INBOUND 2024 was a whirlwind of energy, innovation, and unforgettable experiences.

The QuotaPath team was right in the heart of it all, making waves with our massive casino-themed booth (because who wants to gamble on commissions?), an exciting product launch in HubSpot with our App Cards, a speaking session that drew a filled room on pipeline reviews, and co-sponsoring one of the best happy hour events of the week.

We also had the opportunity to connect with some of the brightest minds—HubSpot executives, App Partners, developers, customers, and more—throughout meeting-filled days.

But the real win? The pipeline we generated from booth demos, valuable conversations, and engaging experiences. INBOUND 2024 proved to be not just an incredible event, but a wise investment with a lucrative return for our team.

If you didn’t catch it all, don’t worry—we’ve rounded up the top 10 things you might have missed!

Let’s dive in.

Easy. Fast. Unified.

Much of the theme from INBOUND’s Partner Day, an invite-only event designed exclusively for HubSpot partners, including solutions partners, app partners, and agency partners, focused on the theme, “Easy. Fast. Unified.”

This included a nod to the 200 product updates HubSpot launched throughout the Fall of 2024, and HubSpot’s ongoing efforts to bring together app and solutions partners who complement and build upon HubSpot’s easy, fast, and unified methodology.

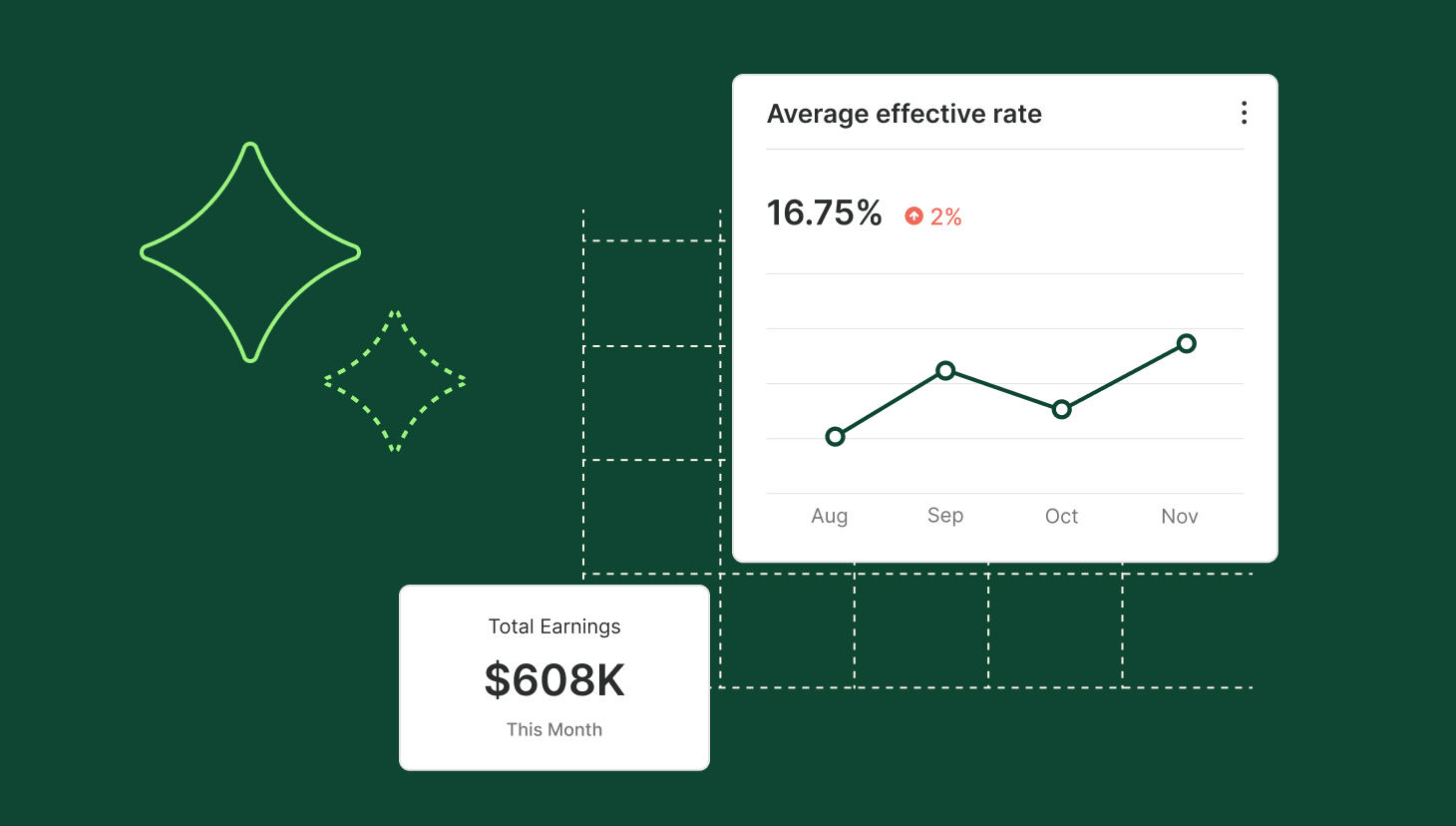

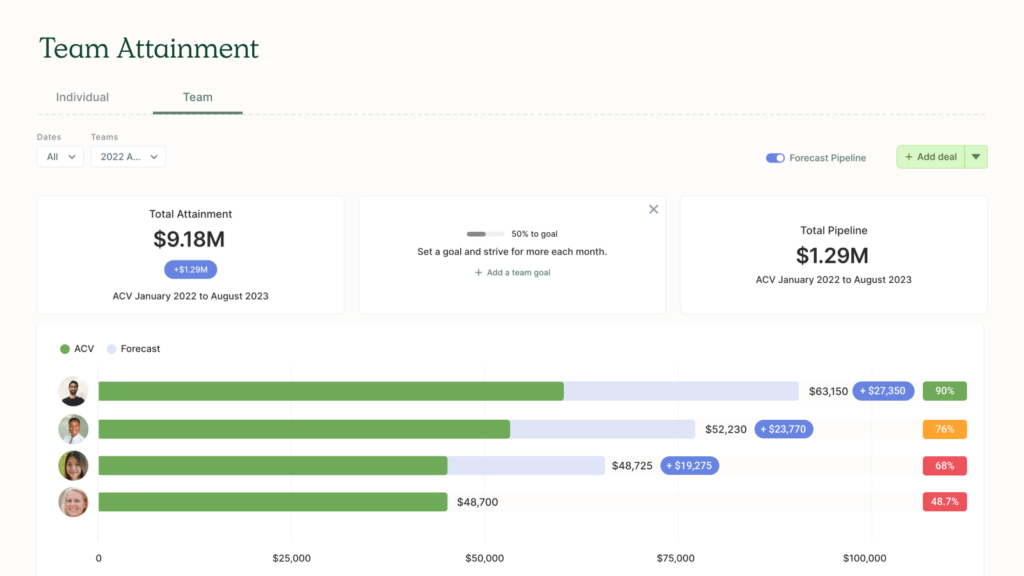

