Sales prospecting can be a disheartening process.

You research a lead, get a good feeling about them, find their contact information, reach out, and… you get a rejection.

And then it’s back to researching. Over and over and over again. Have you ever tried, then, using a different method, such as a sales lead database?

A sales lead database can help you streamline this process, automating the search and verification of contact details and allowing you to conduct outreach on a larger scale.

In this article, you’ll learn everything you need to know about sales lead databases.

Let’s jump in.

What is a sales lead database?

A sales lead database is a repository of all your sales leads, key decision-makers, and contact information.

It’s more than just a list, though.

Having a database of sales leads can help you learn more about your potential customers, segment leads into actionable categories, and personalize your sales pitch presentation to each decision-maker based on data.

A sales lead database is your instruction manual for finding, qualifying, verifying, and contacting leads.

The benefits of using a sales lead database

If you still think you don’t need a sales lead database, looking at the benefits might convince you of its necessity.

This kind of database:

- Keeps all of your lead data in one place for easy searching and a more streamlined workflow

- Frees up time during sales prospecting. If one lead doesn’t work out, you can move right on to the next

- Allows you to target multiple businesses at once based on commonalities

- Allows you to learn more about your leads and craft personalized outreach based on relevant data

- Increases sales efficiency at scale and ultimately leads to more conversions.

Sales lead database: Best practices to automate outreach and boost efficiency

Free to use image sourced from Unsplash

There are a couple of ways you can acquire a sales lead database – depending on the size of your company, your sales requirements, and your budget. You can either build your database or purchase one from a SaaS provider.

Let’s go through both options in detail.

Build your own sales lead database

Sales lead database software can be expensive, and SMBs and startups might not have the budget for a dedicated provider.

Creating your own database will take time and effort upfront, but it’s a cost-effective solution to fueling sales efficiency down the line. And once the bulk of the database is compiled, it’s quick work to add to it as you discover more leads over time. Here’s how you do it.

Collect the data

The first step is data collection. You’ll want to gather a company’s:

- Name

- Size and number of employees

- Financial information

- Contact information, including phone numbers, email addresses, physical addresses, etc.

- Structure, including who the executives and key decision-makers are.

The first four steps are relatively simple. Business information is regularly reported to government agencies, and third-party directories scrape that information to add to their own repositories.

The fifth step is a little more intensive. To find a company’s decision-makers and their direct contact information, you might have to dive deeper into their website, social media, or LinkedIn profiles.

Government websites

Different regions have their own business reporting regulations, but most have some kind of government directory of businesses. Luckily for us, these websites are accessible to the public.

Websites like the Better Business Bureau allow you to search for business categories by area, which is a useful tool for finding lots of leads.

Once you’ve located some businesses of interest, you can find more detailed information through state-specific government sites where businesses legally have to file.

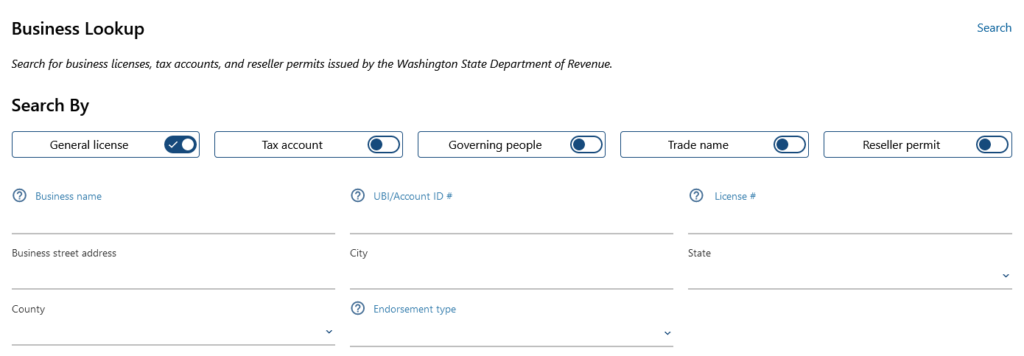

For example, if you want to find a business in the state of Washington, you’d head here and enter the details you have.

You can also head to the SEC website to find businesses that are registered with the SEC. Bear in mind that businesses earning under $1 million aren’t required to register.

