When the sales team grows, it’s not just headcount.

New territories, teams, quotas, and more follow suit. And with that comes new comp plans and complexities.

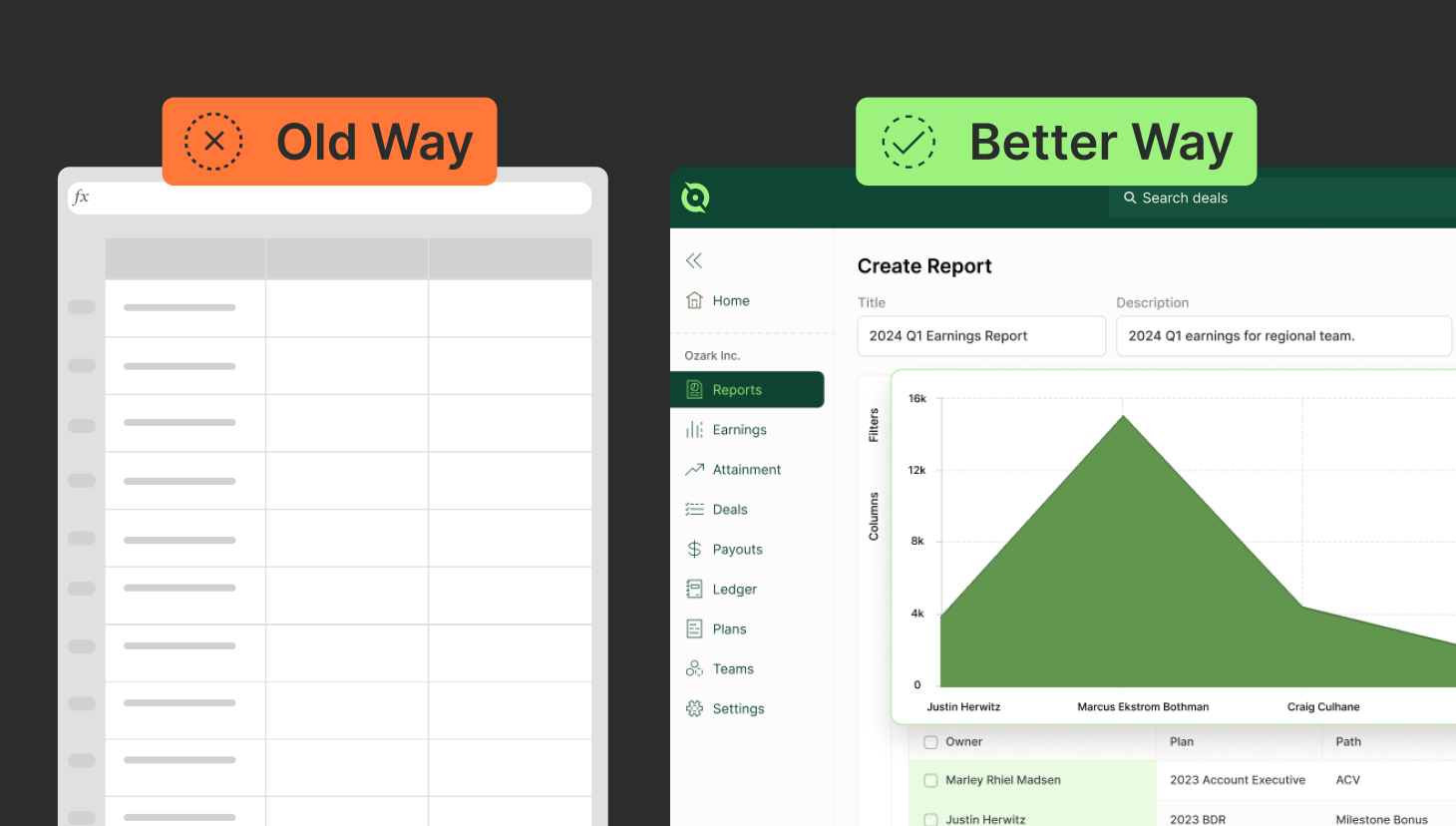

What starts as a manageable spreadsheet quickly becomes a sprawling web of manual calculations, error-filled audits, and wasted time between RevOps, Finance, and Sales to determine who is getting paid what and when.

Payout cycle slowdowns follow, and, in the worst-case scenarios, a rep (or reps) receive incorrect commission checks.

These inefficiencies not only slow down payout cycles, they erode trust across the organization.