Like us, who have invested in making significant enhancements to our integration with HubSpot that continue to bring powerful new capabilities to the HubSpot CRM ecosystem. (See: Commissions data and actions now in HubSpot.)

“At HubSpot, we work with scaling companies from all over the world, and they all have three things in common: they value tools that are easy, fast, and unified,” said Andy Pitre, EVP of Product at HubSpot, “Without these three ingredients, growth is harder to achieve. That’s why everything we build at HubSpot is easy, fast, and unified, including the over 200 updates from this year’s Fall 2024 Spotlight.”

Breeze

The darling of the Fall 2024 Spotlight was none other than Breeze, HubSpot’s AI to power the customer platform.

As part of this, HubSpot introduced Copilot, a new AI companion designed to boost productivity and streamline work across the platform. It includes four AI agents—Content Agent, Social Media Agent, Prospecting Agent, and Customer Agent—that help users complete tasks efficiently.

Additionally, HubSpot unveiled Breeze Intelligence, a powerful data enrichment and buyer intent solution. Breeze enriches contact and company records using a database of over 200 million profiles and identifies high-fit prospects through buyer intent data. It also features form shortening, automatically filling in known information to improve conversion rates. Copilot and Breeze Intelligence are part of over 80 new AI-powered features embedded in HubSpot’s platform.

