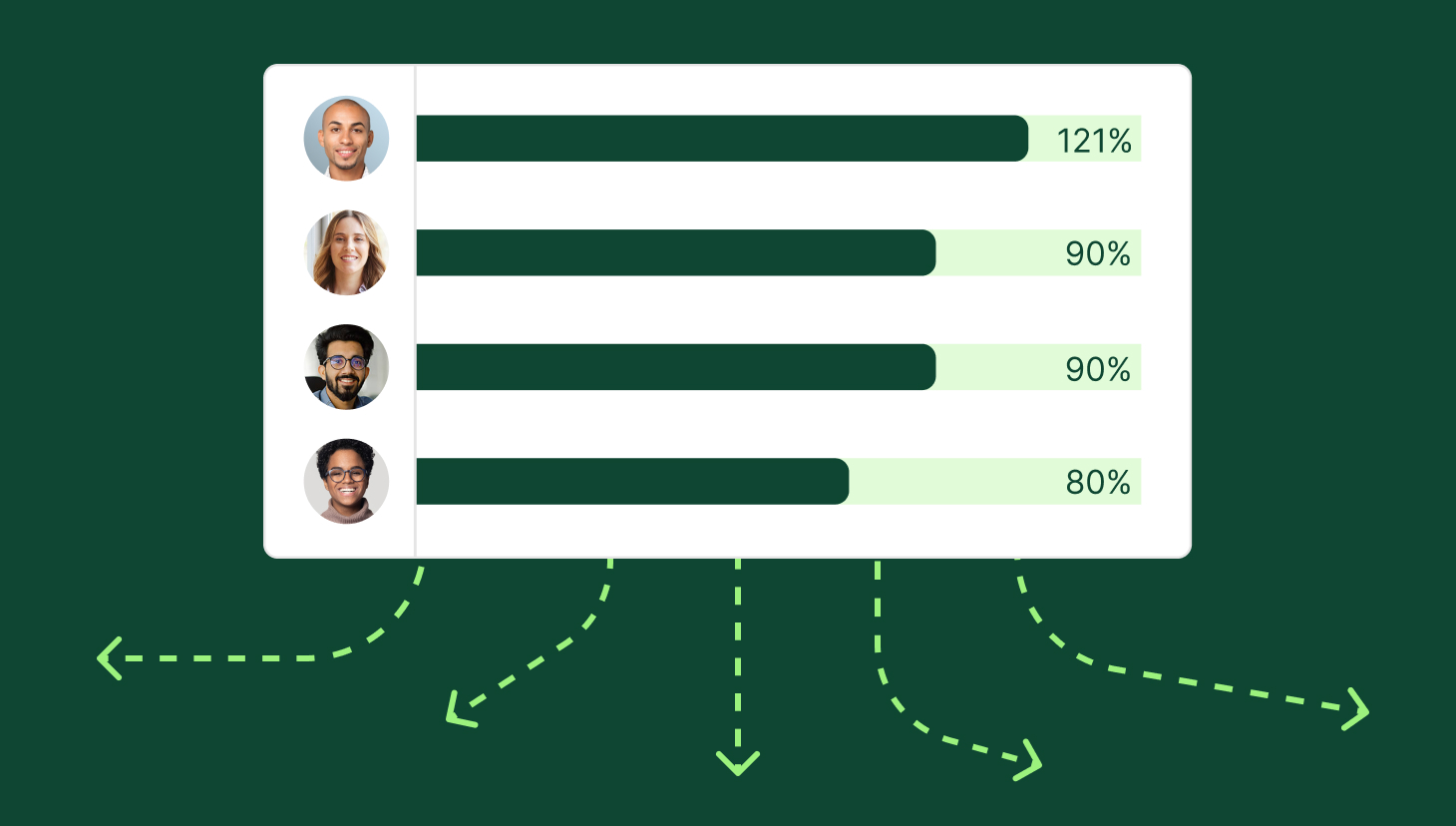

Commission payouts are essential for driving sales performance, yet 80% of companies have paid their reps incorrectly at some point.

