Sales quota management refers to the process of setting, tracking, and achieving specific sales goals for certain periods of time. It is a critical part of sales management and can be used to motivate sales reps, boost and measure performance, and reward sellers who reach their goals.

The best sales quotas are realistic, backed by math, and aligned with company goals.

And, the worst?

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesReps will say the worst kinds of quotas are restrictive, unrealistic, and therefore demoralizing. Most leaders will agree with the reps while also classifying bad quotas as those that they’ve set too low, which can lead to complacency.

So, how can you find the right balance between a quota that pushes reps to achieve individual and company targets while ensuring that they’re actually attainable?

The key is in your sales quota management strategy.

Below we look at common terminology to set sales quotas, key components of effective sales quota management, and sales analytics to drive selling behaviors.

Understanding sales quotas: definitions and purpose

First, let’s review the basics of sales quotas.

What are sales quotas? Sales quotas are quantitative goals set for sales reps or teams over a period of time, like monthly, quarterly, or annually.

They are typically expressed in terms of revenue, units sold, new customers acquired, or sales activities, such as the number of new opportunities. Quotas are an important part of sales management because they provide sales reps with clear goals to work towards that help the entire company reach its financial targets.

Sales managers also use quotas to track their team’s performance and identify areas where they need to improve.

Quotas by role: Quotas typically differ by role. For instance, reps selling to enterprise clients will follow longer quotas with larger quotas. That’s because enterprise deals take longer to close and are usually much higher in value.

Where an enterprise account executive might have one quota tied to annual recurring revenue, a sales development representative could have two or even three quotas. We’ve seen SDR sales compensation plans that have a quota based on number of demos booked, plus a quota tied to a revenue target.

Meanwhile, account managers usually have quotas tied to gross or net revenue retention — or both.

Quota attainment: A sales quota is the total number that the seller should aim to achieve while the attainment of quota is the percentage of progress toward that goal. This metric is especially useful for sales leaders to review to understand who is overperforming or underperforming on their team.

What is a good quota attainment percentage?

While most sales leaders think that your team should achieve 80% of the team’s total number, our belief is that 80% of your team should achieve 100% or higher.

“This perspective promotes consistency across the entire team,” said QuotaPath CEO AJ Bruno.