Read more about Breeze here.

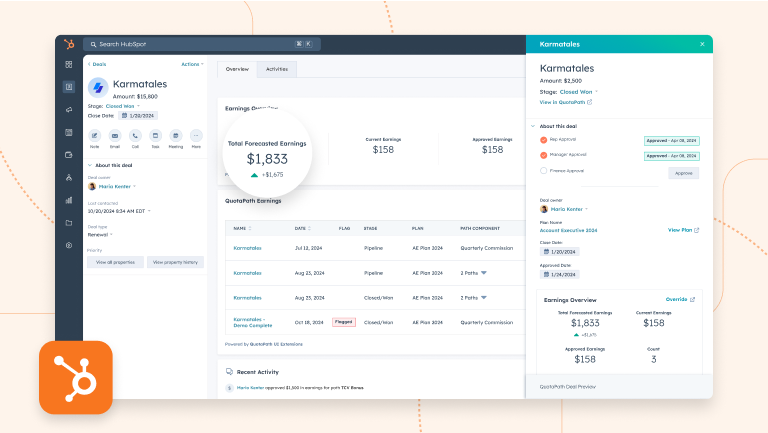

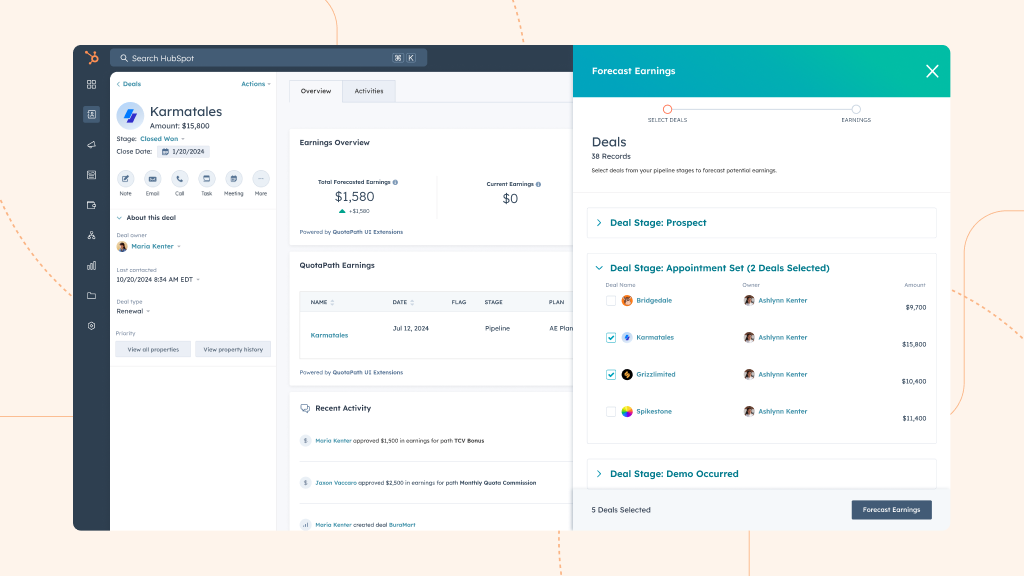

Manage Commissions in HubSpot

Learn more about QuotaPath’s App Cards built natively in HubSpot Sales Hub for familiar, seamless experience.

Read MoreLaunch of Natively-built Apps in HubSpot

Called App Cards, HubSpot unveiled new App Cards powered by UI extensions from QuotaPath, Sendoso, Arrows, and more.

These companies received an exclusive, invite-only opportunity to build directly on top of HubSpot to present a uniquely native and unified experience within Sales Hub.

Now, without having to toggle between platforms, Sales Hub customers can unlock commission tracking and forecasting, send gifts, and coordinate onboarding, amongst other mission critical tasks to the customer journey, directly in HubSpot.

“Companies that customize their CRM are 1.2x more likely to experience organizational growth.”

Growth Fund for Partners ($10M)

Another update that came directly from Partner Day was HubSpot’s announcement of a $10M Growth Fund.