Is this correlated to the fact that our biggest competitor is the spreadsheet?

We’d like to think so.

More Stats on Comp Challenges

Read the full report on Solving the Biggest Sales Compensation Challenges.

Read ReportFor Keegan Otter, Head of Revenue at Warmly, managing commissions manually in Google Sheets worked—until it didn’t.

“What started as a small problem grew as we scaled. I went from spending an hour on commissions to multiple hours, and then the errors started creeping in,” Keegan said. “My CEO would audit it and catch something. Then Biz Ops would catch something we missed. When three sets of eyes are missing errors, that’s when you know there’s a problem.”

Warmly’s team expanded from three reps to over 30 in just two years.

As commissions became more complex, manual processes led to payout errors, misalignment, and wasted time—valuable hours that could have been spent driving revenue.

“When it comes to commissions, you don’t want to get it wrong. You’re dealing with people’s paychecks,” said Keegan. “My anxiety skyrocketed as I spent more time troubleshooting, double-checking formulas, and answering Slack messages about payouts. At that point, I knew we needed to automate.”

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialWhy Automation is Essential for Growth

For companies like Warmly, automating commissions isn’t just about saving time—it’s about reducing costly errors, improving transparency, and boosting sales performance.

Having an automated, audit-ready system is no longer optional—it’s a necessity.

“Before QuotaPath, commissions were a black box,” said Keegan. “The reps had no visibility, and even leadership was surprised at the final payouts. Now, our team sees exactly what they’ll earn as they close deals, which builds trust and motivation.”

Beyond accuracy, automation saves significant time. Instead of spending 5+ hours per month troubleshooting commissions, Keegan and his leadership team can now focus on strategy and revenue growth.

“QuotaPath has saved us a lot of money just in executive time alone. If you take my salary, the CEO’s salary, and our Biz Ops manager’s salary—and then factor in the hours we were spending troubleshooting—it’s a huge cost saving,” said Keegan. “And that doesn’t even include the value of being able to actually forecast commissions correctly.”

By replacing spreadsheets with an automated solution, Warmly streamlined operations and strengthened sales culture. Reps know what they’re earning, leadership has full visibility, and commissions are processed quickly and accurately.

If your team is still manually managing commissions, it’s time to consider the ROI of automation.

The ROI of Commission Automation

For companies like Warmly, automating commissions was about reclaiming time, reducing costly errors, and building a more transparent sales culture.

When a simple process becomes a bottleneck, it slows down the business and erodes trust.

Keegan summed it up best: “When it goes from taking an hour of my time to two to three hours—and then the back-and-forth in Slack takes even more time—you realize it’s just a bubbling problem that shouldn’t exist,” said Keegan.

QuotaPath solved that problem, delivering measurable ROI in three key ways:

Saves Time

Before implementing automation, commission tracking often requires:

- Exporting CRM data

- Adjusting spreadsheets

- Cross-checking deal terms

- Manually validating earnings

Keegan lived this process firsthand, spending hours in Google Sheets reconciling payouts.

At first, it was manageable. But as Warmly scaled, so did the complexity.

“What used to take me maybe an hour and a half started taking multiple hours. And it wasn’t just my time—it was my CEO’s time, Biz Ops’ time, and then even more time going back and forth in Slack. It wasn’t sustainable.”

With QuotaPath, Warmly eliminated this manual work.

Real-time calculations now ensure commissions are accurate from the start, reducing the need for troubleshooting and audits. Instead of firefighting errors, Keegan and his leadership team can focus on revenue-driving initiatives.

“QuotaPath gave me hours of my time back every month. Now, I don’t have to stress whether the math is right—it just works.”

Integrate Your Data

Connect your source of truth, whether it’s your CRM, Rippling, ERP, or data warehouse for trusted, accurate commissions.

See All IntegrationsReduces Errors

Additionally, manual commission tracking is prone to mistakes, and Warmly wasn’t immune.

