To succeed in business today, you need to use your data. Efficiently using your data can help you unearth many essential insights and improve operations tenfold – or even more.

The issue isn’t what data can potentially do for you; it’s that data is simply information on its own. It cannot do anything or be valid until it’s sorted, analyzed, and processed through systems.

Leveraging your sales data can unearth many benefits, from improved cost savings to supercharged operations, but only after it’s been properly sorted, cleaned, and applied through a practical sales data management approach.

So the question isn’t “What can my sales data do for me?” but “How can sales data management help my business?”

This blog gets into everything you need to know. By the end, you’ll know just how sales data management can improve your strategic business decisions and how to get started with an effective sales data management strategy.

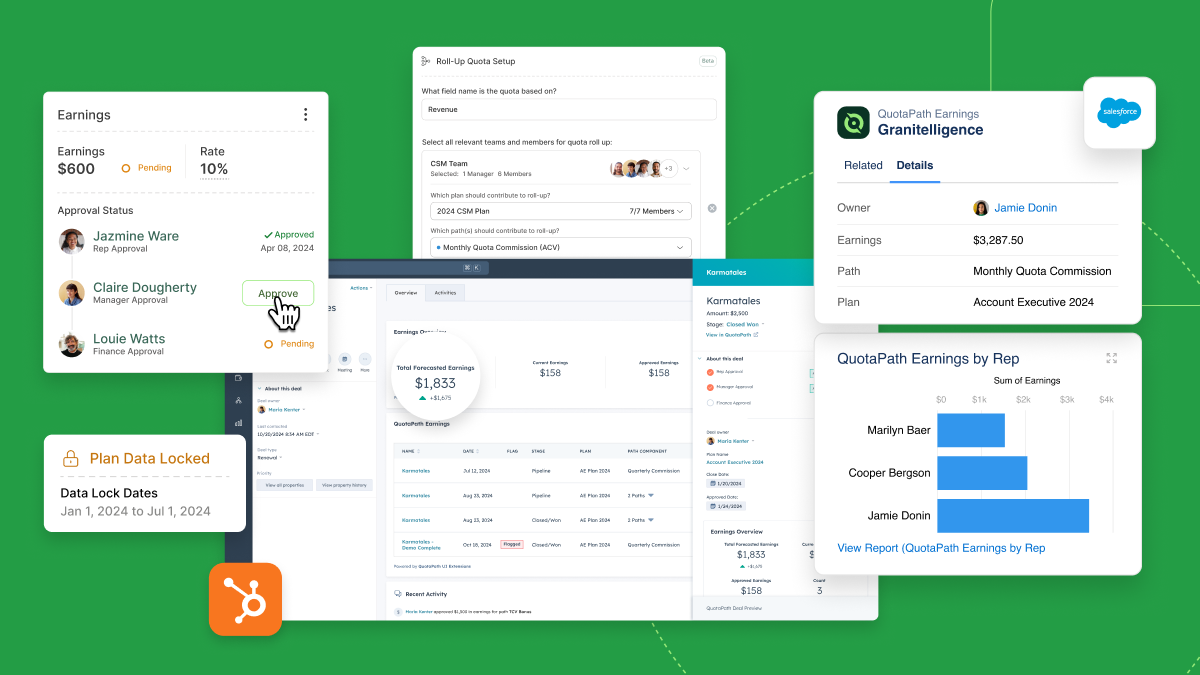

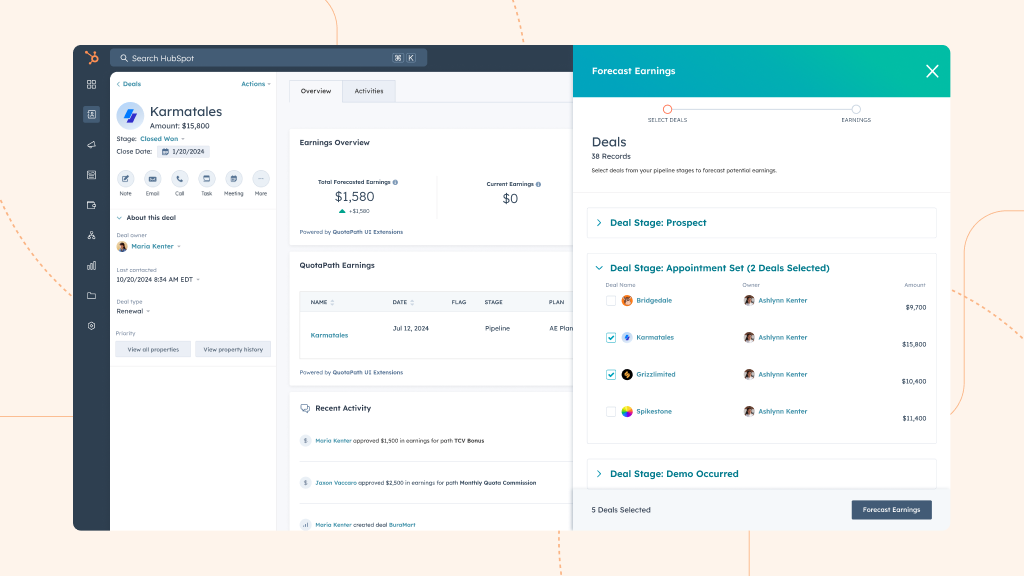

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesWhat is sales data management?

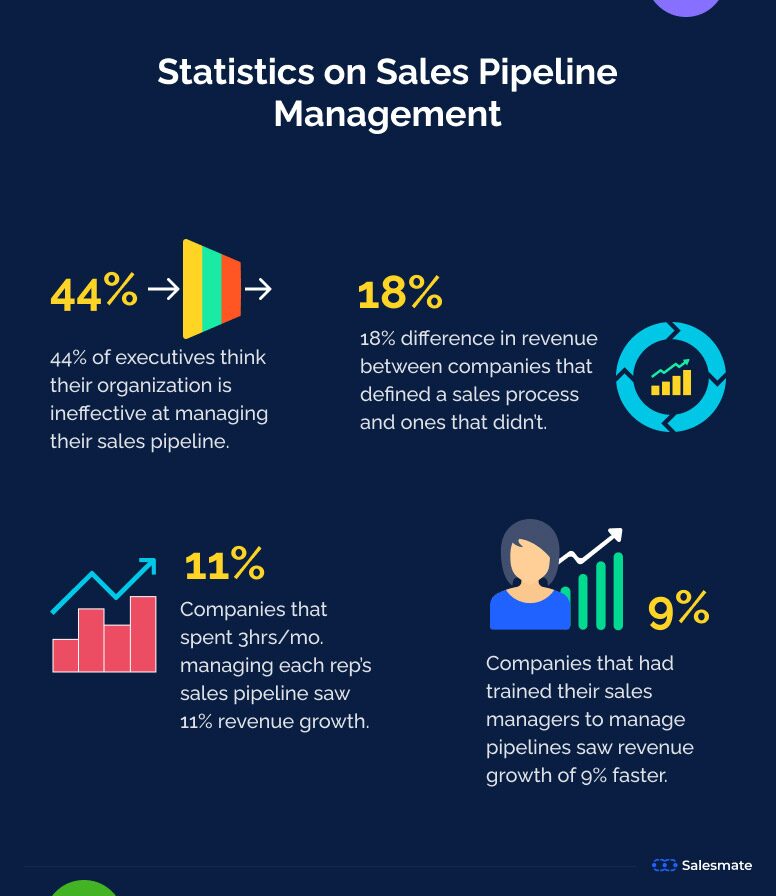

Sales data management is a full-scale process that includes collecting sales (and marketing) data, organizing it, storing it, analyzing it, and finally using it to improve your business’s performance. It should be included on every enterprise transformation roadmap, as it’s essential for taking large-scale businesses from the murk of guessing into the clarity of precise analytics and streamlined processes.

How can sales data management improve your strategic business decision-making?

