Sales capacity planning helps businesses estimate the number and roles of sales reps to meet monthly, quarterly, or annual organizational goals.

Accurate and consistent sales capacity planning is essential for consistent revenue growth as market and economic conditions continue fluctuating. Otherwise, you risk falling short of business objective achievement.

There are several key considerations involved in creating a sales capacity model including data accuracy, sales resources, and quota attainment. Effective sales capacity planning requires data-driven decisions for reliable projections. Interestingly, Forrester found that data-driven companies are 58% more likely to beat their revenue goals.

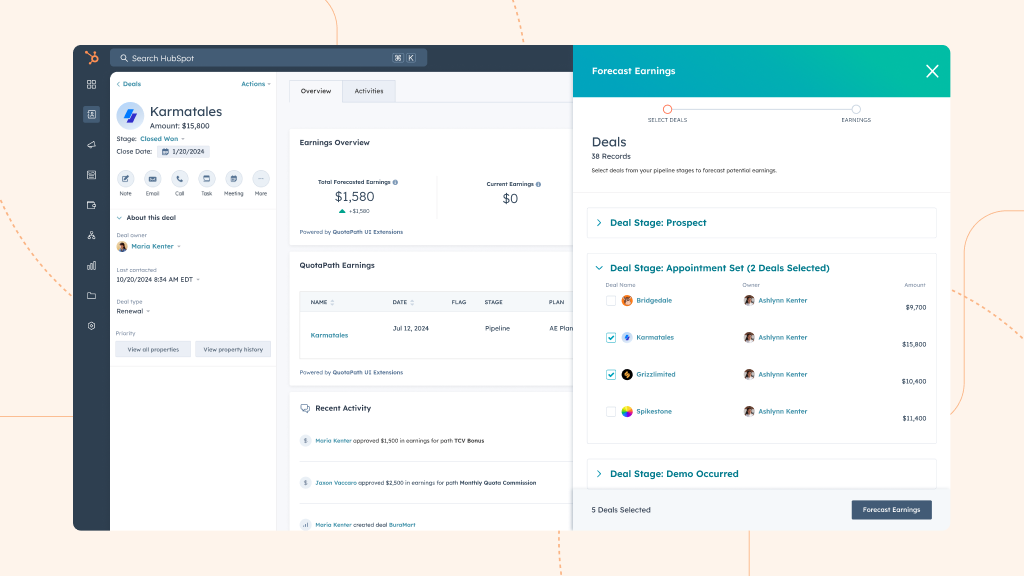

However, these data-driven sales capacity projections are only as accurate as the historical data they’re based on. CRM improves forecast accuracy by as much as 42% according to Salesforce. So, leveraging a CRM helps improve sales capacity planning effectiveness.

The use of sales resources such as sales automation tools is another consideration.

Sales automation improves sales efficiency up to 15 percent and sales productivity by up to 10 percent according to McKinsey. These tools directly impact the number of sales reps your organization will require to achieve sales revenue targets.

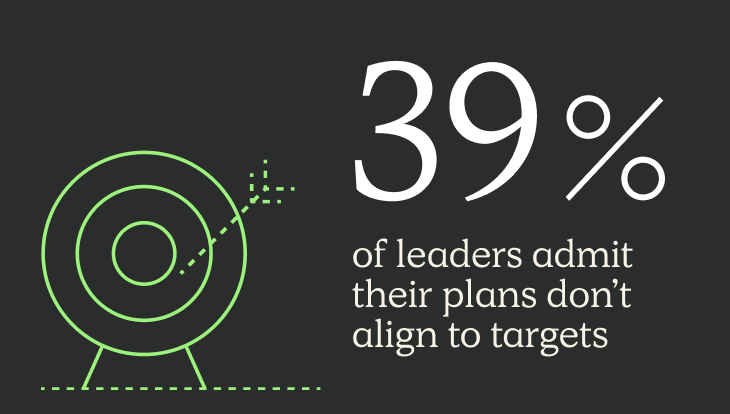

Finally, across industries, average quota attainment has remained a challenge.

Data from 2012–2024 shows that only about 51% of sales reps typically hit their quotas, with downturns exacerbating this challenge. In 2023 and 2024, quota attainment saw a further decline due to market disruptions. This factor also directly affects your sales capacity planning projections.

Ultimately, the goal of sales capacity planning is to determine the ideal number of sales team members to achieve business objectives and avoid under or over-utilized reps.