As the team scaled, so did the risk of payout discrepancies.

“I’m not a mathematician—I have a PR degree,” said Keegan. “But you don’t want to get it wrong when it comes to commissions. And once we had 35 reps, there was no way I could do this in Google Sheets without making mistakes.”

With QuotaPath:

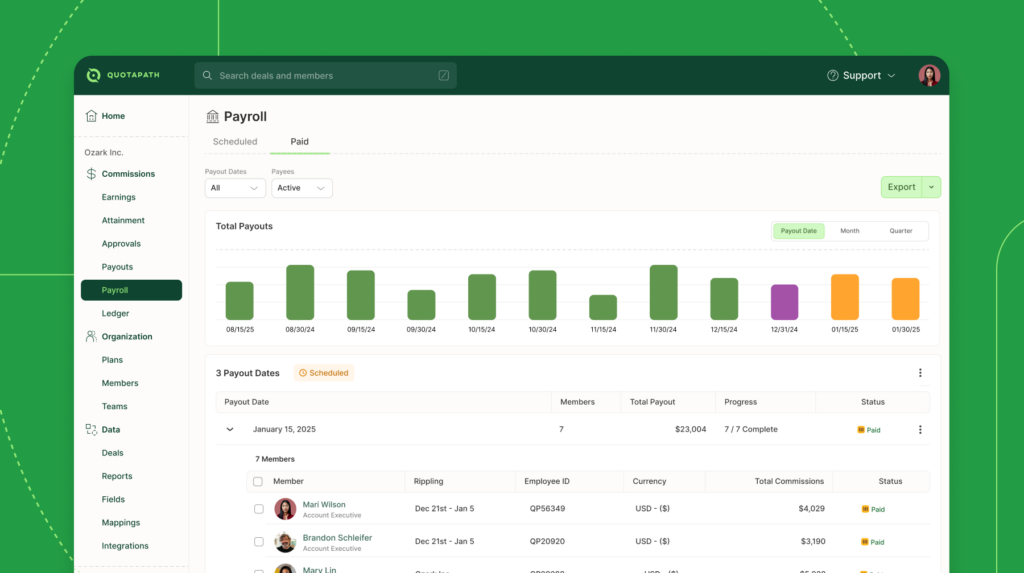

- Payouts are ASC-606 compliant and audit-ready

- Data syncs directly from the CRM, eliminating manual entry mistakes

- Leadership has full visibility, preventing last-minute payout surprises

- Leaders can use comp to drive sales revenue

Fosters Transparency & Motivation

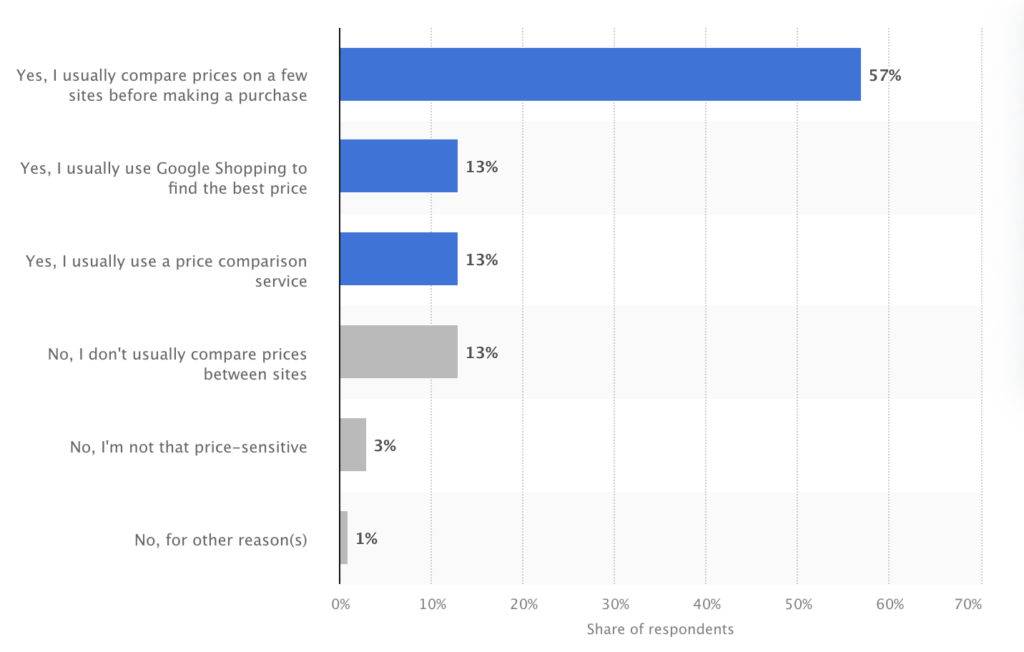

Lastly, when commission calculations happen behind closed doors, reps are left guessing their earnings.

That lack of visibility creates uncertainty and, even worse, shadow accounting.

“That’s not a good way to run a sales team,” said Keegan.

QuotaPath changed that.

Warmly’s reps see their commissions in real time as deals close, reducing disputes and increasing motivation.

“Now our team can see, ‘If I close this deal, I’ll earn this much.’ That builds trust. And when reps trust their comp plan, they focus on closing more deals instead of second-guessing their pay,” said Keegan.”

With QuotaPath, commission automation doesn’t just improve accuracy and efficiency—it strengthens company culture by ensuring everyone, from reps to executives, is aligned and informed.

How QuotaPath Delivers ROI Through Commission Automation

Saving time, reducing errors, and increasing transparency are game-changing for any sales organization.

But the real power of commission automation comes from seamless integrations, intuitive plan-building tools, and smarter payout processes—all of which ensure sales and finance teams stay aligned.

For Keegan and Warmly, these were key factors in choosing QuotaPath.

“We’re a startup—our comp plan this quarter might slightly change next quarter,” said Keegan. “I needed something easy to adjust and manage myself. When I talked to QuotaPath’s CEO, he asked me what I had today in spreadsheets and showed me exactly how simple it would be to transfer over. That gave me confidence.”

