The following blog explores the sales jobs with the highest commissions.

One in eight jobs in the U.S. (nearly 13%) are full-time sales positions, but only 39% of salespeople plan to go into sales.

Despite what appears to be a reluctance to enter sales, a sales career has its benefits. For instance, salespeople develop many skills they can use in other facets of their life like communication, trust-building, analytical thinking, and problem solving.

These skills easily transfer to other career paths, so accepting a sales role, even temporarily, provides growth opportunities.

Plus, a career in sales is never boring thanks to the ever-changing marketplace.

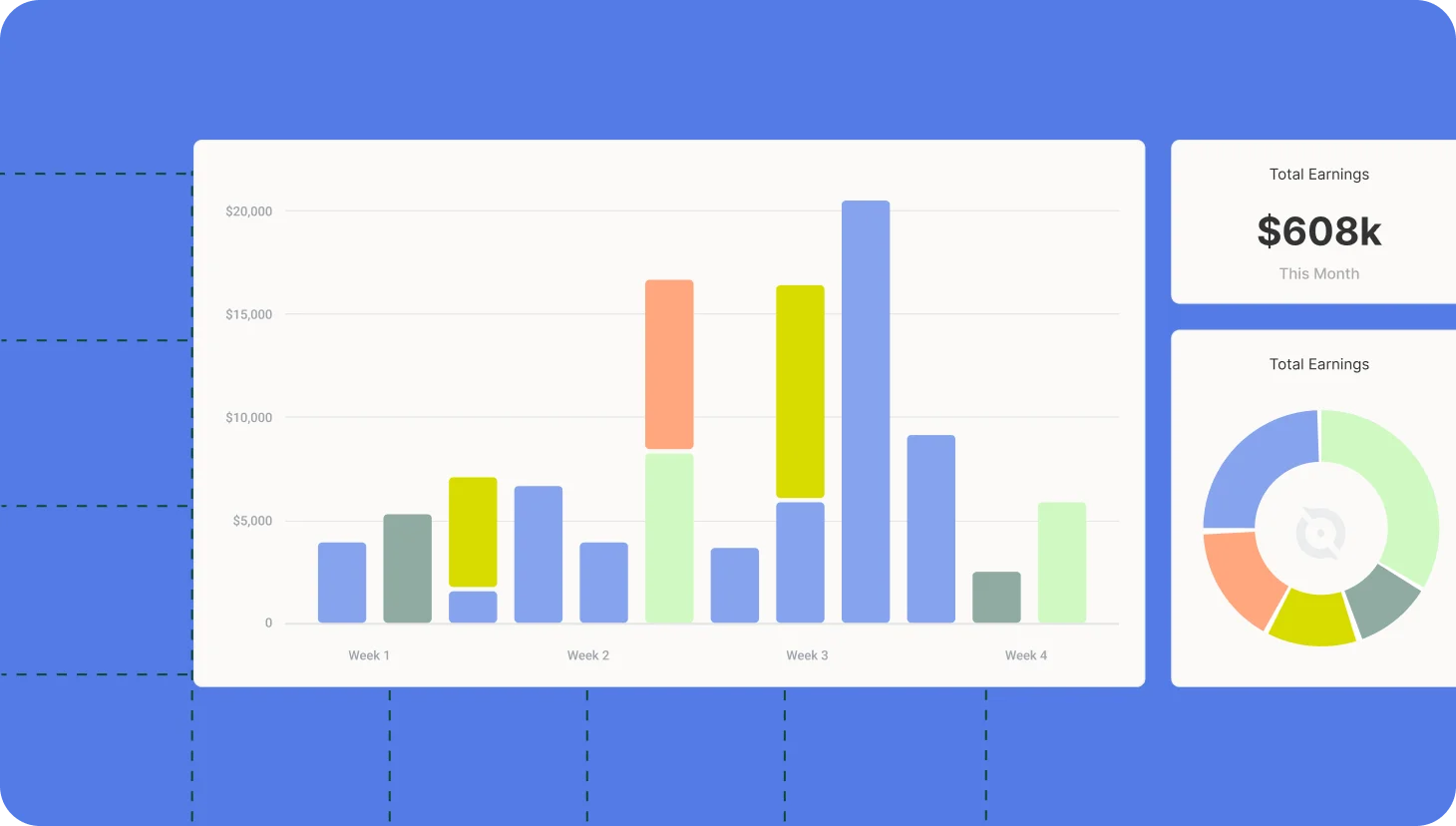

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialSales offers plenty of flexibility and solid promotional paths. It’s a field that is both challenging and rewarding with high earnings potential.

