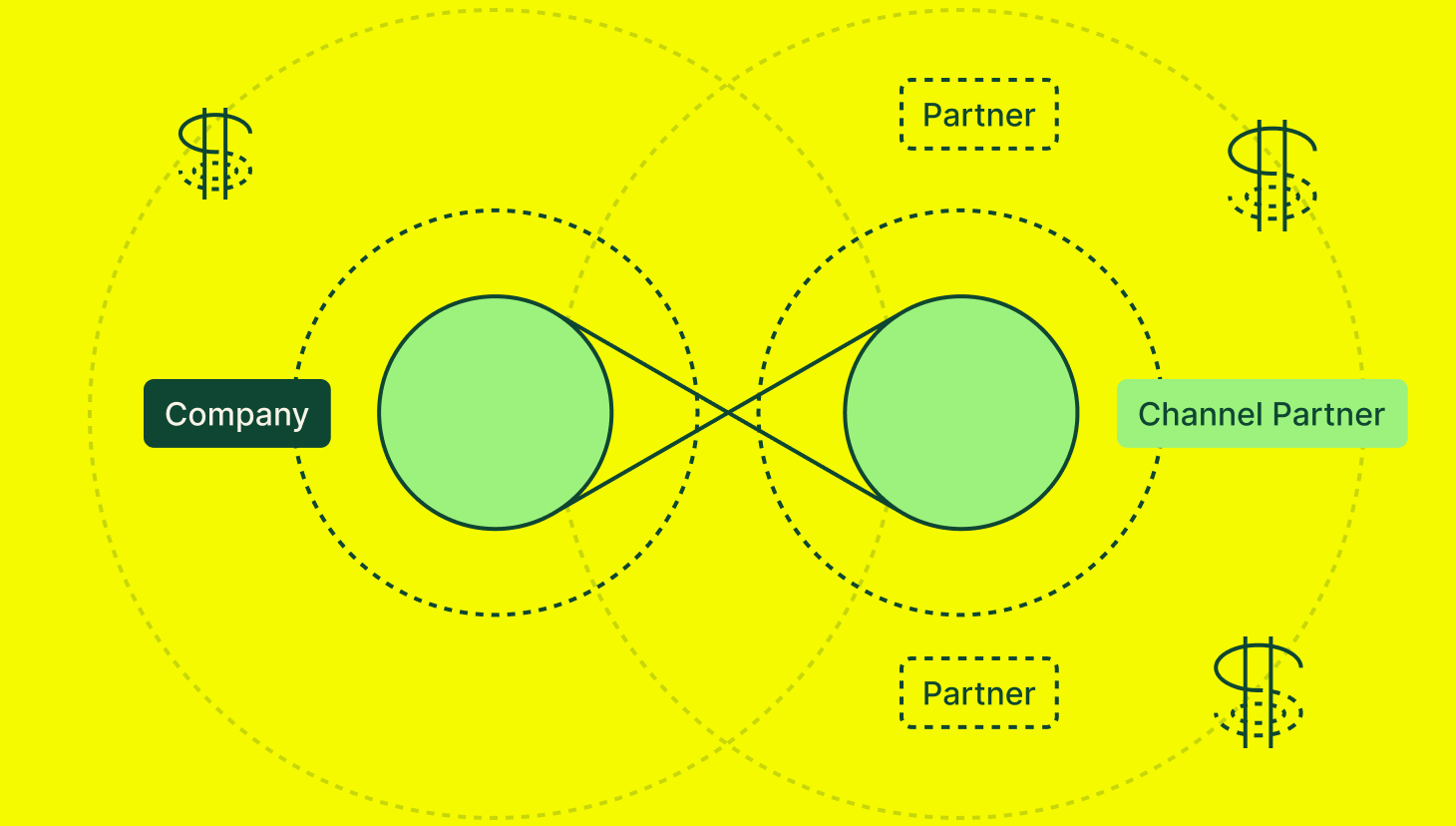

Managing multiple sales channels and territories in a growing SaaS company has its challenges. Competition and confusion can arise when different sales channels, such as inside and outside reps, target the same customers or prospects.

Goals and incentive structures may not be fully aligned across all teams, creating conflicting priorities and a lack of collaboration. Territory management issues can result in an unbalanced workload where some territories or channels have a greater concentration of leads or larger deals.

Clear alignment with business goals and collaboration across all teams is crucial to achieving sales goals and, by extension, company targets.

If you’re struggling with any of these challenges, we’re here to help. This blog focuses on common SaaS sales structures, best practices for management, and incentive strategies for different teams.