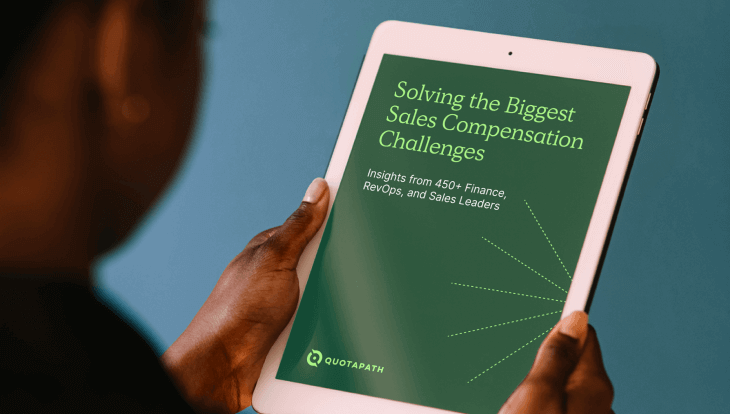

Did you know: 75% of sales reps don’t trust are paid fairly (Report)

The natural question arises: How can companies scale their commission processes without scaling their operations team?

That’s exactly where sales commission software like QuotaPath comes in.

Built to automate, streamline, and bring transparency to sales compensation, QuotaPath helps fast-growing companies eliminate manual pain points while maintaining lean ops.

And the results speak for themselves: from saving hours of administrative time each month to improving rep motivation and payout accuracy, teams across industries, from SaaS to healthcare, have proven that you don’t need to add headcount to scale commissions.

Below, we’ll explore:

- The hidden costs of commissions and manual tracking

- Why scaling sales shouldn’t mean scaling ops

- And, how QuotaPath’s automation empowers teams to grow smarter, faster, and without compromise.

Calculating the True Cost of Sales Compensation: Key Metrics and Considerations

Unpack the hidden costs of your sales compensation plan and dive into a practical approach for calculating the true cost of commissions and bonuses. Placeholder Content

Read BlogThe Hidden Costs of Manual Commission Tracking

First, let’s get into the costs of commissions you don’t typically come across until there’s an issue.

Manual commission tracking may seem like the path of least resistance (especially for lean teams), but unexpected costs can accumulate quickly.

Every month, RevOps, Finance, or Sales leaders spend hours toggling between spreadsheets, CRM exports, and comp plan documents to calculate who earned what. This time drain is rarely sustainable, especially as the organization grows and comp plans diversify.

But the real cost? Errors.

A single cell drag error can break the accuracy of the commission calculation, resulting in incorrect payouts. Then what happens? Your reps lose trust in how they’re paid, compromising the entire purpose of commissions: to motivate certain selling behaviors.

Take Keegan Otter, Warmly’s Head of Revenue, who used to run commissions manually.

“We had errors, multiple audits… When six sets of eyes still aren’t enough to prevent errors, you know it’s a problem,” said Keegan.

So, in addition to financial and operational risks, you now have teams chipping away at rep morale and organizational credibility due to manual sales compensation management practices riddled with mistakes.

When time and trust are both on the line, the cost of not automating becomes hard to ignore.

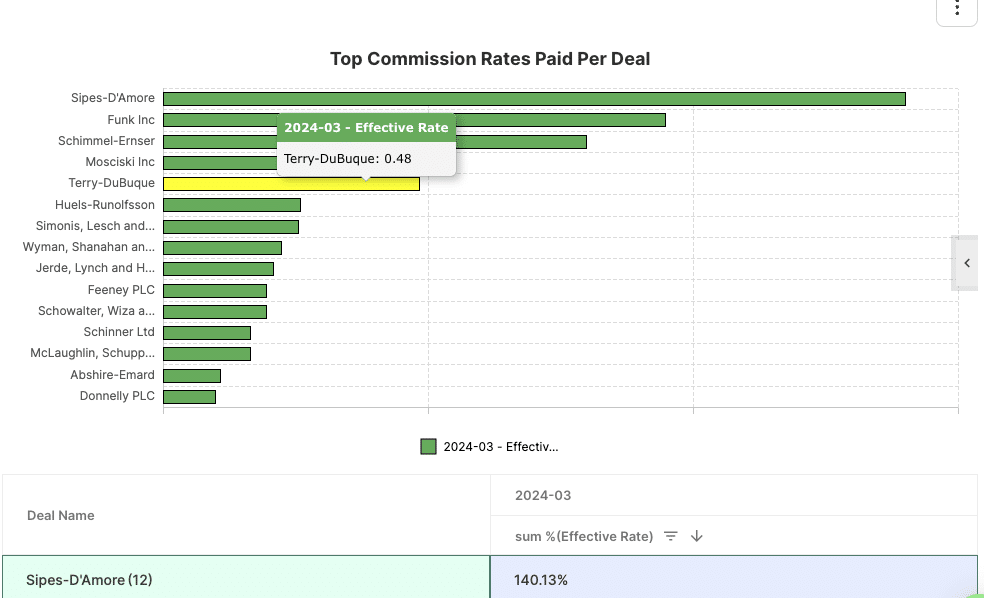

The Blind Spot in Spreadsheets: Total Commission Rate

Additionally, when commissions are managed manually, one critical metric is often overlooked: the total commission rate.