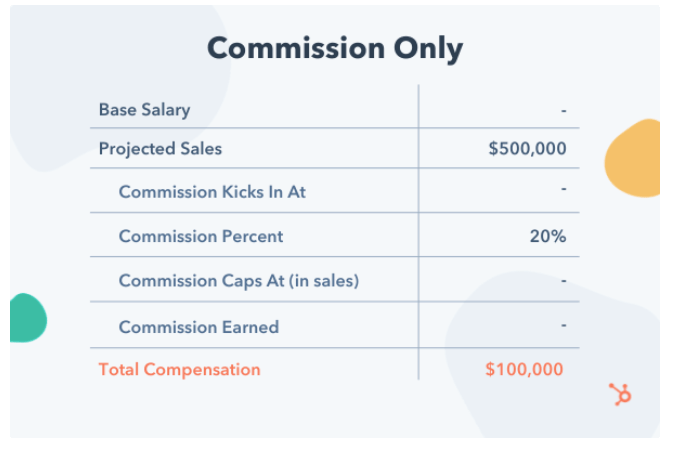

Most positions pay a base salary plus commission, often giving reps unlimited earning potential — one of the most enticing aspects of sales.

But not all sales roles are created equal in terms of income potential. High-commission sales jobs typically result in higher total earnings.

If that’s what you’re after, we’ve got you covered with this list of 10 sales jobs with the highest commissions.

Read on to plan your next sales career move.

Highest commission sales jobs

1. Enterprise Sales/Account Executive

| Average salary: | $75,000 | Average commission: | $64,000 |

| Salary range: | $54,000 – $130,000 | Average OTE | $172,000 |

Our first of the sales jobs with the highest commission is the enterprise sales rep. Enterprise sales executives typically work in a business-to-business (B2B) environment and are responsible for managing and expanding their company’s largest customers.

Since deals with enterprise clients tend to have a higher dollar value, the income potential is much greater for these sales roles. But this earning potential comes at a price: more responsibility and stress from dealing with the business’s biggest and most important clients.

Most candidates for enterprise sales executive roles must work their way up through the ranks to qualify, but someone with an MBA can occasionally get their foot in the door at this level.

— Source

2. Medical Device Sales Representative

| Average salary: | $60,000 | Average commission: | $31,000 |

| Salary range: | $41,000 – $98,000 | Average OTE | $107,000 |

A medical device sales rep sells medical equipment to medical professionals like surgeons and physicians. These sales professionals often demonstrate their medical products in doctors’ offices and hospitals. Some reps are even present in the operating room during medical procedures to confirm surgeons are using their devices correctly.

Although medical sales reps aren’t required to have a medical background, they usually need to have a bachelor’s degree, a thorough understanding of the potential impact of their medical device, and the ability to comfortably watch medical procedures.

— Source

3. Printing Sales Representative

| Average salary: | $98,000 | Average commission: | Not available |

| Salary range: | $72,000 – $130,000 | Average OTE | Not available |

A printing sales rep sells printing services and printed materials to businesses within a designated territory. This role involves creating relationships with current and potential customers, writing contracts, bidding on large commercial print jobs, and servicing existing clients. Additional responsibilities of printing reps include maintaining existing active accounts, following up with customers to confirm their level of satisfaction, or assisting with reorders. These reps also create presentations and proposals for business and keep abreast of their company’s new product and service offerings.

Printing sales reps don’t necessarily need any special educational requirements, but those with prior printing industry knowledge or experience are most likely to land the highest commission sales jobs.

— Source

4. Pharmaceutical Sales Representative

| Average salary: | $81,000 | Average commission + Bonus: | $44,000 |

| Salary range: | $50,000 – $118,000 | Average OTE | $133,000 |

Pharmaceutical sales reps visit doctors’ offices, hospitals, and medical facilities in their designated territory. Their goal is to develop relationships with doctors and educate them about the proper use and benefits of the drug and manufacturer they represent with the intent of driving more prescriptions.

Pharmaceutical sales roles are highly sought after. A bachelor’s degree from a leading university plus a high GPA is typically required to break into the industry.

— Source

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales5. Solar Sales Representative

| Average salary: | N/A | Average commission: | $101,000 |

| Salary range: | $80,000 – $162,000 | Average OTE | $101,000 |

A solar sales rep sells solar energy systems to residential and commercial customers. Responsibilities include determining if each location is a good fit for solar, creating cost and saving estimates, and responding to customer questions. In this role, reps may also need to develop strategic plans for sales territories, demo equipment, and keep up to date with product changes. Plus, some solar salespeople are required to prospect for leads while others are tasked with calling on warm inbound leads. It’s worth noting that this position typically pays solar sales commission with no base salary.