Below, we’ll lean into sales capacity models and share best practices along the way, so you’re all set for the new year.

What Is Sales Capacity Planning?

First though, let’s define it.

Sales capacity planning is an essential process leveraged by businesses to ensure consistent growth.

The process of creating a sales capacity model involves forecasting the optimal number of sales resources, such as sales reps, tools, skills, and knowledge, needed to meet revenue targets efficiently. It includes setting quotas, assessing hiring needs, and aligning resources with market demand.

Sales capacity planning is especially critical for SaaS companies where revenue is largely based on subscription renewals and consistent growth from customer acquisition. Effective sales capacity planning can increase revenue growth by up to 15% for SaaS companies by optimizing resource allocation, according to a Salesforce study. This highlights the importance of leveraging accurate historical sales data to ensure the creation of an effective sales capacity model.

Benefits of Sales Capacity Planning

Next, let’s outline the benefits of effective sales capacity planning, which offers many advantages in addition to driving business goal achievements.

| Optimized Resource Allocation | Capacity planning helps businesses allocate sales resources such as headcount, budget, and tools more effectively, ensuring the right number of reps are focused on the right accounts or territories. | According to a report from McKinsey, companies with optimized sales resource allocation see 10-15% improvements in overall sales efficiency. |

| Improved Revenue Predictability | By forecasting sales capacity and aligning it with revenue goals, companies can better anticipate future revenue and meet their financial targets. | A Salesforce report found that companies with structured capacity planning experience up to 20% more predictable revenue streams. |

| Enhanced Sales Team Productivity | Proper capacity planning ensures that sales reps have manageable quotas, realistic goals, and sufficient support, which keeps them motivated and productive. | Studies by Xactly show that reps at companies with clearly defined and realistic quotas achieve their targets 15–20% more often than those without structured planning. |

| Lower Sales Turnover | Balanced workloads, fair quotas, and achievable goals contribute to greater job satisfaction, which reduces sales turnover. | LinkedIn’s State of Sales report notes that companies with capacity planning strategies see up to 25% lower turnover in their sales teams. |

| Increased Customer Coverage and Market Penetration | Territory allocation and forecasting enable sales teams to cover more accounts effectively, particularly when entering new markets or expanding territories. | Forrester reports that companies that align capacity planning with territory management see a 30% improvement in customer reach and engagement. |

| Better Responsiveness to Market Changes | Capacity planning often includes real-time adjustments based on market conditions, ensuring companies can quickly adapt to changes like seasonal demand or economic shifts. | McKinsey’s research shows that companies with flexible capacity planning can respond 20% faster to market changes. |

| Efficient Use of Sales Tools and Technology | Sales capacity planning encourages alignment between team needs and available technology, ensuring the best tools are used efficiently to support reps in meeting their quotas. | Gartner reports that sales teams with optimized technology utilization through capacity planning achieve 10–15% higher productivity. |

| Alignment with Strategic Business Goals | Capacity planning aligns sales efforts with broader business objectives, such as revenue targets, growth strategies, or expansion into new markets. | Bain & Company found that businesses aligning sales capacity with strategic goals experience 15–20% greater alignment in revenue outcomes. |