Sales data management can help you understand your customers and your sales. This is particularly crucial in B2B sales, where it starts by first getting your data in order. From there, you’ll need to use the right tools to put that data to work. Once you fully set up your sales data management pipeline, you’ll enjoy these key benefits:

- Build better campaigns to increase sales

In sales data management, you organize customer data to gain a complete and simplified understanding of each customer. This makes segmenting your customer base and using sales data to build better and more personalized marketing and sales campaigns much more manageable.

For example, say you own a party supply store, and a customer buys a whole set of decorations. Thanks to your sales data pipeline, you can infer that these decorations are for a child’s birthday party.

You can then use that information to market to that customer more effectively in the lead-up to that period, helping to increase the likelihood of repeat sales and a higher checkout price.

- Build better products

You can use information like sales, reviews, and even return data to help you understand which products are doing well, which are being poorly received (high sales, high returns), and which aren’t gaining public interest. Using this information, you can then workshop what works and what doesn’t and move forward on improving your product development.

- Reactivate inactive customers

Ultimately, you want to increase the number of repeat customers and their customer lifetime value (CLV).

One of the easiest ways to do that is by working to reactivate inactive customers.

To do this, you will need to be able to track and store when a customer last:

- Visited your website

- Opened an email

- Purchased or hired from you

- Participated in a survey

- Etc

You will then have to set a time limit. For example, if three months go by without any engagement from your customer, you can then work on reactivating them via their SMS or email. You can try to recapture their loyalty (and get a sale) with:

- We miss you: Use personalization to show top offerings or provide exclusive discounts.

- What’s new: Work to recapture interest by highlighting what’s new with your business.

- Have your say: Invite customers to comment on your following product or to fill out a survey.

- Your privacy matters to us: This is a simple but effective way to inform customers you’ll delete their data soon unless they log in or tell you otherwise. Combined with a roundup of what they’re missing, you can work to reactivate even years’ cold leads.

- Improve sales forecasting

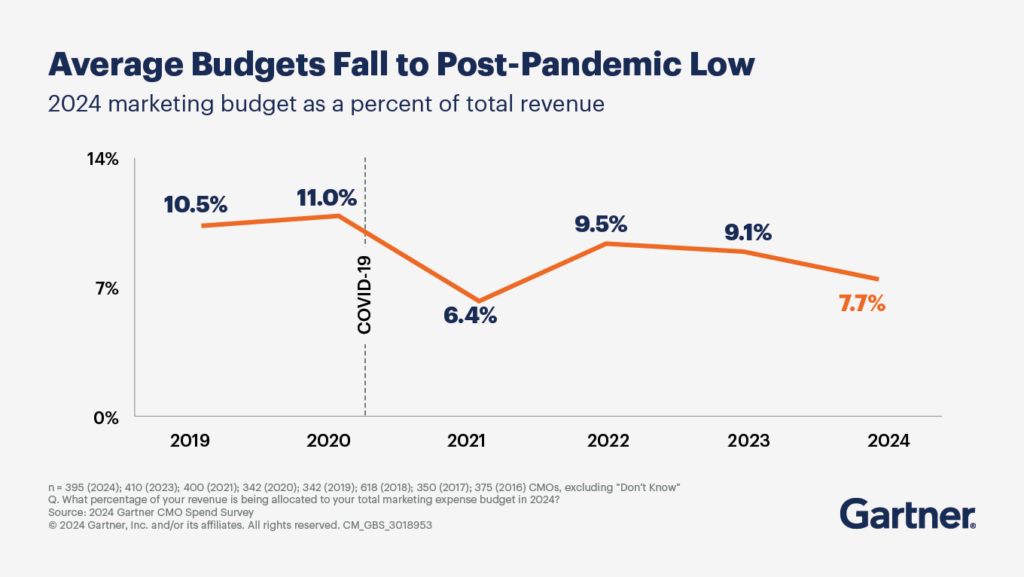

According to a Gartner study, most CMOs don’t believe they have enough budget to execute their strategy, with the average budget falling to just 7.7% of total revenue. In comparison, marketing teams usually had between 10 and 11% of their businesses’ revenue to work with pre-pandemic.

