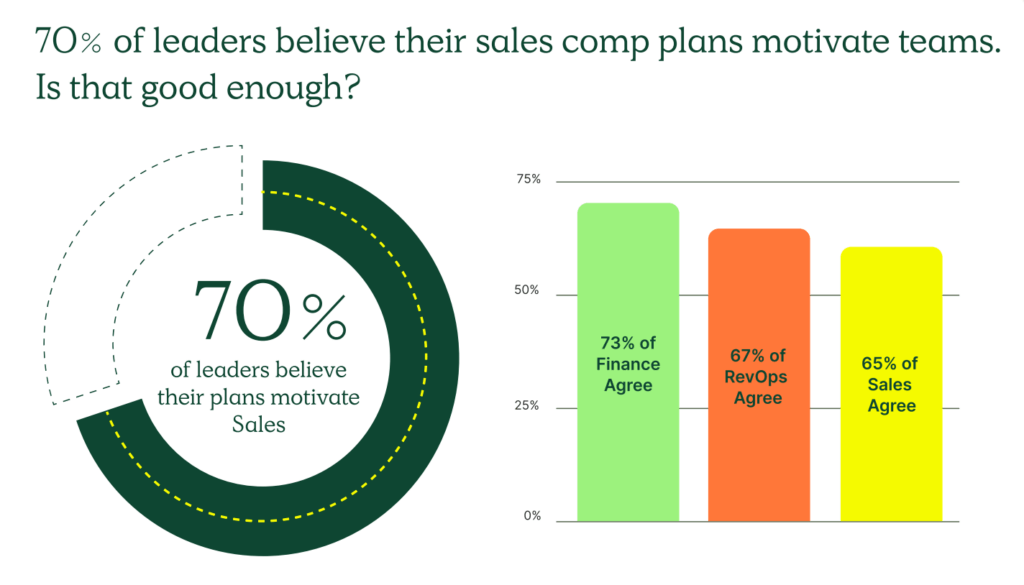

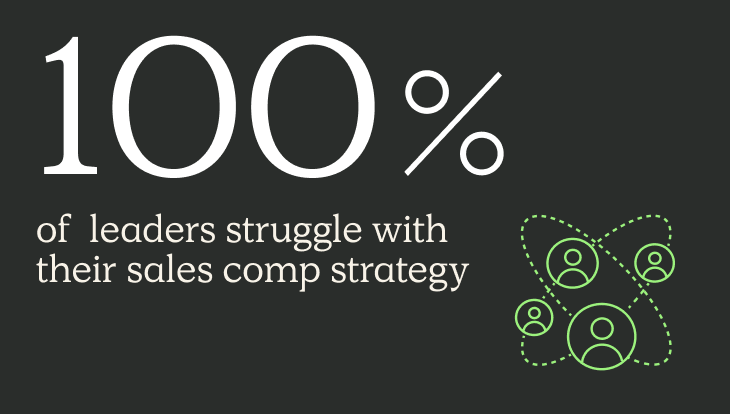

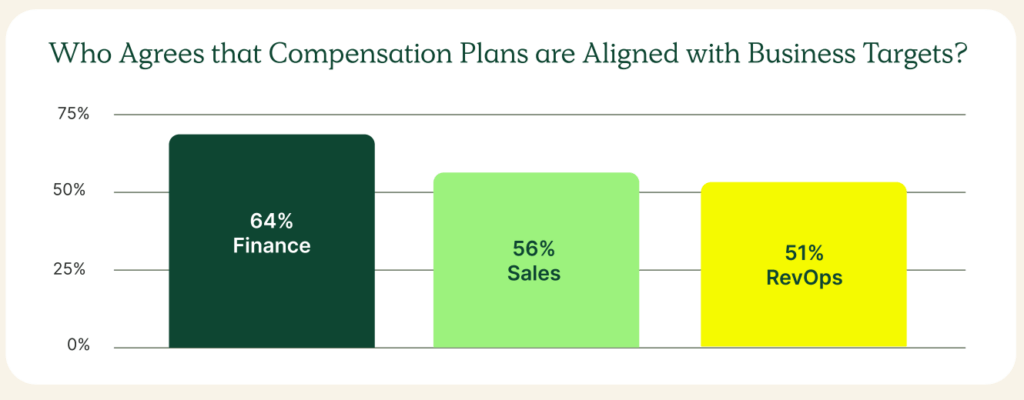

According to our 2024 sales compensation report, Solving the Biggest Sales Compensation Challenges, more than 450 Finance, RevOps, and Sales leaders reported “failure to motivate reps” as their most challenging issue with comp plans.