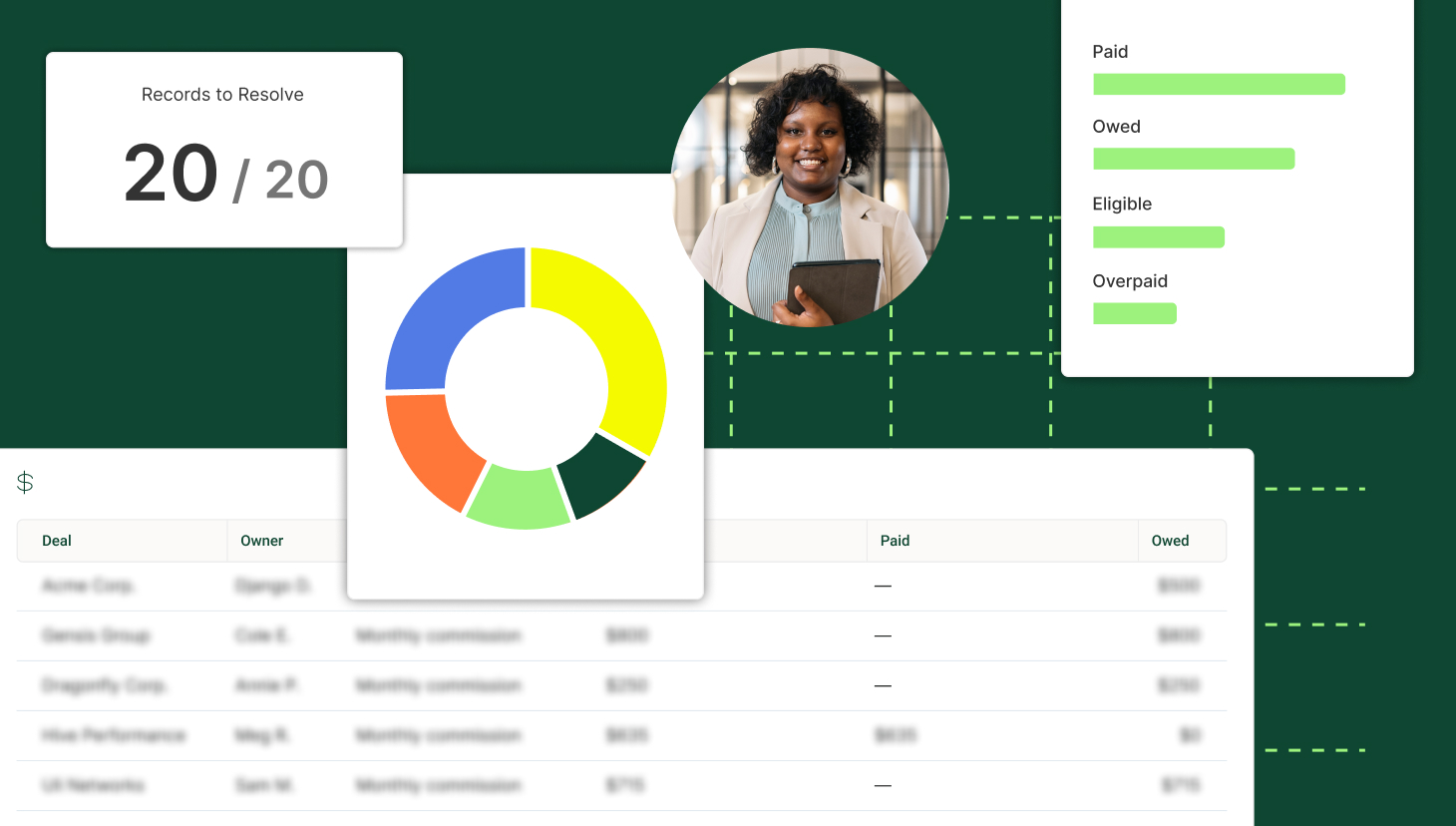

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesHow To Create A Sales Capacity Plan

Complete the following nine steps to build an effective sales capacity plan.

1. Set Clear Revenue and Growth Targets

Define Sales Goals: Establish specific revenue and growth targets for the quarterly or annual planning period.

Align with Business Objectives: Ensure targets are aligned with the company’s overall business goals, such as expansion, retention, or market share growth.

Example: A SaaS company might set a 20% revenue growth target with goals for both customer acquisition and retention.

2. Analyze Historical Sales Data

Review Past Sales Performance: Analyze historical data on revenue, deal sizes, win rates, and sales cycle length.

Identify Patterns: Look for patterns in sales volume, seasonality, and trends that can inform future capacity needs.

Example: If sales tend to spike in Q3, the company may plan for additional capacity during that period.

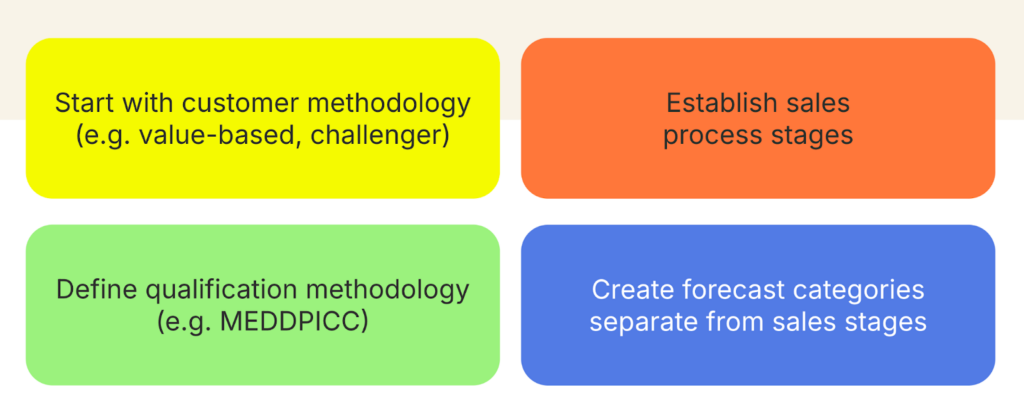

3. Forecast Sales Demand

Use Sales Forecasting Models: Apply forecasting methods such as linear regression and pipeline forecasting to project future sales demand.