This figure represents the combined percentage of a deal’s revenue paid out to every team member who earns compensation, including SDRs, AEs, Marketing, Sales Leaders, and others. While each payout might seem reasonable on its own, spreadsheets make it nearly impossible to track the cumulative cost at the deal, segment, or company level.

And that’s a problem.

Without visibility into total commission rates, Finance leaders can’t accurately forecast commission expenses or evaluate whether compensation is aligned with margin. Worse, high payout overlap across roles can quietly eat into profits without anyone noticing.

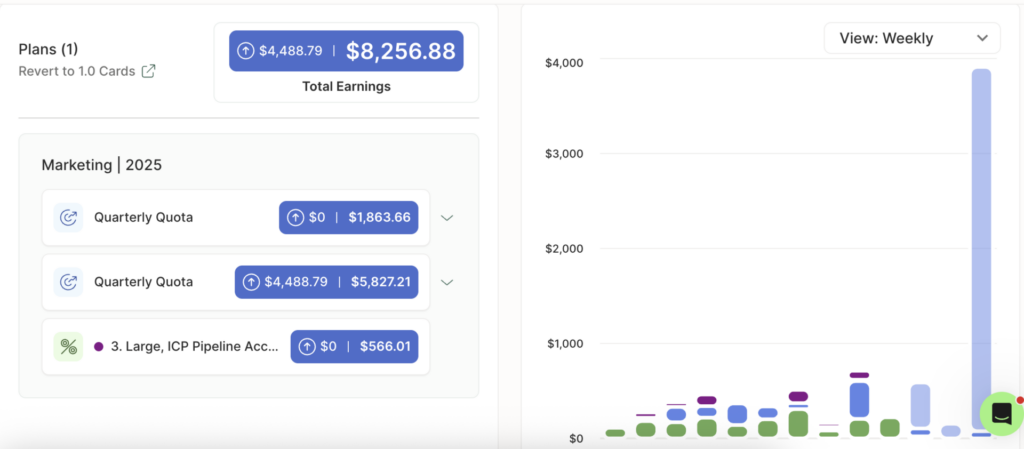

Automated solutions like QuotaPath expose this hidden metric in real-time across teams, plans, and deals.

David Thai, Augury’s RevOps Team Lead, switched from spreadsheets to QuotaPath and immediately benefited from greater clarity into total costs.

“Now we have more lines of sight between budget forecasting, commission forecasting on a monthly and a yearly basis… QuotaPath helped unlock a lot of things that I think were gaps for us in the past,” said David.

When you can see the full picture, you can make smarter decisions, whether it’s adjusting accelerators, capping overlaps, or aligning plans with strategic goals.

Total commission rate should never be a guess. With QuotaPath, it doesn’t have to be.

Why Scaling Sales Shouldn’t Mean Scaling Ops

Keep in mind, visibility is only half the battle.

Even when leaders understand the full cost of commissions across every role and deal, managing those costs manually is another story entirely.

As headcount increases and compensation plans become more nuanced, spreadsheet-based workflows struggle to keep up under the pressure.

That’s why scaling your sales team shouldn’t automatically mean scaling your ops team.

Yet that’s often the default when manual processes remain in place.

Instead of empowering existing ops leaders, outdated workflows bog them down, consuming time, increasing errors, and making audits a nightmare. What once worked for a five-person team becomes a high-risk bottleneck as the org scales.

That’s exactly what James Hall, EVP of Revenue at Gappify, experienced firsthand:

“I probably spent five or six hours a month personally doing [commission calculations]… not a great process for everybody,” said James.

With QuotaPath, leaders like James can reclaim their time and refocus on strategy, rather than spreadsheets.

Or Liza Dukhova at Rootly, who runs RevOps solo for a growing sales org:

“My time is a valuable resource. I’m a team of one… QuotaPath saves me hours of time,” said Liza.

