After months of crafting a sales compensation plan and meticulously calculating quotas and commissions, you roll it out with fanfare.

But instead of attainment results to match, you’re met with missed targets, a revolving door of frustrated reps, and a growing misalignment with your overall business goals.

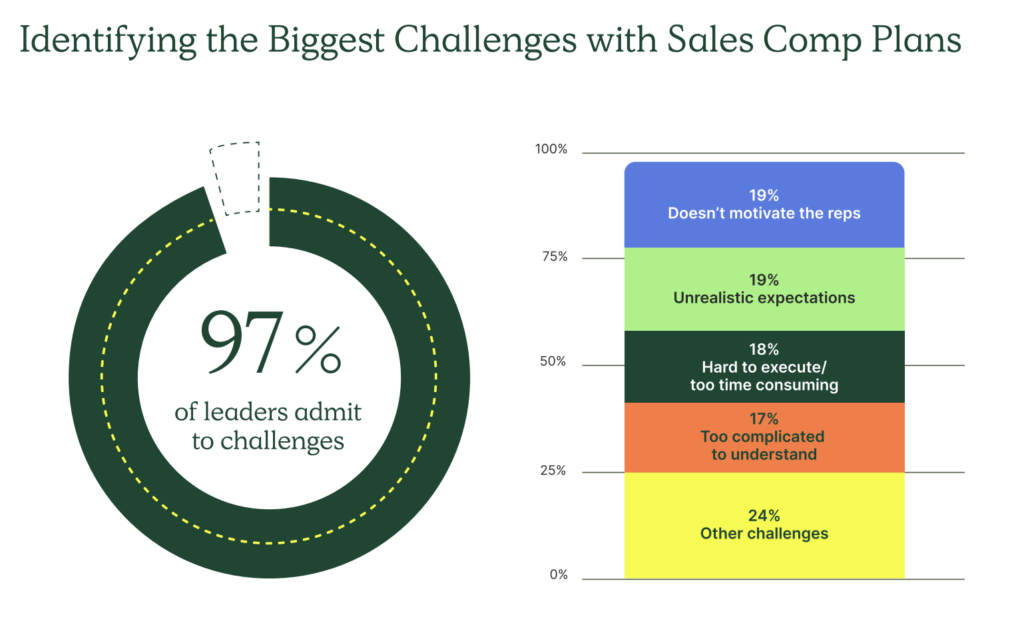

Unfortunately, this scenario isn’t uncommon.

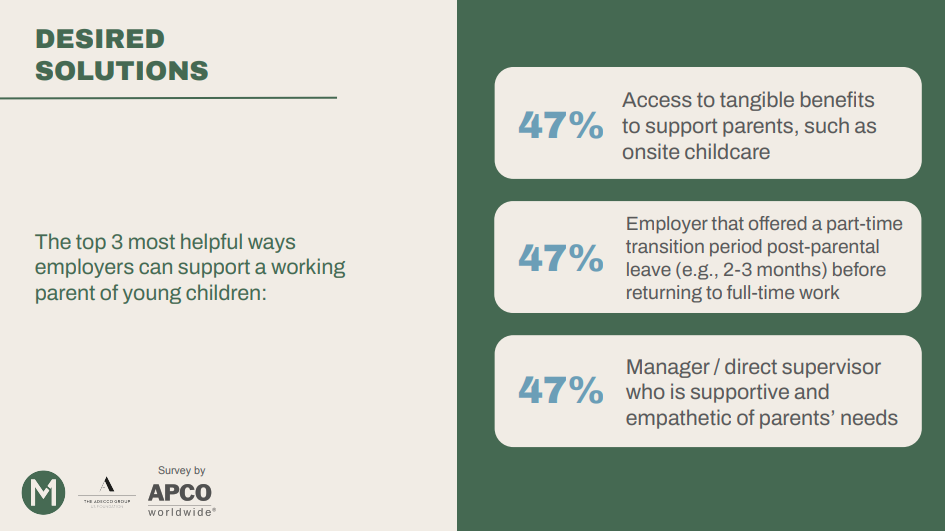

A shocking 39% of revenue leaders admit their compensation plans fail to align with business targets. What’s more, 30% said their plans don’t motivate their reps.

Why? Because too often, companies rely on outdated data, gut feelings, or worse yet, simply copying plans that worked for someone else.