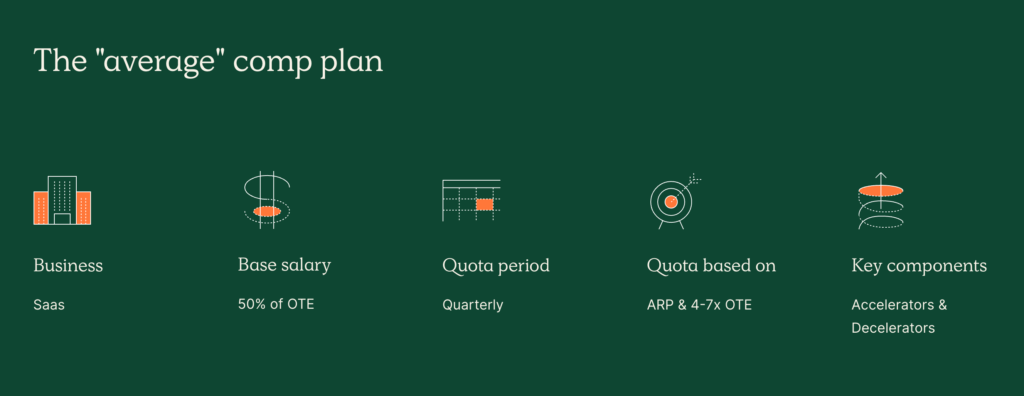

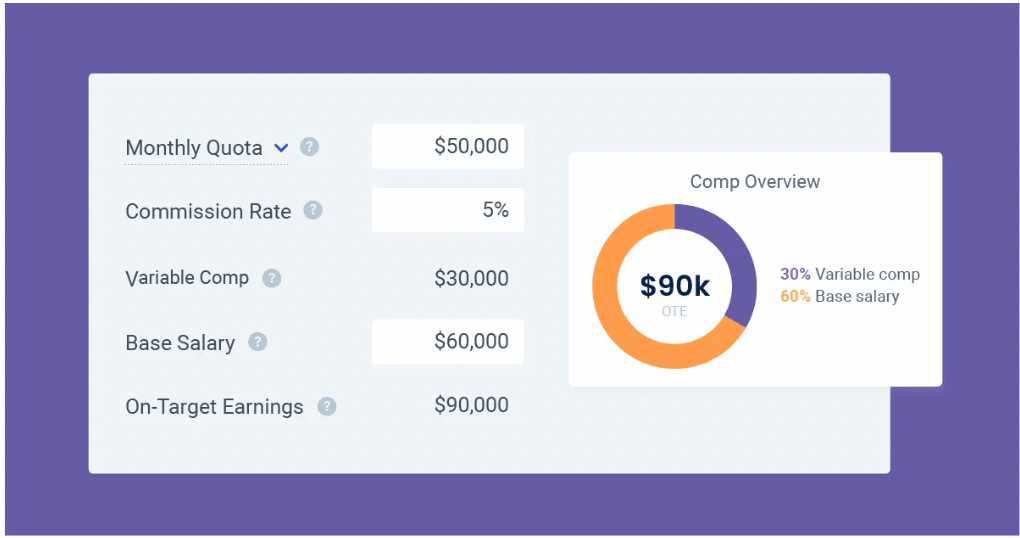

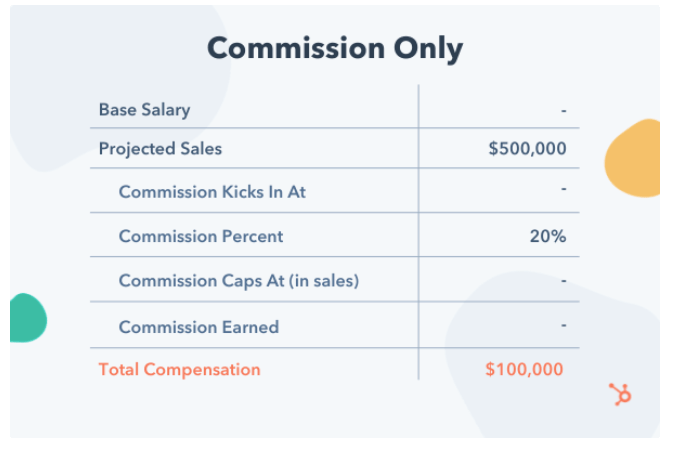

On-target earnings (OTE): To properly set quotas, you also need to have a solid understanding of on-target earnings, more commonly referred to as OTEs.

This number represents the total compensation a rep can expect to earn should they achieve 100% of their quota. It consists of the rep’s base salary and variable pay. The split between salary and variable pay is called paymix, which in SaaS is often 50:50.