Other countries and regions have their own government directories for businesses. For example, the UK uses the Companies House Services.

You’ll want to research government directories in all the regions you wish to operate.

Web searches

Web searches are a useful tool for finding information about businesses.

For example, a SaaS provider for small businesses might search for “small businesses” in the area of interest for a list of potential leads. They might also use advanced search features to only return results from certain areas and within certain time frames.

You can use a search engine’s site search capabilities for specifics, like nailing down key decision-makers at a specific business. For example, you might search “site:specificsmallbusiness.com chief technical officer” or “site:specificsmallbusiness.com CTO”.

Third-party directories

There are two categories of third-party resources at your disposal – free and paid. For now, we’ll talk about free directories. We’ll get into paid services later in this guide.

You can find free business directories through a web search, but here are a few:

- Dun & Bradstreet – they offer a free global database boasting hundreds of millions of businesses

- Kompass – another free global business database

- Thomasnet – this one is more of an industrial sourcing platform, but it offers free access to thousands of businesses’ information

- GetApp – like Thomasnet, GetApp is industry-specific to SaaS companies

These websites contain a variety of contact information, allowing you to reach out through email, text message, or business phone service.

Find key decision-makers

Directories can help you put together business profiles based on size, revenue, and geographical location. But to find key decision-makers, you’ll need to look deeper.

You can do this by reading a company’s official website and looking for “about us” or “meet the team” sections. You can also search LinkedIn for a business’ key personnel and their contact details.

You can even look at a business’s social media accounts. Businesses might involve and tag employees in their content, which is a great way to find their personal social media accounts. Bios often contain contact details, or you can contact employees directly via direct message.