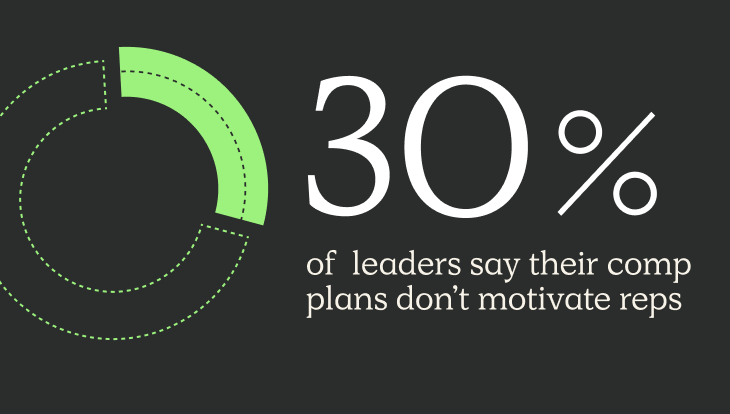

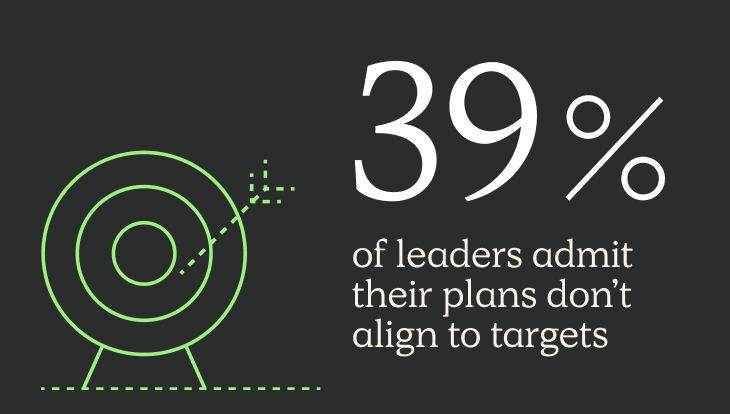

Another 30% admitted their plans don’t motivate reps when asked directly if they do.

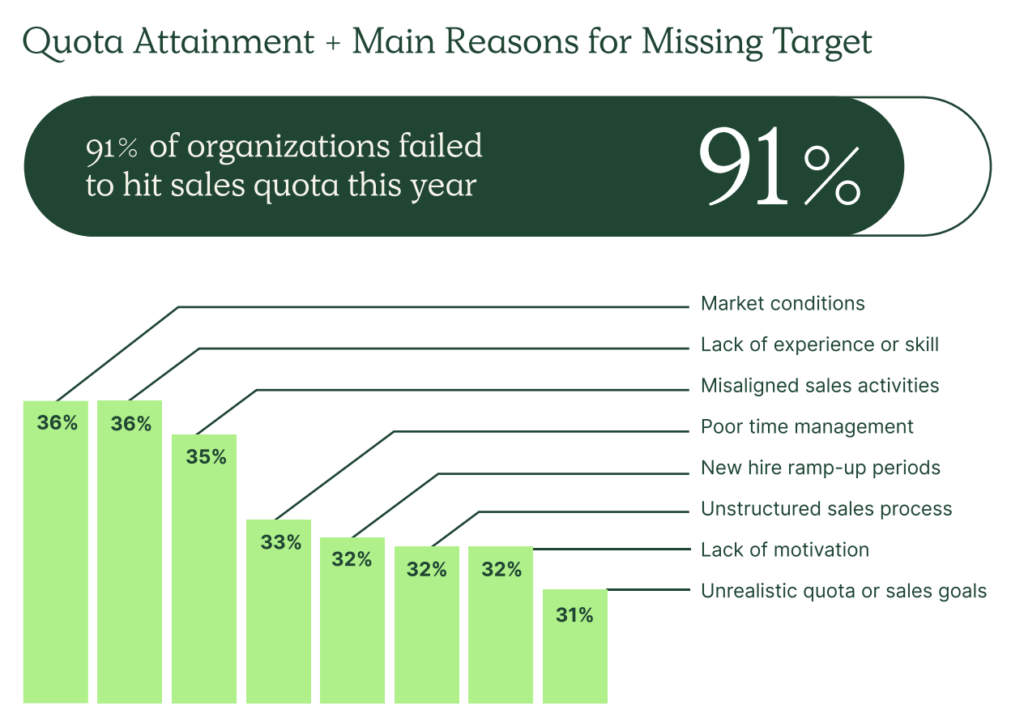

In today’s market, which is only recently showing signs of rebounding with initial public offerings and valuations steadily rising, we understand that the stress on Sales is exceptionally high. Their teams, plus the teams they’re selling to, have downsized. This has made motivating teams facing so much economic opposition more difficult.

