The following blog is a guest post from Vonage.

Working with technology has become the new norm, no matter what sector you work in. The right technology can be a driving force behind an excellent team, assisting with marketing, generating leads, and much much more.

But did you know that your business’s software, apps, and other technologies may be outdated even if once considered state-of-the-art? If you want to remain ahead of the competition in your chosen field, you need to adapt to changes in technology and utilize the best tech. This is where Revtech stacks come in.

A Revtech stack is a collection of technologies that help businesses to transform their operations and processes. Using a Revtech stack, you can improve how your business interacts with customers and collects data. This article will explore what a Revtech stack is and how it can transform your business.

Try QuotaPath for 30-days

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Try for FreeWhat is Revtech?

Revtech stands for Revenue Technology and is used by a revenue operations team (RevOps). It is an updated approach to marketing and sales, using a digital platform combining fantastic software like machine learning, AI, and cloud-based software. Although you may have heard of AI and cloud software, machine learning is a growing industry which is currently in high demand.

Machine learning is a branch of computer science mixed with AI. It focuses on algorithms and data, learning from documented trends and sales performance. This allows it to make informed recommendations for your business while minimizing risk.

Revenue Technology can modernize the way your business works. You can also implement Revtech alongside other modern working methods, such as using a VoIP (Voice over Internet Protocol) phone system. This comparative guide on VoIP or landline explains everything in more detail.

RevOps

If your business is unaware of RevOps, it’s time to get acquainted. A RevOps team can assist your business in reaching revenue targets that align across customer success, marketing, and sales.

They can also help build a Revtech stack that correctly aligns with your business’s values, vision, and needs. Once you know how to successfully grow your RevOps practice, you can benefit from better results across the board.

What is a Revtech stack?

A Revtech stack is a collection of technologies enabling businesses to modernize their processes, operations, and business models. A Revtech stack can include software, hardware, automation tools, and cloud-based solutions (which are explained in more detail below).

When used properly, a Revtech stack can improve efficiency, increase productivity, and provide a more satisfactory experience for each customer. By using a Revtech stack, your business can also streamline operations and reduce costs.

Technologies used in a Revtech stack

The technologies you use in your Revtech stack will depend on the nature of your business and how you want to revolutionize it. Some of the most common technologies found in a Revtech stack include:

- Automation tools: An automation tool is a highly beneficial application for your business. Automation can be used in many ways, no matter your industry. With an automation tool, employees can complete repetitive tasks quickly and with little chance of error. Once these tools have been programmed, they will perform tasks in the background. Automation tools can include robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML).

- Cloud-based software: The cloud is another important technology that your business should utilize if it doesn’t already. With cloud-based software, your business can access data from anywhere, at any time. Cloud technology has many uses, including cloud-based virtual phone systems. If you want more information on this type of technology: Vonage answers what is a virtual phone system.

- Collaboration tools: A collaboration tool is exactly what it sounds like, a way for your teams to communicate and collaborate effectively. There are many different collaboration tools available, so which you choose depends on the needs and size of your business.

- Customer relationship management (CRM) software: CRM can help businesses manage customer relationships. With a CRM, you can view customer data and have everything you need in one platform. CRM also integrates with other platforms, such as social media.

All of these technologies can be used to improve the way your business works.

To build the perfect Revtech stack, you’ll need to know how to start a RevOps team. You can either hire specialists in the field or RevOps or look at your team’s existing skills to see if they could fill a role in your new team.

How your business can benefit from using a Revtech stack

Now you understand more about how a Revtech stack works and what technology is used, it’s time to focus on what a Revtech stack can do for your business.

1. Reduced cost

Your business can use a Revtech stack to reduce labor costs and increase efficiency by automating tasks and streamlining business processes. Additionally, cloud-based solutions can reduce the need for expensive hardware and software licenses.