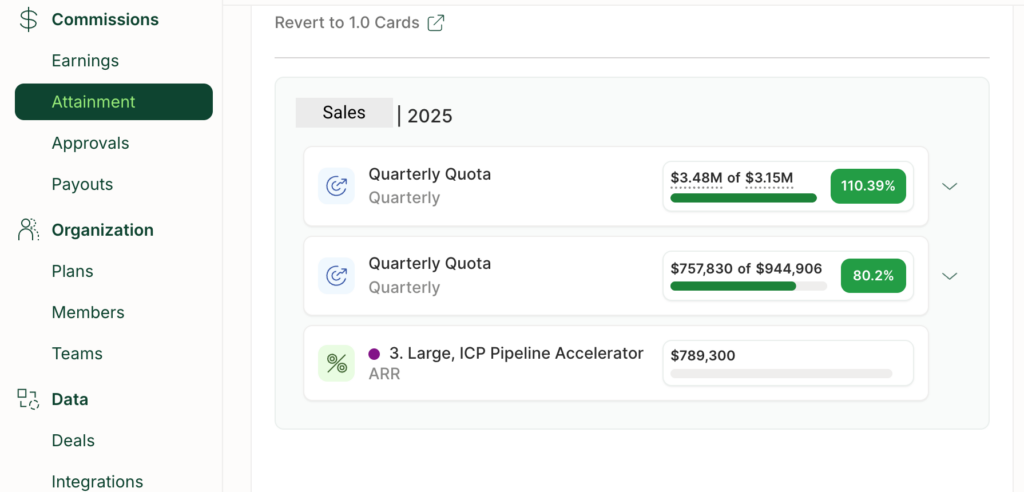

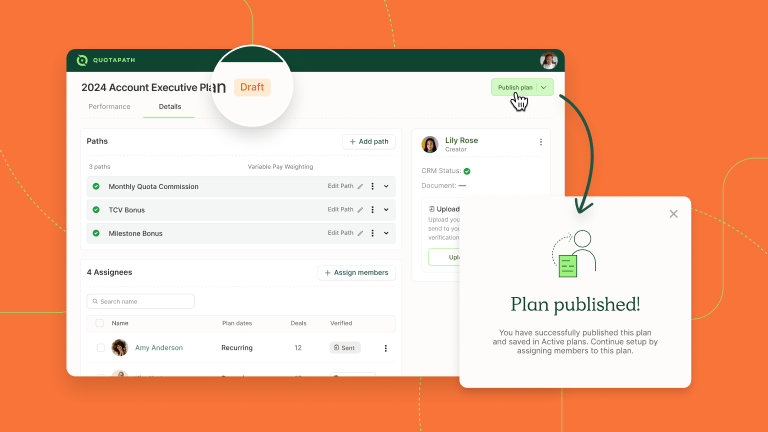

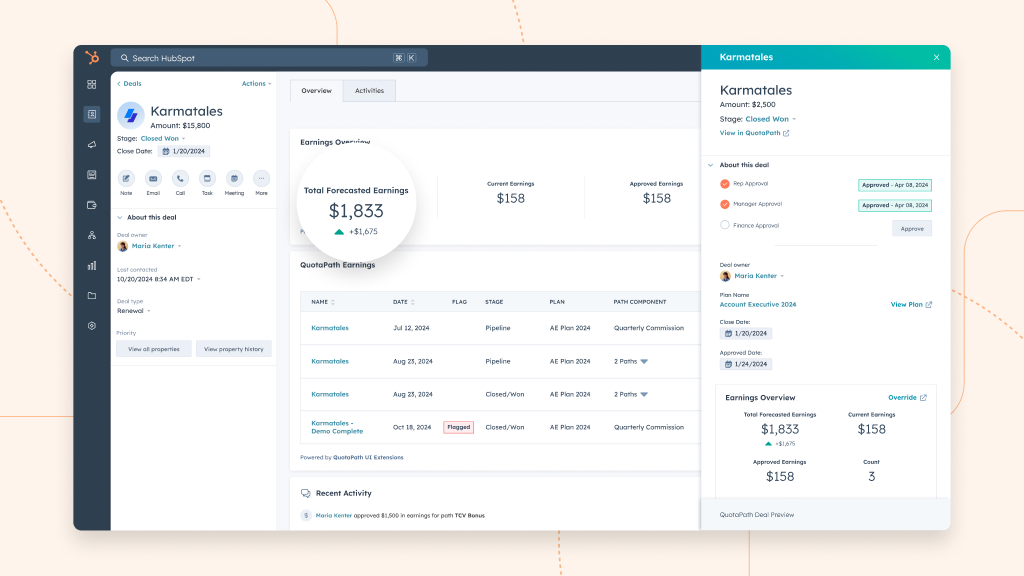

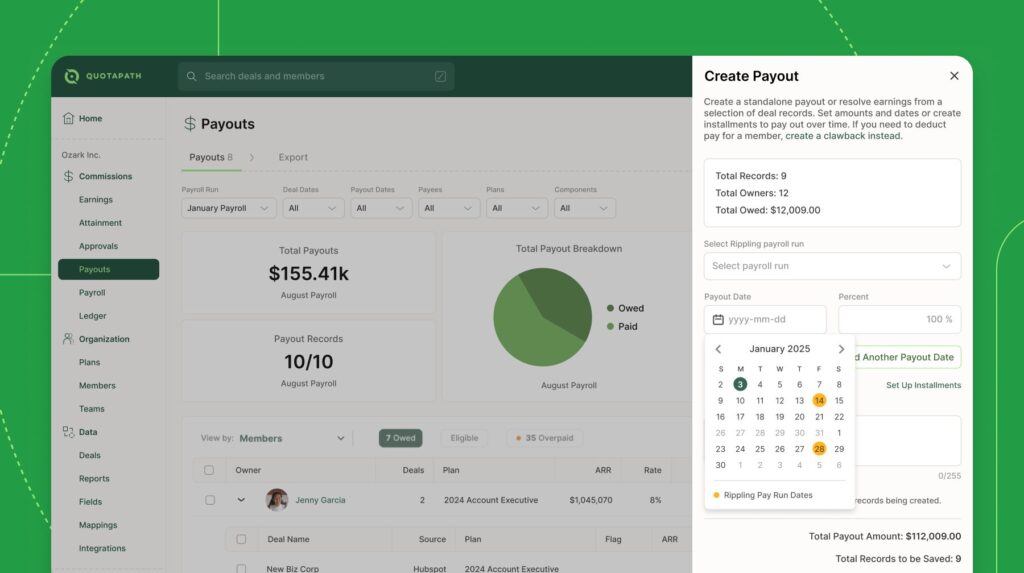

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesCreate your database

Your database needs a home. Depending on your tech capabilities, this can range from a simple document or spreadsheet to an SQL database.

