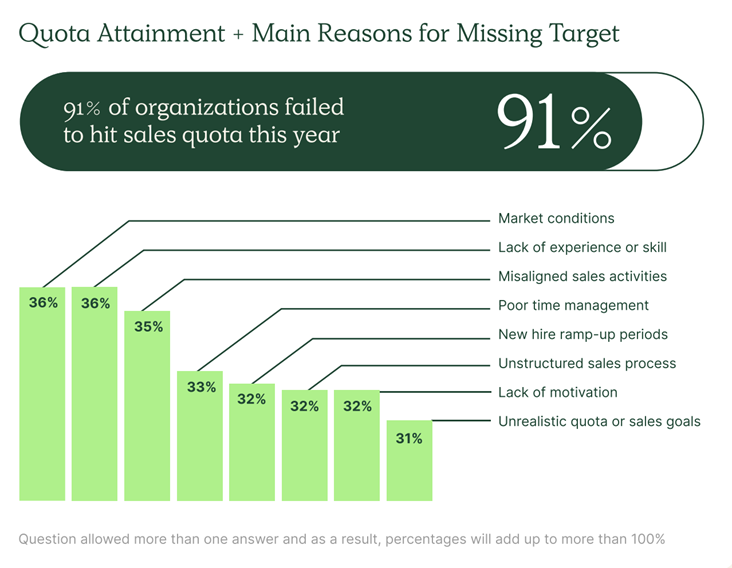

According to our compensation data, 91% of teams missed sales quota last year.

Market conditions were the leading reason, along with misaligned sales activity and unrealistic quotas or sales goals.

All of which relate to the sales quota.

The pressure to hit these targets can be immense, leading to demotivation, burnout, and ultimately, a revolving door of sales reps paired with missed revenue goals.

That’s where we come in, with years of experience partnering with organizations to build fair, realistic, and aligned compensation plans and quotas.

In this blog, we’ll explain a step-by-step process for setting quotas. This will ensure that your quotas are both challenging and attainable, keeping your team motivated and on track for success.

What is a sales quota?

Best Practices Before Setting Your Sales Quota

As you prepare to set your sales quotas, leverage these proven techniques to improve your success.

Gather Historical Data and Market Insights:

- Analyze past sales performance data to understand trends and baselines.

- Research current market conditions and competitor activity.

Set SMART Goals:

- Specific: Clearly define what the quota represents (e.g., revenue, units sold).

- Measurable: Establish quantifiable metrics to track progress.

- Attainable: Set ambitious yet achievable targets based on data and market insights.

- Relevant: Align quotas with overall sales goals and company strategy.

- Time-Bound: Define a clear timeframe for achieving the quota (e.g., quarterly, annually).

Consider Team Input and Collaboration:

- Involve your sales team in quota discussions to gather feedback and foster ownership.

- Facilitate discussions about individual and team goals to ensure alignment.

Account for Territory and Product Variations:

- Adjust quotas for different territories based on market size, customer base, and sales complexity.

- If applicable, tailor quotas to account for varying product lines with different price points and sales cycles.

Factor in External Influences:

- Be prepared to adjust quotas based on unforeseen market shifts or economic changes.

- Consider seasonal trends that might impact sales performance within specific timeframes.

Communicate Clearly and Transparently:

- Clearly explain the rationale behind the quotas to your sales team.

- Regularly communicate progress and provide ongoing support throughout the sales cycle.

Review and Revise as Needed:

- Monitor performance regularly and be ready to adjust if necessary.

- Conduct periodic reviews to assess the effectiveness of the quota and fine-tune for future periods.