We can’t control the market.

But one thing we can control is the levers to promote desirable selling behaviors, which can be done through intentional, direct, and tactful compensation design.

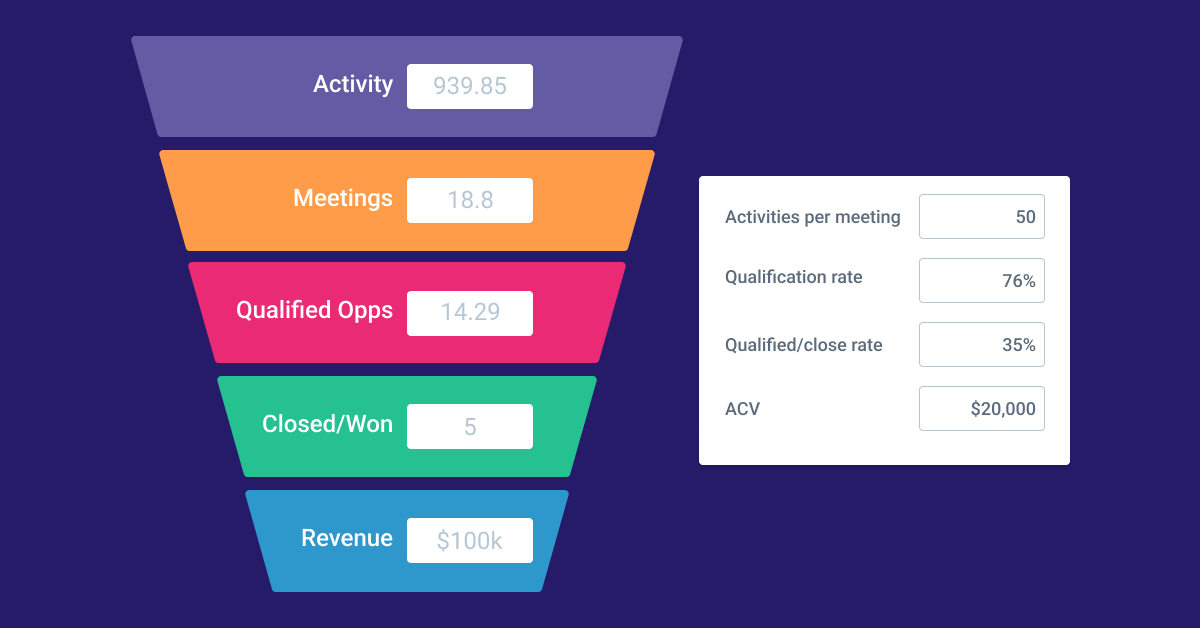

The core function of a sales compensation plan is to inspire reps to sell deals that earn them and the business the biggest bucks in the long term. When the plan fails to do that, your reps are more inclined to sell what is easiest for them, which is typically not the best deal for your organization (high probability of churn, lower lifetime value).

Below, learn how to motivate sales teams using compensation and other tactics.

How to motivate your sales team

First and foremost, before you put anything into place, you need to understand what motivates your team.

Is it money? Recognition? Team collaboration?

Our previous blog explores the psychology behind motivation and outlines the differences between extrinsic and intrinsic elements. Extrinsically motivated individuals value outside influences like a higher commission rate or avoidance of a negative outcome, such as a decelerator.

Meanwhile, intrinsic motivation ties to personal interest or accomplishment.

Salespeople often are a mix of both.

To find out what motivates them, this may seem obvious, but you must ask them directly.

You can do this through surveys, one-on-one meetings, or focus groups. Ask open-ended questions that allow your team members to share their honest thoughts and feelings.

Secondly, pay attention to their behavior. What are your team members doing that gets them excited and motivated? What are they not doing? Pay attention to their behavior and try to identify patterns. For example, do they seem more motivated when working on complex deals or competing against each other?

