 Rating: 4.4 out of 5

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialPartnering with the Best Compensation Planning Software

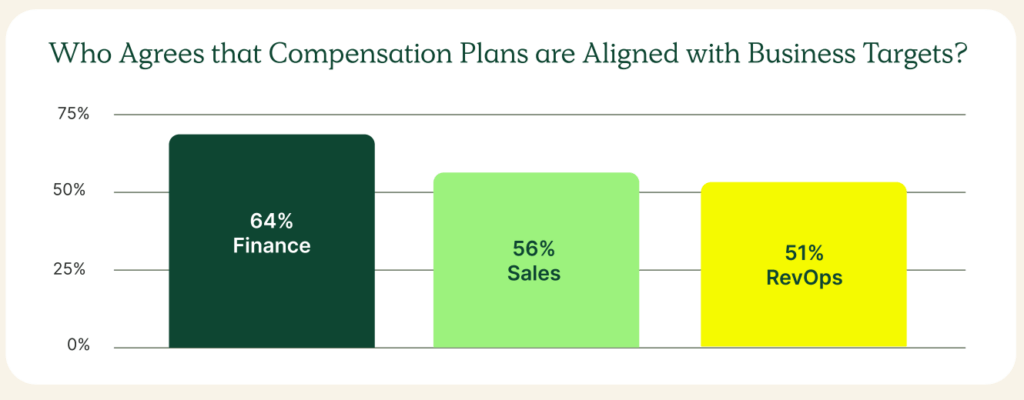

The growing complexity of compensation structures, a focus on revenue performance, and the rise of remote work have made compensation analysis tools essential. Choosing the best compensation management software is crucial for optimizing sales performance and ensuring fair, transparent, timely, and accurate payouts.

There are advantages of leveraging compensation tools such as increased payroll accuracy and efficiency, earnings transparency, sales rep motivation, and cost savings.

QuotaPath provides a user-friendly interface with straightforward updates and transparent, low professional service fees when compared to major competitors. The platform includes free native, real-time integrations, a free trial period, quick implementation, and dedicated support.

Multiple native CRM integration options, visible pricing, short implementation times, and compensation plan modeling make QuotaPath different than other compensation management tools.

As you work through the compensation management software selection process, seek:

- Easy and accessible sales compensation reporting

- Compensation plan modeling and testing capabilities

- Plan effectiveness tracking

- Streamlined commission payouts

- ASC-606 compliance capabilities

- Driving sales performance

- Support access

- A platform your reps will use and enjoy

- In-app team collaboration features

QuotaPath fulfills these requirements and more, making us the top compensation management software.

Discover why QuotaPath is the best option. Explore QuotaPath with a free trial or schedule time with a team member today.

FAQs

How does compensation management software work?

Compensation management software consolidates data through integrations with various platforms enabling plan administrators to create, calculate, and manage employee compensation packages. Such a platform automates processes, ensuring fair and competitive pay while adhering to budget constraints and market trends. It typically includes features for compensation analysis, benchmarking against industry standards, and reporting to facilitate informed compensation decisions.

What are the benefits of using compensation management software?

The benefits of leveraging compensation management tools include efficiency, accuracy, improved sales, motivation, transparency, and a single source of compensation information.

This software helps eliminate errors in payroll calculations, reduces the time needed to prepare payroll, and gets all teams on the same page through access to the same compensation data.

Employees also gain a greater understanding of how they earn and can track their earnings, motivating them to pursue and achieve greater results to drive organizational goal attainment.

Can compensation management software integrate with other tools?

Yes, compensation management software can integrate with other tools fundamental to the commission process. Integrations include CRMs, data warehouses, spreadsheets, business analytics, and payment and ERP systems. This facilitates smoother data flow and more accurate compensation calculations by pulling relevant employee data from multiple sources. These integrations also enable robust reporting, enabling informed strategic decision-making.

What types of compensation can these tools manage?

Compensation management tools can manage a variety of compensation types. For instance, compensation tools administer base salary, bonuses, commissions, incentives, stock options, merit increases, performance-based pay, benefits, paid time off, and other types of employee incentives. These platforms also enable adjustments based on individual performance, market data, and company budget.

Recent Comments