This traditional approach leads to a slew of problems.

Setting fair and achievable quotas becomes a guessing game. Compensation structures might not incentivize the behaviors that drive your company’s “north star” metrics, like customer lifetime value or gross revenue retention.

Confusion and a lack of transparency can demotivate even the best reps. And perhaps most concerning, you’re left in the dark about the true impact and cost of your compensation plan on revenue.

But what if there was a better way?

Below, we highlight how QuotaPath positions customers to make informed sales compensation decisions.

By leveraging powerful analytics, actionable insights, and an adaptable user experience, QuotaPath helps you build and revise high-performing comp plans that motivate your team, align with your goals, and ultimately, drive sustainable revenue growth.

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesUnlocking the Power of Sales Compensation Data

Intuition and guesswork might have a place in the world, but designing a high-performing sales compensation plan is not one of them.

The key to unlocking true effectiveness lies in the power of data.

QuotaPath empowers revenue leaders with a wealth of rich sales performance information, giving them the insights needed to build and refine compensation strategies that drive results.

The Data Advantage

Imagine having a crystal ball that reveals your sales team’s historical performance, individual and team contributions, and even attainment rates for different quota levels. This isn’t magic; it’s the power of QuotaPath’s data.

By providing access to these crucial data points, QuotaPath equips you to:

- Set Smarter Goals: Historical sales data allows you to identify trends and seasonality, enabling you to set realistic yet challenging quotas paired with accelerators and bonuses to offset slower periods. This data can also be factored in with market forecasts to ensure your goals are aligned with broader industry trends.

- Identify Your All-Stars: QuotaPath dives deep into individual and team performance metrics. You can easily identify top performers and understand the behaviors that drive their success. Are they selling the most multi-year contracts? Most profitable products? Do they discount the least? You can use these insights to tailor compensation plans to incentivize those behaviors across your entire team.

- Uncover Hidden Gems: Sometimes, hidden potential lies beneath the surface. QuotaPath’s data can reveal reps who consistently exceed specific metrics, even if they fall short of overall quotas. These “unsung heroes” might benefit from targeted coaching or adjustments to their territories or quotas to unlock their full potential.

Data-Driven Decision Making

Data is powerful, but without insights, it’s just numbers.

QuotaPath goes beyond raw data, transforming it into actionable intelligence that empowers you to make informed decisions about your compensation strategy.

Access to past compensation plans and performances gives leaders the information they need to confidently adjust and set quotas. This is especially timely, as 91% of teams missed the quota last year due to market conditions and unrealistic expectations.

Plus, QuotaPath allows you to analyze how different compensation structures impact metrics beyond just pure sales volume.

If you want to incentivize customer lifetime value (CLTV) or retention, we can help you design plans that reward reps for upselling, renewals, and other behaviors that drive long-term customer relationships and recurring revenue.