— Source

6. Territory Account Manager

| Average salary: | $66,000 | Average commission: | N/A |

| Salary range: | $44,000 – $98,000 | Average OTE | $104,000 |

A territory account manager estimates the potential of increasing sales goals or closing deals in a geographic territory. This role also manages a sales team. Other duties include developing sales plans, monitoring costs, improving customer service, gathering data, and reporting results.

This role requires strong management and communication skills. A bachelor’s degree in business or marketing and proven field sales experience are common requirements of a territory account management position.

— Source

7. Realtor

| Average salary: | $54,000 | Average commission + Bonus: | $44,000 |

| Salary range: | $24,000 – $150,000 | Average OTE | $108,000 |

Realtors are consistently on the sales jobs with highest commissions lists. A realtor sells commercial or residential real estate. They represent buyers, sellers, or both. They help people buy or sell a property and earn a percentage of the sales price as a commission. A selling agent is responsible for things like listing and marketing the property, hosting open houses, and completing closing paperwork. Buyer’s agents help clients find properties, craft offers, and assist people throughout the property buying process until the sale is complete.

The main requirement to be a realtor is completing training and passing a licensing exam in the state where they sell properties.

— Source

8. Sales Engineer

| Average salary: | $73,000 | Average commission + bonus: | $27,000 |

| Salary range: | $50,000 – $112,000 | Average OTE | $105,000 |

The sales engineer role combines sales, engineering, science, and technology. Companies that sell equipment, mechanical systems, or software products involving complex technologies often employ sales engineers. Sales engineers are typically responsible for assessing the client’s current equipment, mechanical systems, or software stack, understanding the customer’s needs, challenges, and goals, and creating a customized solution.

To qualify for a sales engineer’s role, an engineering bachelor’s degree or higher, or comparable experience, is typically required, due to the technical nature of this position.

— Source

9. Advertising Agent

| Average salary: | $58,000 | Average commission: | $8,000 |

| Salary range: | $23,000 – $114,000 | Average OTE | $66,000 |

An advertising sales agent works with potential clients to earn their firm’s advertising business. They typically initiate contact with the prospect to explain the various advertising services offered by their company. After conducting a thorough discovery call, they provide potential customers with quotes, handle paperwork, and make sales presentations to potential and existing clients. This role requires you to establish a good professional working relationship with clients. This facilitates identifying pain points and recommending advertising services that best meet their needs.

— Source

10. SaaS Enterprise Account Executive

| Average salary: | $140,000 | Average commission: | $158,000 |

| Salary range: | $107,000 – $180,000 | Average OTE | $327,000 |

A software-as-a-service (SaaS) enterprise account executive is responsible for generating new business within a portfolio of large enterprise accounts. They engage with C-Suite executives within prospect companies that meet their ideal customer profile and are most likely to need their solution. The sales cycle for these deals tends to be 6-12 months long and requires advanced strategic selling skills across a large buying committee. This role is quite demanding and extremely rewarding. That’s why these are some of the highest commission sales jobs available.

Our research revealed that the highest commission sales jobs in this category were Workday and PayCom. And those with the highest total compensation were Snowflake, Workday, and SumoLogic.

Although these aren’t entry-level sales jobs, they are ones to strive for as you advance your career.