Adjust for Market Factors: Consider external factors like economic conditions, market trends, or new product launches that could affect demand.

Example: If you are expanding into a new region, increase demand forecasts accordingly to account for potential growth.

4. Calculate Sales Capacity Requirements

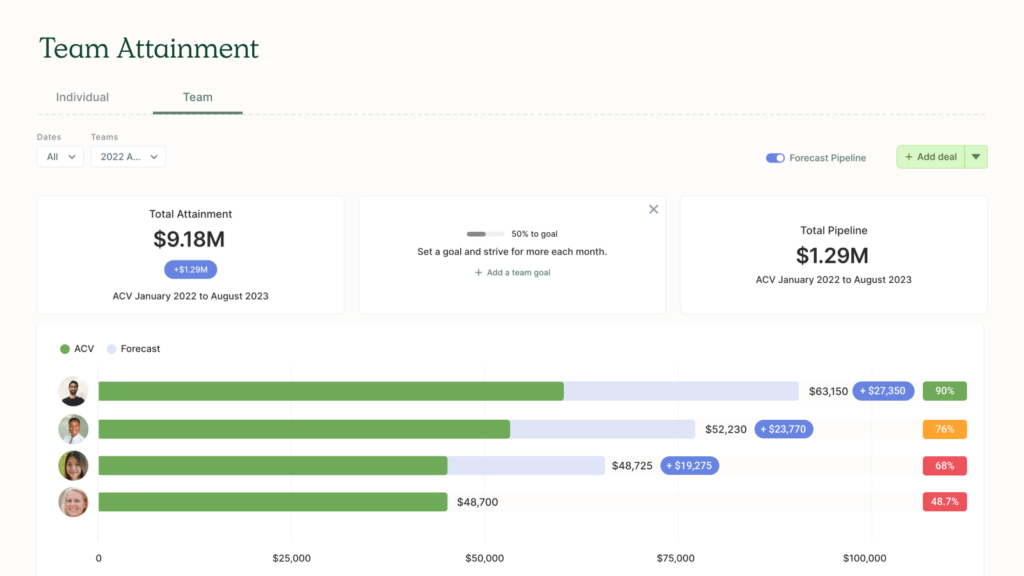

Determine Optimal Sales Headcount: Based on sales targets, calculate the number of reps needed to achieve goals, factoring in productivity and quota attainment.

Define Productivity Benchmarks: Set realistic quotas and productivity benchmarks per rep, based on factors like average deal size and win rate.

Example: A company aiming for $10M in revenue with average quotas of $500K per rep would require 20 reps.

5. Account for Attrition and Ramp Time

Estimate Attrition Rates: Consider average turnover rates to determine the additional headcount needed to maintain capacity.

Factor in Ramp Time: Include ramp-up time for new hires to reach full productivity. This is typically 3–6 months in SaaS.

Example: For a 20% annual turnover rate and 6-month ramp-up, the company may need to hire 25% more reps than planned to ensure steady capacity.

6. Align Territory and Quota Allocation

Optimize Territory Assignments: Assign territories or segments to reps based on potential and coverage needs.

Set Fair and Attainable Quotas: Use historical performance data and market potential to set achievable quotas for each rep or team.

Example: For high-growth regions, assign more reps and set higher quotas compared to mature markets.

7. Plan for Seasonal or Cyclical Adjustments

Account for Seasonality: Adjust capacity plans for anticipated seasonal or cyclical variations in demand.

Adjust Resource Allocation: Hire temporary reps or reallocate resources to manage peak periods effectively.

Example: If demand is higher in Q4, allocate extra resources or consider temporary hires to manage the load.

8. Implement Sales Tools and Support Resources

Leverage Sales Technology: Equip reps with CRM, automation, and analytics tools to maximize productivity.

Provide Training and Support: Ensure reps have the necessary training, resources, and support to reach their quotas.

Example: Implement a CRM system for better tracking of sales activities and pipeline management.