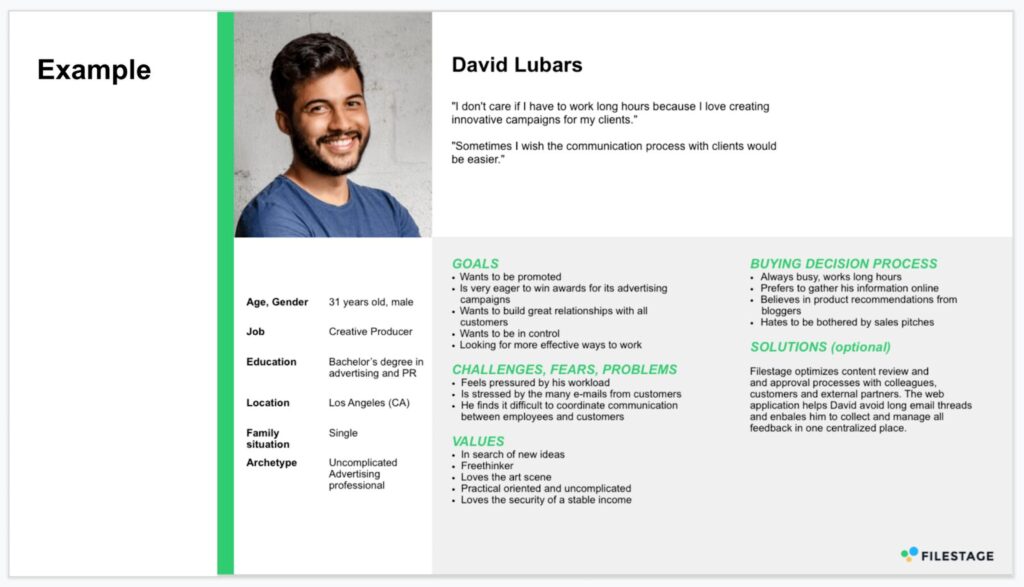

However you do it, it’s all about segmenting leads into actionable categories:

- Firmographic – company name, size, financials, and number of employees

- Geographic – company location or locations

- Technographic – the company’s tech capabilities, from existing infrastructure to tech-savviness to potential future tech needs

- Behavioral – if the company has interacted with you before and how they communicate, make purchases, etc.

- Psychographic – a company’s psychological profile, such as cultural norms and ethical stances

- Needs-based – predictive data such as a company’s sale cycles, budget, growth targets, and pain points

- Decision-makers – the people you’ll need to approach and their contact details.

Constructing a database like this streamlines a lot of your sales outreach.

You can easily identify your most qualified leads, find the key decision-makers, and personalize your outreach to them based on behavioral, needs-based, and psychographic data.

Ensure data security and compliance

Every region has its own data laws. When compiling your sales lead database, make sure you’re following data regulations in each region you’re gathering and storing data from.

You should also schedule regular maintenance of your database to ensure ongoing regulatory compliance and hardware and software integrity and security.

Update and verify regularly

Out-of-date details are a waste of database space and manpower – you can’t approach a key decision-maker who has left the company you’re aiming to sell to.

For this reason, you’ll want to regularly assess and prune your list for invalid data.

Invest in third-party sales lead database solutions

If your business can budget for it, a third-party provider is an all-in-one solution to automating outreach.

Sales lead database solutions come in dedicated software, cross-platform apps, and browser extensions. They also cover a number of budgets and business requirements.

There are major benefits of using a dedicated sales lead database, including:

- Cost-efficiency: You don’t need to expend resources searching for and collecting leads yourself

- Sales acceleration: Enhances the database capabilities, boosting outreach effectiveness and increasing sales efficiency.

- Regular monitoring: Providers update and verify the database for you to ensure contact information is up-to-date

- Faster outreach: Providers locate key decision-makers and their contact details so you can go straight to outreach

- Better security and compliance: Providers ensure data compliance across all the regions data is gathered from

- Laser-focused targeting: Apps allow you to narrow down searches by categories/tags for more specific prospecting of your target audience.

While the upfront cost of a third-party database solution is higher, automation cuts out so much manual time and effort in the long run that the initial investment generally pays off.

Assess your needs

Every business is different, and your provider needs will vary based on your unique circumstances.