This fund is created to recognize and reward partners who are driving substantial growth. The first group of qualified partners for 2025 has been selected based on their achievements in three key areas: sourced ARR, Upmarket ARR, and customer retention.

The fund will be ongoing, with plans to reopen for additional participants in 2026.

Plus, the new funds underscore HubSpot’s dedication to empowering its customers with innovative tools and services. By supporting promising startups and established companies within the HubSpot ecosystem, HubSpot aims to drive growth and innovation for both its partners and its customers.

Learn more here.

Increased APIs

Next up, increased APIs!

API limits control the number of requests a system can handle to ensure performance, reliability, and fair usage. And last week, HubSpot announced they are increasing them to provide more flexibility and capacity to scale their operations for accounts with Professional or Enterprise subscriptions, as well as those using the API Limit Increase capacity pack.

For Professional accounts, the daily request limit will increase from 500,000 to 650,000, with burst limits rising from 150 to 190 requests per 10 seconds. Enterprise accounts will see their daily limit increase to 1 million requests per day, with the same burst limit.

The API Limit Increase capacity pack now adds 1 million daily requests, with the option to purchase two packs for an additional 2 million requests, and boosts the burst limit to 250 requests per 10 seconds.

Public apps will also see their burst limits increase from 100 to 110 requests per 10 seconds, while the CRM Search API will have its burst limit raised to 5 requests per second and will support up to 200 records per response, up from 100. These changes are already live for existing accounts and reflected in the X-HubSpot-RateLimit- response headers.

Learn more here.