9. Monitor and Adjust the Capacity Plan

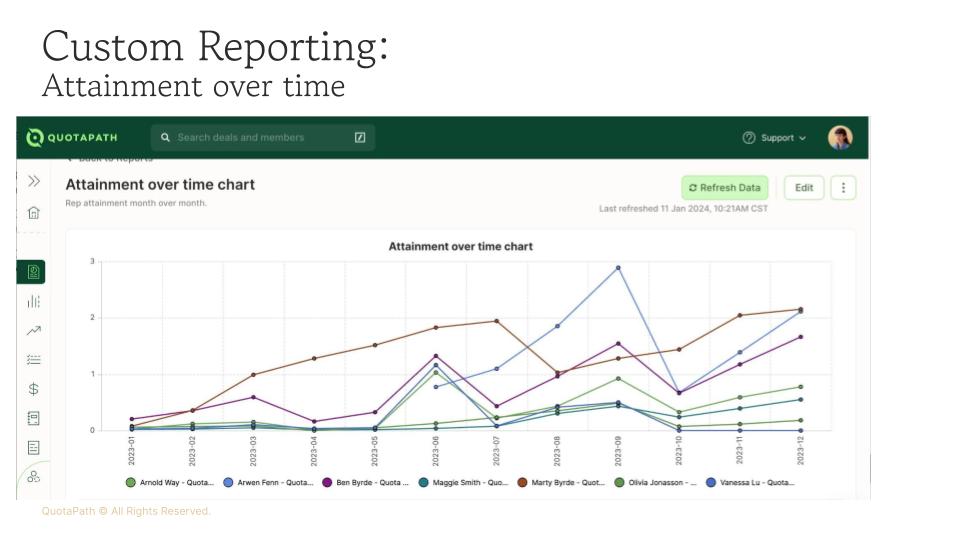

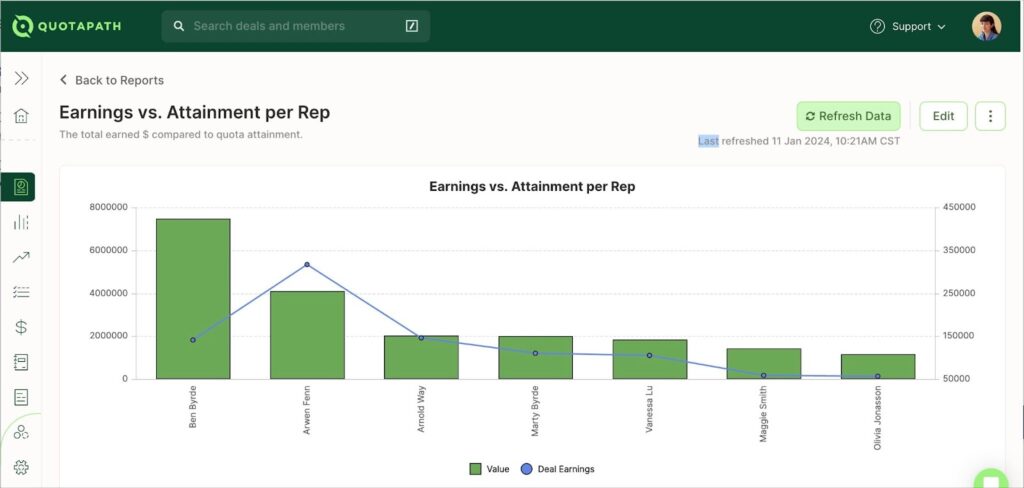

Track Performance Metrics: Regularly review metrics such as quota attainment, pipeline health, and territory coverage to assess capacity.

Make Data-Driven Adjustments: Adjust the plan as needed based on performance, turnover, and market changes.

Example: If quota attainment is low, consider revising quotas or reallocating resources to underperforming areas.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialMetrics To Consider When Sales Capacity Planning

Another detail to keep in mind as you explore capacity models if the data to include.