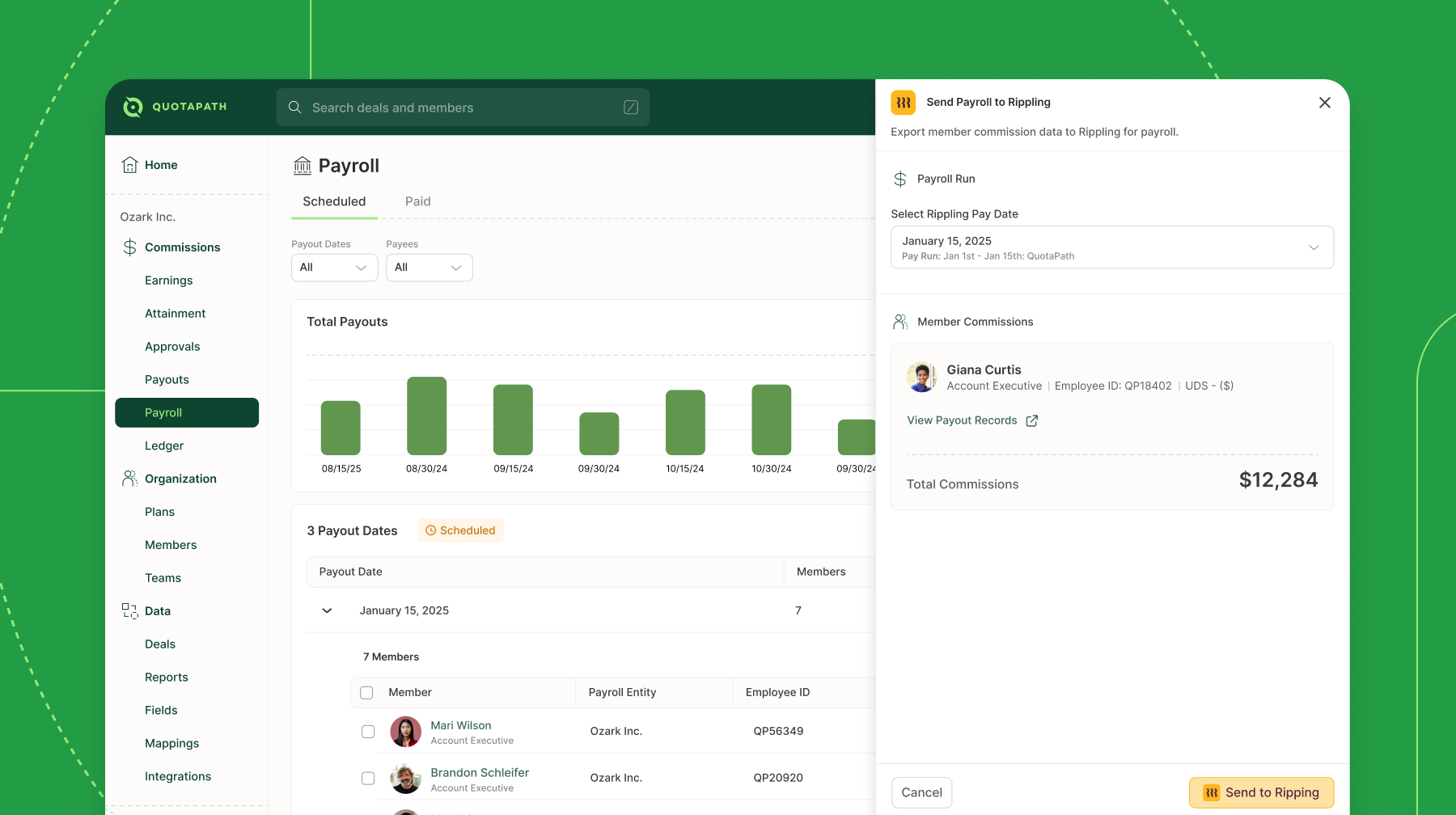

Seamless CRM and Payroll Integrations

Data silos and manual exports create inefficiencies that slow down commission payouts. QuotaPath eliminates these roadblocks by integrating directly with leading CRMs and payroll platforms, including Salesforce, HubSpot, Rippling, Xero, and Microsoft Dynamics 365.

For companies like Warmly, this means eliminating the need to cross-reference spreadsheets with CRM data, ensuring real-time syncing of deal data to improve accuracy, and pushing payouts directly to payroll to remove manual entry errors.

“I know where my closed-won revenue lives in the CRM,” said Keegan. “So when I started using QuotaPath, I wanted it to map directly to that data. Once we connected everything, it became a true set-it-and-forget-it system.”