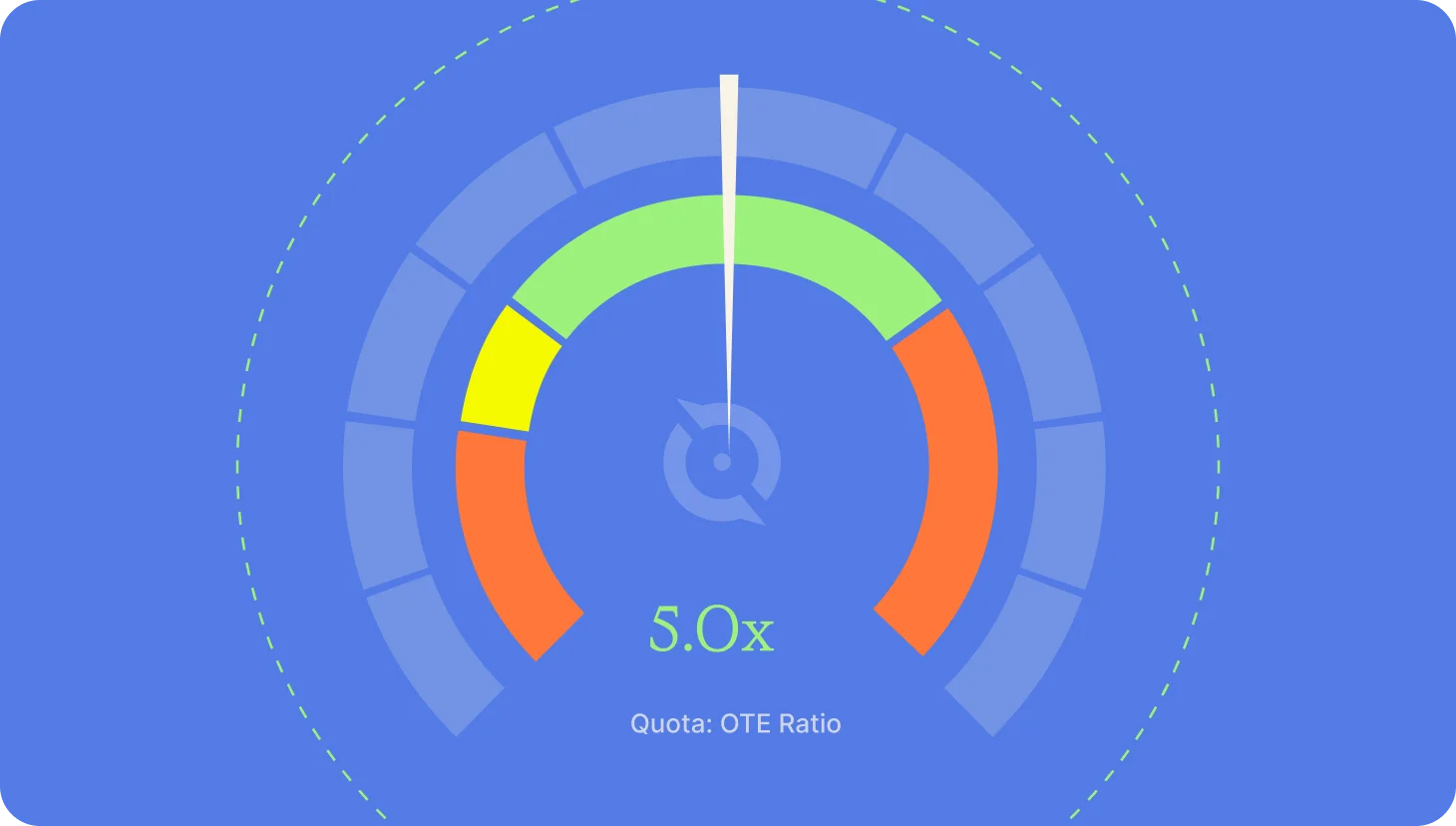

Additionally, in SaaS, your quotas should sit about 5x higher than your OTEs. However, this number fluctuates between 3x and 8x depending on your organization’s size. (Larger companies that pack a lot of resources and marketing spend behind each deal typically have larger OTE multipliers closer to 8 or 9x.)

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it NowHow to set quotas

Before you can manage sales quotas, you first need to set them.

That’s where that OTE multiplier comes in. You can set your quotas by using our recommendation above or finding a healthy quota:OTE ratio using our free calculator.

You can also work from the top down by taking your company-wide new business goal for the year and dividing it by the number of reps on your team. Then, divide by your quota frequency, which will depend on your sales cycle.

For instance, a quarterly quota makes sense if your average sales cycle lasts about 90 days. If it’s less than that, shoot for a monthly one. Anything significantly longer than 90 days should be set for annually.

Just remember to review it. Adjust quotas as you learn more about your business and as the market changes.

Learn more about how to set sales quotas in this blog.

Importance of sales quota management

Now, let’s talk about the importance of sales quota management.

Sales quota management is the process of setting, tracking, and managing sales goals for individual sales reps or teams. It’s essential for any sales organization, especially for driving results and informing future compensation strategies.

One of sales quota management’s key benefits includes its impact on sales productivity.

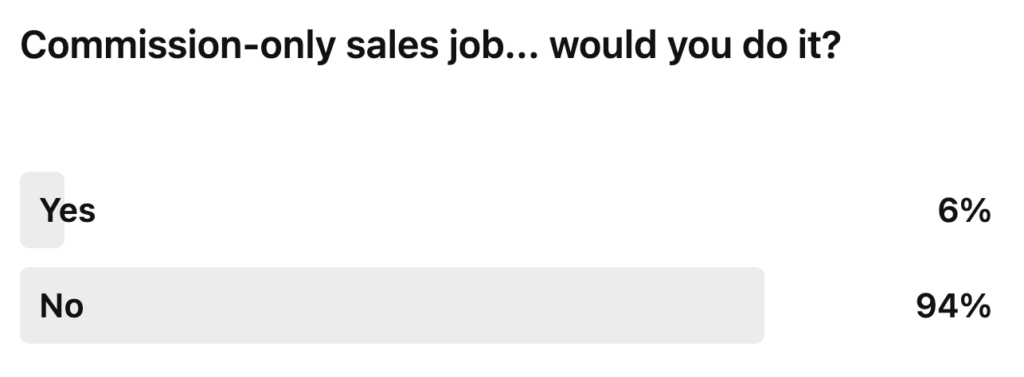

Providing sales reps with clear goals to work toward can help them stay focused and motivated. This also helps to increase rep accountability because they are held to a target that often impacts their earnings potential.

Additionally, the performance (or lack thereof) of quotas can help forecast future revenue goals, which makes it easier for leadership to plan for future growth and make better decisions around resource allocation.

Plus, when you align quotas with the company’s overall goals, you ensure reps focus on activities that drive the most important metrics of your business.

Key components of effective sales quota management

But, to make sales quota management effective, several key components must be considered.

First, you have to commit to evaluating your quotas and possibly adjusting them throughout the year.