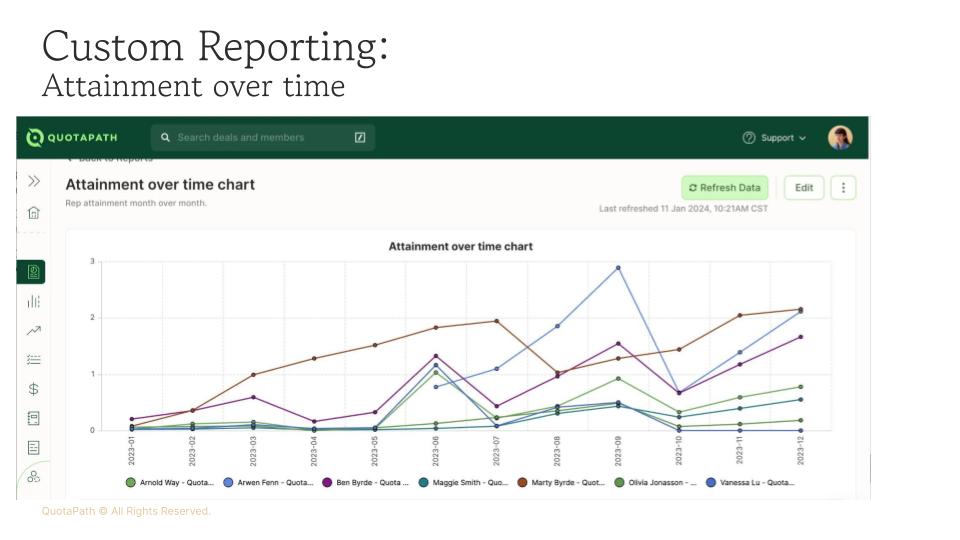

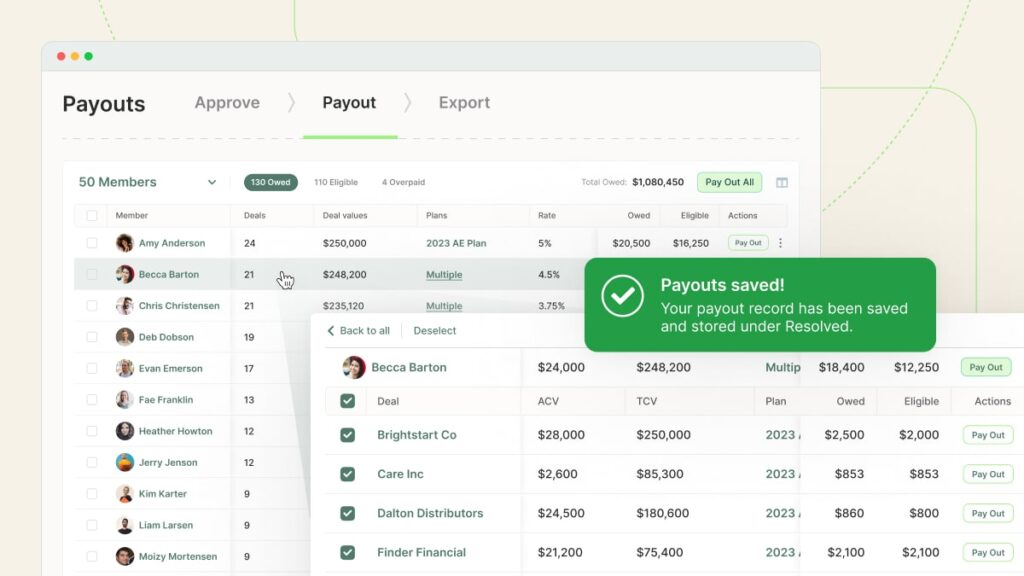

Customized Commission Reporting

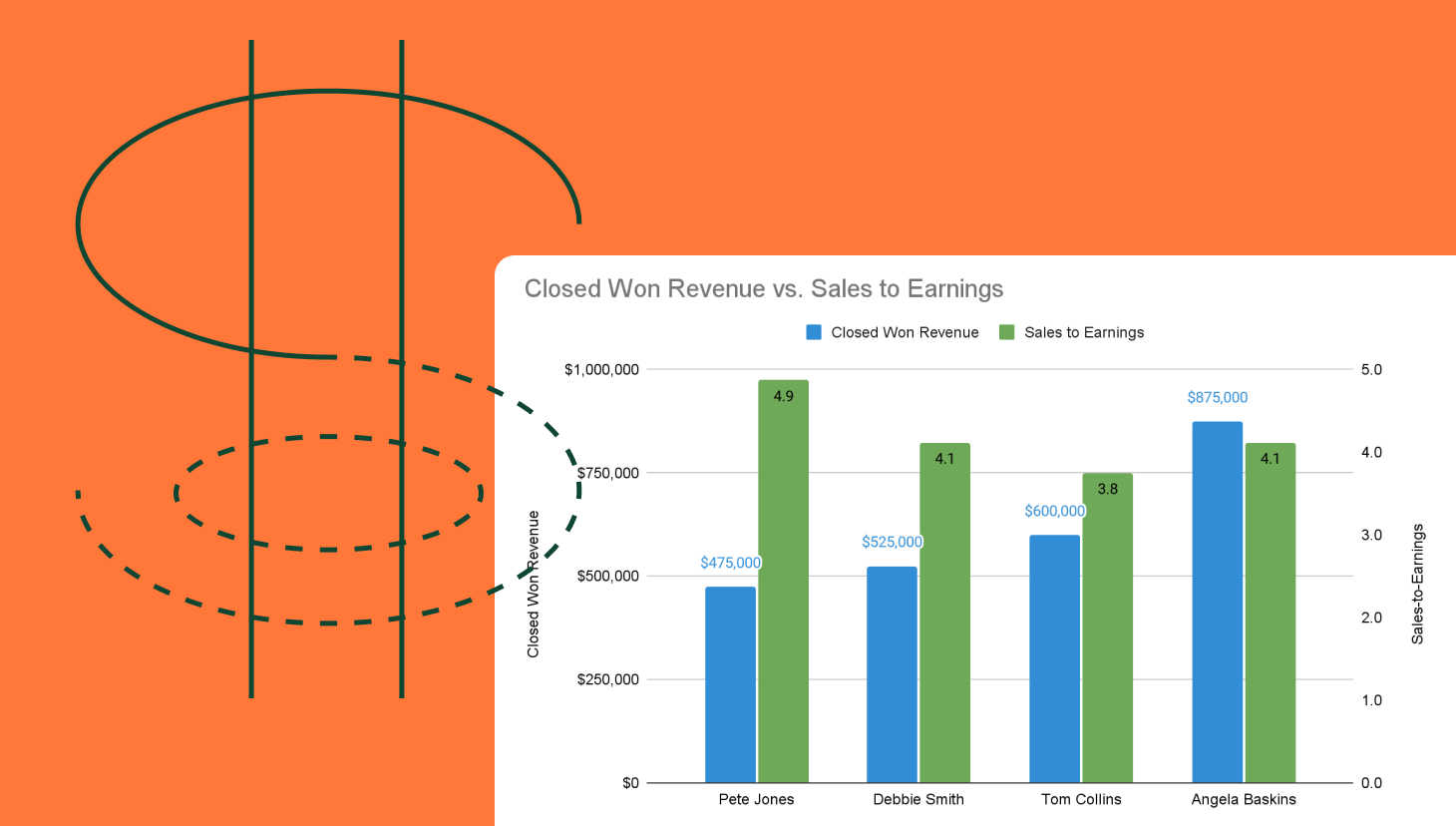

QuotaPath’s commission reporting measures the business value and performance of the GTM team’s compensation plans and performance.

Check Out ReportsOur platform also highlights your top, middle, and bottom performers so that you can tailor compensation plans to incentivize those behaviors across the entire team. This can include things like rewarding reps who focus on selling to ideal customer profiles (ICPs), closing multi-year deals, or driving early customer renewals.

Scenario Modeling/Testing: The Crystal Ball of Compensation

Lastly, QuotaPath developed modeling and testing tools to project the total compensation costs based on performance bands and use historical data against new plans to see how they’d perform.