By cutting costs, businesses can invest in other areas, such as marketing or instant support services. Employees, management, and customers depend on you to keep business operations running smoothly. By using the money you save by not needing to expand your team, you can focus on improving how your business manages and resolves issues.

Using an On-Demand Assistant such as RealVNC, your team can start a support session with a customer in a matter of seconds. This will improve customer satisfaction and ensure better reviews for your company, generating more leads and website traffic.

2. Improved efficiency

One of the fundamental benefits of a Revtech stack is that it improves efficiency. Automation tools can complete repetitive tasks that are usually done manually. From data entry to invoicing and inventory management, automation tools will turn arduous tasks into a simple click of a button.

Through automation, employees can focus on more important tasks requiring human expertise. Furthermore, by automating repetitive tasks, businesses can improve accuracy and reduce human error, ultimately delivering a better product or service.

3. Increased productivity

Employees are more likely to feel unproductive and tired of their job role when constantly carrying out repetitive tasks, rather than stimulating ones. With automation tools completing tasks faster than humans and with fewer errors, businesses can complete more work in less time. This allows employees to carry out valuable work, allowing them to learn, grow, and achieve.

Completing tasks quickly offers more room for business development and growth too, which is essential if you want to upscale but don’t have the budget to employ more staff yet. Increased productivity also leads to increased revenue and customer base.