Last, look at your company culture. Your company culture can greatly impact what motivates your sales team. For example, if your company culture is very competitive, your team members may be more motivated by financial incentives. If your company culture is more collaborative, your team members may be more motivated by recognition and rewards.

Once you better understand what motivates your sales team, you can tailor your management approach accordingly. For example, if you know that your team members are motivated by competition, create sales contests or other competitive initiatives. If you know that your team members are motivated by recognition, recognize and reward them for their achievements.

Additional tips for uncovering what motivates your sales organization

- Be specific. Don’t just ask your team members what motivates them. Ask them specific questions about what motivates them, such as:

- What are your top three career goals?

- What are your biggest challenges at work?

- What are you most passionate about?

- Be open-minded. There is no one-size-fits-all answer to the question of what motivates sales reps. Different people are motivated by different things. Be open to hearing different perspectives and don’t try to fit your team members into a mold.

- Be consistent. Once you know what motivates your team members, use that information to inform your management style. Be consistent in your approach and give your team members the support and resources they need to succeed.

How to motivate sales team outside of commissions

More often than not, compensation is not the only motivator.

Before we get into sales compensation, let’s look at how to motivate your Sales team without money.

Here are four ways to incentivize behaviors outside of commissions.

| Recognition | Sales reps want to be recognized for their achievements. Companies can recognize their sales reps through public praise, awards, and other recognition programs. |

| Professional development opportunities | Companies can provide reps with professional development opportunities, such as training programs, mentorship programs, and access to industry resources. |

| Rewards | Show appreciation for your reps’ hard work by offering gift cards, concert tickets, time off, lunch with execs, and special experiences. |

| Quota relief | During slow months, consider dropping quota for the next month applicable to anyone who sold over quota in the current month. (Our Chief of Staff Graham Collins did this previously and reported that his reps over performed) |

Additionally, you can encourage outbound efforts by following these tips.

How to motivate sales team with compensation

There are several compensation components you can implement to drive performance.

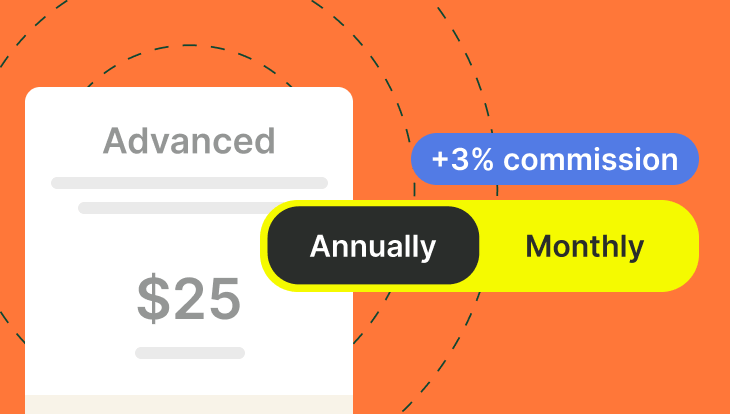

Accelerators, which take the shape of a higher commission rate, bonus, or multiplier, reward over-performance or incentivize reps to surpass an attainment threshold. This is one of the most widely adopted components of sales compensation plans, according to our 2023 Trends Report.

TIP: If you add an accelerator or multi-year accelerator (paying a higher commission rate on deals with contracts beyond one year), strike the right balance between having enough rate increase to inspire change but not too much where you find yourself paying extreme commissions.

Similarly, you could put decelerators in place or lower commission rates or bonuses to deter your reps from selling certain deals (unfavorable payment terms, a customer outside your ideal customer profile, monthly contracts, etc). Pairing accelerators with decelerators is one of our most-used compensation plan templates.

Next, play with SPIFs throughout the year when you need to encourage a short-term burst, launch a new product or service, enter a new market, test a potential permanent comp plan, change, or more.

Some of our favorite SPIFs include “fast close” SPIFs when a rep earns a flat bonus for securing several deals within the first month of the quarter, and team-wide SPIFs that apply to every rep if they hit their team goal. But the best ones target specific business-wide metrics, like:

- Cash flow: SPIF on deals under Net 30-60-90 day payment terms

- Gross profit: SPIF for deals more profitable to the business long-term

- Retention/renewals: Reward a SPIF when customers commit to early renewals

Check out our Learning Center article, Do SPIFs work? to learn how to run these successfully.