This means that marketing and sales teams need to do more with less. One of the easiest ways to do that is to focus on when customers do business with you.

How do you know when that is?

You use your historical data to generate a sales forecast. This will help you identify critical periods when sales volumes were highest so you can refocus those smaller marketing budgets and sales performance incentive funds on when you can develop the most significant number of sales (for example, during Christmas or another relevant holiday).

- Identify cost-saving opportunities

You can identify many cost-saving opportunities by managing and analyzing your sales data. For example, a Canadian business might notice an increase in sales to the US during specific times of the year, but the ROI on those sales is low because shipping is higher.

That information lets you know you need to find the cheapest international shipping options to reduce costs.

- Identify bottlenecks and improve efficiency

Sales require a massive assortment of different systems to work effectively. This complexity can often lead to inefficient tools, redundant applications, and disorganized connections as your business grows.

Auditing your applications is a great step to add to your sales data management strategy. Application portfolio management best practices can quickly optimize your entire collection of tools to ensure they work towards your business goals.

The goal is to end up with the most valuable and cost-effective options that work together to help streamline and automate your sales pipeline.

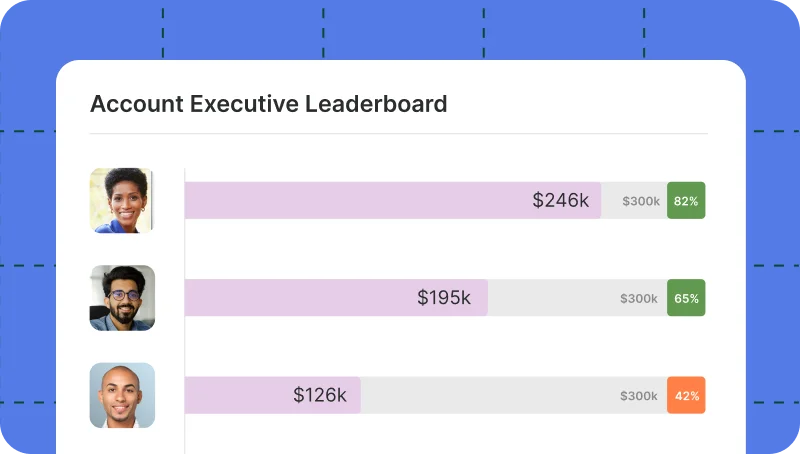

- Easily manage multiple sales teams

Structuring your sales data will allow you to identify repeat processes, files, and profiles. Cleaning them up so that there are no repeats or conflicting information makes managing multiple sales channels effortless and effective.

After all, one of the biggest conflicts within sales teams is when territories overlap. For example, if your inside and outside reps target the same customers. With a sales data management strategy, you can work to clear up sales operations to ensure everyone has their responsibilities without overlap.