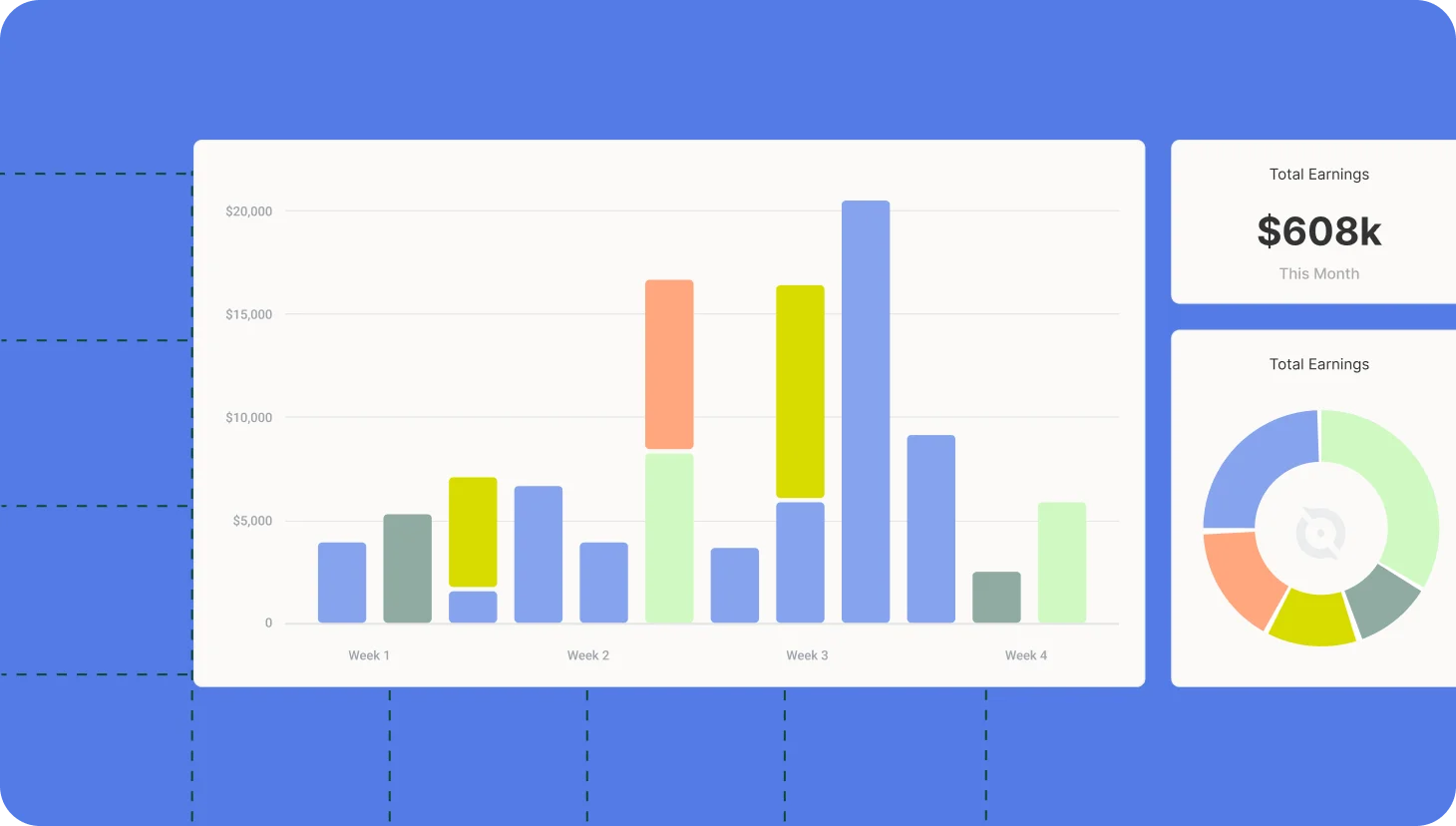

4. Real-time data

A top trend within revenue operations at the moment is the need for clean data. By using the right revenue technology, you can improve data hygiene practices, ensuring that any sales data is efficient and organized. No business wants to deal with inaccurate, incomplete, or duplicate data, especially regarding sales data. This leads to revenue loss, client misunderstandings, and cold leads.

A good business knows how to use its data to improve processes, increase revenue, and ultimately deliver a better customer experience. With the help of a Revtech stack, your business can view data in real-time.

Managers and employees can then make more informed decisions based on recent numbers, as working on data more than a few hours old won’t give the same results. Real-time data can therefore support businesses in identifying current problems and opportunities.

5. Future-proofing

A Revtech stack, which includes a PIM solution (Product Information Management), can help future-proof businesses by centralizing and managing product information, automating tasks, improving efficiency, and providing real-time data for better decision-making, ultimately delivering a better user experience and increasing productivity and revenue. With the use of cloud-based solutions, your Revtech stack can scale with the needs of your business, allowing you to add or remove resources as needed.

By embracing new technology, businesses can stay relevant and adapt to changes in the market as they happen. Another clever way to future-proof your business is by registering your domain name. For example, if your business is situated in Malta, you should look at getting a .mt domain registration. Being one step ahead in every aspect makes for a successful business.

6. Better user experience

Finally, a Revtech stack can provide a better user experience. Your business can deliver customers a better product or service by streamlining processes and reducing errors. By utilizing cloud-based solutions, your business can also provide customers with access to real-time data. This makes it easier for customers to track orders, view invoices, and chat with support.

If you haven’t got one already, you should consider using a telephone system so customers can reach you quickly. There are different types of telephone systems available that can fit within your RevOps strategy. Implementing a reliable telephone system aligned with your RevOps strategy not only enhances customer loyalty, retention, and trust but also ensures prompt accessibility for customers seeking quick assistance.

