More than 60 percent of SEC enforcement actions against companies for financial statement fraud relate to improper revenue recognition.

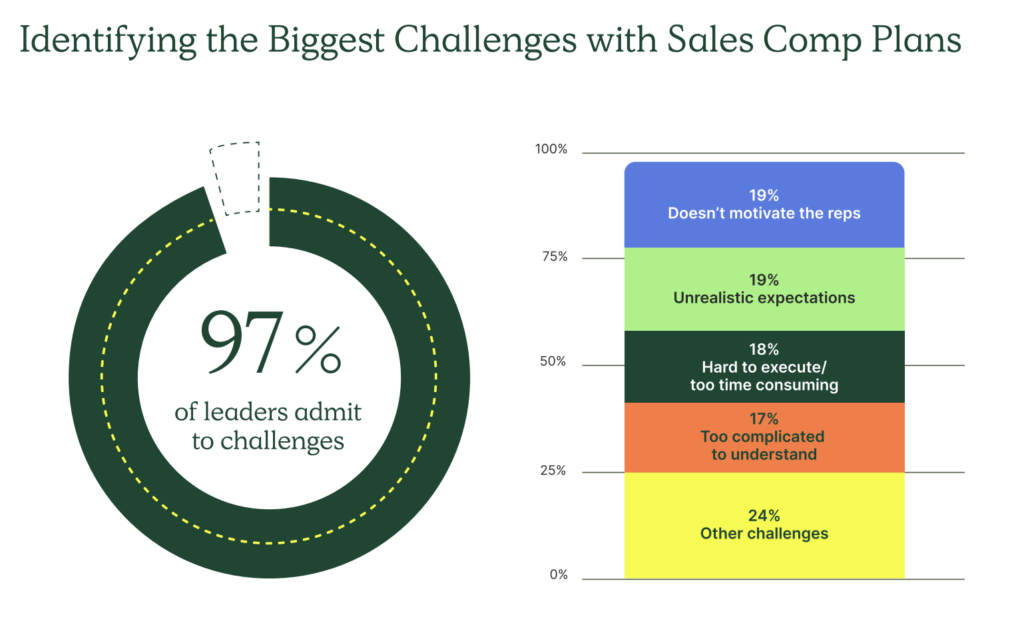

Some of these violations were the result of unethical practices. However, many are due to sales compensation compliance challenges including the:

- Complexity of regulations

- Misclassifications and Worker Status

- Data Management and Record-Keeping

- Communication and Transparency

- Audits and Investigations

The potential risks of non-compliance are quite serious, resulting in hefty fines, penalties, and reputational damage.

Avoid these risks by knowing how to navigate sales compensation compliance with best practices for clear structures, record-keeping, and audit prep. The benefits of implementing these strategies include avoiding costly mistakes, fostering trust with employees and auditors, and ensuring a smooth and efficient sales program.

In this blog, we discuss:

- Regulatory Requirements: Understanding the legal landscape governing sales compensation.

- Legal Considerations: Addressing potential legal pitfalls associated with commission plans.

- Risk Mitigation Strategies: Implementing best practices to minimize the risk of non-compliance.

- Resources: Providing valuable tools and references to help you navigate sales compensation compliance effectively.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesSales Compensation Compliance Challenges

Knowledge is power.

Understanding the challenges of sales compensation compliance will help you overcome these obstacles and boost your success. Read on to grasp potential difficulties before they arise.

- Complexity of Regulations: Sales compensation plans are subject to various regulations depending on your location. These regulations can be intricate and change over time. Keeping up to date on relevant laws and ensuring your plan adheres to them can be a significant challenge.

- Different regulations might apply to different types of sales compensation, such as commissions, bonuses, and profit sharing, or different types of employees, for instance, salaried versus hourly. Navigating these nuances can be complex.

- Misclassifications and Worker Status: Improperly classifying employees, such as misclassifying a salesperson as exempt from overtime, can lead to legal trouble. Determining the appropriate classification based on job duties and compensation structure also requires careful attention.

- Data Management and Record-Keeping: Maintaining accurate and detailed records of all sales activity, commission calculations, and payouts is crucial for demonstrating compliance during audits. This can be a time-consuming and tedious task, especially for companies with large sales teams or complex compensation plans.

- Communication and Transparency: Ensuring clear communication with employees about their compensation plan and its calculation can help prevent misunderstandings and potential legal disputes. Employees need to understand their eligibility for commissions, bonus structures, and how deductions and taxes impact their pay. Using a compensation communication plan is one way to avoid these issues and enhance employee understanding.

- Audits and Investigations: The possibility of audits by government agencies can be stressful. Having a well-organized and compliant system in place allows for a smooth audit process and minimizes the risk of penalties.