What’s a recommended sales team structure for startups?

Your startup’s sales structure selection affects all aspects of sales, including lead generation, conversion rate, and speed to close.

Take Me to BlogCommon SaaS Sales Structures

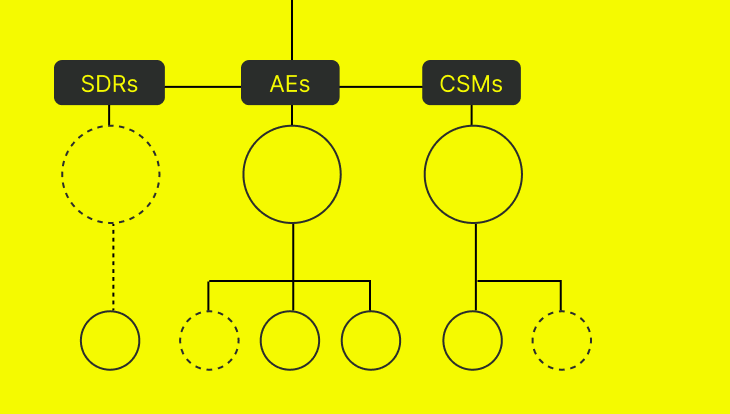

SaaS companies typically adopt the following three sales structures. Read on to learn their defining characteristics and their pros and cons.

Inside Sales vs. Outside Sales

What’s the difference between inside sales and outside sales?

Inside sales reps (ISRs) focus primarily on inbound lead qualification. ISRs use various forms of digital communication, such as email, messaging apps, social media, video conferencing, and phones, to engage prospects.

By contrast, outside sales reps (OSRs) focus on outbound prospecting, in-person meetings, conferencing, networking events, and closing deals.

The advantages of inside sales are that it is less costly, more efficient, and easily scalable, enabling businesses access to a greater talent pool. On the other hand, outside sales facilitates relationship building and offers the opportunity for more focused engagement with the entire buying committee all at once.

Inside sales is an excellent choice for SaaS sales, where outside sales benefits businesses offering physical products, enabling prospective buyers to personally experience the product during a demo.

Hybrid Sales Model

A hybrid model is a blend of inside and outside sales. Hybrid reps work remotely at least a percentage of the time, leveraging multiple channels to engage prospects, such as email, text messaging, social media, phone, and Zoom calls. Remote salespeople also visit potential clients based on customer preferences.

Hybrid sales increased in popularity during the COVID pandemic and is said to be the future of B2B sales, according to McKinsey.

There are benefits to adopting a hybrid model. For instance, it helps businesses minimize costs. It enables former outside reps to increase customer engagement while accommodating the 40% of customers who prefer to buy from a sales rep they’ve met in person.

Hybrid sales can also facilitate gathering the entire buying committee to help build consensus. Yet the remote aspect of the model allows more data to be gathered throughout the buyer’s journey.

Account Management vs. New Business

Account managers (AMs) focus on existing customer relationships and upselling opportunities to retain and grow these essential client accounts. Accomplishing this is typically done by helping the customer achieve their goals for using the product or service they procured from your company.