Think about:

- The size and capabilities of your business

- Your budget

- The amount of leads you need to gather, approach, and convert to hit targets

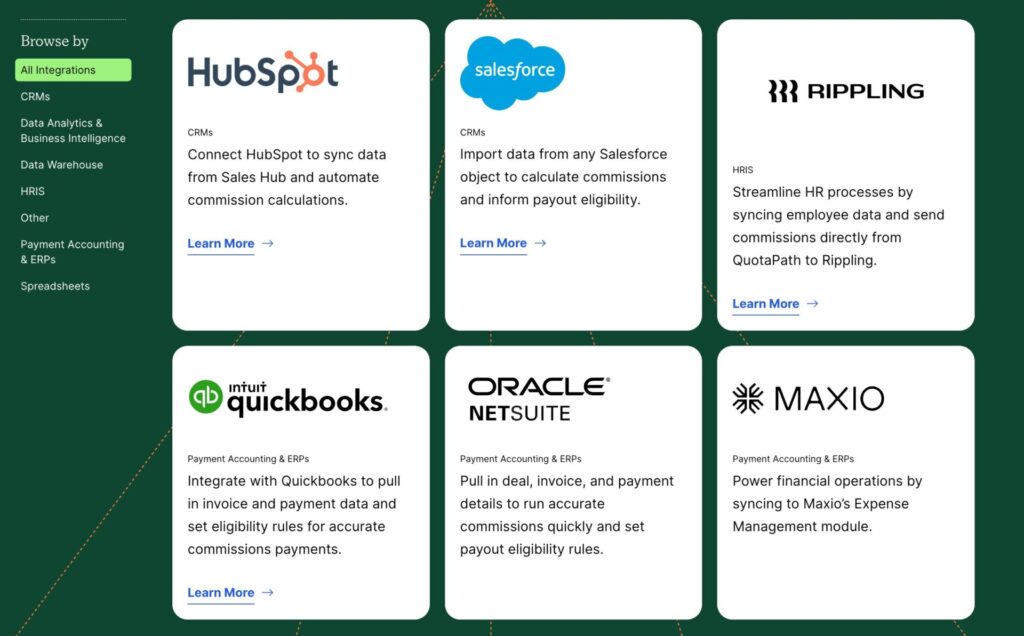

- Integrating with your existing CRM tech and other tools such as AI transcription

- How tech-savvy your employees are and the learning curve each app requires

- The price tiers and features each provider offers

- Comparing providers to get the best deal.

Once you’ve evaluated your needs, you can choose a provider that meets them at your budget.

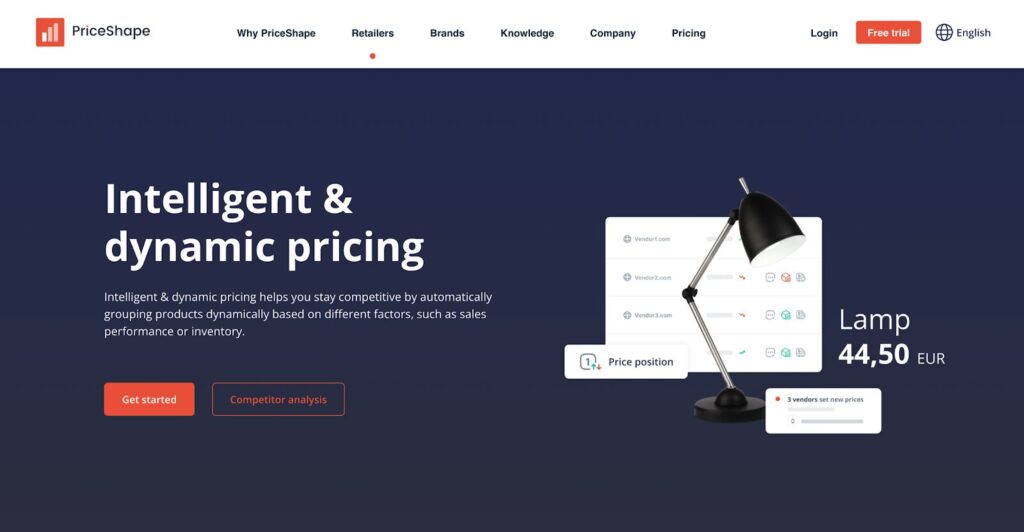

Generate lists of leads based on segmentation

Earlier, we talked about segmenting leads into actionable categories – firmographic, geographic, technographic, etc.

