The MEDDIC sales methodology is a highly popular qualification method and sales training for complex sales that flourished in the 90s. This approach was developed by John McMahon, Richard Dunkel, and Jack Napoli to train their new sales hires at PTC. They gathered all the best practices of their over-quota reps on consistently closing high-value deals to create the MEDDIC method.

The approach attracted attention when the PTC sales team grew its sales from $300 million to $1 billion in four years. It works by focusing reps on continuously qualifying prospects so they can filter out the unwinnable ones and spend time on those most likely to close. We like to refer to these as the “ideal customer profile.”

In doing so, sales reps avoid wasting 50% of sales time on unqualified leads and losing approximately 67% of their deals because they aren’t properly qualified.

The MEDDIC framework helps reps identify and better qualify prospects for higher close rates and retention. If your business sells solutions that are technical, complex, expensive, or require a significant user behavioral shift, MEDDIC is a valuable process to adopt. By using MEDDIC to thoroughly evaluate and qualify potential customers early in the sales process, your sales team can focus their time on prospects who are most likely to close.

Deep dive of MEDDIC

MEDDIC is an acronym for Metrics, Economic buyer, Decision criteria, Decision process, Identify pain, and Champion. Below, we listed the details of each of the six qualification steps included in this sales methodology.

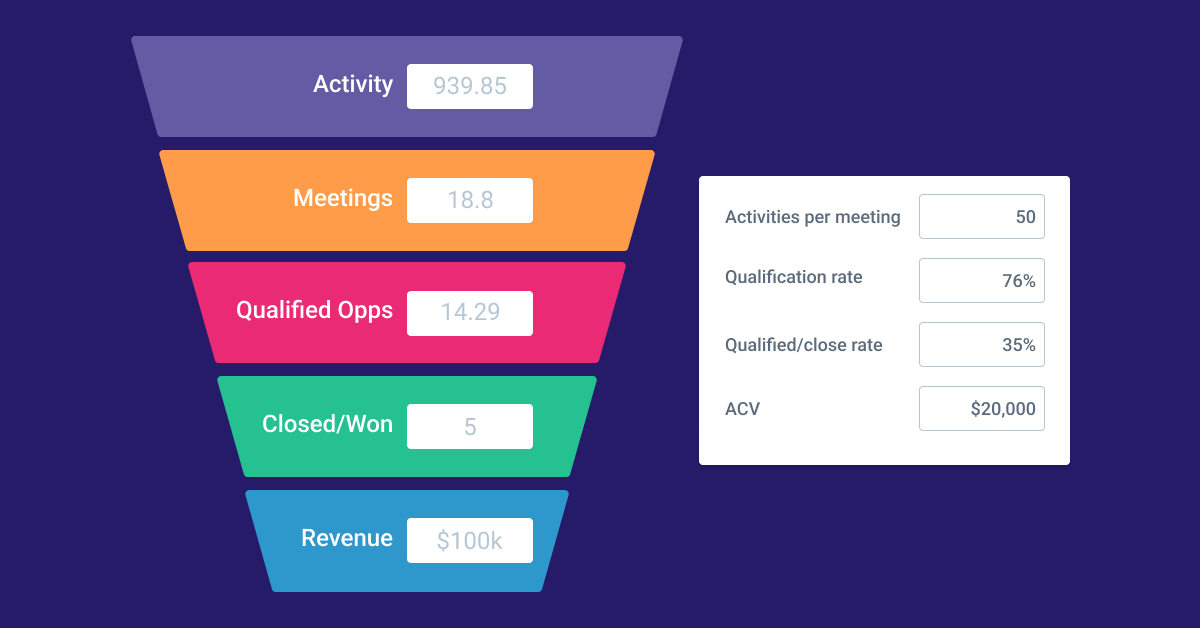

Build a Sales Funnel

Use our free sales funnel resource to see how many meetings your team needs to book to hit quota.

Calculate Now1. Metrics

Determine the prospect’s quantifiable goals so you can explain how your product will help them attain their goals. Then, go a step further to understand how the prospect will measure success, enabling you to speak in their terms.

2. Economic buyer

Identify the person who makes the financial decisions for your solution type. Although the person may not be your regular contact, it’s important to know who they are. Then it’s time to contact the economic buyer. If this isn’t possible, ask your primary contact about the economic buyer’s mindset, expectations, decision-making process, and priorities so you can speak to their motivations when presenting your solution.

3. Decision criteria

It’s important to discern what factors the prospect’s company is prioritizing as they compare various solutions. For example, if your solution is software, these criteria might include things like ease of use, onboarding, integration, price versus budget, and potential ROI. Identifying these key factors enables reps to tailor their pitch to emphasize these areas of interest.

4. Decision process

Beyond the decision criteria, it’s essential to understand the prospect’s decision-making process. These are the internal steps required for them to finalize a purchasing decision. Knowing the steps in their buying process enables reps to track their progress toward closing the deal from the prospect’s perspective. Your sales managers will thank you.

5. Identify pain

It’s essential to know the prospect’s problems and pain. This enables sales reps to show the prospect how your solution confronts and addresses their needs. A deeper understanding of the magnitude of the potential customer’s pain allows reps to quantify the value your solution will deliver.