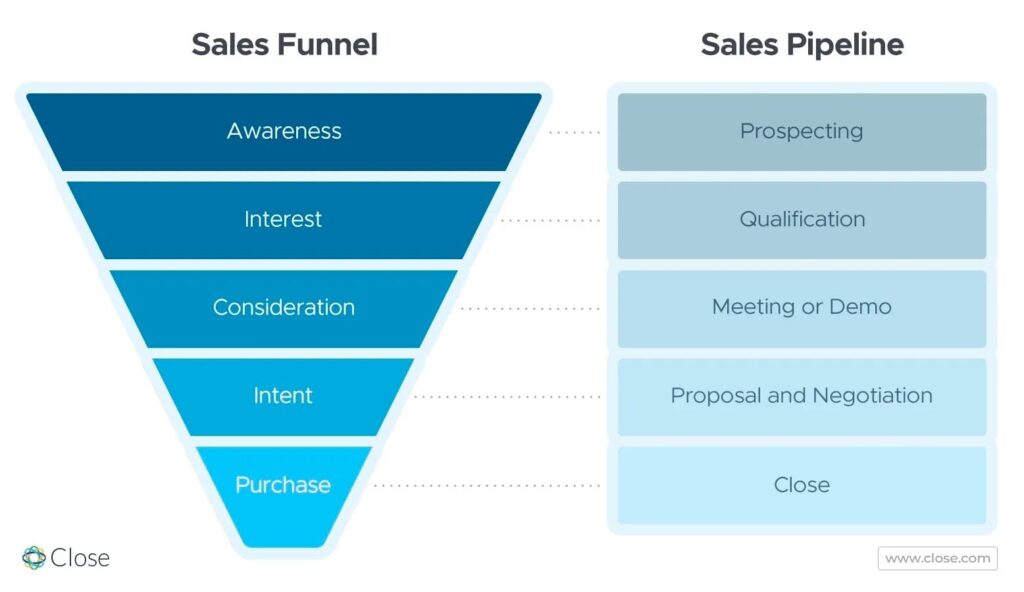

On the other hand, new business reps focus on acquiring new customers. They engage with inbound leads and potential prospects to nurture and guide them through the sales process until, ideally, they become a paying customer.

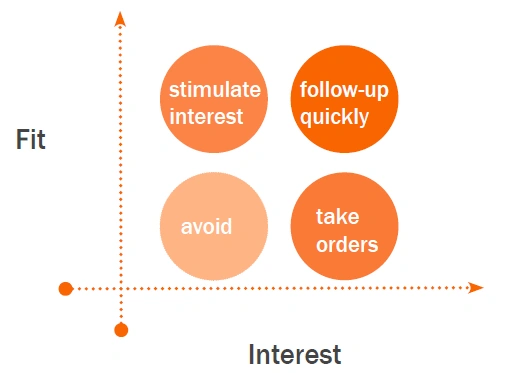

Account managers and new business reps can work together to maximize customer lifetime value. It starts with new business reps prioritizing leads and prospects who match the ideal customer profile (ICP). These are the prospects likely to benefit the most from your product and remain as customers in the long term.

Then, new business reps and account managers collaborate for a smooth customer handoff where essential customer information is shared, facilitating a superior onboarding experience. This sets the customer up for greater success with your product as the account manager works to retain and grow the customer.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesBest Practices for Managing Multiple Sales Channels and Territories

Leverage these best practices to more effectively manage multiple sales channels and territories.

Clear Channel and Territory Definition

Clearly defining each sales channel and territory is crucial so sales reps can function efficiently. When there is confusion or miscommunication of sales channels and territory, reps can become unsure of which specific customer segments or regional areas they are responsible for. This can ultimately result in finger-pointing and weaker sales results.

Strategies for segmenting territories include leveraging factors like customer size, industry, or geographic location.

Alignment and Collaboration

Alignment across revenue-generated teams around shared goals gets the team pulling together to achieve organizational objectives. Fostering communication and collaboration between different sales teams facilitates the attainment of targets.

Sales collaborate with various teams to reach their goals. Examples of collaboration practices include joint lead nurturing by sales and marketing, effective handoff processes from sales to account management, and team selling efforts involving AEs and SEs to advance deals.

Performance Management

Set clear performance metrics tailored to each channel and territory to gauge sales performance and identify adjustment and coaching needs. These metrics help sales teams track progress toward goals, prepare and plan for growth, and build compensation plans.

Relevant metrics vary based on role. For example, ISR metrics include the number of calls, meetings, or deals closed, and OSR metrics include the number of demos, meetings, and proposals. By contrast, AM metrics include customer retention, lifetime customer value, and account growth. New business rep metrics include the number of opportunities created, demos completed, meetings, and calls.

Feedback and coaching are essential strategies that help boost sales team performance. To be effective, these practices must take place on a routine basis. Focused 1:1 and team sessions are both effective ways to improve techniques and progress toward goals. Remember not to overload an individual rep with too much feedback in one session. Instead, prioritize one area and work on that before advancing to another. This ensures consistent improvement.