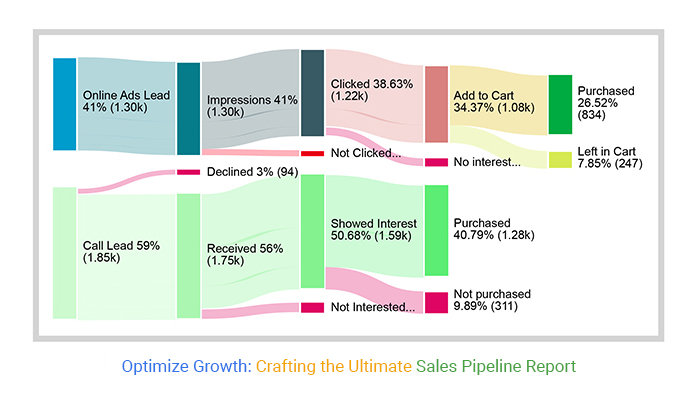

- Identify which marketing strategies are performing the best

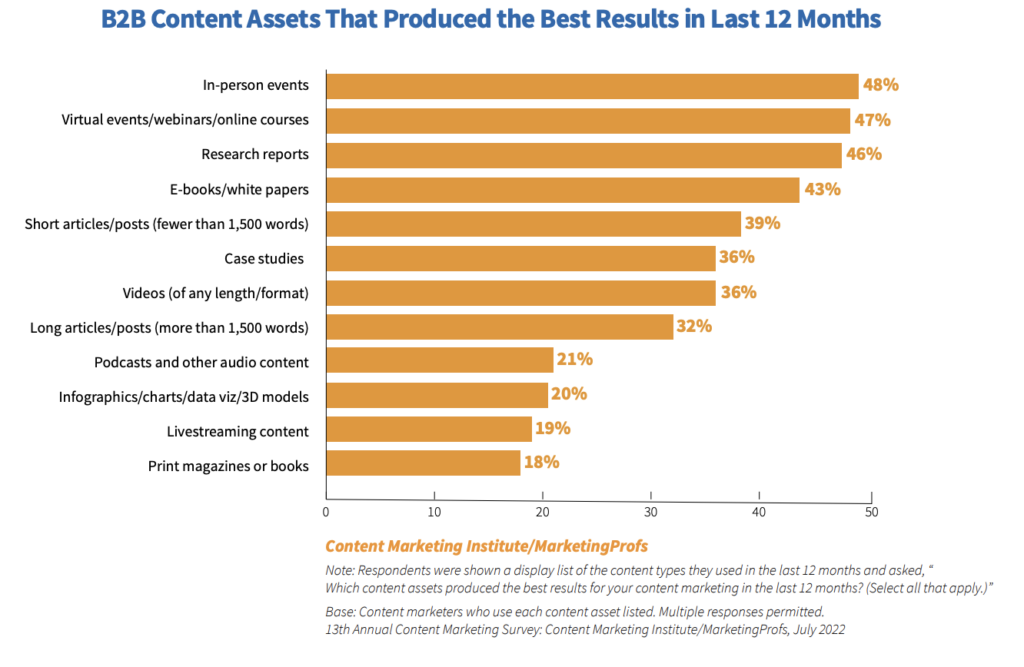

A fully realized sales data management system can help you understand which sales pipelines are the best value for your business. Over 40% of polled B2B businesses generally believe in-person/virtual events, online courses, research reports, and e-books/white papers performed best. This is, however, average. Your business may find that your podcast or magazine is the most lucrative portion of your content strategy.

With a fully realized sales data management strategy, you can clearly understand the content pathways that provide the best results and allocate your marketing budget to where your business would benefit the most.

Top tools to start making better sense of your sales data today

Sales data management isn’t a tool; it’s an approach. You will need various tools and software at your disposal to make the benefits of sales data management a reality for your business, including:

- Data Analytics

- Customer relationship management

- Data visualization

- AI and machine learning analytics

- Automation

- Marketing

- Social listening

- And more

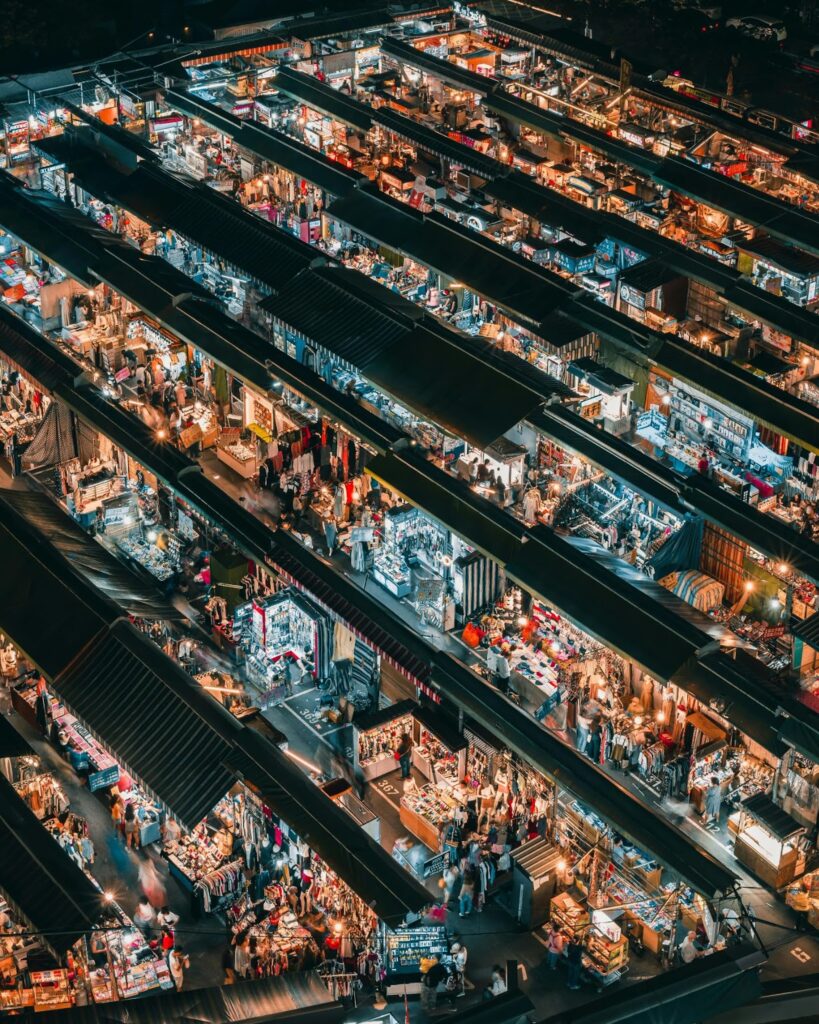

First, however, you will need what’s known as sales intelligence. What is sales intelligence, you may ask? It’s the tools that work to collect, analyze, and use sales data from all sources. This means collecting data from your website, social media, databases, third-party marketplaces, and more.

Once all that information is collected and sorted, you can use the other tools to make sense of it and put it to work.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialHow to start implementing a winning sales data management program

Implementing a robust sales data management strategy requires an extensive audit and processing period as you get a handle on all the relevant data. To help you through this process, follow these steps:

- Assess your current capabilities

The first step is to understand your current capabilities. You’ll want to organize what your system can currently do into core, supporting, and strategic categories. Focusing on the information being handled rather than the processes themselves is essential, as this helps avoid process overlap.

For example, a capability is customer detail management. Technically, two processes can be involved—onboarding new customers and servicing existing customers. However, the processes involved are very similar (updating details and preferences). By focusing on the information (customer data), you can avoid overlap and simplify this identification step.

This step helps prep you for the others, so review this business capability example to understand better how to sort through your sales data capabilities and learn how to use them to identify gaps and bottlenecks.

- Adopt or replace crucial sales data tools

Once you’ve identified your systems and capabilities, you’ll want to select the legacy, outdated, or unusable systems and work to delete, replace, or support them with new technologies. This is particularly important with the rise of new AI and machine learning systems, which can help automate more of your sales process than in the past.

- Centralize your data

You’ll need to centralize your data for any automation tool to work. If data exists in individual silos, then everyone in your company is working with an incomplete view of your operations.

There are several ways to approach this step. If you have legacy systems you cannot get rid of or replace, start with hybrid integration solutions that connect them to more modern systems. This lets you access data from the cloud from those legacy systems.

You can also work on using a data fabric solution or create a data mesh to safely import data from all sources and store it in a single data warehouse.

Whatever your method, you want all of your data in one place. From there, you’ll need to clean it up.

- Clean up data

Having all your information in one place means nothing if you still have conflicting files, missing information, and poor metadata. That’s why the next step is to clean it up. During this process, you’ll want to consolidate relevant files, like your customer information profiles, into a single source of truth. For example, if there are two “John Doe” customers at the same address, you will want to consolidate them for a complete view of that customer.

You will also want to establish data governance, which helps future information go where it needs to go and stay secure regardless of whether it’s in transit or at rest.