How to evaluate sales quotas

Look for the following sales performance metrics to indicate bad quotas.

| Wide range of attainment | Is half of your team hitting 110% quota and the other half only achieving 10%? You should strive for a normal curve with a few people overachieving and a few underachieving. Ideally, most of your reps are clustered in the middle. |

| Lumpy attainment | Does a rep achieve 200% one quota period, then just 10% the next? This indicates lumpy or inconsistent attainment. To remedy this, you should consider extending the quota period, changing your compensation plan by adding consistency bonuses and decelerators, or removing decelerators if they’re too punitive. |

| Low attainment | A huge red flag that you set your quotas unfairly is if everyone consistently hits 30 to 40% of the goal. Check your pipeline health. Do you have the correct pipeline coverage to get your reps to the goal? Are product reasons interfering? Or does it fall to sales coaching reasons? |

Automate quota tracking

Setting up automated quota attainment tracking will make evaluating quotas easier for you and more accurate.

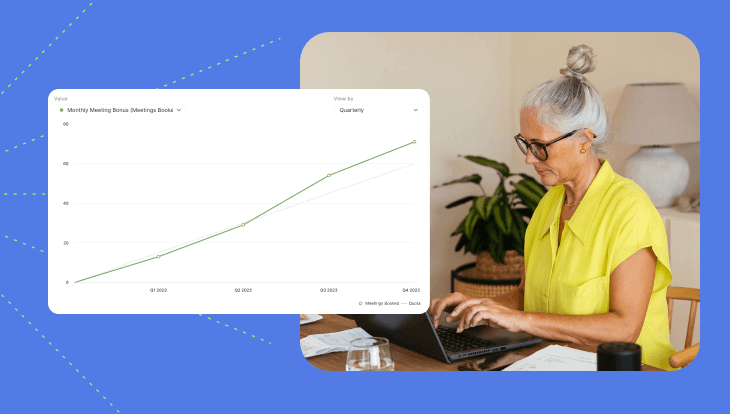

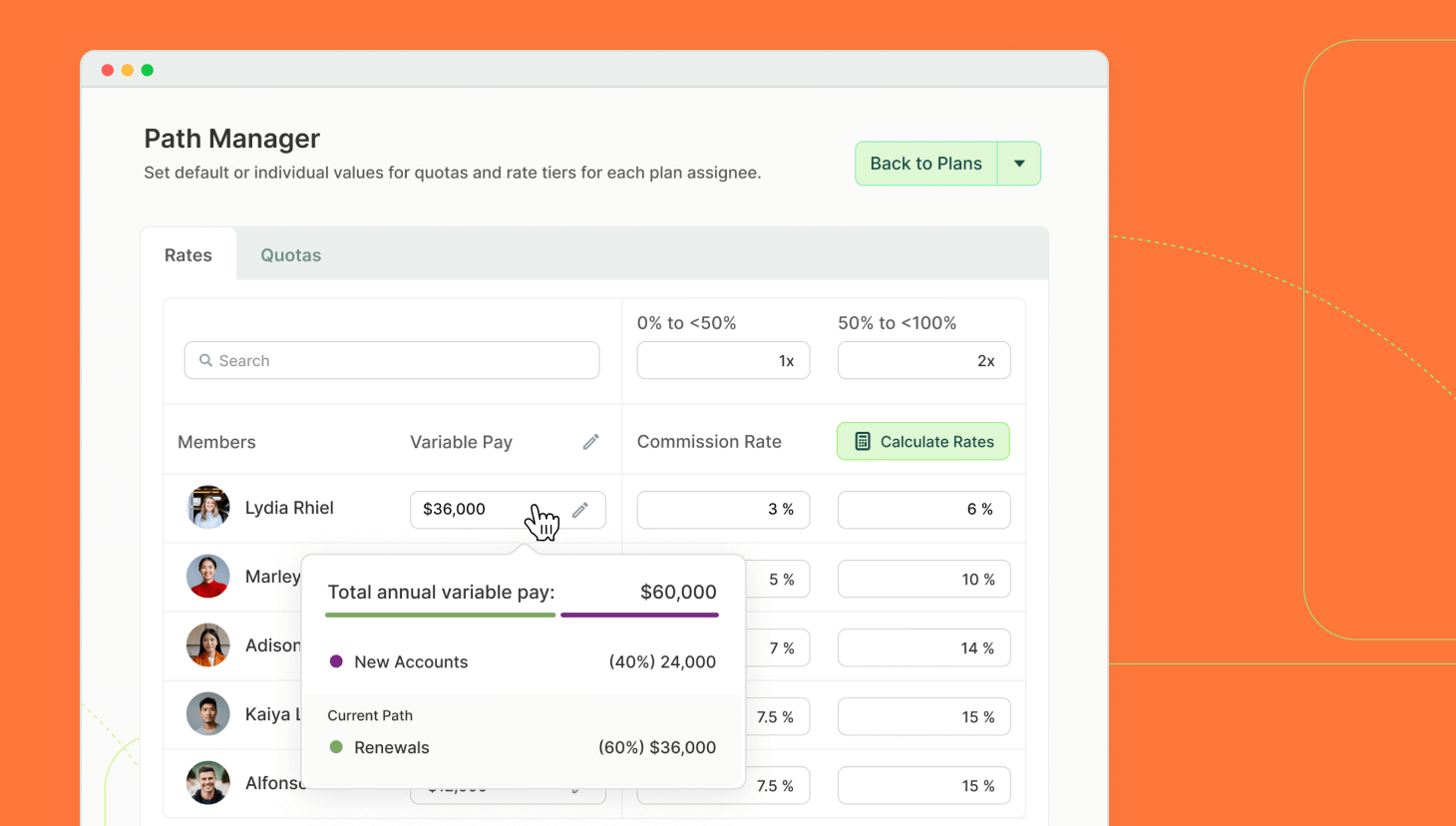

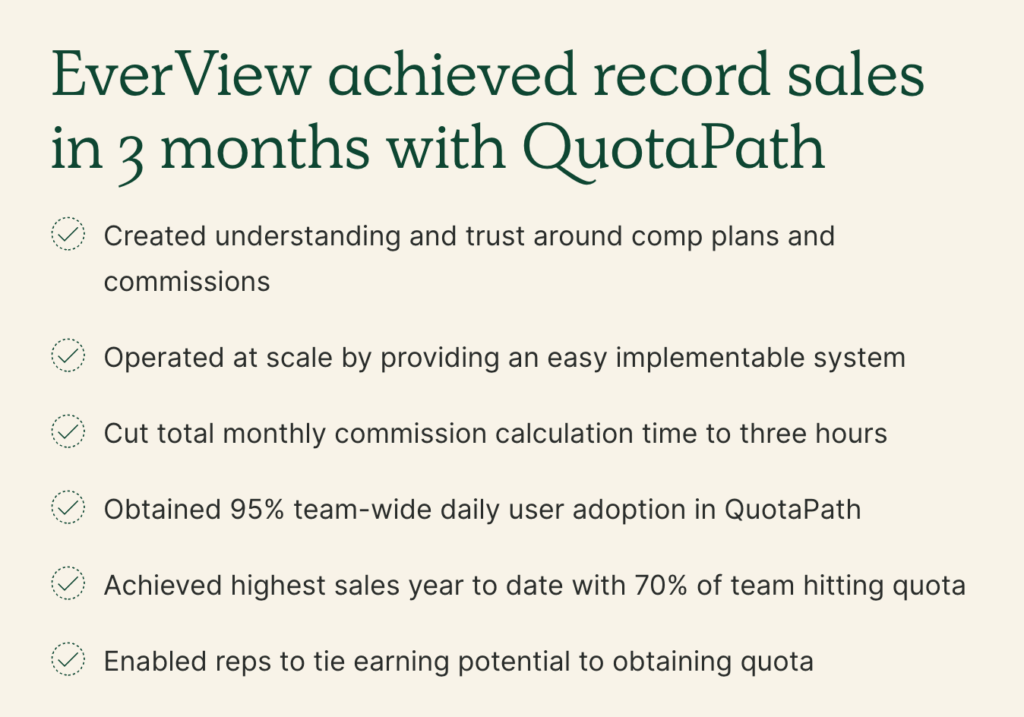

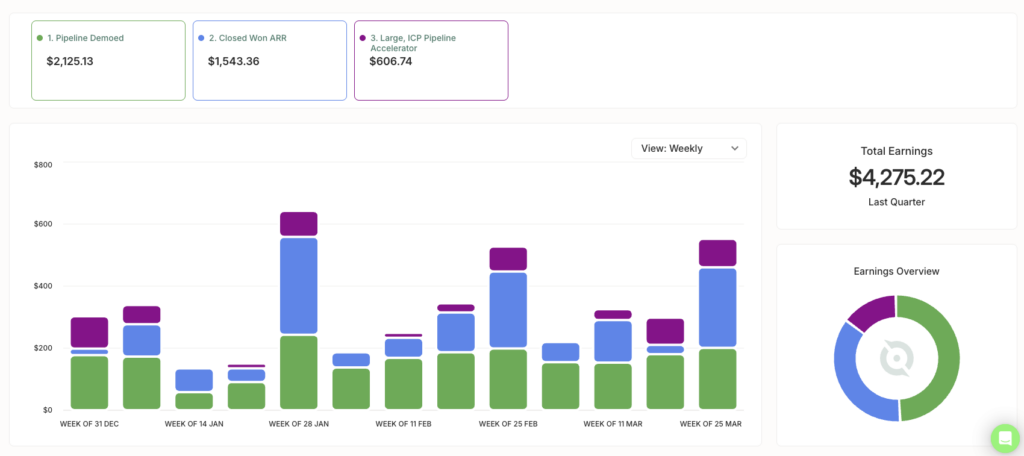

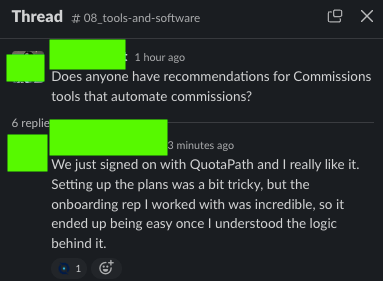

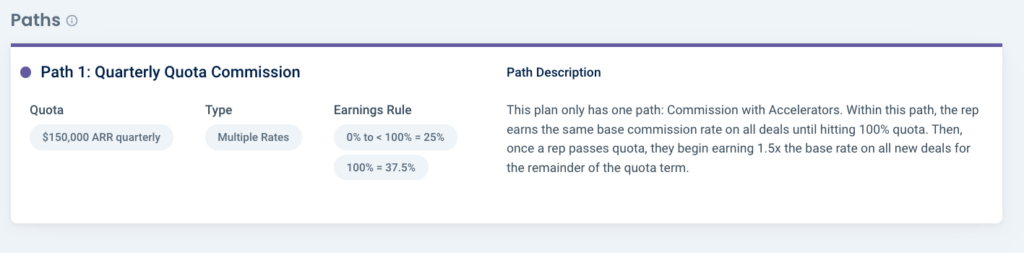

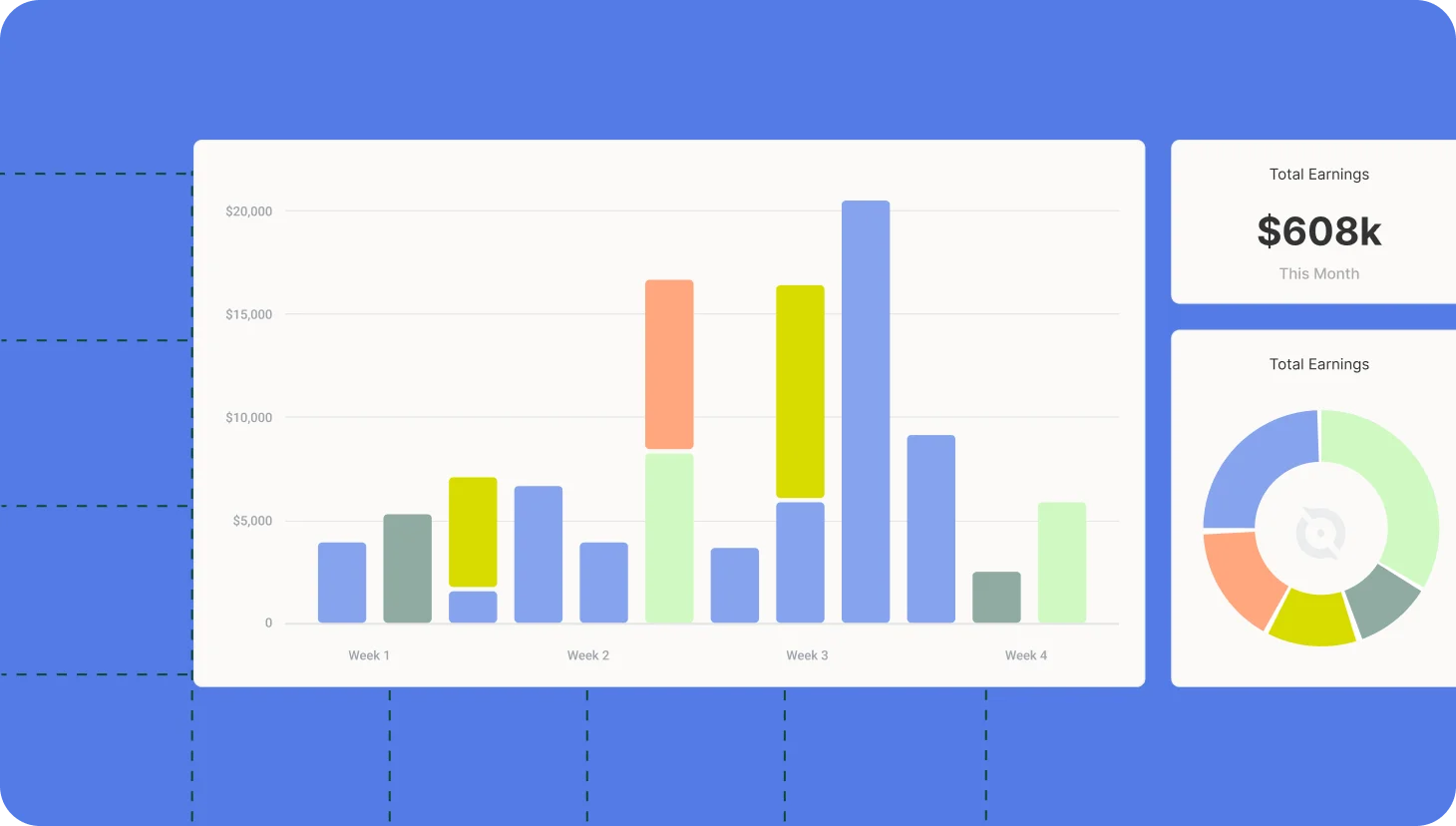

You can use a sales compensation system like QuotaPath to track commissions as well as attainment progress at the individual and team levels. This can help leadership prioritize where to spend their coaching time, especially if reps are just shy of achieving quota or if a rep is consistently underperforming. Plus, it’ll save your team time and the headache of manually tracking and calculating deals and earnings.

Automating the process can:

- Improve tracking accuracy

- Provide insights into team performance

- Motivate your team

- Inform better decision-making around resources, sales team strategy and compensation.

Provide reps with visibility to quota progress

You can also use an automated tool to give your reps visibility into their progress.

Studies have shown that when you consistently check daily progress toward a goal, you’re more likely to reach it.

Think about weight loss.

If you check your weight daily while on a new exercise program and see the small “gains” over time, you’re more likely to stick to the plan until you reach or surpass the target.

The same applies to quota attainment.

When you give your reps visualizations filled with real-time and forecasted progress, they can see how close they are to the goal or how the next deal pushes them over the finish line. This helps motivate them to hit their targets. It also helps hold them accountable by helping them think through, “Am I doing everything I can today to help me reach my goal tomorrow?” And, “If I get a deal in this week, then I only need one more to get me to my goal.”

Leveraging data analytics for sales quota management

How else can data analytics impact your sales quota management, you ask?

In sales quota management, data analytics can track progress, identify trends, and make better decisions.