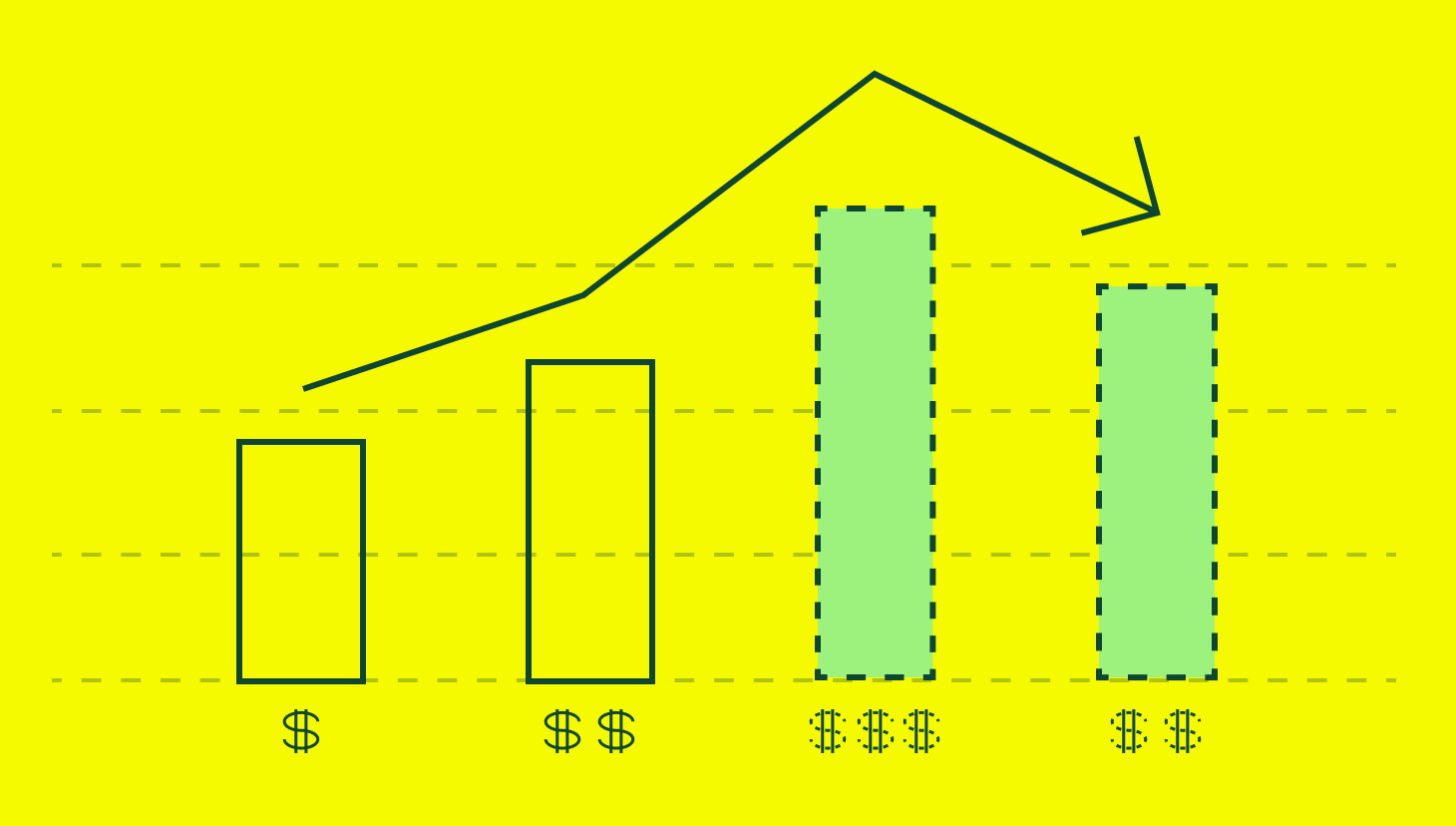

Marketing-Focused No More

Remember when INBOUND, and HubSpot even, was just for marketers?

That is not the case in 2024.

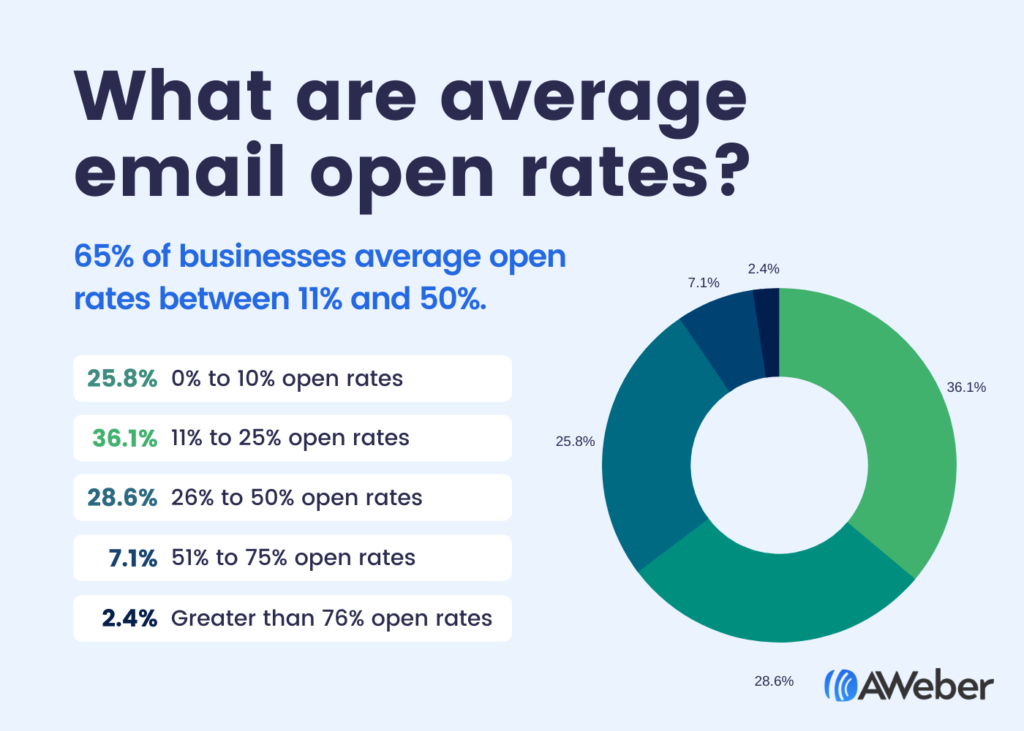

Twelve years later and the conference is filled with leaders and teams from the entire go-to-market function.

We checked our event lead base (north of 6,000 contacts) and 60% were not from the marketing function, according to titles and main responsibilities.