6. Champion

A champion is an advocate or someone within the prospect’s company who stands to benefit the most from your solution. Developing this level of relationship with a contact facilitates keeping your solution top of mind throughout the buying process until the deal is closed. The longer your typical sales cycle or the more costly your solution, the more important it is to identify a champion to influence the decision-making process on your behalf. The sooner you can identify and foster your relationship with the champion, the better.

How it’s evolved over time and its current state

The MEDDIC sales training has evolved since its creation in the 90s. The original six MEDDIC qualification factors remain with additional criteria added over the years. The two most commonly implemented variations of MEDDIC include MEDDICC and MEDDPICC.

MEDDICC

The seventh qualification factor, represented by the additional C, is competition. This is for businesses selling high-dollar, large projects in a highly competitive market. In this case, salespeople need to have an understanding of the suppliers they typically compete against and be able to differentiate their solution against their opponents.

MEDDPICC

The eighth qualification criteria, represented by a P, is the customer’s “paper process.” This is where sales reps need to understand customer prerequisites. These include contractual, approval, legal, and vendor onboarding procedures. Also known as things that could slow down or block your deal.

And, a more recent refinement to the MEDDIC sales methodology is:

MEDDPICC+RR

As with the other two variations of MEDDIC, this latest iteration was created to accommodate the most complex B2B sales opportunities. The two Rs stand for:

- Relative Priority: This refers to the prioritization of internal projects in terms of budget and time allocations since not all goals can actively be addressed at the same time. So, internal prioritization can become a deterrent to closing the deal.

- Risk Factors: These factors have the potential to impact the customer’s decision process and include both internal and external factors. An example of an internal factor is a personnel change on the buying committee. Whereas an example of an external factor might be unforeseen factors like COVID-19.

Businesses usually don’t need all 10 criteria in the MEDDPICC+RR. So, you may choose to start with the original MEDDIC sales methodology and expand from there as needed.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to Sales- Prepare your coaching approach to reinforce initial MEDDIC training and promote continuous improvement in applying what they learn.

- Train sales and marketing management on the MEDDIC method so they’re equipped to effectively support the sales team.

- Initiate the creation of sales enablement resources to support continuous improvement and updates. Cold calling scripts instruct reps on how to incorporate the right questions into their sales conversations. This also helps them get started and facilitates role-playing.

Once you have completed these initial steps, it’s time to train your sales team on the revised resources and the steps in the MEDDIC sales methodology. Then have them start applying it in their day-to-day prospect conversations.

MEDDIC best practices

Implementing any new sales methodology can involve some trial and error. To facilitate your launch of the MEDDIC sales methodology, we’ve assembled some sales tips.

Review sales objections to help reps with talk tracks in overcoming objections.

Review lost deals to determine if you need to adjust qualifying questions to prevent reps from spending time on the wrong prospects.

Continuously finetune customer personas. This will ensure they are up to date and reflect the evolving characteristics of your ideal customers.

Update sales qualification questions as needed based on new insights, changing market conditions, and changing customer priorities.

Customize CRM fields with MEDDIC acronym. (Measurable goals, Metrics of success, Economic buyer, Decision criteria, Decision process, Pain points, and Champion.) Having these in place reinforces this sales training, keeps reps focused on the process, and makes it easier for them to record these valuable insights as they discover them.

Enable automated alerts to your internal chat platform whenever there is a change in the status of an opportunity in your CRM. This helps sales leadership inspect the change, determine whether it should be happening, and coach reinforcement or course correction.

Other sales methodologies to consider

Effective lead qualification filters out prospects that are unlikely to buy. This shortens sales cycles, improves sales forecasting, boosts deal value, and improves win rates.

If you’re not sure MEDDIC is right for your organization, you may want to consider its predecessor or one of its variations such as BANT, ANUM, CHAMP, and FAINT.

BANT marks one of the earliest efforts to formalize opportunity qualification in the B2B sales environment. IBM developed it and the acronym stands for Budget, Authority, Need, and Timeframe.

ANUM, developed by Ken Krogue at InsideSales. It redefined BANT and stands for Authority, Need, Urgency, and Money.

CHAMP focuses on prospect challenges. This acronym represents Challenges, Authority, Money, and Prioritization.

FAINT, developed by the Rain Group, stands for Funds, Authority, Interest, Need, and Timing.

These simplified lead qualification methods tend to be more effective in shorter sales cycles and lower cost, less complex sales.

Conclusion

Having an effective lead qualification process in place makes a significant difference in sales outcomes. The MEDDIC sales methodology focuses on qualifying prospects throughout the sales process to filter out prospects unlikely to buy. This boosts close rates and sales productivity. Try this method if you have a complex sale and want to improve your team’s results.

QuotaPath’s technology maps your commission plan by automating sales compensation and commissions calculations. We also support the sales community with free sources, like our Quota:OTE Ratio Calculator and Sales Funnel.

To see how QuotaPath can support your compensation plan, schedule a demo with our team.

Recent Comments