- Integration with Existing Systems: Ensuring seamless integration between your sales compensation software and other HR or payroll systems can be a challenge, potentially leading to data inconsistencies and errors.

- Internal Controls: Implementing strong internal controls to safeguard against errors and ensure data accuracy throughout the commission calculation and payout process can be complex. Controls might include establishing data validation procedures, keeping a clear audit trail for all calculations, and mandating supervisor approvals for commission payouts.

- Globalization: For companies operating in multiple countries, managing compliance with the varying regulations in each location can be a significant obstacle.

Download your copy of a customizable commission policy template.

Regulatory Requirements

Understanding relevant regulations for compliant sales compensation plans is crucial. Otherwise, you risk consequences of non-compliance such as fines, penalties, and legal issues.

Key Regulatory Bodies

Although regulations vary based on location, the main regulatory bodies that govern sales compensation in the United States include:

- The Fair Labor Standards Act (FLSA): The FLSA defines minimum wage, overtime pay, and employee exemptions such as commission-based salespersons under certain criteria may be exempt from overtime. The Wage and Hour Division (WHD) of the U.S. Department of Labor (DOL) administers and enforces the FLSA.

- The Equal Pay Act (EPA): The EPA is focused on ensuring equal pay for equal work regardless of gender or sex. For instance, The EPA prohibits paying female salespeople a lower commission rate than their male counterparts performing the same job duties. The EPA is part of the FLSA and is administered and enforced by the U.S. Equal Employment Opportunity Commission (EEOC)

- The Internal Revenue Service (IRS): The IRS dictates how commissions are categorized for tax purposes, impacting withholding requirements and employee tax burdens.

Additional Regulations to Consider

Regulations vary not only by country but also depend on the state, industry, or specific circumstances. For example, state wage and hour laws and industry-specific regulations exist. To ensure compliance, it’s best to consult with legal counsel or HR professionals for guidance on regulations specific to your location and industry.

Staying Up to Date

Staying informed about changes in regulations is essential to sales compensation compliance. Some resources for helping you stay up to date with regulatory changes include government websites such as the DOL website and the website for your specific state labor law agency as well as reputable legal publications.

Legal Considerations

Beyond adhering to official regulations, there’s an additional layer of legal considerations. Failure to consider these can lead to potential legal disputes arising from unclear or poorly designed commission plans.

Key Legal Considerations

Independent Contractor vs. Employee Misclassification

It’s crucial that businesses correctly classify individuals providing services to the company as independent contractors or employees. An employee, also known as a W-2 worker, is a person who works for and under the direction of the company. By contrast, an independent contractor, also known as a 1099 worker, can perform their work at their discretion in terms of means and methods.

Proper classification carries implications for compensation structure. Businesses must withhold and deposit income, social security, and Medicare taxes from the wages paid to employees. Businesses must also pay the matching employer amount of social security and Medicare taxes along with unemployment taxes. Typically, tax withholding or payment is not required on payments to independent contractors.

The potential consequences of misclassification include unpaid overtime and tax liabilities. For instance, improperly classifying a salesperson as an independent contractor can result in the company being liable for back pay of overtime wages and payroll taxes.

Employment Contracts and Commission Agreements

Having clear and well-drafted employment contracts or written commission agreements that outline the terms of compensation is essential, preventing confusion and potential future issues.

Eligibility criteria, commission rates, calculation methods, payout schedules, and termination clauses are key elements to include.