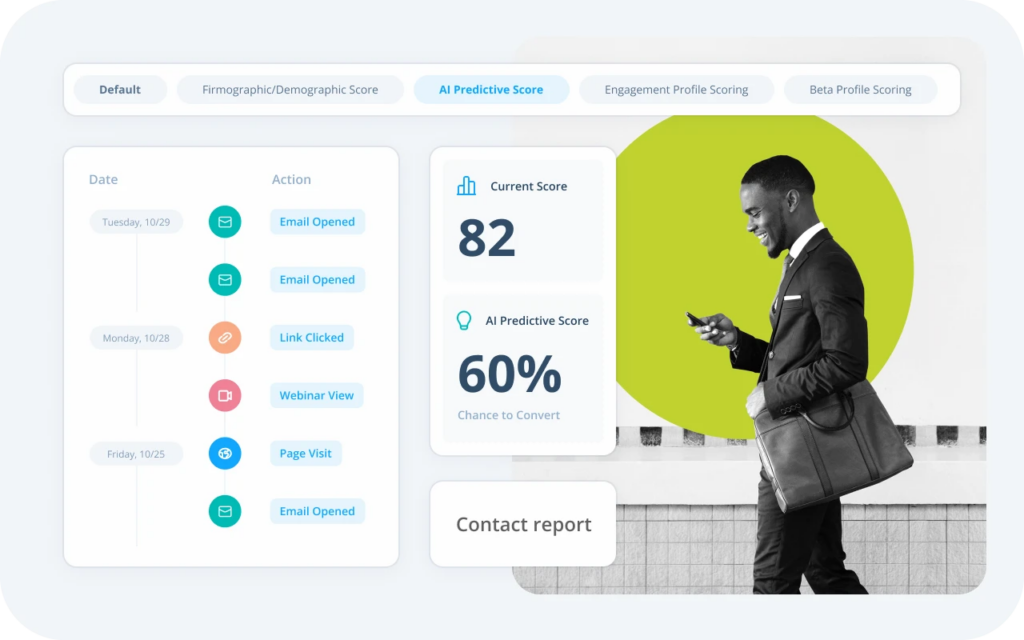

- Segment and define customers

Now that all your data is consolidated and you’re prepared, it’s time to shift focus to the customer segment of sales. Start by segmenting your customers. While demographic data is essential, prioritize understanding who the customer is and what they need.

You will want to create ideal customer profiles to help your sales and marketing teams do their jobs best and analyze intent data to understand why and when sales are made. This will help you increase revenue on your terms.