This allows you to create “what-if” scenarios by modeling different compensation structures and their potential impact on key metrics. Imagine testing a commission plan that rewards early renewals before you actually implement it. QuotaPath can show you the predicted impact on churn rates and revenue, allowing you to refine your plan before launch.

This data-driven approach to testing eliminates the guesswork and allows you to make adjustments before rolling out a new compensation plan, saving you time, money, and frustration in the long run.

Building Powerful Compensation Strategies with QuotaPath

Next, the business landscape is anything but static.

Market conditions shift, team structures evolve, and your North Star metrics might need to adjust accordingly.

A truly powerful compensation strategy and process needs to be adaptable to keep pace with these changes.

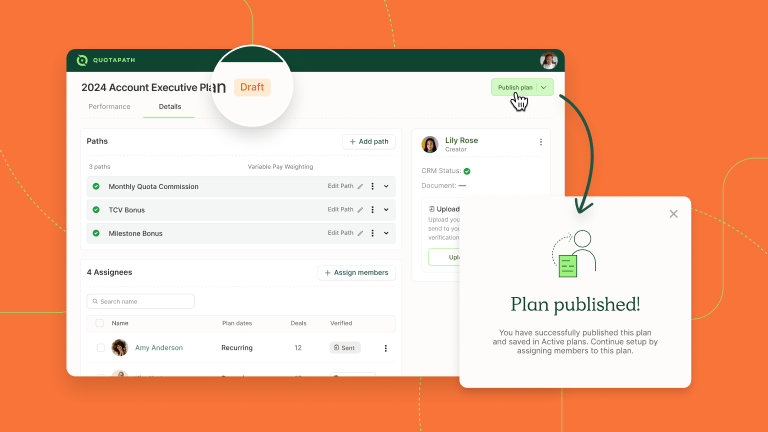

QuotaPath offers you the flexibility and adaptability to manage your comp plans dynamically.

