Sales forecasting is one of the most essential yet challenging aspects of business. However, having an accurate estimate of revenue through a sales forecast can shape your success.

Everything from developing budgets to planning production capacity relies on this forecast. That’s why accurate insights are crucial.

The solution? Demand forecasting. Here, we’ll explore why this process is so beneficial and strategies to implement.

What is demand forecasting and why is it important?

Demand forecasting is the process of estimating future sales of your products or services by using relevant data to predict demand. The aim is to remove the guesswork by gaining a more accurate view of predicted revenue streams to help better manage budgets and sales cycles.

Why is this important? One aspect is streamlining. Accurate forecasts allow you to anticipate fluctuations in demand to better allocate resources. Determining stock levels helps avoid understocking inventory or product obsolescence. It’s also beneficial for avoiding lost sales opportunities.

All of this has a knock-on effect on operational efficiency and, consequently, brand awareness. It ensures you’re always able to meet customer demand. This, in turn, can increase your company’s profitability, protect your brand reputation, and ensure steady business growth.

Key benefits of accurate demand forecasting

As we mentioned, demand forecasting offers numerous benefits, from resource allocation to sales opportunities. Let’s dive into these in more detail.

Inventory management

Demand forecasting in supply chain and inventory management is essential for maintaining optimal stock levels throughout the year.

Rather than guessing what you need and when, you can use forecasts to reduce the potential of stockouts, improve ordering efficiency, optimize revenue management, and save on the cost of storage. By ensuring a healthy fill rate, you can meet customer demand consistently while minimizing the risk of understocking or overstocking inventory. You could even save on transport costs by spotting ways to consolidate orders.

Resource allocation

Anticipating demand equips you with the knowledge to better plan and allocate resources. Whether it’s production capacity, manpower, or marketing budgets, you can approach allocation strategically to be more effective during times of high demand and scale back during quieter periods.

Budgeting and planning

Demand forecasting gives you some of the best insights to plan budgets. This can help you decide how much to spend on areas like marketing, hiring, or product development, depending on what resources you will need and how much revenue you anticipate coming in.

Utilizing budgeting software can streamline this process further by automating data analysis and providing real-time insights into budget allocation. With budgeting software, you can efficiently track expenses, identify areas for cost-saving, and make informed decisions to maximize your resources and optimize financial performance.

You may even be able to spot investment opportunities. Automation is becoming increasingly prevalent in businesses today, so you may free up the budget for click to call dialer software to support your sales team’s outreach efforts or customer service chatbots to improve conversion rates.

Risk management

Demand forecasting helps identify potential risks and uncertainties related to sales performance. This way, you can be better prepared to manage challenges.

For example, if your demand forecast indicates a potential downturn in sales during a specific season, you can adjust inventory levels or implement targeted email marketing campaigns to give sales a boost.

Improved decision-making

Any forecasting model replaces guesswork with reliable information specific to your business and customers. With that information, you can make more informed decisions about future sales trends.

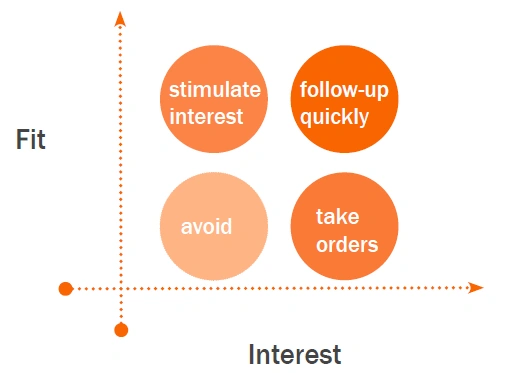

For example, if your forecast indicates a surge in demand for a particular product, you can adjust your pricing strategies. This could mean offering promotions or increasing sales incentives during peak demand periods to capitalize on increased customer interest.

Understanding cross-channel demand patterns, particularly in the context of omnichannel ecommerce, becomes crucial for effectively allocating resources and maximizing sales across multiple sales channels.

5 steps for effective demand forecasting

While demand forecasting can benefit your company, it’s important to do it correctly if your strategy is to be successful. We’ve broken it down into five easy steps.

1. Collect data relevant to your goals

Begin by collecting and analyzing relevant data available that aligns with your sales and business growth goals. This information could include any or all of the following:

- Historical data: Past sales data can tell you a lot about what might happen in the future. Pull data from sources like your CRM, inventory management software, call center reporting tools, customer forms, and even other departments. Review previous demand, looking out for patterns, trends, and seasonal fluctuations that are likely to repeat.

- Market research: Gather information about your target customers, including their preferences, buying habits, and what influences their purchasing decisions. This could be done through surveys, interviews, or analyzing existing market studies.

