This article interviews Pete Crosby, who teaches the revenue leadership course The Definitive Guide to Revenue Leadership through Sales Impact Academy. This course is being offered for free to QuotaPath customers.

The chance of getting fired as a VP of Sales is high.

For instance, a VP of Sales averages 17 months per gig. Meanwhile, a CFO’s tenure comes in at 4.7 years.

“The revenue leader role is one of the most insecure because it’s the most measurable,” said Pete Crosby, a revenue leader, executive coach, and founder. “You’re measured based on how much revenue you deliver, and you’re paid well compared to other executive roles. The chances of you getting fired go up because there’s more on the line.”

That alone leaves many sales leaders stuck in a mental cycle of impending doom.

Fortunately, plenty of resources, revenue leadership courses, and coaches exist to help sales execs manage these feelings of doubt.

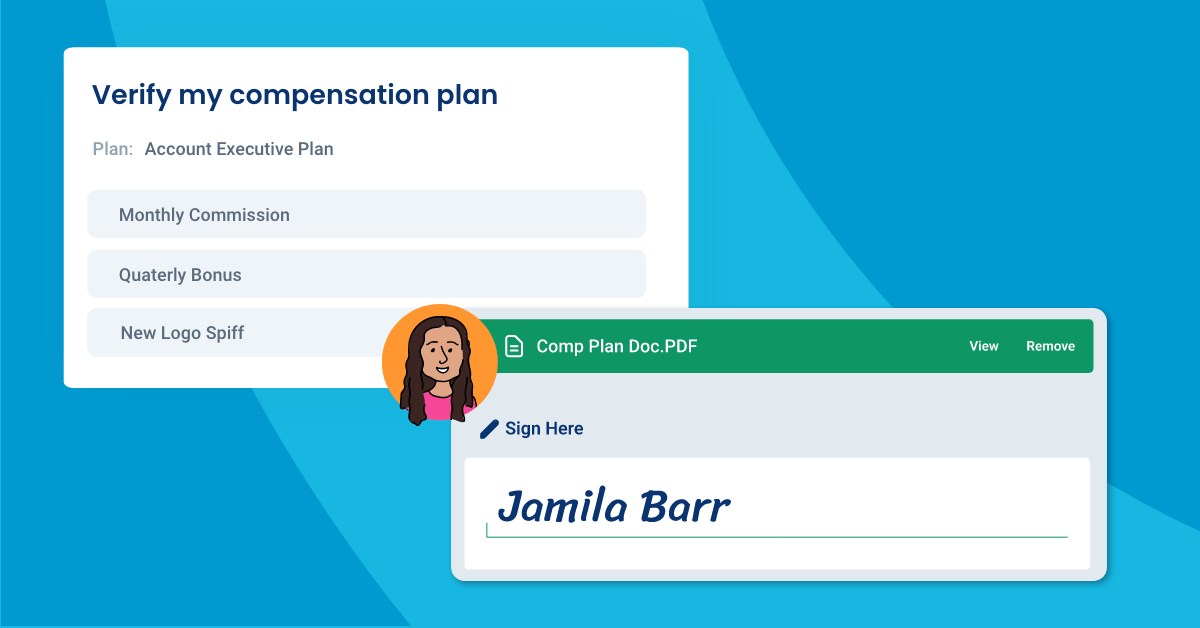

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialAnd, Pete is one of those resources.

The 4x Chief Revenue Officer coaches about 40 sales and revenue executives from around the world and supports five companies in an advisory capacity. He led several companies through successful exits, including Viadeo, the French equivalent of LinkedIn that went public in 2014.

He’s also an author and instructor. In Spring 2021, Pete partnered with Stage II Operating Partner Mandy Cole on the Sales Impact Academy Course: The Definitive Guide to Revenue Leadership. Mark Roberge, Managing Director at Stage 2 Capital and former Hubspot CRO, also serves as a guest coach and teaches the Masterclass “Building the Revenue Model.”

“This course will give you a sense of allyship in the exposed and risky position that you’re in.”