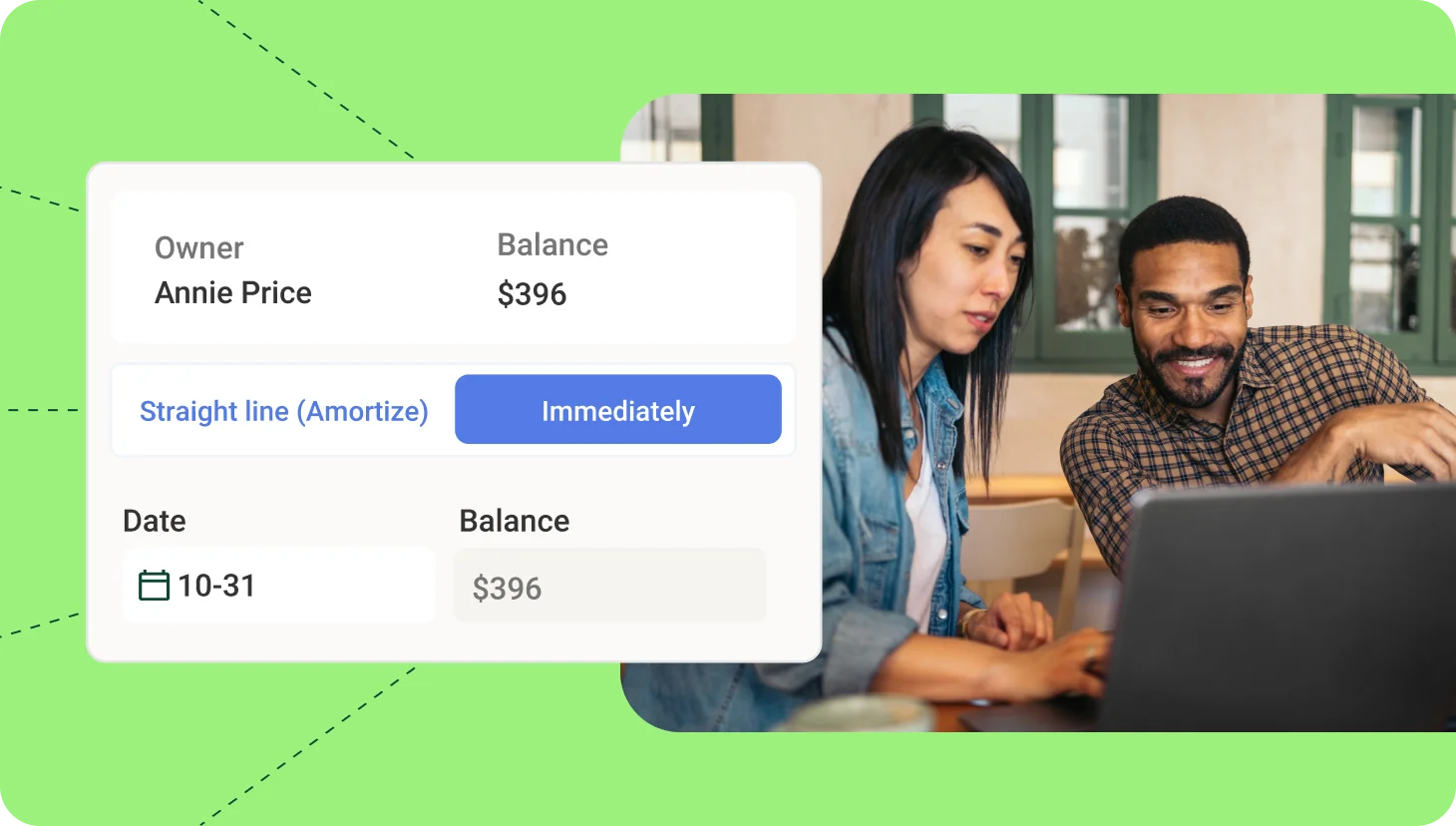

Streamline commissions for your RevOps, Finance, and Sales teams

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesRevtech: The future of sales

A Revtech stack is a crucial component of any modern business. By modernizing company operations and processes, your business can improve efficiency, reduce costs, increase productivity, and provide a better experience for each customer or service user.

Customers are at the heart of everything we do as a business, so using technology that can provide an improved customer experience and more accurate data is the way forward to a better way of working.