- External factors: Industry trends and competitor activities can impact your forecast. But it’s also worth gathering data on economic conditions and socio-political factors like regulation changes or consumer sentiment. For example, a new competitor entering the market might affect demand for your products, or a change in government policy might influence consumer buying behavior.

2. Implement your chosen forecasting methods

Once you have the data, you must analyze it to draw conclusions. You can do this manually or with the help of automation. Let’s explore a few options.

Statistical models

Statistical techniques like time series analysis and regression analysis are useful for creating forecasting models.

Time series analysis looks at patterns in historical data over time, such as increases or decreases in sales during certain months.

Regression analysis identifies relationships between variables. It considers how factors like marketing spend, promotions, and economic conditions have impacted sales.

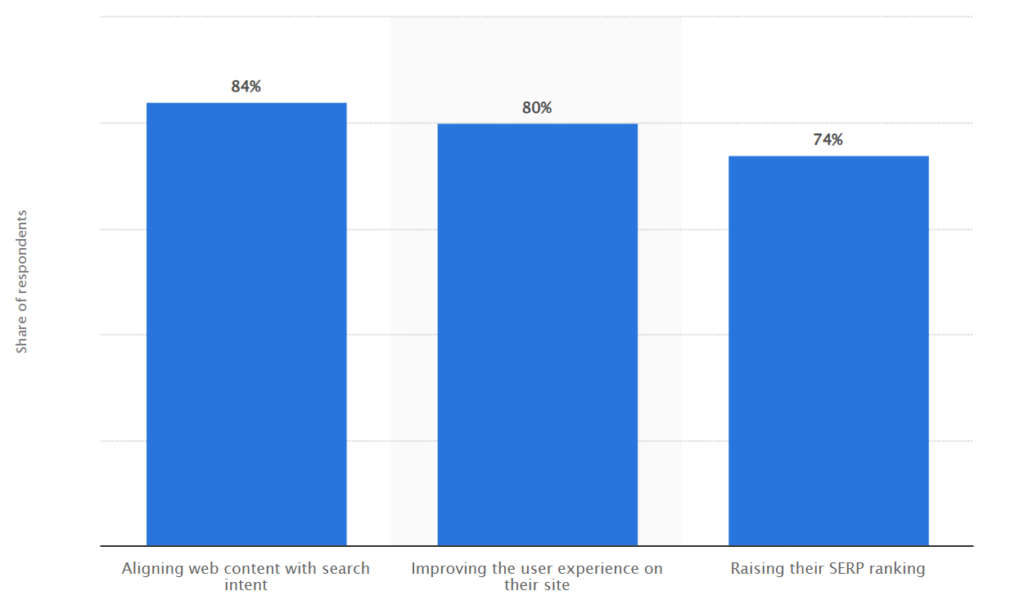

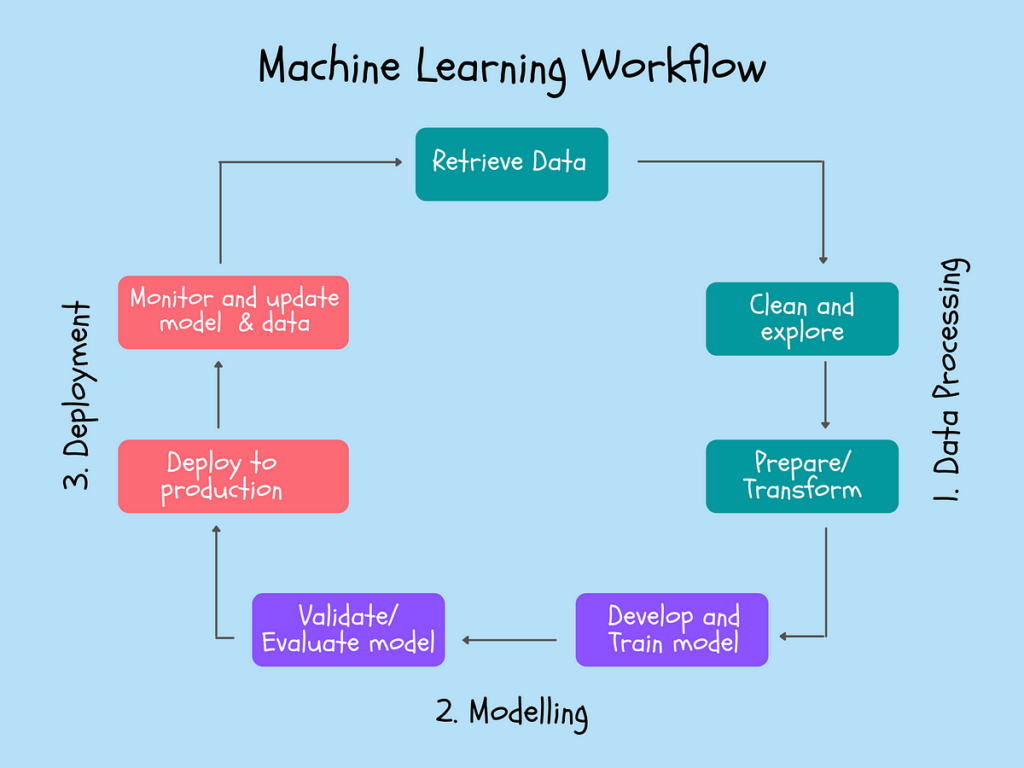

Conducting an in-depth analysis of large data sets manually can be challenging. However, machine learning algorithms make this process more efficient and can help identify complex patterns, resulting in more accurate predictions.

Forecasting software

As with many business processes, software can make forecasting much smoother. If you choose the right model, it can help to automate data collection and analysis and generate reports for you.

But it’s crucial to choose the right solution for your business needs. You should also understand how that solution creates the forecasts so you can make better decisions.

Remember that your existing software such as your ERP system may have built-in forecasting capabilities. Or you may need a customized program for your specific industry.

Collaborative forecasting

Technology isn’t always the answer. Bring together different departments to share insights and perspectives to help shape your forecast.

For example, a software company launching call script software might get input from their sales team on customer demand and predicted sales. The marketing team would provide campaign insights, while the finance department could offer financial projections.

3. Segment your market

Market segmentation can refine your sales forecast by accounting for demand drivers and behavior variations across different segments.

After segmenting your audience or products, you can develop separate forecasts for each category. This allows you to account for demand drivers and behavior variations across different segments.

Here are two ways you might segment your market.

Customer segmentation

Narrow your wider target market into smaller groups based on different characteristics that influence purchasing patterns. This could be:

- Demographics: Age, gender, income

- Psychographics Lifestyle, values, interests

- Geographic location

- Buying behavior

Product segmentation

Categorize your products based on their attributes, such as price, functionality, and lifecycle stage. This helps you tailor your forecasting approach to the different characteristics of each product category.