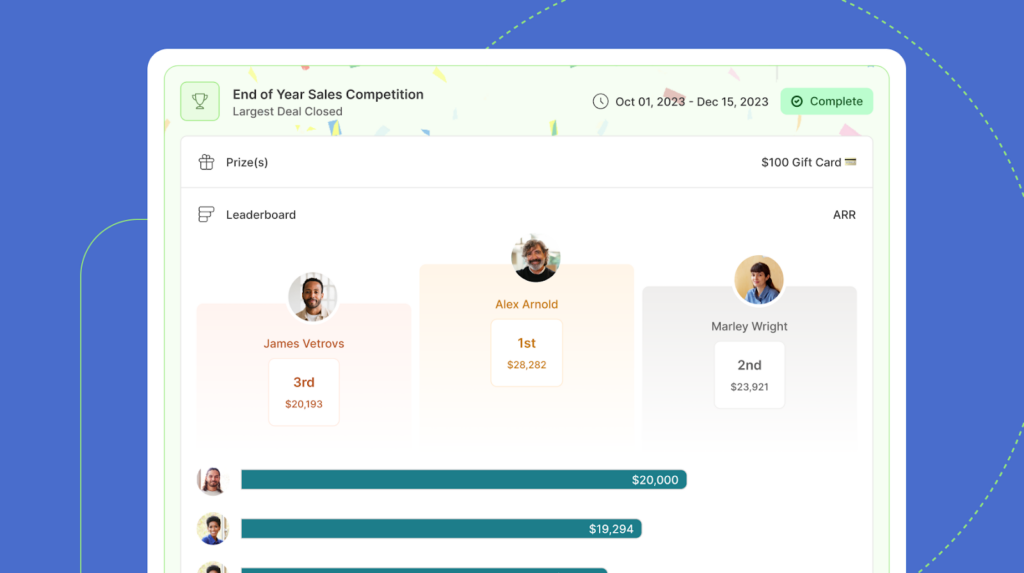

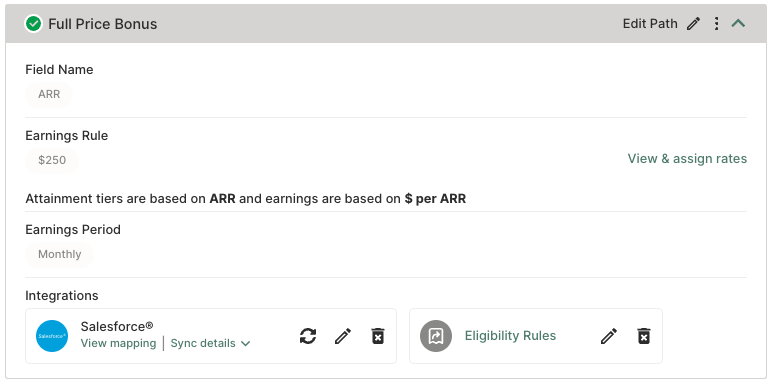

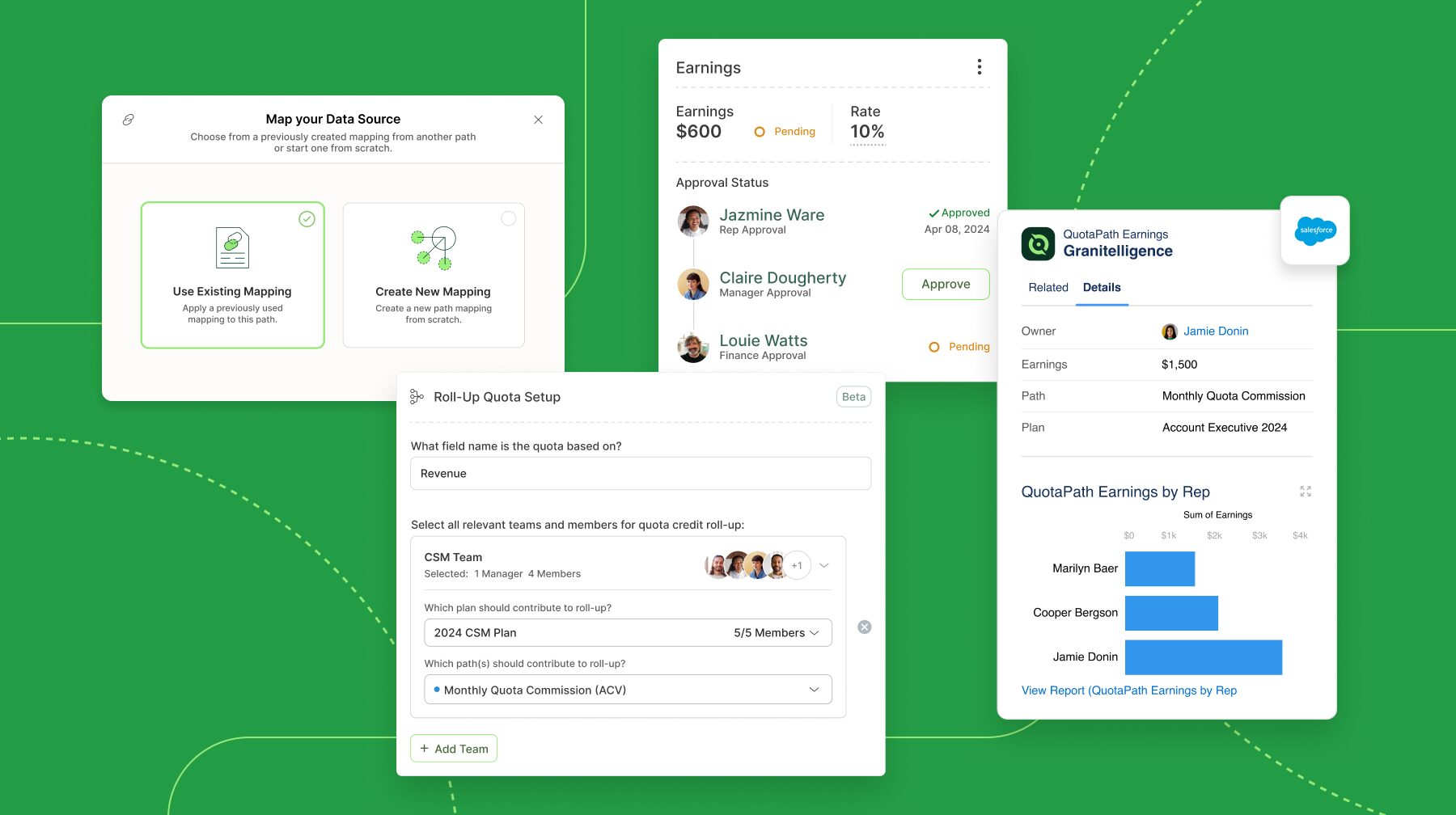