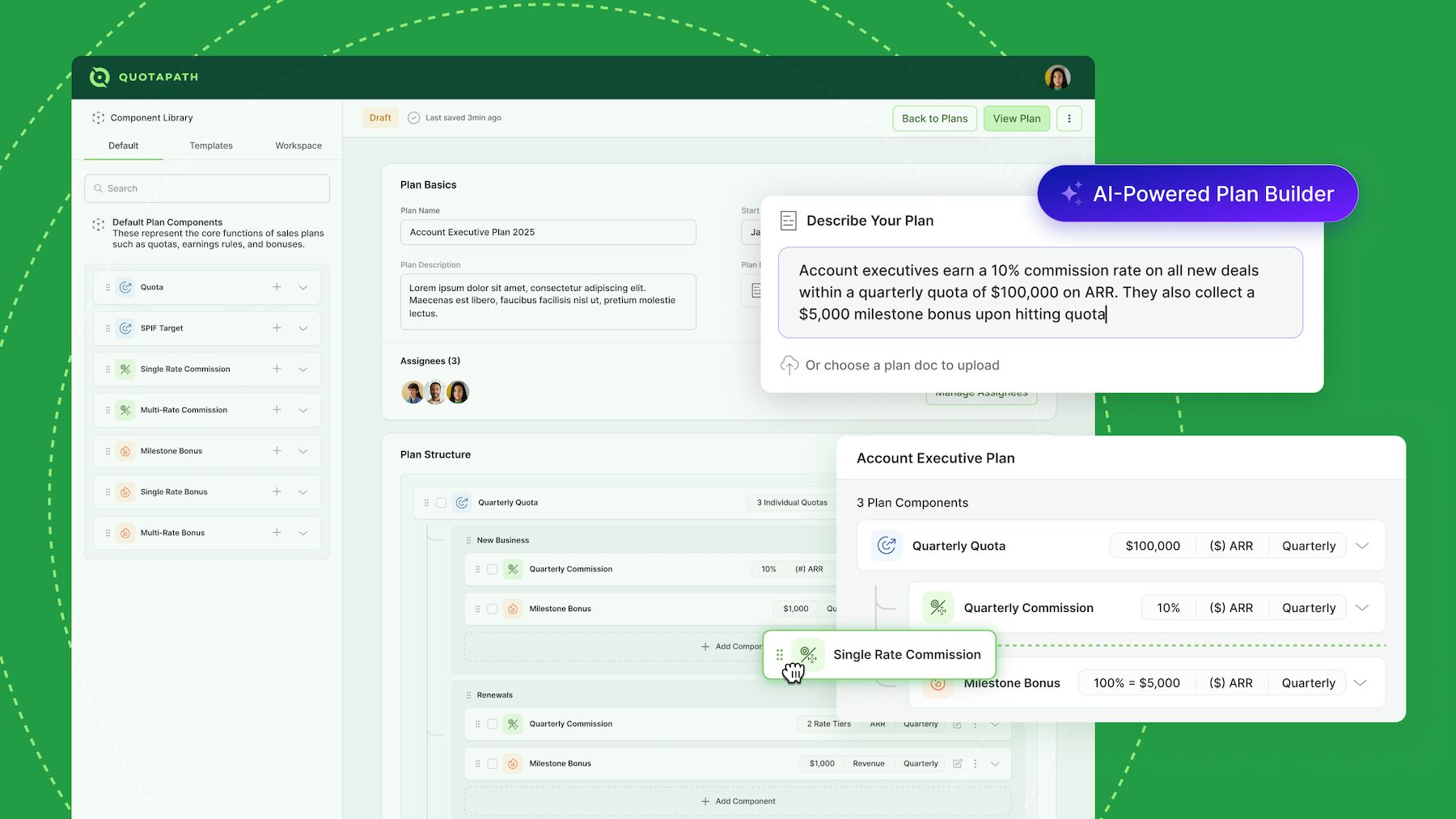

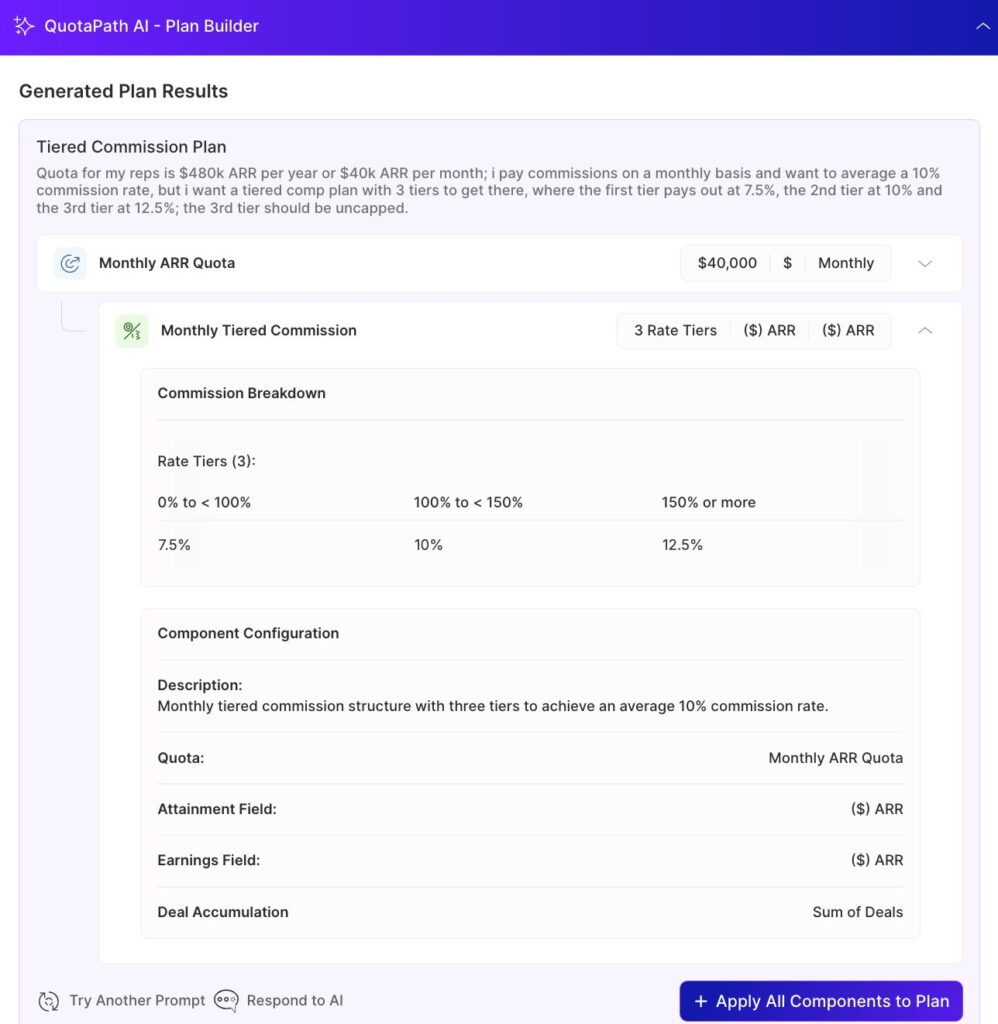

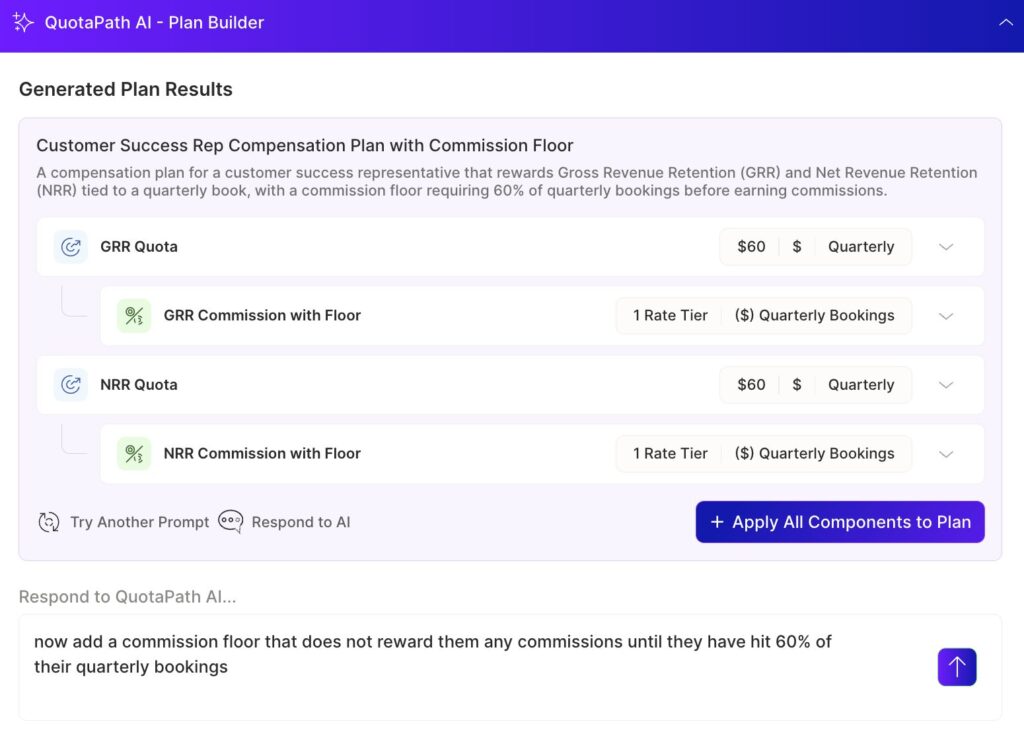

Meet the Industry’s First AI-Powered Compensation Plan Builder

Easily create, customize, and optimize compensation plans faster than ever within a commission tracking platform.

Learn MoreAI-Powered Plan Builder: Faster, Smarter Compensation Design

For high-growth companies, like Warmly, compensation plans are not static. Rather, they evolve as headcounts grow and incentives shift.

QuotaPath’s AI-Powered Plan Builder makes building, adjusting, and optimizing compensation structures easy without requiring specialized RevOps or Finance expertise.

“We might add an accelerator or change our SDR headcount plan from one quarter to the next,” said Keegan. “With other tools, that means a massive implementation fee or complex configurations. With QuotaPath, I can make adjustments myself or have my CSM help in minutes.”

Using AI-powered tools, teams can automatically import compensation structures from spreadsheets, modify plans in real time without developer support, and ensure payout logic aligns with evolving business goals.

Multi-Level Payout Approvals

One of the biggest risks in commission management is premature or incorrect payouts.