You might forecast higher-priced products differently from budget items or adjust forecasts based on a product’s lifecycle (e.g., introduction, growth, maturity, decline).

4. Monitor sales performance and make adjustments

Tracking sales performance is crucial to improving the accuracy of your forecast. This allows you to make changes when needed and stay responsive to changing market dynamics.

Keep an eye on key performance indicators (KPIs), sales metrics, and market trends. How do they compare with your forecasted values? If your actual sales drop below what you forecasted, it could be a sign that you need to adjust your strategy or allocate resources differently to adapt to changing market conditions.

Remember that while it’s great to have a demand forecast in place, there are some things you can’t predict. So, it’s essential to remain agile in response to new information or unexpected events that may impact demand.

It’s likely that you will need to revise forecasts, reallocate resources, or adjust marketing strategies along the way. For example, a competitor launching a similar product could unexpectedly reduce your demand, meaning you need to consider scaling back production.

As part of this step, establish a feedback mechanism. Gather regular insights from frontline employees, customers, and partners about their experiences and perceptions. Their feedback can provide valuable information about changing customer preferences, market trends, or other factors that may influence demand.

5. Review and repeat

After making forecasts, it’s essential to compare them with actual sales data to identify discrepancies and understand their root causes. You may need to change your data collection tactics or forecasting methods in the future.

Forecasting isn’t a job you can do at the start of the financial year and forget about. It’s an ongoing process that needs continuous refinement. Regularly review and refine your forecasting models based on stakeholder feedback, performance metrics, and learnings from past forecasting experiences.

Consider building a scenario analysis into your forecasting process, too. This involves preparing for the potential impact of various scenarios or events on your sales forecast. For example, you might consider what would happen if there’s a recession, if you launch a new product, or if a competitor starts a price war.

Imagining these scenarios and their potential effects on sales helps you better prepare and make plans to respond effectively.

Demand forecasting: Unlock powerful insights to drive sales

While we can’t see into the future, demand forecasting could be as close to a crystal ball as it gets.

Accurate sales forecasts help businesses make more informed decisions and plan strategically. The ability to anticipate future demand means you can make the right adjustments to everything from stock levels and manpower to meet customer needs.

This not only contributes to a more efficient business model but also reduces inefficiencies and reduces costs, leading to a more profitable business and satisfied customers.

Recent Comments