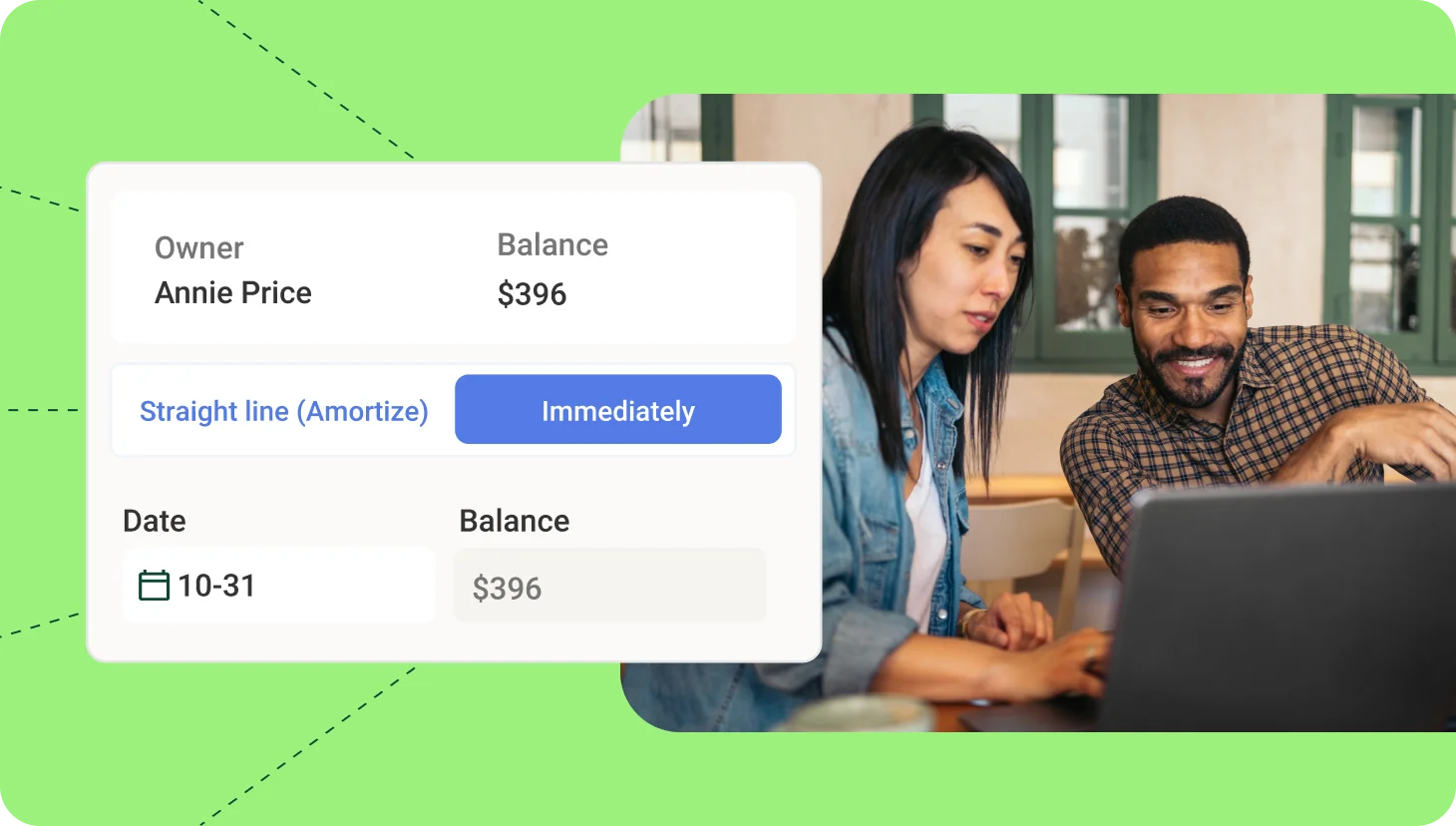

One way to ensure the data is updated and accurate is by syncing your customer relationship management (CRM) to whatever automated solution you use to track quota progress. QuotaPath, for instance, syncs with CRMs such as HubSpot, Salesforce, Copper, Pipedrive, and more so that deal data comes directly from the team’s direct source of truth.

QuotaPath’s insights can help you measure how successful your compensation plan is at driving your reps toward achieving quota.

This, in turn, drives efficiency across your process. For example, if you pay a higher commission rate on multi-year contracts that includes quota retirement, you can see how many reps take advantage of that compensation lever.

Use data analytics for sales quota management to:

- Track progress: Track progress towards quota attainment. This can be done by tracking individual sales rep performance, team performance, or overall company performance.

- Identify trends: Identify trends in sales performance by tracking historical data and looking for patterns.

- Make better decisions: Data analytics can be used to make better decisions about sales and compensation strategy and resource allocation.

Here are some additional tips for leveraging data analytics for sales quota management.

| Use a variety of data sources | This will give you a more complete picture of your sales performance. |

| Maintain clean data | Before you start analyzing your data, it is important to clean it by removing any errors or inconsistencies from your data. |

| Use the right tools | Analyze your quota data with a platform like QuotaPath |

By following these tips, you can leverage data analytics to improve your sales quota management process.

To learn more about how QuotaPath can support sales quota management, connect with our team, or log in with a free 30-day trial to see for yourself.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialFAQs:

What are the benefits of automating sales quota management processes?

There are many benefits to automating sales quota management processes. Here are a few of the most important ones:

Increased accuracy: Automated quota management systems can help to ensure that quotas are accurate and up-to-date, which reduces the risk of inaccurate sales forecasts and missed targets.

Improved efficiency: By automating quota management, you can free up sales managers and reps to focus on other tasks and increase productivity and efficiency as a result.

Improved visibility: Real-time visibility into quota progress helps sales leadership make adjustments, prioritize coaching, and create a culture of goal setting.