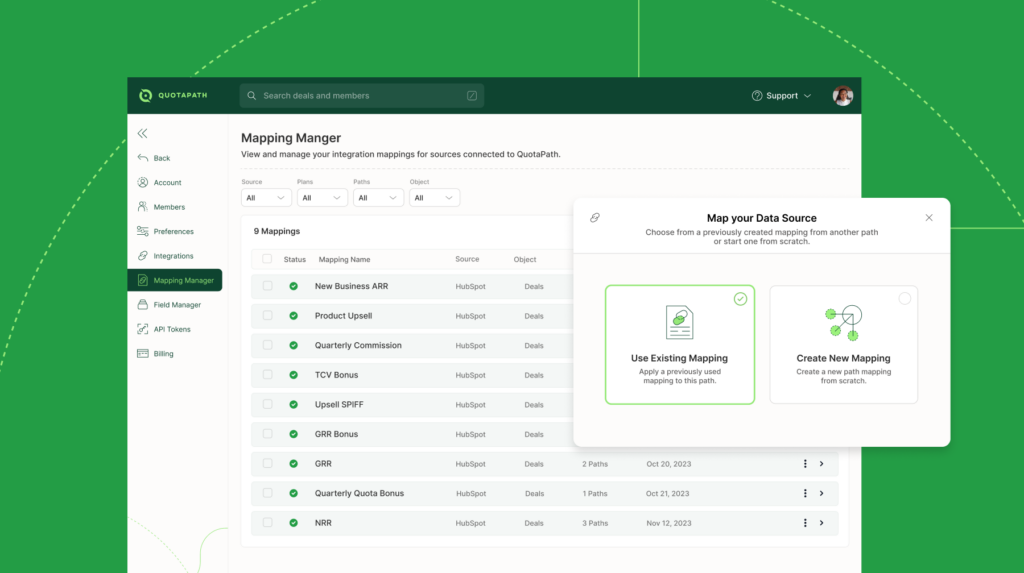

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesSteps to Set a Sales Quota

Now you’re ready to set your sales quota.