The following sales data is typically used during the sales capacity planning process.

| Metric | What it is | Why to include it |

| Revenue Target | The total revenue goal for the planning period, for instance monthly, quarterly, or annually. | Drives the overall capacity needs and informs the number of sales reps required to hit the target. |

| Quota per Rep | The expected sales target or quota assigned to each rep for a given period. | Helps set realistic targets and balances workload; impacts morale and retention if set too high or low. |

| Sales Cycle Length | Average time taken to close a deal, from initial contact to deal closing. | Influences how many deals each rep can handle simultaneously and how quickly they can impact revenue targets. |

| Average Deal Size | The average revenue generated per closed deal. | This affects the number of deals needed to reach revenue targets and impacts on the capacity required per rep. |

| Win Rate | The percentage of deals closed relative to total opportunities created. | It impacts how many opportunities reps need to work on to achieve their quotas. |

| Rep Productivity | The amount of revenue generated per rep which is often calculated as revenue per full-time rep. | Allows realistic capacity estimation by defining expected output per rep based on historical performance. |

| Headcount Requirements | The number of sales reps needed to achieve the revenue target. | Ensures adequate staffing to meet targets while balancing workload to avoid burnout. |

| Ramp Time for New Reps | The time required for new hires to reach full productivity which is often 3–6 months for SaaS. | Ensures accurate planning for when reps will start contributing fully to revenue targets. |

| Attrition Rate | The rate at which sales reps leave the organization annually. | This helps calculate the extra headcount needed to maintain capacity and avoid capacity shortages. |

| Territory Potential | Estimated sales potential in each territory or segment. | Assists in territory allocation, ensuring reps are deployed to areas with sufficient opportunity to hit quotas. |

| Pipeline Health | Assessment of current opportunities, including pipeline value and deal stages. | Provides insight into future capacity needs and helps balance workloads across the team. |

| Seasonality | Variations in sales volume that are based on seasonal or cyclical demand patterns. | Allows for adjustments in resource allocation during peak and off-peak seasons to meet demand. |

| Sales Support Resources | Availability of tools, training, and support resources for sales reps. | This increases rep productivity and capacity by enabling reps to work more effectively. |

| Market Conditions | External factors such as economic trends, competitive landscape, and industry growth rates. | This helps adjust capacity based on anticipated changes in demand or market shifts. |

| Cost per Rep | The total cost associated with each sales rep, including salary, benefits, and commission. | Aids in budgeting for headcount and helps ensure cost efficiency while meeting sales goals. |

Implementing Your Sales Capacity Model

Feeling ready to go? You should be!

As you execute your sales capacity plan, keeping best practices in mind will increase its effectiveness in driving organizational objectives.

Start by aligning the plan with business goals to ensure it supports the company’s overall revenue and growth objectives. Then use historical sales data to help you assign attainable quotas based on average rep productivity, deal sizes, and territory potential.

Plan for ramp-up and attrition to maintain consistent sales capacity and adjust for seasonality and market changes to align headcount with demand. Applying reliable forecasting models to project demand and revenue more accurately will help as you refine your capacity needs. Optimizing territory allocation to maximize market potential and balance workloads across the team is also important to ensure productivity and prevent underutilization.

Incorporate sales support and technology to enhance productivity and meet capacity expectations. Then monitor key performance indicators (KPIs) routinely to evaluate plan effectiveness.

Remember, your plan requires regular reassessment and adjustment based on performance data and changing business conditions.

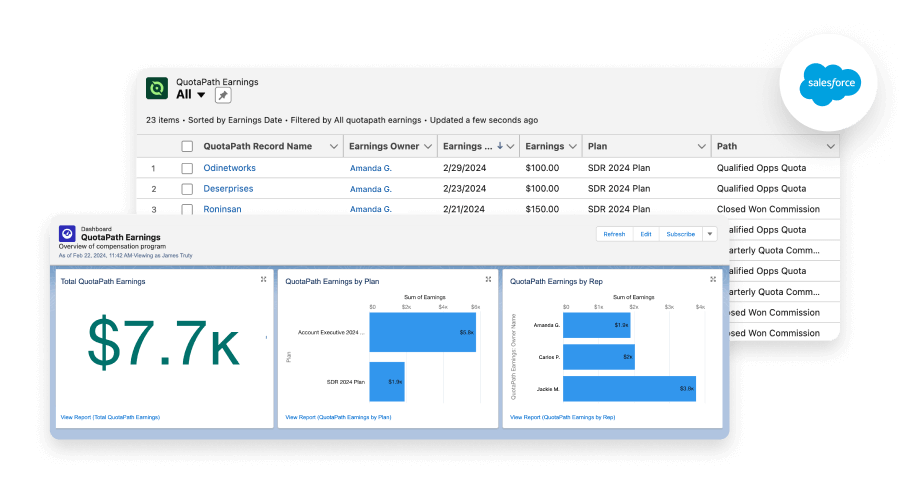

To learn how QuotaPath can support your sales capacity planning process through attainment reporting and commission reporting, schedule time with a team member.

Recent Comments