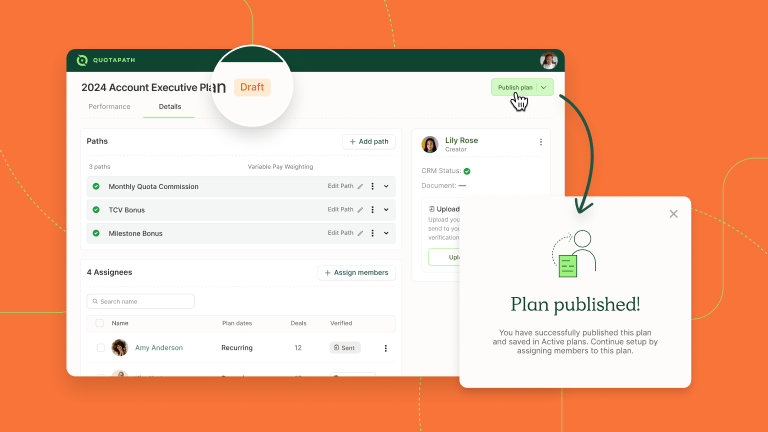

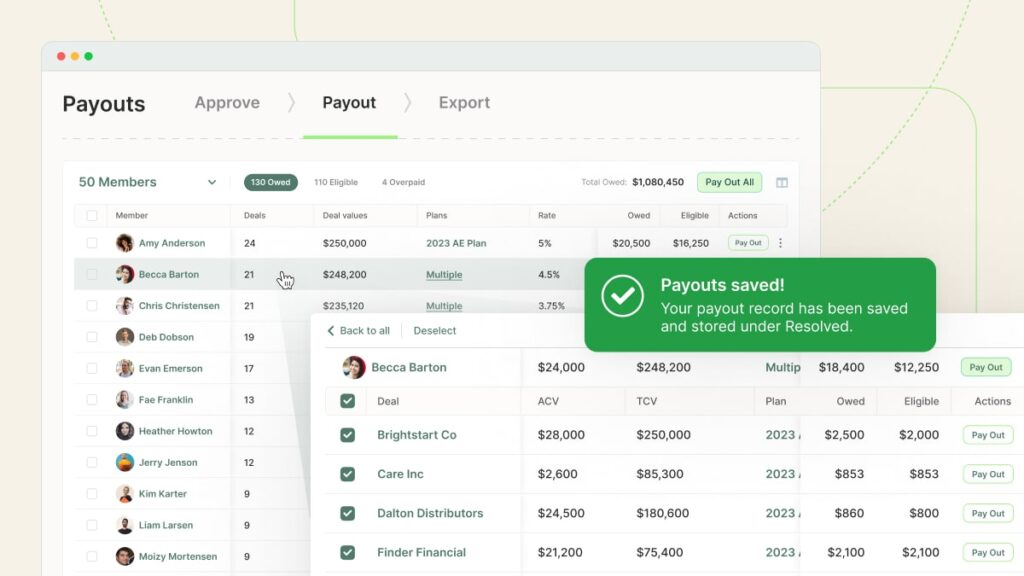

QuotaPath is a tool where you can distribute, track, and collect signatures of sales compensation policies while giving employees access to their comp plans. This increases transparency while helping employees better understand how they earn commissions and streamlines compensation communication and adoption.

What is a Clawback?

Reps don’t love them, but clawbacks play an integral role in the sales compensation space. Below, we define clawbacks, how companies present them in comp agreements, example clause copy, and why leaders should protect their businesses with detailed policies.

Take Me to BlogNon-Compete Agreements and Clawback Provisions

Non-compete agreements were historically quite common, designating a period after termination of employment where the employee could not work for a direct competitor. The enforceability of non-competes varied by region.

However, the Federal Trade Commission (FTC) recently banned the implementation of new non-compete agreements in the United States, which is set to go into effect in September 2024.

Assuming their legality in your region, non-compete agreements may limit geographic scope and duration depending on your location. Consult legal counsel to ensure enforceability.

Clawback provisions are clauses that allow the company to recoup commissions in certain situations such as customer returns or product cancellations.

Seeking Legal Advice

Proactively seeking legal counsel from an attorney experienced in employment law can help reduce the odds of legal disputes or litigation. Consulting a lawyer is highly recommended in situations like developing a new compensation plan or facing potential legal disputes.

Risk Mitigation

Proactive risk mitigation is key to minimizing the chances of non-compliance issues. Effective risk mitigation delivers many potential benefits such as avoiding costly fines and penalties, fostering employee trust, and streamlining internal processes.

Key Risk Mitigation Strategies

Develop Clear and Transparent Commission Plans

Commission plans must be clearly defined and well-documented to ensure employees understand them. This increases plan effectiveness, which drives company objectives and increases plan adoption.

Key elements to consider for clarity include eligibility criteria, commission rates, calculation methods, and payout schedules. Covering all these details reduces the odds of misunderstandings or disagreements.

Implement Strong Internal Controls

Establishing internal controls safeguards against errors and ensures data accuracy throughout the sales compensation process. For instance, this could mean implementing data validation procedures, mandating supervisor approvals for commission payouts, and keeping a clear audit trail for calculations.