Technology and Tools

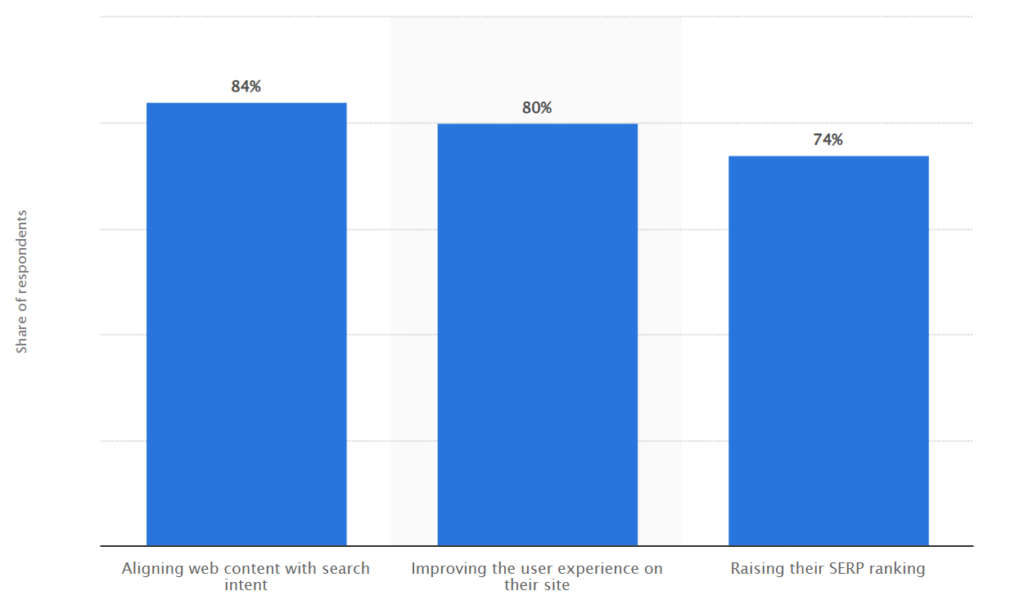

Leverage CRM and marketing automation tools to streamline team communication and data sharing. This improves alignment and collaboration across teams while boosting efficiency and results.

Utilize sales forecasting tools to improve territory and quota planning. These platforms deliver up-to-date metrics that enable data-driven decision-making and scenario modeling for greater success and results.

Incentive Strategy for Different Sales Teams

Using these strategies will help you successfully create and communicate incentive plans.

Aligning Incentives with Goals

It is essential to design incentive plans that motivate reps to achieve specific goals relevant to their channel and territory. This ensures rep buy-in while driving the achievement of organizational objectives.

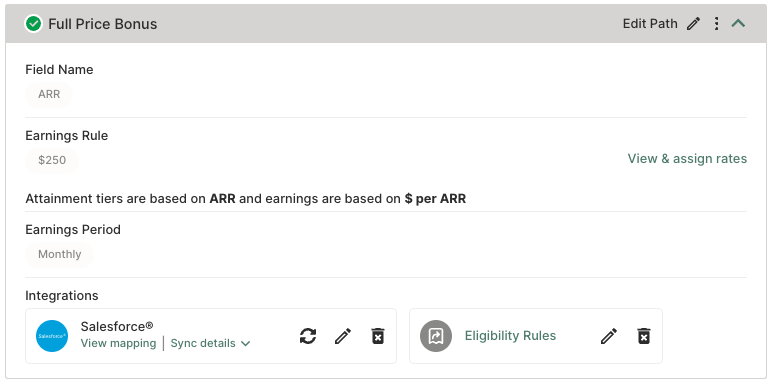

Quotas, commissions, and bonuses can be structured to motivate goal achievement based on the specific role and territory.

For instance, ISRs, OSRs, and new business reps can be incentivized by a commission-based bonus, which is triggered when the rep exceeds the quota. Tiered commissions for these same reps pay increasing percentages as specific targets are exceeded, such as 10% commission for 100% and 15% for 120%.

Account managers, on the other hand, are incentivized based on metrics like customer retention rate, upsells and cross-sells, and CLTV. An example of an account management bonus structure might include renewal bonuses for exceeding customer retention goals, with the bonus triggered at a 95% renewal rate. They may also receive an expansion bonus for increasing average revenue by a designated percentage through cross or upsells to existing customers.