Whatever components you include, it is imperative to communicate with your reps the “why” behind the comp plan and how their performance directly moves the business forward. Their understanding of optimizing their comp plan is paramount; without it, your efforts to motivate them will fall flat.

How to check if your comp plans are motivating

Once you find what motivates your team, you must check in throughout the year to ensure your strategies still work.

Here are 10 ways to evaluate your sales motivation tactics:

- Host 1:1 with your reps to learn about what motivates them

- Incorporate their feedback in your comp plan design process

- Incentivize different behaviors

- Test future changes with SPIFs first before implementing in plan

- Reward overperformance

- Avoid demotivating levers if you can (commission floors or cliffs, decelerators, lack of accelerators)

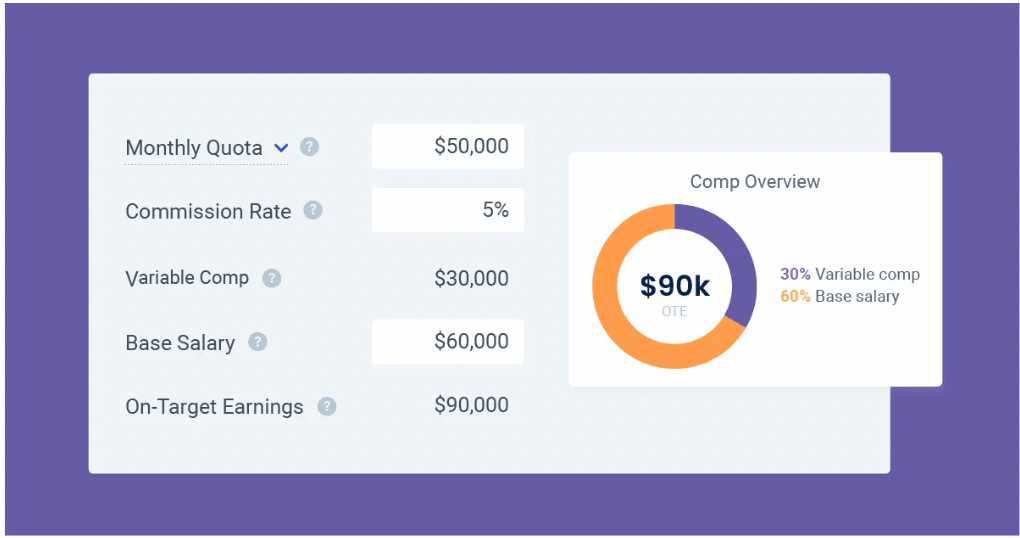

- Use historical and industry data to ensure quotas and OTEs are fair

- Communicate plans, changes, and policies (clawback clauses, compensation agreements)