There are various types of revenue and non-revenue quotas, with revenue quotas being the most common. Follow these steps to set your revenue-based sales quotas.

1. Calculate revenue targets based on OTE

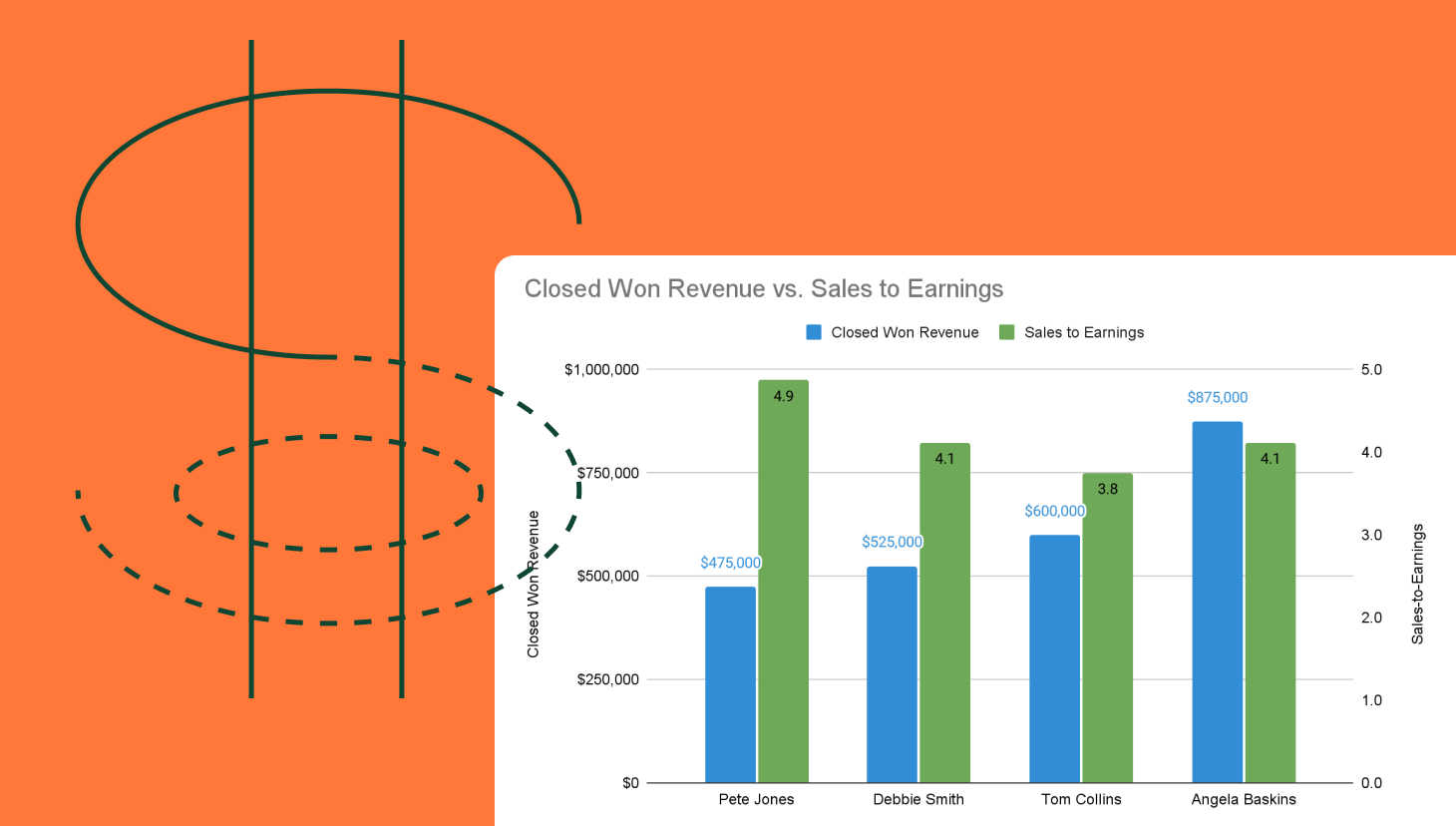