A B2B sales lead database automates this process by offering its own filtering systems.

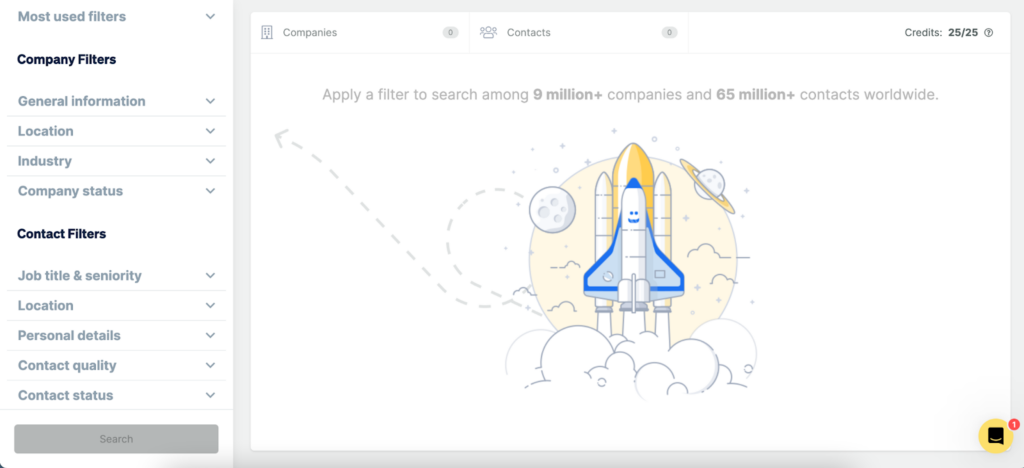

Let’s use Dealfront as an example.

You can see how there are company and contact filters that allow you to narrow down your search results.

For example, if you’re looking for all of the decision-makers at hospitals in a specific area, you can select the relevant filters and generate a list of leads ready to go.

And since a provider does all the work for you, you don’t need to worry about verifying or updating contact details. You can move right on to crafting your outreach and planning an approach through a virtual call or other channel.

Personalize outreach

Through filtering, you can prioritize high-quality leads and target them with personalized marketing for a better conversion chance.

Imagine doing this without a database for a moment.

You’ve been researching and contacting leads all day, converting a few and losing a few more. You find a lead with lots of potential, but the website swims before your bleary eyes as you try to research a decision-maker and come up empty. You find an email – any email – and fire off a generic pitch. You receive no reply. This high-quality, high-potential lead is a dead end.

Now do this again with a sales lead database.

Your database provider collects and verifies all your lead data, as well as allows extensive search functionality and filtering. You’ve created a list of high-quality leads by industry, area, and budget. You’ve found the decision-makers for each business effortlessly. Bingo!

One lead stands out. You look at its profile and see that the company boasts a strong environmental message. Its head of finance once worked at the ASPCA.

You craft a personalized message to them, emphasizing that your business only uses ethically sourced materials and that your products are not tested on animals.

You’ve already begun building a strong relationship based on data that took you mere minutes to access.

Personalizing sales outreach takes physical and mental effort. You have to understand your demographics, identify leads with potential, find personal connections, and craft messaging that appeals to decision-makers on a financial, practical, and emotional level.

A database provider does all the menial work for you, so you can focus on that vital outreach.

Sales lead databases: Key takeaways

A high-quality lead is worth its weight in precious metals, and you don’t want to risk missing out on leads because you were too busy digging in the wrong bit of mud.

A sales lead database offers a comprehensive repository of your outbound and inbound leads in one searchable, filterable, and actionable solution.

For SMBs and startups on a tight budget, sales prospecting at scale might sound like an impossible goal. But creating your own sales lead database offers a cost-effective way to manage lead data and automate workflow to scale up your operation.

A sales lead database provider can automate this process even further for businesses that can afford it. A provider will compile, verify, and filter sales leads for you, letting you get on with the job.

However you choose to do it, a sales lead database is a vital prospecting tool you don’t want to neglect. If we’ve finally convinced you, our guide to sales lead databases will help get you on your way.

Recent Comments