A tool like QuotaPath allows lean teams to do more with less by replacing brittle manual work with reliable automation, so you can scale sales, not spreadsheets.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

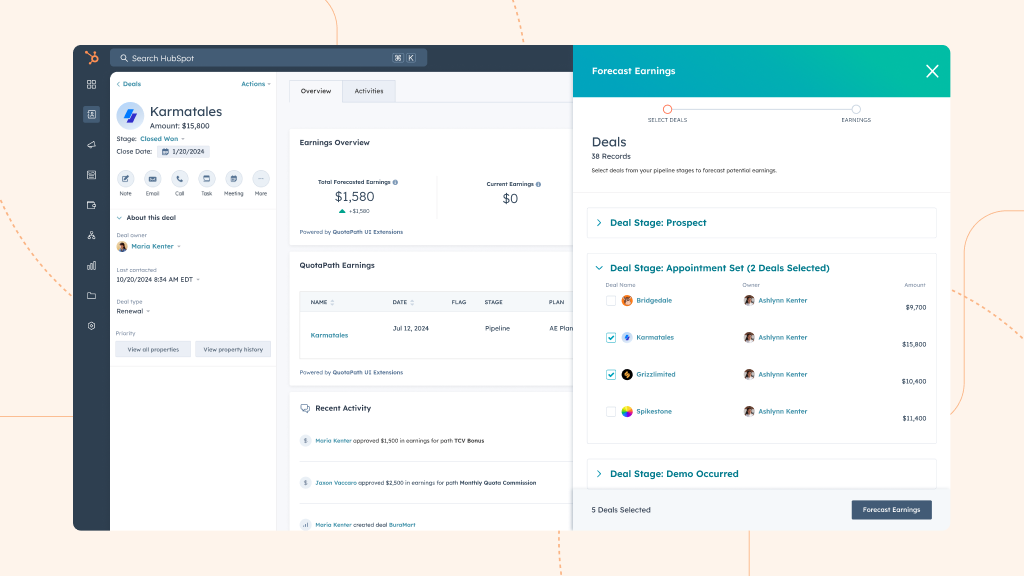

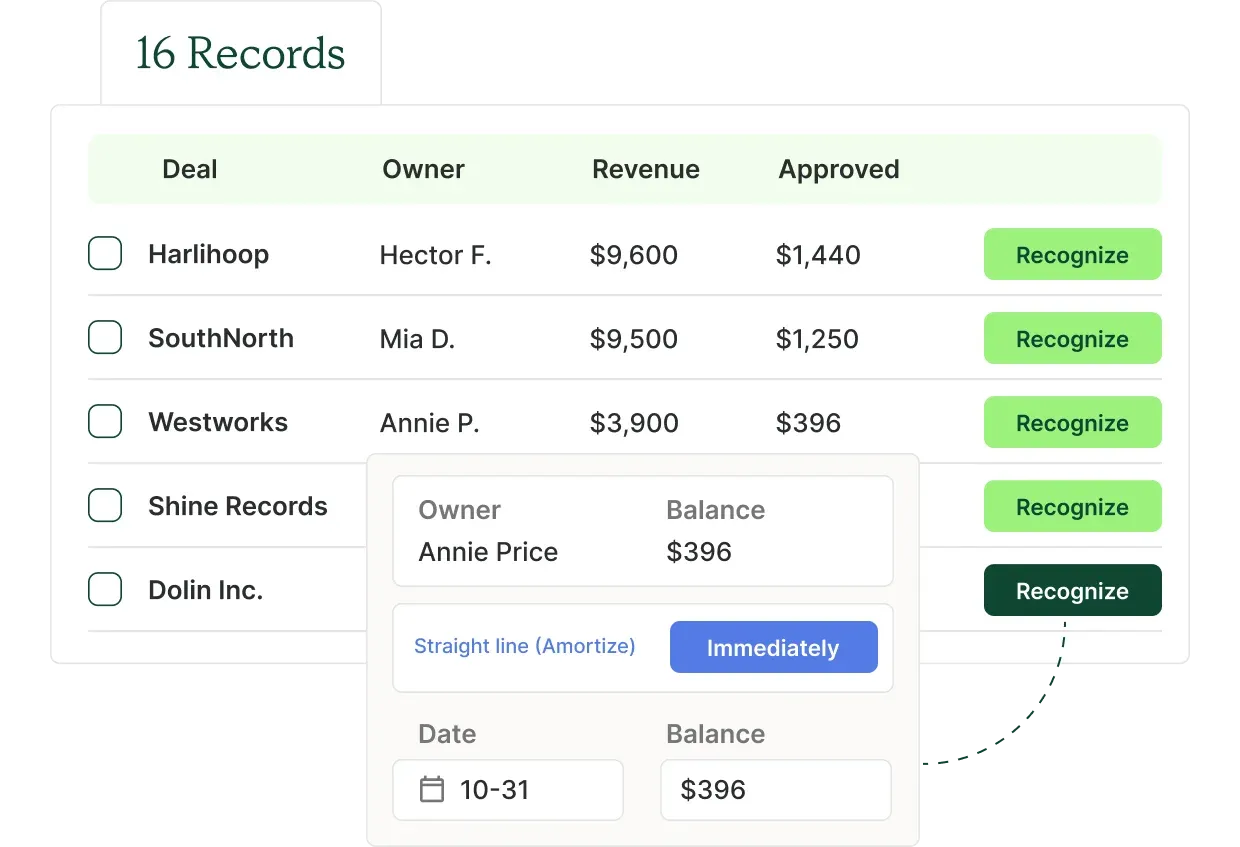

Start TrialWhat Scalable Commission Automation Looks Like