Compare that to 20% in 2012 according to previous event data, and we think it’s fair to say that the times… they are a changing.

For companies like us, with buyers consisting of RevOps, Sales, and Finance leaders looking to make their sales and commissions processes easier, this is great news.

Sales Rapper, Content Creator, and Co-Founder of Event Shark Ding Zheng wraps while playing Blackjack at the QuotaPath booth at INBOUND24 alongside HubSpot Co-Founder and Chairperson Brian Halligan.

Content Creators

Whether you like it or not (we welcome it!), the rise of content creators at conferences like INBOUND has become a significant trend.

The presence of creators was more visible than ever, with many seen filming themselves or accompanied by small production teams.

This shift highlights the evolving landscape of marketing and networking, where personal and professional brand-building often occurs simultaneously.

Content creators are not just there to learn—they are sharing, engaging, and shaping the narrative of the event in real-time, amplifying its reach far beyond the walls of the venue. This trend is a testament to the growing power of individual voices in the digital age, and it’s clear that content creators will continue to play a pivotal role in the future of conferences like INBOUND.

For instance, we were featured in four separate videos, including HubSpot’s production team, RevPartners’, and the creator above, Ding Zheng.

Sales Hub is Happening.

The growing adoption of HubSpot’s Sales Hub was evident at INBOUND.

This comes as no surprise, as over the past five years, HubSpot’s platform has been embraced by more than 150,000 companies, and Sales Hub has played a pivotal role in transforming how these businesses manage their sales operations.

Leaders are drawn to its seamless integration along with powerful features like automated lead scoring, AI-driven forecasting, and customizable sales pipelines.

The enthusiasm for Sales Hub was clear as we heard firsthand how sales teams are ditching legacy systems in favor of HubSpot’s agile, all-in-one platform.

Many emphasized how Sales Hub has streamlined their processes, automated critical tasks, and provided real-time insights that help their teams close deals faster. As more companies look for scalable and flexible solutions, Sales Hub’s growing presence in the market is solidifying it as the go-to CRM for modern sales organizations.

See QuotaPath in Sales Hub

Learn More

Solution Partners + App Partners + HubSpot is the Future of HubSpot

The future of HubSpot lies in the collaboration between Solution Partners, App Partners, and HubSpot itself.

We’re seeing a shift where Solution Partners and App Partners are no longer just working independently with HubSpot—they’re working together.

This partnership ecosystem is creating new opportunities for innovation and growth.

At QuotaPath, we fully embraced this shift by setting up numerous meetings with Solution Partners at INBOUND to explore how we can collaborate, drive mutual success, and ultimately grow our business—and HubSpot’s—together.

This new model of partnership is paving the way for a more interconnected and powerful HubSpot ecosystem.

INBOUND 2025 in San Francisco!

And last but not least, INBOUND25 is headed to the West Coast!

The event will take place earlier in the month next year, Sept. 3-5, at Moscone Center in San Francisco.

Will you be there?

Wrapping Up INBOUND 2024: A Transformative Year for Partnerships and Innovation

INBOUND 2024 was a landmark event for innovation, growth, and collaboration.

QuotaPath was at the center of the action, making a bold statement with our casino-themed booth, launching our App Cards directly in HubSpot, and delivering a packed speaking session on pipeline reviews. Beyond the exciting events, the real success came from the valuable conversations and partnerships we fostered. Meetings with HubSpot executives, App Partners, Solution Partners, and customers led to new opportunities, and our demo-packed booth generated a significant pipeline—solidifying our participation as a lucrative investment.

This year’s theme of “Easy. Fast. Unified” resonated throughout INBOUND, especially during Partner Day, where HubSpot emphasized the importance of collaboration between Solution Partners and App Partners.

We experienced this firsthand by setting up numerous meetings with Solution Partners to explore new ways of working together to drive mutual growth. As HubSpot continues to evolve its product offerings and ecosystem, we’re excited to be a part of this forward-thinking community that is paving the way for more seamless and powerful integrations.

Want to learn more about QuotaPath’s seamless integration with HubSpot’s Sales Hub for streamlined commission process and earnings visibility? Schedule time with our team to learn more.

Recent Comments