— Source

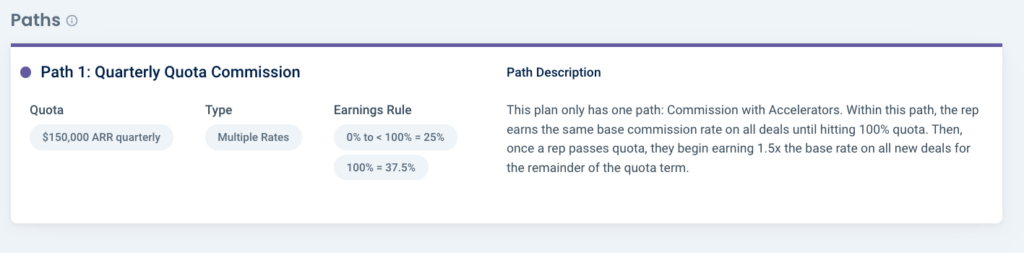

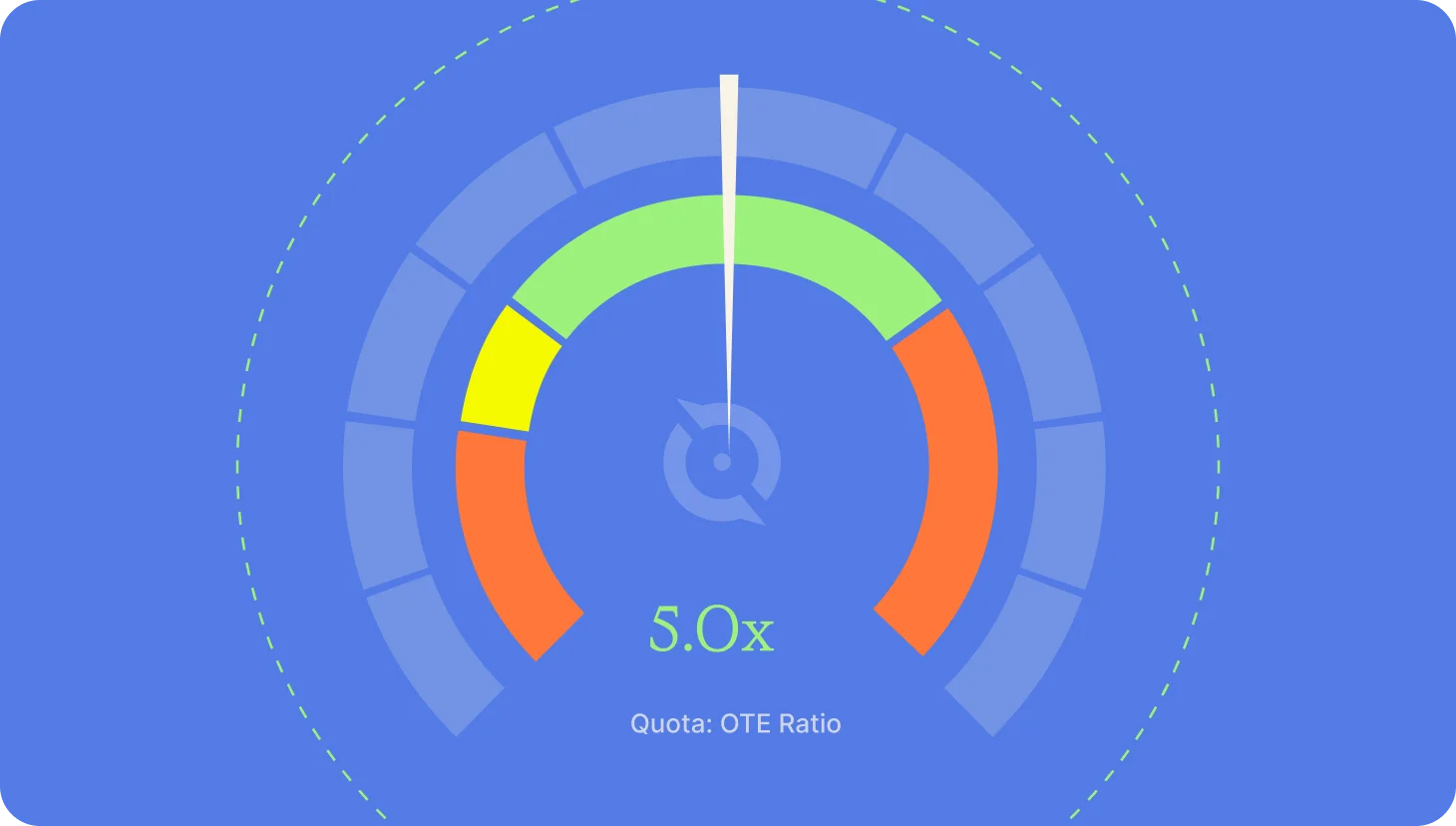

RevOps, sales leaders, and finance teams use our free tool to ensure reps’ on-target earnings and quotas line up with industry standards. Customize plans with accelerators, bonuses, and more, by adjusting 9 variables.

Build a Comp PlanHighest commission sales jobs, roles, and industries

As you can see, there are many different sales jobs with high commissions. The highest paying roles are enterprise account executives in both SaaS and non-software industries, followed by print sales reps. And the highest commission sales jobs from our list are SaaS enterprise account executives followed by solar sales reps.

Automate sales compensation management and commission tracking with a 30-day free trial of QuotaPath or see it live in a guided demo with our team.

Recent Comments