Balancing Individual and Team Performance

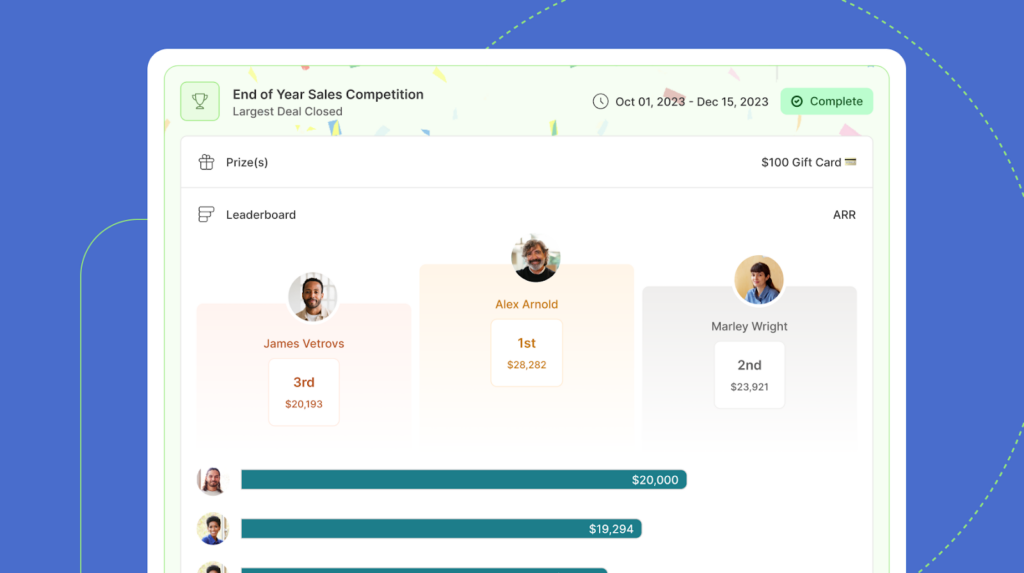

Create incentive plans that reward both individual achievement and team collaboration. Team incentives or challenges foster healthy competition and promote cross-departmental relationships and teamwork while driving goal achievement.

Team-based bonuses or contests to encourage collective success include competitions that involve territories, verticals, or small groups facing off against each other to boost sales. These contests are especially productive when combined with individual SPIFFs to achieve goals.

Transparency and Communication

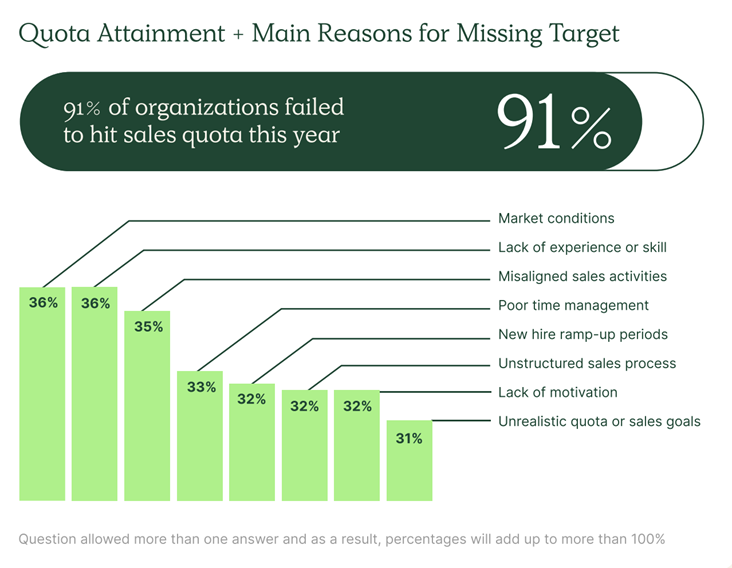

Ensure clear communication of incentive plans and how performance translates to rewards. Reps will not be motivated if they don’t understand how they’re compensated. Consequently, they will fall short of their targets, hindering organizational objective attainment.

Incentive plans are not static instruments. It’s crucial to regularly review and update compensation plans to adjust for performance, market conditions, and changes to organizational objectives.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialManage and Align Multiple Sales Channels and Territories

Managing and aligning multiple sales channels and territories in SaaS has its challenges. Boost your success by implementing the best practices and incentive strategies we’ve discussed.

Remember to clearly define channels and territories to avoid confusion. Create alignment across revenue-generating teams and foster a collaborative culture to improve results. Set clear performance metrics tailored to each channel and territory and consistently provide feedback and coaching to individual reps and the collective team.

Leverage technologies and tools like CRM, marketing automation, and sales forecasting tools to streamline communication and data sharing while enabling data-driven decision-making and plan modeling.

Then, incentives will be aligned with goals to drive organizational goals by structuring quotas, commissions, and bonuses in a way that motivates goal achievements. Balancing individual and team performance through rewards to encourage collaboration and cross-departmental relationships. Transparency and clear communication are essential for rep buy-in and motivation to achieve goals and drive organization objectives.

Sales structures and incentive strategies require ongoing adaptation and improvement based on performance, market conditions, and organizational goals.

See how QuotaPath supports complex teams and compensation plans. Schedule time with a team member or start a free trial today.

Learn more about sales management with additional resources like HubSpot and communities like Pavilion and Women in Sales.

Recent Comments