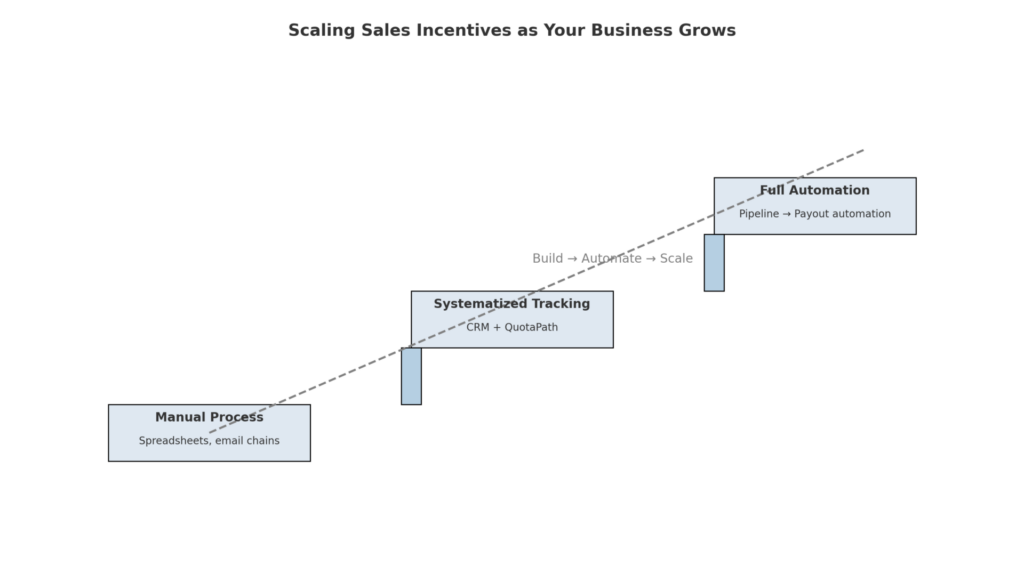

So, what does scalable commission management actually look like in practice?

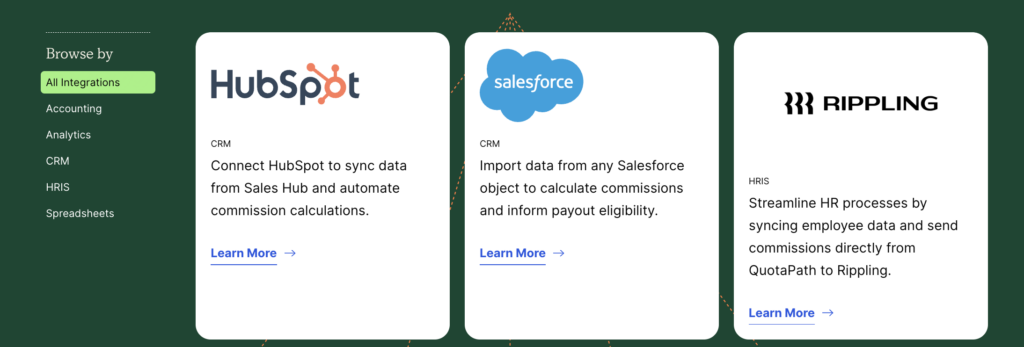

It starts with replacing spreadsheets and disconnected workflows with a platform designed to grow with you. One that integrates with your existing systems, and one that supports complexity without sacrificing usability.