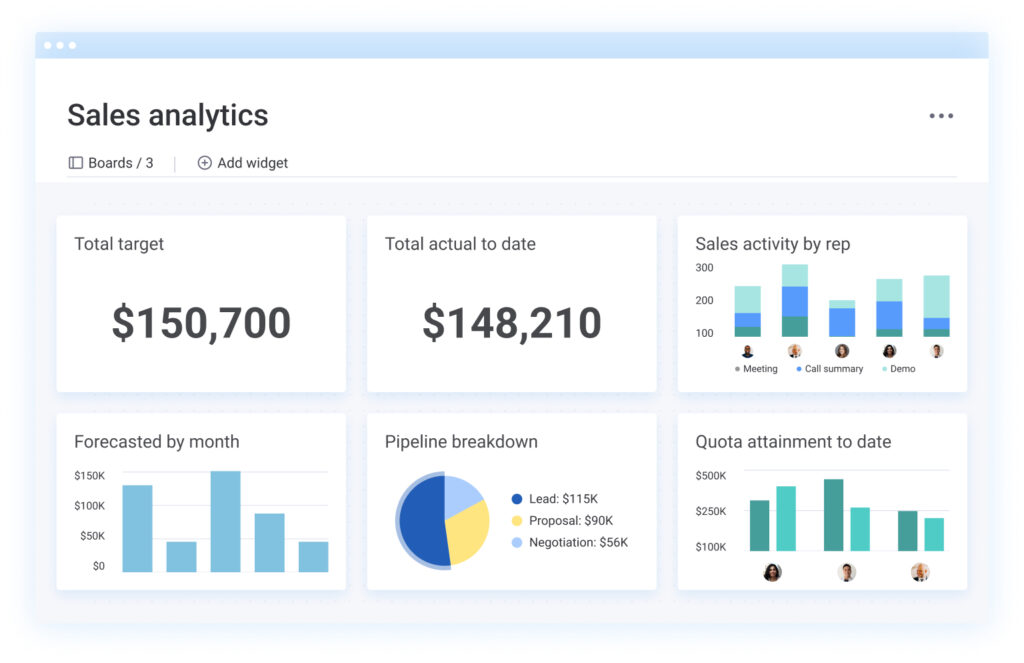

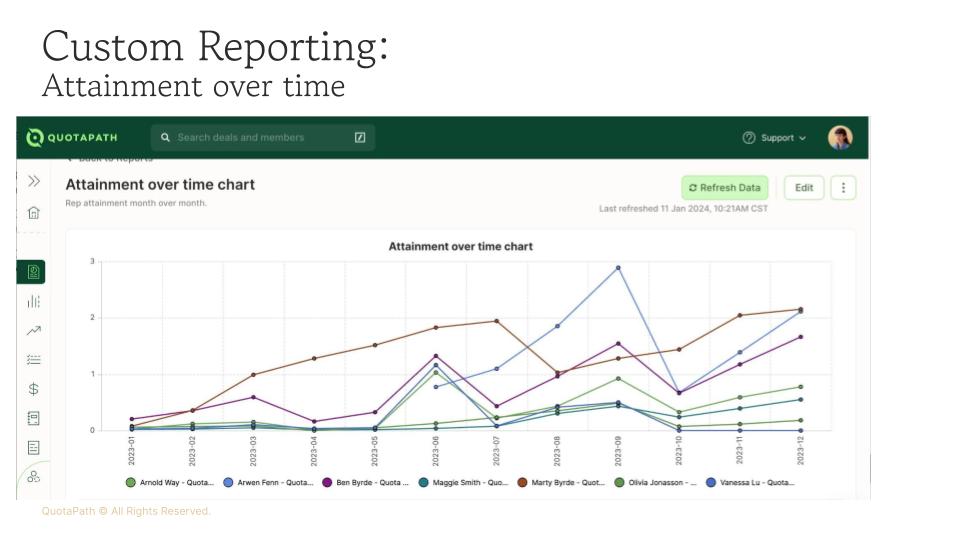

- Optimize your sales performance

With your operations primed and ready to go, it’s time to start optimizing your sales. To do this, you’ll want to outline which metrics you’re tracking and the KPIs you will use to determine success or failure. For example, you may want to start tracking:

- Revenue

- Customer acquisition cost

- Customer lifetime value

- Average order value

- Units sold

- Conversion rate

- Etc.

As for analyses, you can implement moving averages, regression analysis, or exponential smoothing to help you get a more realistic look at your sales averages.

Regardless of your exact methods, you will want to rely on the analysis extracted by your systems to improve your approach. Use A/B testing to help you adjust your marketing and sales methods to increase revenue, sign-ups, followers, or your latest goal.

- Keep records accurate

When optimizing your sales process, don’t forget the steps that occur after a sale. All records must stay 100% accurate. You must also optimize inventory management, supply chains, and finance teams. It is all connected!

Integrating automation software is the best way to ensure all the information stays accurate. Automated reconciliation software, for example, helps streamline processes by providing real-time data and reports, enabling you to quickly audit your finances and ensure compliance.

- Continuously work to improve

As with any strategy, you must continually work to improve your efforts. Customer trends come and go, newcomers rise as disruptive competitors, and regulations change the game in your industry every day. The good news is that, with a well-managed sales data stream and strategy in place, you’ll be ready to adapt to those changes quickly.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesBuild Your Sales Data Management Strategy Today

Investing in your business’s custom sales data management strategy offers many benefits, including boosted revenue, better resource allocation, cost reduction, and improved performance. While the exact steps to implement a sales data management strategy will be unique to your company, the tips outlined in this guide will help you effectively approach your sales data management adoption, so get started today.

Recent Comments