Automate Calculations and Data Management

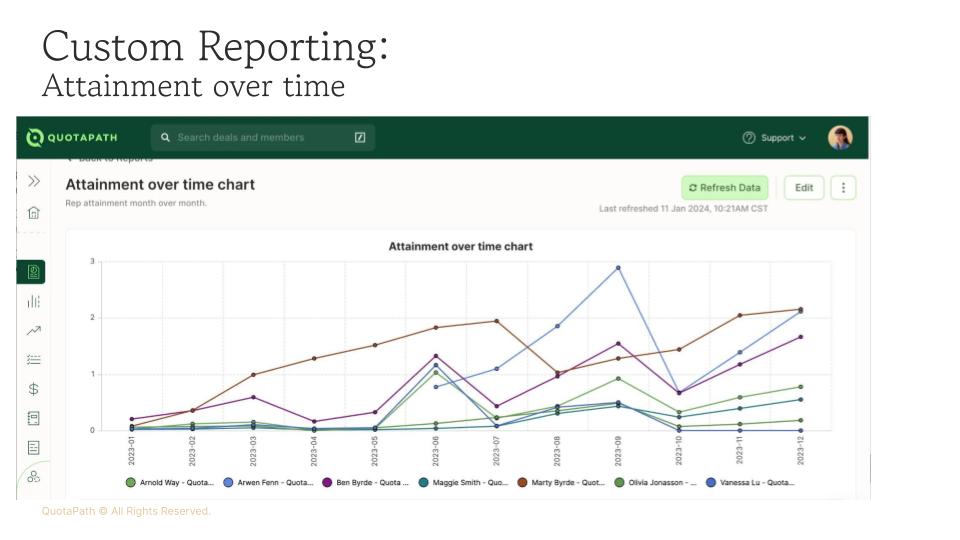

Leveraging sales compensation software to automate calculations, data entry, and record-keeping reduces the risks of human error and ensures commission tracking consistency. Sales compensation software like QuotaPath automatically pulls sales activity data from your CRM, increases accuracy, and streamlines processes.

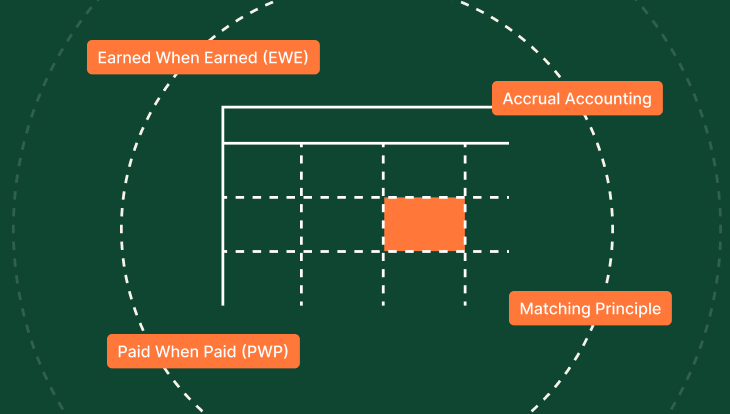

“ASC 606 involves recognizing both revenue and expenses over the proper period of a SaaS or enterprise contract. Software like QuotaPath automates those calculations to keep you compliant,” Amy Walker shared.

How to Scale Finance Operations

In your first year as a startup, your finance operations can survive with a good, solid bookkeeper and cash-based accounting. However, the minute you start raising money, you should follow these steps.

Take Me to BlogRegular Reviews and Audits

Conducting regular internal reviews of your sales compensation practices is essential for compliance. These internal audits allow for the early identification of potential issues while ensuring continued adherence to regulations and internal controls.

Consider including external audits at regular intervals for an independent assessment of your practices.

Proper documentation is crucial for audit preparedness. During a due diligence audit, “they’re going to want to see you have a solid set of books, you have a closing process, you have SOPs in place for your accounting function, and that you’ve got the proper controls in place,” according to Amy, “That lets people have faith in you and what you say your business is doing.”

Employee Training and Communication

Educating your sales team about the company’s compensation plan and their rights and responsibilities is vital to the plan’s success. Sharing the reasoning behind the plan helps develop rep buy-in, enthusiasm, and understanding of how they earn commissions.

By contrast, failing to provide proper training and information increases your risk of confusing and frustrating employees, possibly causing them to quit.

Regular communication is also essential, as it keeps employees informed and fosters trust in the system.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesResources

Use the resources in the following table to support your sales compensation compliance success.

| Government Resources | |

| The U.S. Department of Labor (DOL) Wage and Hour Division (WHD) | https://www.dol.gov/agencies/whd |

| The Internal Revenue Service (IRS) | https://www.irs.gov/ |

| Industry Associations | |

| The National Association of Professional Sales Organizations (NAPSO) | https://www.naps360.org/ |

| The Society for Human Resource Management (SHRM) | https://www.shrm.org/ |

| Legal Resources | |

| The National Employment Lawyers Association (NELA) | https://www.nela.org/ |

| Sales Compensation Software | |

| QuotaPath | https://quotapath.com |

Simplify Sales Compensation Compliance

Navigating sales compensation compliance is challenging. Develop an understanding of the relevant regulations and legal considerations. Then implement proactive risk mitigation measures to ensure sales compensation compliance.

Schedule time with our team to learn how QuotaPath can simplify sales compensation compliance navigation for Finance and Accounting teams.

Recent Comments