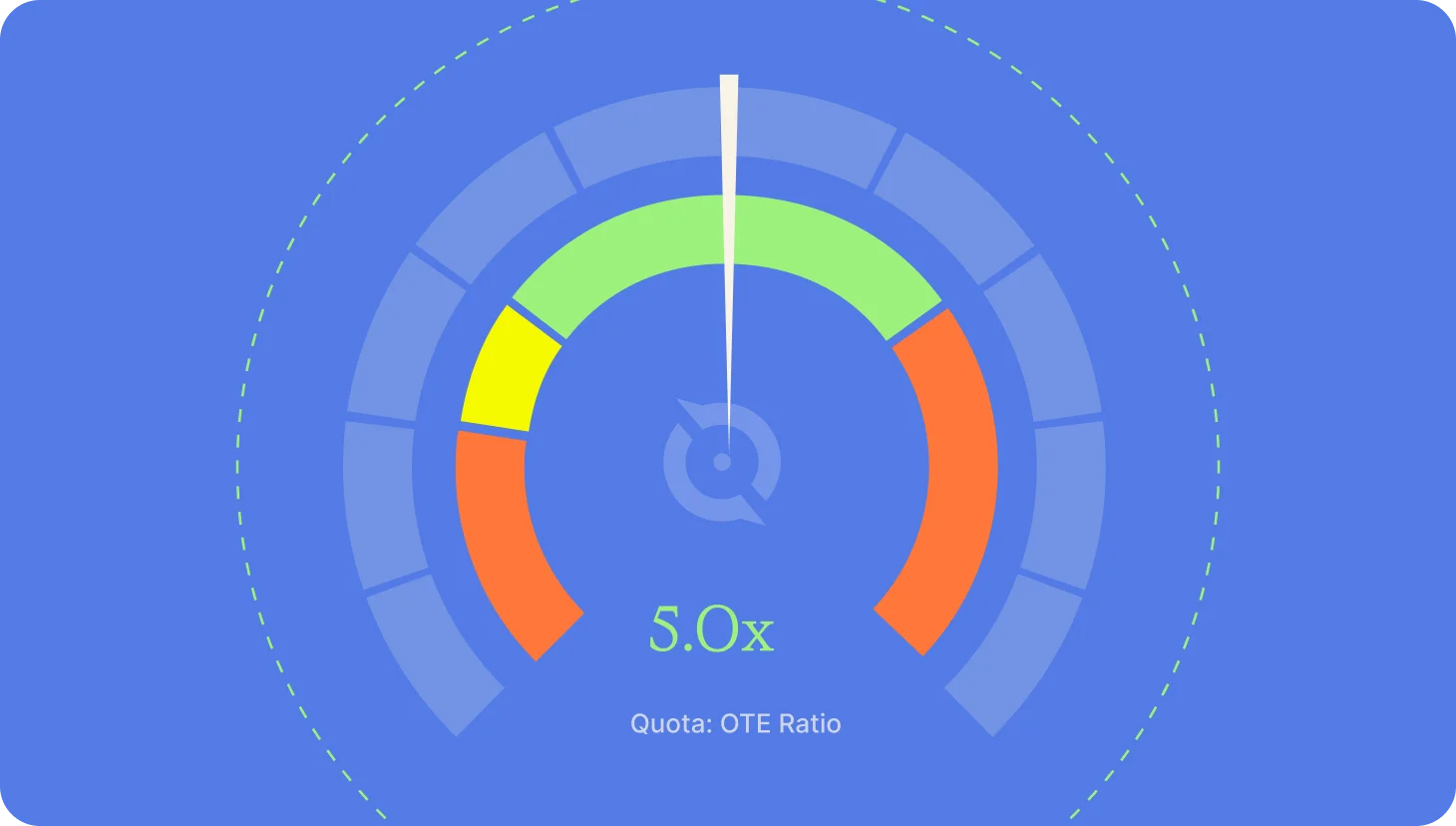

About QuotaPath

QuotaPath rallies teams around their financial goals by providing a source of truth for sales compensation, including automated commission tracking, in-app collaborative tools for compensation design and commission discrepancies, and more. Learn more today.

Recent Comments