Build sales strategy alignment: Having a source of truth for quota attainment progress helps to facilitate collaboration between sales managers and reps and build alignment as everyone works toward the same goals.

Sales team motivation: Giving reps a system to track their quota progress means they will always be up-to-date on how they’re trending toward their goal. This helps to build rep ownership of their performance while keeping them focused and motivated.

If you are looking for ways to improve your sales quota management process, then automating it with a tool like QuotaPath is a great option.

How can companies overcome challenges in sales quota management with SaaS solutions?

SaaS solutions such as QuotaPath can help companies overcome challenges in sales quota management by automating quota management and providing real-time visibility into progress.

For instance, if you have a sales compensation plan that includes commission tiers based on quota attainment, you need to know when the rep crosses into the next tier to track and pay correctly. That, and how much more they earn upon doing so. A sales quota management system can provide visibility to the rep and leadership to show how close they are to unlocking higher earnings while also automatically tracking the calculations.

Plus, as an organization scales and additional quotas follow, SaaS solutions can save time from manually calculating and tracking quota management. This makes adding or removing employees, implementing compensation plan changes, and providing transparency to each rep and stakeholder tied to the compensation and quota process easier.

Overall, SaaS solutions can be a valuable tool for companies that are looking to improve their sales quota management process. By automating the process, providing real-time visibility, and being flexible and scalable, SaaS solutions can help companies to overcome the challenges of sales quota management and achieve their sales goals.

How does quota management increase sales productivity?

Quota management increases sales productivity by enabling teams to set clear goals with progress toward those goals widely visible. It also helps leaders and reps to manage performance, motivate sales reps, and improve sales efficiency.

In fact, we found that companies that use quota management systems are 25% more likely to meet their sales goals. Plus, a study conducted by Salesforce found that companies that use quota management tools are 10% more likely to increase their sales revenue.

Recent Comments