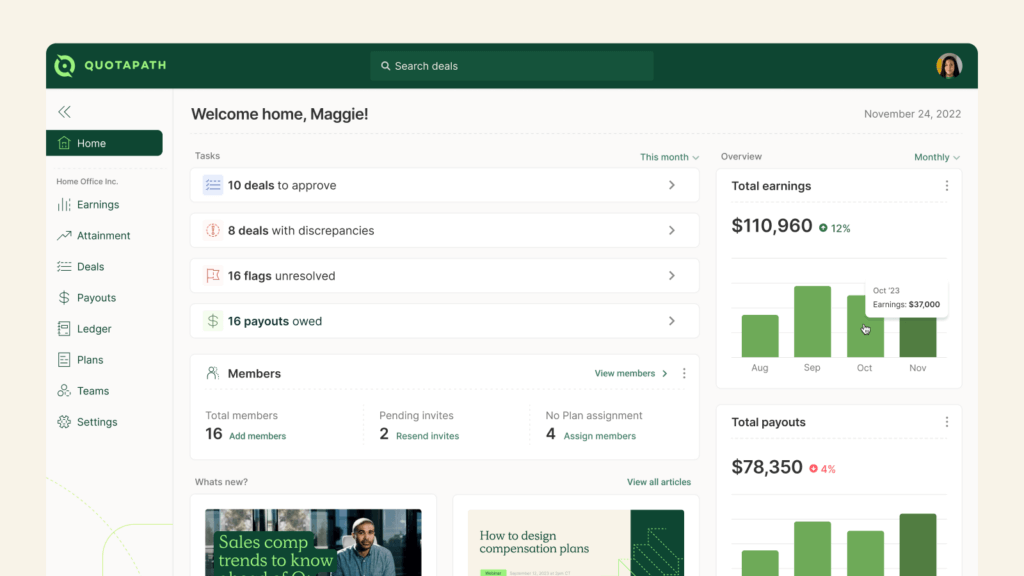

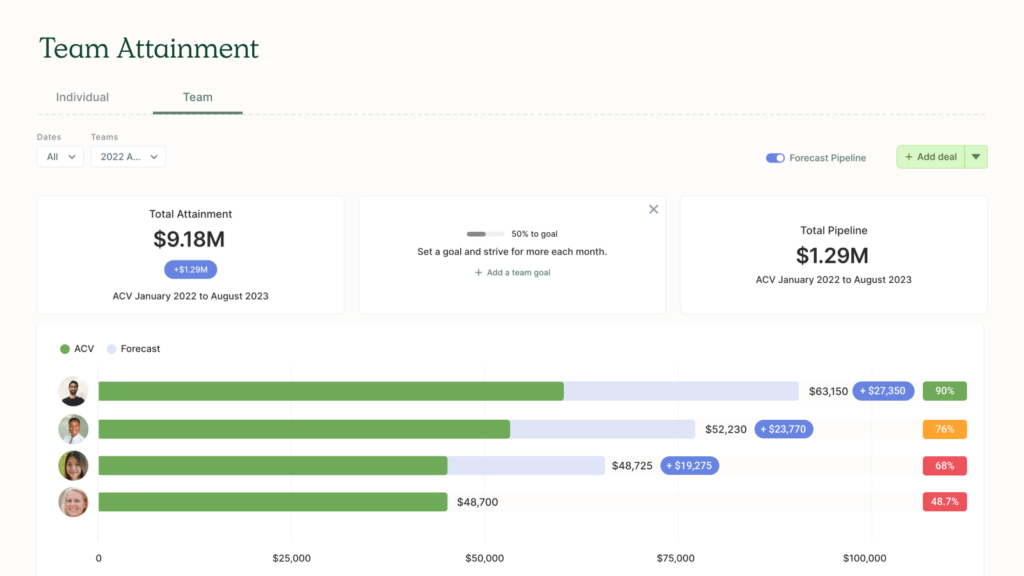

- Provide visibility into commissions and compensation plans (Try QuotaPath for free)

- Remove risks of inequities by standardizing comp plans and building fair territories and account scoring models that evenly distribute opportunity.

Conclusion

Our report uncovered that motivating reps posed the most significant challenge for revenue leaders regarding their comp plans.

That tells us we can do a better job finding out exactly what motivates our reps while blending non-compensation incentives with comp-related ones.

About QuotaPath

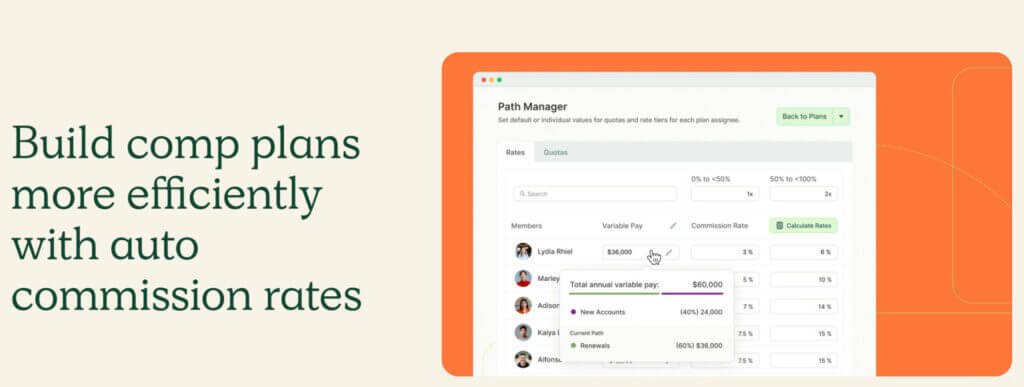

Founded in 2018, QuotaPath’s sales compensation management and commission tracking software rallies Sales, Finance, and RevOps around their financial goals by providing a source of truth for commissions, attainment, and forecasted earnings. Calculate and pay commissions more accurately with QuotaPath. Learn more by scheduling time with our team today.

Recent Comments