Pete Crosby

Sales Impact Academy: The Definitive Guide to Revenue Leadership

The duo split the entire learning pathway into two courses. The first course, Design & Build, focuses on product-market fit, the Raskin Matrix, unit economics, and creating the right culture.

Execute & Scale, the second course, then covers data-driven hiring processes, developing a revenue playbook, pipeline and forecast management, fundraising, and executing and scaling the revenue model.

Pete and Mandy deliver each course over 12-live classes following a six-week schedule. Those who cannot attend live can catch up with recordings of each session.

After completing the Design & Build course, students will be able to:

- Confidently guide an executive team through the GTM process

- Contribute effectively and strategically to product and engineering decisions

- Design value proposition

- Build a predictable model

- Have a model to prioritize and focus time

With the first course, Design & Build, beginning March 1, and Sales Impact Academy offering QuotaPath customers Design & Build for free, we asked Pete to tell us more.

What can students expect when taking this course?

Pete: Expect three things. First, expect a cohort of people who are at the same stage as you in your career. We have VP of Sales, CROs, founders, and CEOs who need to better understand the mechanics of revenue. We all bring our own perspectives and share them in an enriching learning experience.

Secondly, between myself and Mandy, we’ve raised over a billion dollars together. Mandy ran revenue for Zenefits, one of the biggest success stories in scale. Now she’s on the other side, as a partner at Stage 2 Capital. She spends a lot of time with startups reviewing their decks and proposals and helping them with the early predictability phase. Between the two of us, there is a lot of experience, and we apply that directly with our students.

And third, there isn’t anything out there that teaches VPs of Sales all the elements they need to know. We don’t expect our students to know how to do RevOps after a 60-minute class. But they will know how to investigate it further and what questions to ask. We offer a solid systematic framework for sequencing what revenue looks like.

What have you noticed sales executives struggle the most with? How does “The Definitive Guide to Revenue Leadership” address this?

One trend I’ve observed is the idea that there isn’t enough time in the day. You have this level of insecurity shared amongst revenue leaders and this idea that time is a precious commodity.

In our course, we discuss time management and how to de-risk your position by focusing on the right things. Part of that time management involves focusing on one thing at a time and getting really good at it. Breaking things down into prioritized bite-sized chunks is a better way than looking at a mountain of stuff.

What are some other revenue challenges your courses address?

There’s the classic problem of hiring salespeople before establishing product-market fit. Or, hiring salespeople before setting a motion that creates a flywheel of predictability, scalability, and repeatability. Too often, revenue leaders believe that if they hire salespeople, then sales will follow. We know this isn’t true.

Another thing that comes up is unit economics, something that CFOs and CEOs tend to understand pretty well, but maybe not a VP of Sales. In my experience, I’ve seen the topic of unit economics intimidate a lot of sales leaders. In one lesson, we highlight how to calculate core unit economics, what to know, and why they are important. We peel back the curtain and remove some of the mystique around it.

How does your course improve general leadership skills?

We get into the basic fundamentals of leadership in the second course. This includes how to create a culture that intrinsically motivates people. A culture where you’re able to hire in a diverse way and where people are treated equitably and feel included. It’s hard to find people who disagree on these. However, it’s actually very hard to find companies that function like that. We talk about communication, leadership, and what other elite qualities you should hold as a leader.

Lastly, how would you sell this course to a sales executive? Why should they take it?

I wouldn’t sell it to anyone. If what people have heard is not sufficiently interesting then it’s not for them. Being a VP of Sales or a CRO is hard. You don’t have many allies. VCs and founders want you to do well, and they will try to help you. But you have to succeed. A course like this is really useful for showing that we have your back. We care about your career. We have tools that can help you do well. Also, you’re probably pretty good at what you do, and this course helps plug any remaining holes.

To learn more about this course, visit Sales Impact Academy. QuotaPath customers will receive free enrollment for the Design & Build section, register here.

Not a QuotaPath customer yet? Chat with us today to see how we can automate your commissions.

Recent Comments