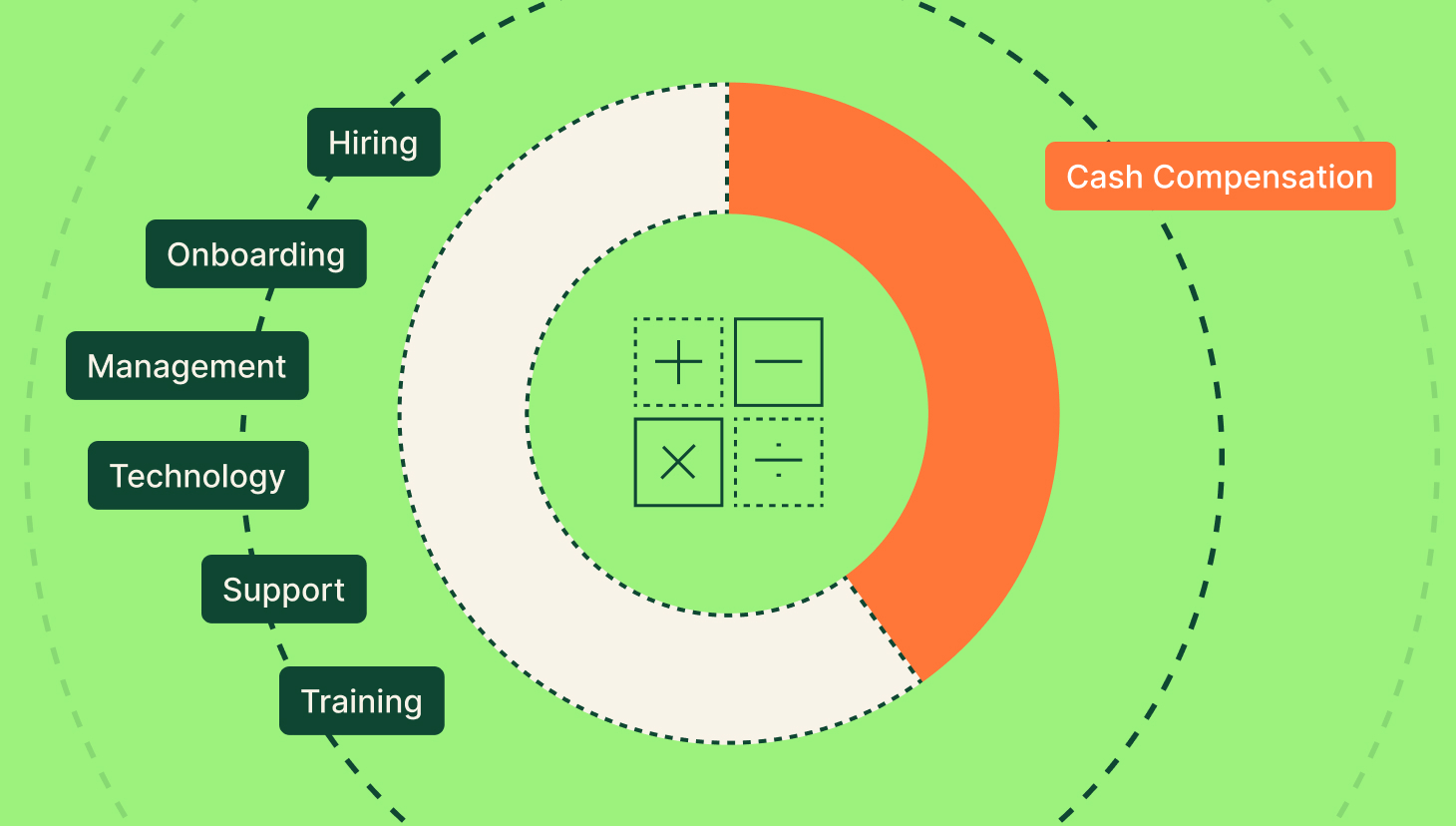

Sales reps must generate sufficient revenue to pay for themselves including such costs as base salary, benefits, overhead, and commission. The revenue target should equal some multiplier of the salesperson’s on-target earnings (OTE).