Easily adjust commission structures and quotas as needed, using the testing and modeling tools along the way to avoid guesswork. This allows you to adapt your comp plans with your business goals based on market volatility.

Here’s where QuotaPath truly shines:

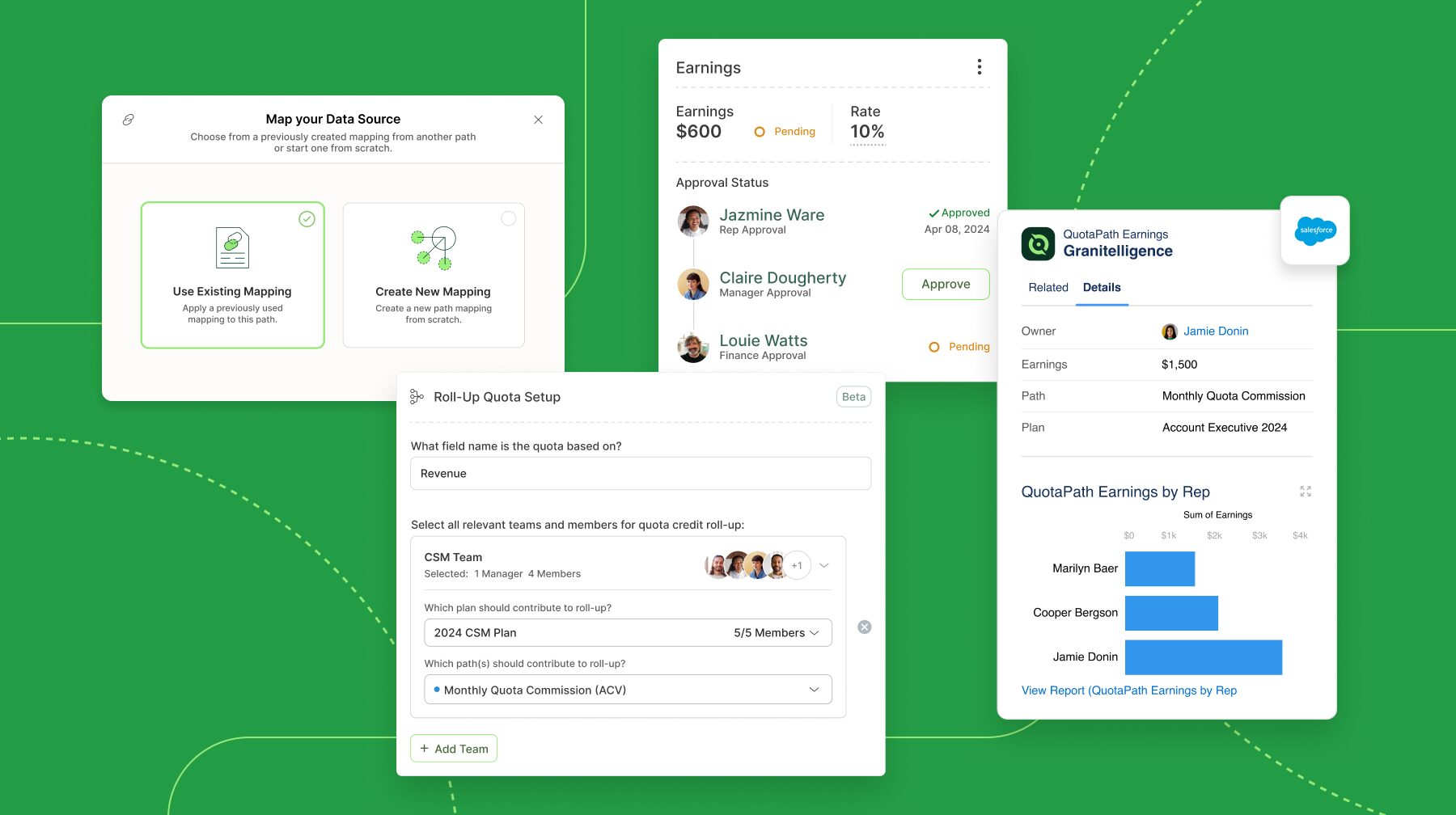

Dynamic Adjustments: When market trends call for quota adjustments, QuotaPath’s user-friendly interface allows you to make adjustments to quotas and commission structures quickly and easily. The same holds true for individuals measured on aggregated teams or rolled-up quotas and reps who shift between teams.