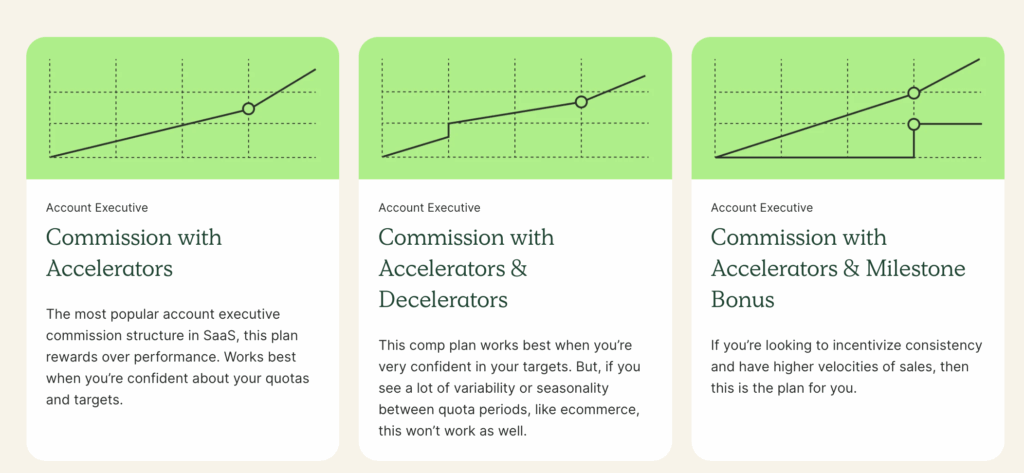

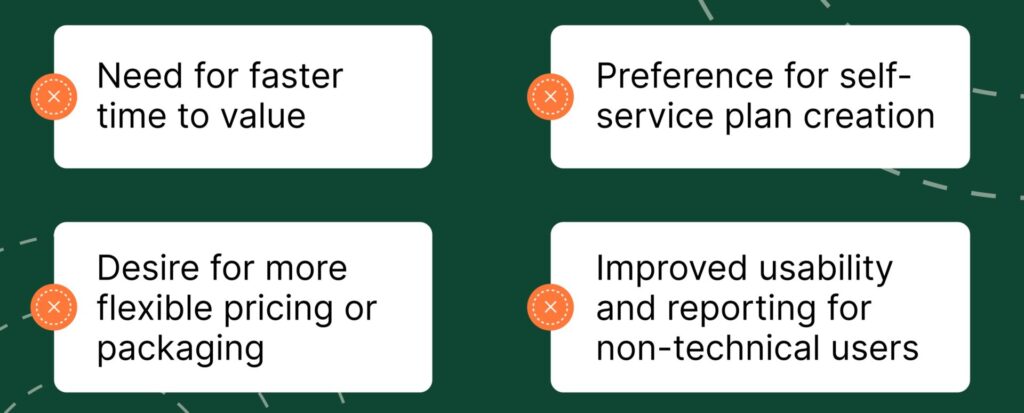

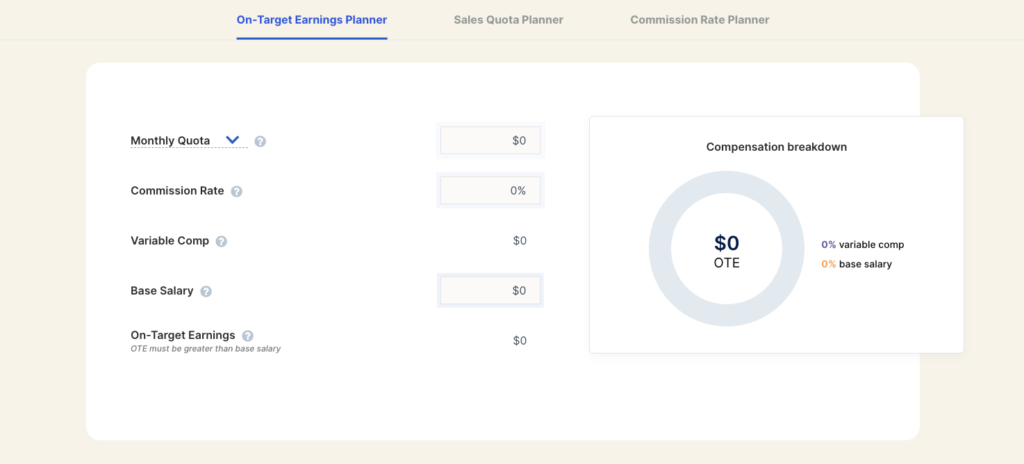

The right commission automation solution will offer:

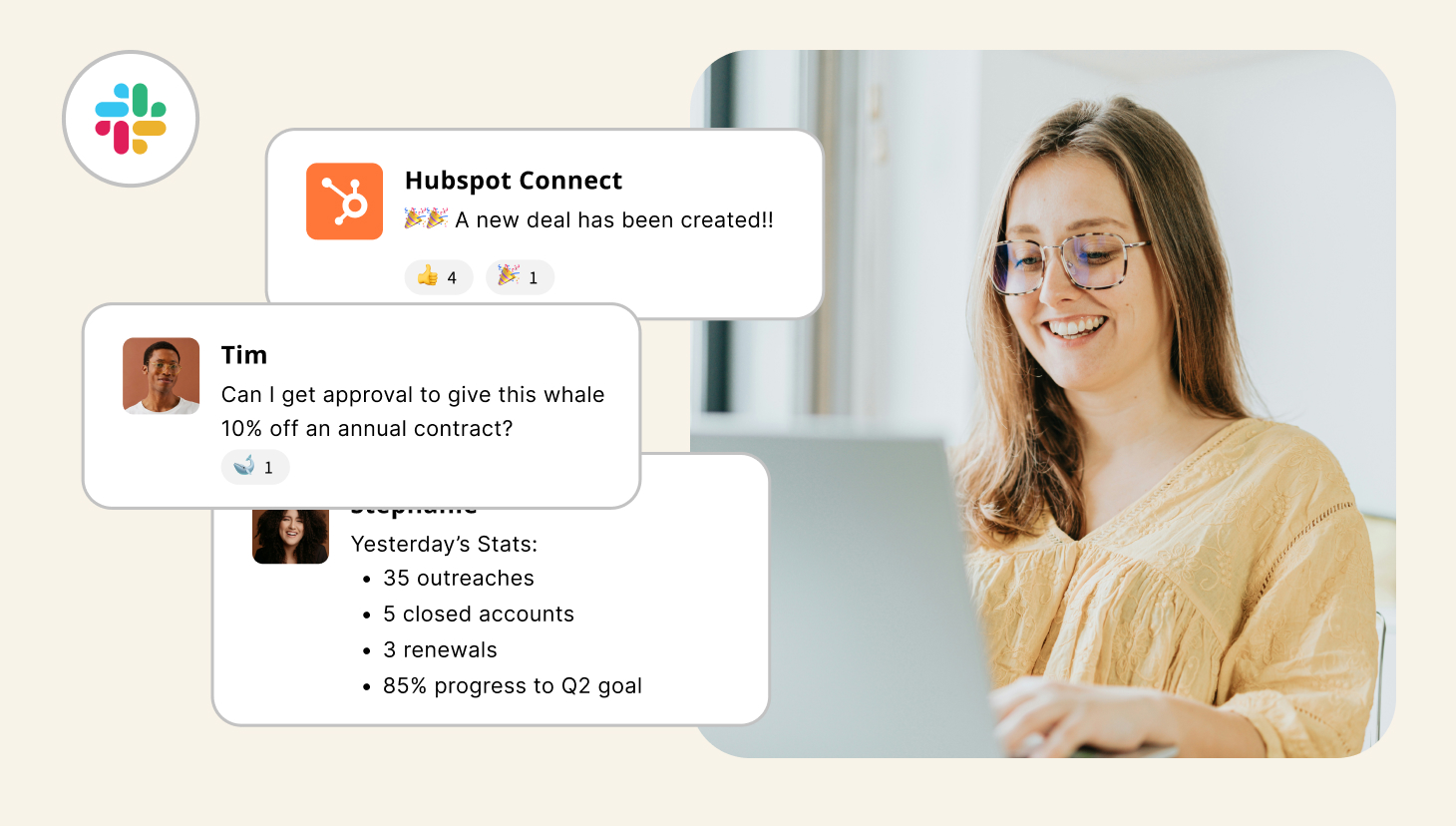

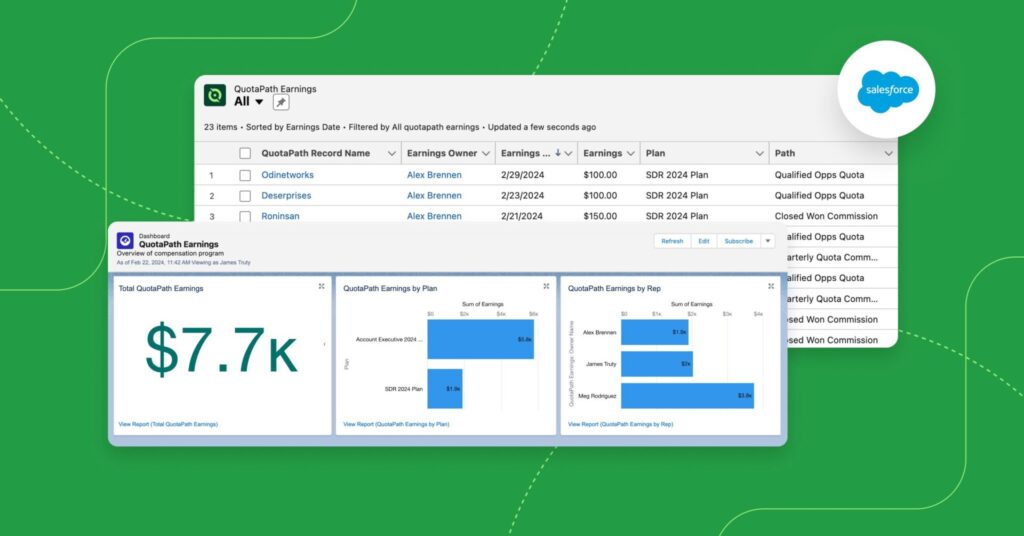

- CRM integrations (like Salesforce or HubSpot) to sync deal data automatically

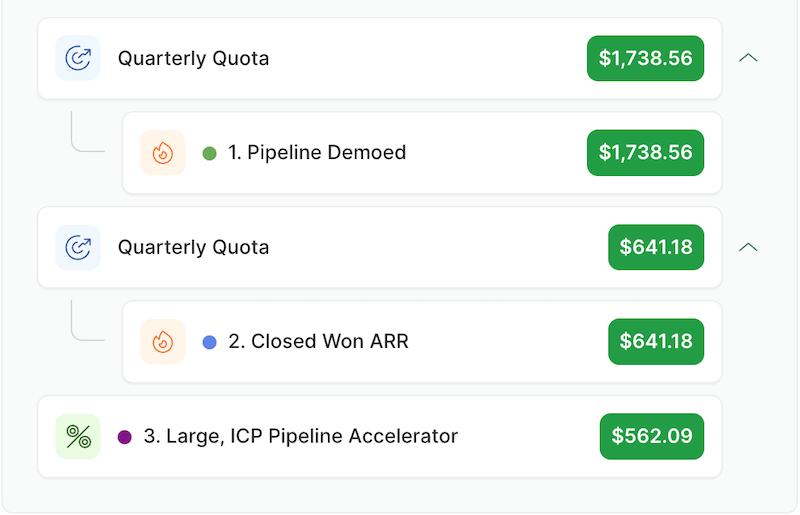

- Real-time visibility for reps to track earnings, forecast commissions, and flag discrepancies

- Customizable compensation plans with built-in automation and logic to support diverse roles and structures

For teams navigating rapid growth or shifting go-to-market strategies, the ability to move fast without rebuilding your compensation infrastructure is game-changing.

“Once we made the decision to get off spreadsheets… the question was how to do it cost effectively,” said Thomas Egbert, Head of Finance at Prefect, who purchased QuotaPath in 2022.

When teams automate calculations, they unlock time, accuracy, and transparency at scale.

That’s what sustainable growth looks like.

ROI Realized ROI with QuotaPath

Of course, don’t just take our word for it.

Our customers have achieved significant wins in terms of time saved and money saved.

- Hydrocorp: Paid for QuotaPath in one month by catching commission overpayment mistakes

- Warmly: Scaled from 3 to 35 reps, saving 5–8 hours/month and increasing trust

- Whistic: Reduced commission processing time by 90% for ~30 reps

- Augury: Cut quarterly processing from 45 days to 15 days

What’s the ROI of QuotaPath?

Calculate the potential return on investment for implementing QuotaPath in your organization.

Use CalculatorStart Early. Scale Smart. No Extra Headcount Required.

The best time to fix your commission process isn’t after it breaks. It’s before it costs you time, trust, and top performers.

“When is it time to introduce automation? Day one,” said Hona VP of Finance Jordan Rupp. “I’ve worked at other organizations where you keep putting that off and you keep thinking and telling yourself, like, ‘Hey, it’s not worth doing it yet.’ But I don’t think we ever really calculate how much time, effort, and also emotional drain it takes on an organization to run this through a manual process.”

As your team scales, QuotaPath ensures your compensation operations don’t have to.

By eliminating manual processes, teams free up hours each month to focus on higher-impact initiatives, such as go-to-market strategy, forecasting, and enablement.

QuotaPath is built for lean teams with big goals.

Whether you’re preparing for scale or already in hypergrowth mode, it’s never too early (or too late) to build a commission process that works for you.

Ready to get started? Schedule a demo with our team today.

Recent Comments