We typically recommend a quota multiplier between 3x and 8x of your team’s OTE. However, the multiplier varies based on industry, experience, location, and company size.

For example, if your salesperson is a mid-level SaaS rep who has a $120K OTE. Using a commonly used 5x OTE, would result in an annual quota of $600K.

Next, you must decide whether your quota is monthly, quarterly, or annual.

Calculate OTE:Quota ratios

Use this free calculator to ensure your reps’ on-target earnings and quotas mirror what they’re bringing in for the business.

Try it Now2. Determine quota period

When setting quota frequency, consider the sales cycle length, average sales price, and company stage.

Our research revealed that companies commonly rely on average sales price and sales cycle length to determine quota periods with quarterly cycles being most frequently selected.

Factoring in the company stage typically leads to longer quota periods for older and established companies, and shorter quota cycles, such as monthly, for startups to create a sense of urgency with their reps.

Using the example of the rep with a $120K OTE, a $600K annualized quota translates to a $50K monthly or $150K quarterly quota.

3. Confirm the quota is achievable

Setting a quota is not an exact science, therefore it’s typically necessary to assess for effectiveness and adjust accordingly.

Sales quotas need to be challenging but attainable. If they are too high, your sales team may become demotivated or simply stop trying to achieve it, and they may choose to leave.

We’re not saying that 100% of your team members should hit quota, a good standard is 80% of reps hitting it each period. This usually results in the overall team hitting quota as top performers make up for laggards.

How do you determine how achievable your quotas are? For instance, take the $50K monthly quota from our earlier example. If your salespeople average $25K per month in sales, the quota or OTE may be too high. However, if your team members average $75K per month in sales, the quota may be too low.

Bear in mind that companies experiencing high growth or low growth are more likely to experience these ‘overpayment’ or ‘underpayment situations due to an ever-changing marketplace, according to Alexander Group. This is especially true when the company is striving to encourage additional growth by setting aggressive quotas and may lead to fewer reps hitting quota.

Comp Plan Evaluation

Take the 1-minute evaluation to get a grade on your existing compensation plan.

Take QuizWhat To Do If Your Quota Is Wrong

Unachievable or “wrong” quotas stem from various factors such as data misinterpretation, market shifts, lack of team input, low team morale, and high turnover. Once you recognize that you have the wrong quotas, you can take measures to adjust them.

Take action by:

- Reviewing sales data to identify trends and pinpoint areas of deviation. Make sure you consider external factors in addition to the obvious internal factors. For instance, market volatility and competitive changes must be considered in addition to individual and overall team performance.

- Holding open communication between sales reps and leadership through scheduled meetings. Discuss concerns, present data-driven evidence of quota inaccuracies in 1-to-1 and team meetings, and gather feedback about how reps believe the plan can be improved. Then, incorporate that feedback when adjusting your quota structure.

- Evaluating other solutions outside of adjusting quota. Sometimes, the solution lies outside the quota. Provide the team with additional resources, coaching resources, or revised timelines. For instance, individual team members may need additional coaching to develop their closing skills or improve their discovery calls to meet or exceed their quotas.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialResources to Help

Setting effective sales quotas is essential to achieving business objectives. Leverage our best practices to improve your success as you prepare to set a sales quota. This includes proactively gathering data, insights, and team input, as well as accounting for territory and product variations and external influences.

Then, follow our simple three-step process for setting a sales quota. If your quota is incorrect, identify the root causes and address them accordingly.

These additional tools will help with your comp plan and quota designs:

Schedule time with a team member, or check out QuotaPath with a free trial to run and manage sales compensation more efficiently.

Recent Comments