Make quick edits without needing a call to support to maintain seamless automation.

Transparency is Key: Building trust and motivation within your salesforce starts with transparency. QuotaPath fosters this by providing reps with real-time visibility into their earnings and clear, easy-to-understand commission structures. This eliminates confusion or hidden calculations.

Reps can see exactly how their performance translates to their paycheck, keeping them engaged and focused on achieving their goals.

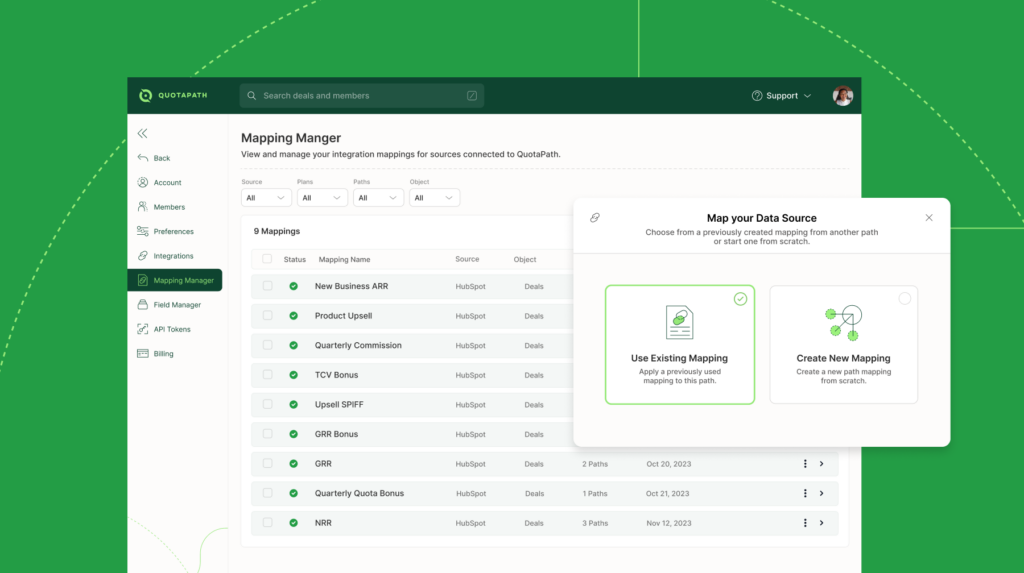

Trusting the Data: Through trusted integrations with CRMs, ERPs, data analytics and business intelligence, spreadsheets, and payment accounting systems, leaders can trust the data feeding QuotaPath is accurate. This creates seamless workflows, shared naming conventions, and data hygiene.

QuotaPath Integrations

Connect QuotaPath with your deal source of truth for trusted, accurate data.

Check Out IntegrationsThe Data-Driven Advantage

Building a high-performing sales compensation plan requires a data-driven approach, seamless workflows, and partnership mentalities rooted in first-hand expertise. That’s where QuotaPath steps in.

QuotaPath empowers revenue leaders with the tools and insights needed to make informed decisions about their compensation strategies.

By leveraging QuotaPath’s data analytics, you can unlock a multitude of benefits:

- Hit Your Numbers Consistently: Set quotas with confidence based on historical performance and market trends. This not only keeps your reps motivated with achievable goals, but also allows for more accurate revenue forecasting.

- Build a Winning Team: Identify and reward your top performers. Analyze their winning behaviors and tailor compensation plans to incentivize those behaviors across your entire team. This fosters a culture of high performance and drives overall sales effectiveness.

- Reduce Turnover: A demotivated salesforce is a revolving door. QuotaPath’s transparent commission structures and real-time earnings visibility keep reps engaged and focused on achieving their goals, leading to a more stable and productive sales team.

- Maximize ROI: Stop throwing money at a broken system. QuotaPath allows you to test different compensation structures and measure their impact on key metrics. This data-driven approach ensures you’re getting the most out of your compensation investment.

Try the most collaborative solution to manage, track and payout variable compensation. Calculate commissions and pay your team accurately, and on time.

Start TrialUltimately, QuotaPath goes beyond just compensation.

It’s an investment in your revenue engine to drive repeatable revenue growth. By leveraging the power of data and fostering a motivated salesforce, QuotaPath equips you to achieve your most ambitious revenue goals in alignment.

To learn more, schedule time with our team.

Recent Comments