Without proper approval workflows, companies either delay commissions while manually reviewing them or risk paying out incorrect amounts, leading to clawbacks and frustration.

QuotaPath introduces a structured approval process that allows RevOps and Finance leaders to review and approve commission payouts before they hit payroll, automate workflows to reduce Slack back-and-forth and last-minute audits, and provide full visibility into scheduled payouts to ensure leadership alignment.

“QuotaPath has improved our procedures, turning a two-hour commission calculation task into a quick 15-minute job.”

— Reza K., CEO at Reignite.

Sales Rep Dashboards and Performance Insights

For commission plans to drive the right behaviors, sales representatives need real-time visibility into their earnings. Before using QuotaPath, many teams struggled with a lack of transparency, leaving reps unsure of how much they had actually made.

“The transparency that we have back to the team is fantastic,” said Genevieve Moss-Hawkins, Systems Operations Senior Manager at NeuroFlow. “Being able to look at what they have in pipeline and forecast what they would make if certain deals were to close—and then all the way through to when they close the deal, seeing exactly how the commission was calculated—has been met really well by our team.”

QuotaPath tracks quota attainment, helping representatives see how close they are to hitting targets.

It also offers visibility into accelerators and bonuses, upcoming payout projections to prevent last-minute surprises, and earnings forecasting to support strategic pipeline planning.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesWhy Companies Can’t Afford to Ignore Commission Automation

Manual commission tracking is more than just a time drain—it introduces errors, slows down payouts, and erodes organizational trust.

As Keegan at Warmly experienced firsthand, what starts as a manageable process quickly spirals into a costly bottleneck as a company scales.

Automation eliminates these inefficiencies, giving teams accurate, real-time commission data, seamless integrations, and the flexibility to adjust comp plans without disruption. Companies that embrace AI-powered commission management are not just improving payroll workflows—they’re creating a transparent, motivated sales culture that drives revenue growth.

The future of commission management is clear. Automated solutions are no longer optional—they are essential for scaling sales.

To see how QuotaPath can improve your commission ROI, book a demo today.

Recent Comments