RevOps is pivotal in aligning sales, marketing, and customer success teams to maximize revenue generation and operational efficiency. However, many organizations struggle with launching RevOps internally and often require external expertise to navigate this complex field effectively.

Enter RevOps agencies.

These agencies, sometimes called fractional RevOps teams, offer services that align sales, marketing, and customer success departments to optimize revenue generation processes. Their knowledge and focus areas include technology implementation, data analysis, process optimization, and strategy development to help businesses improve their overall revenue performance.

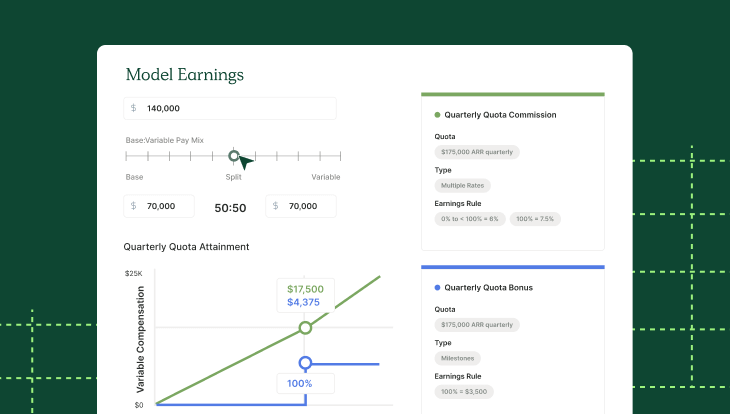

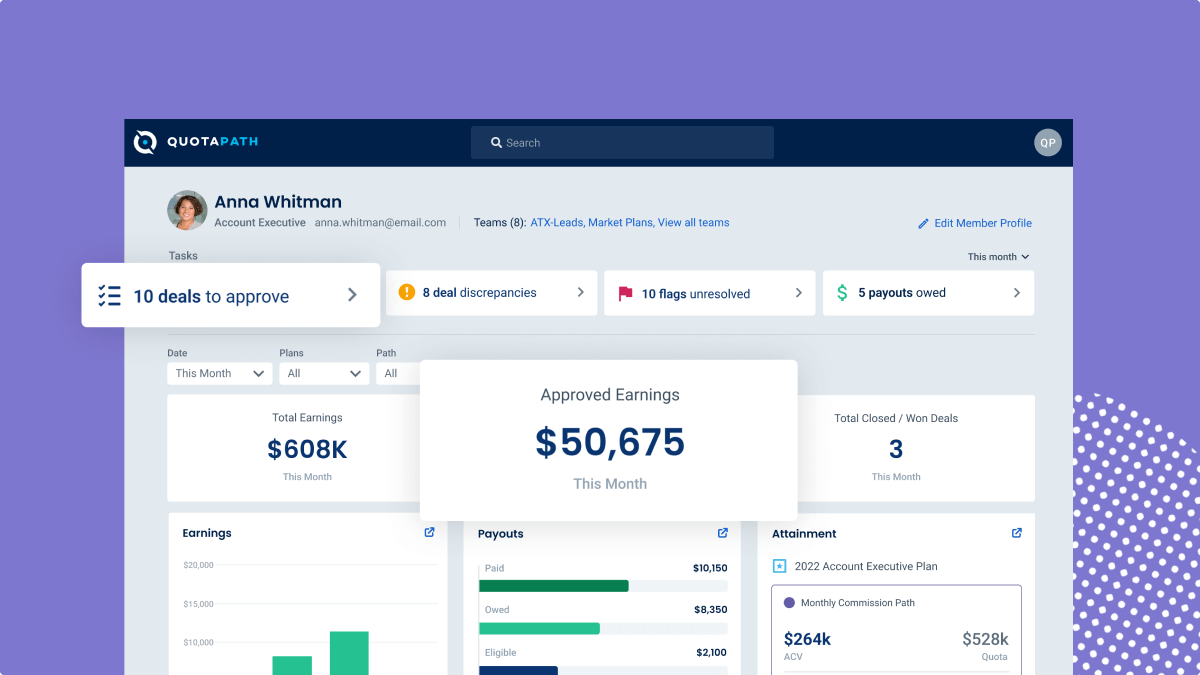

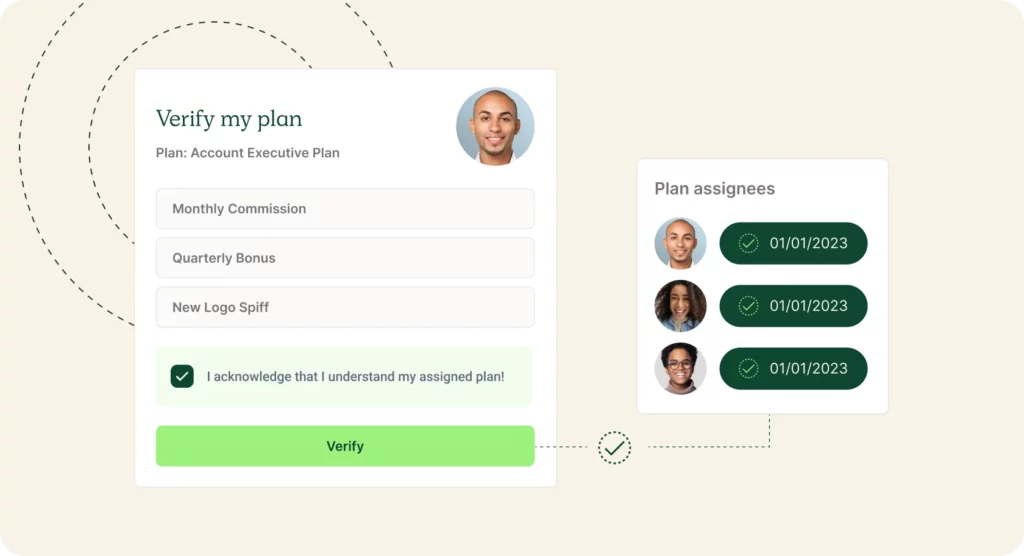

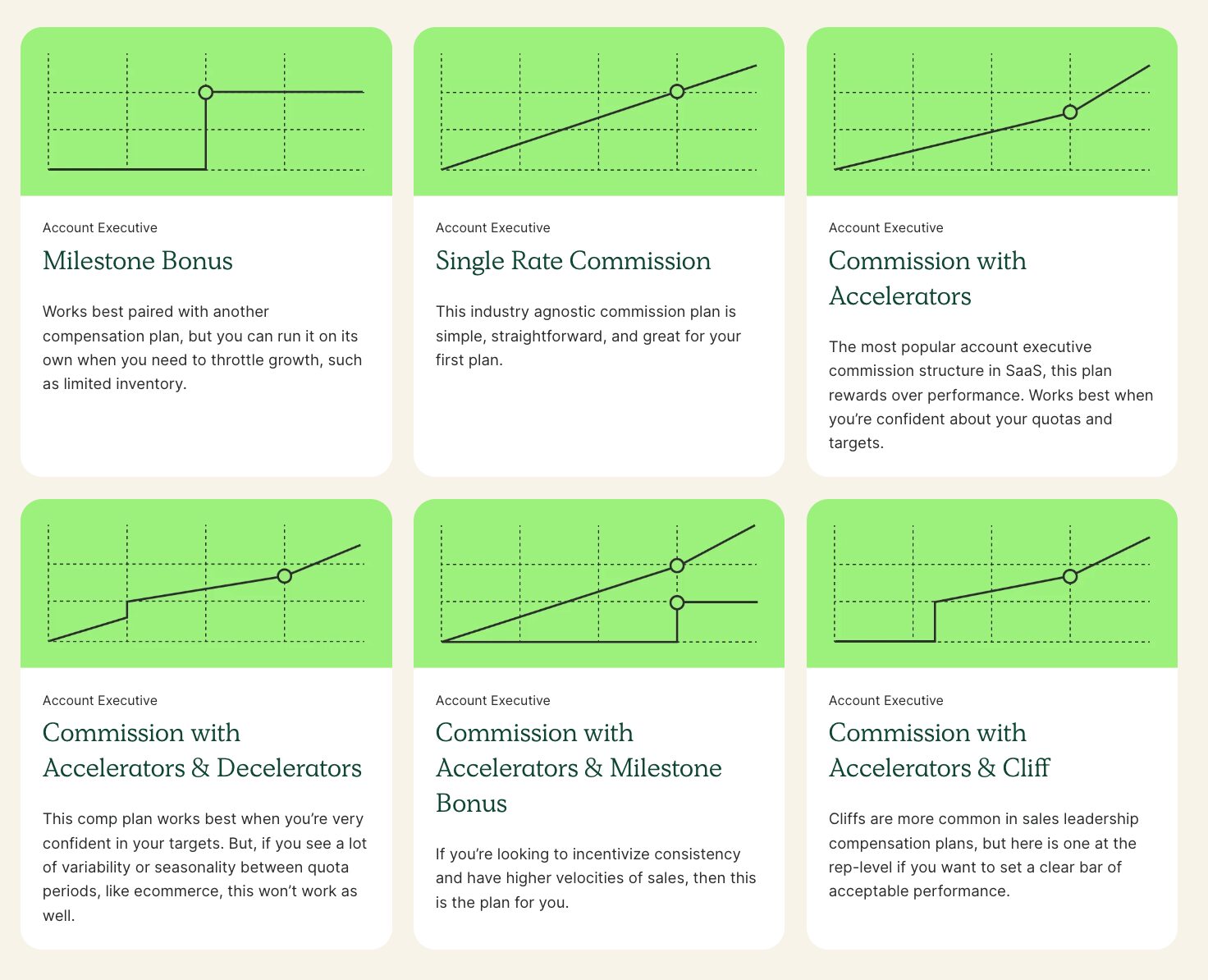

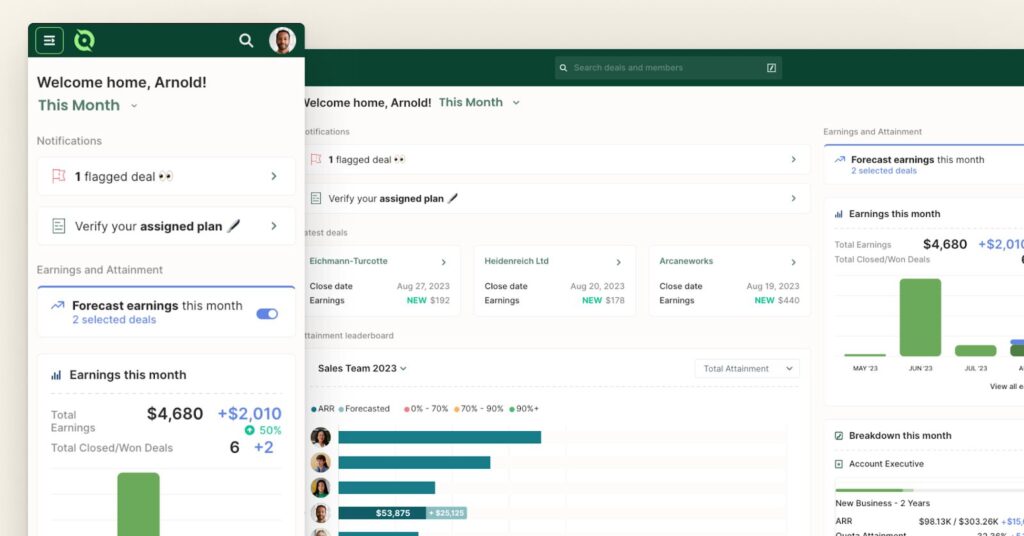

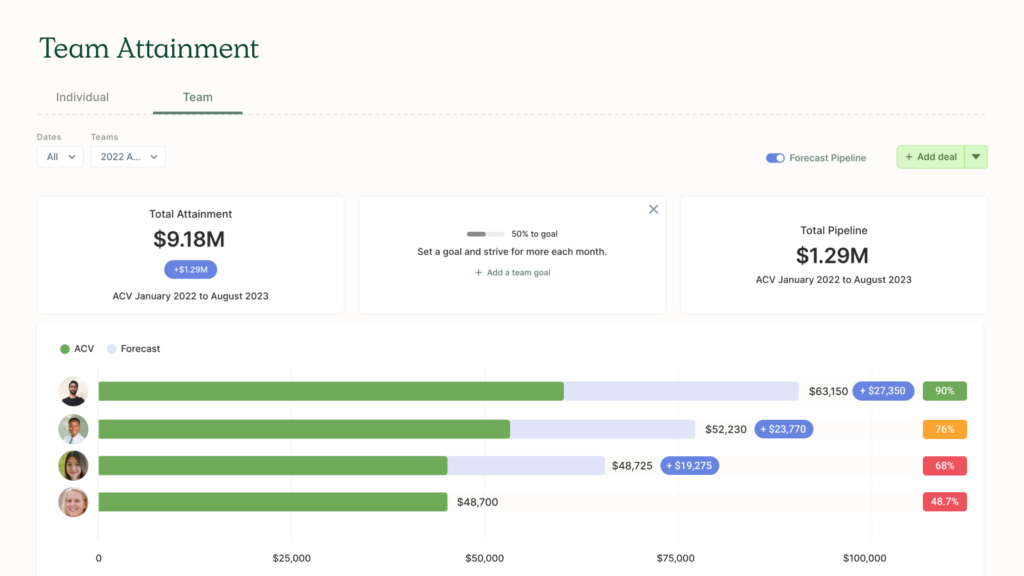

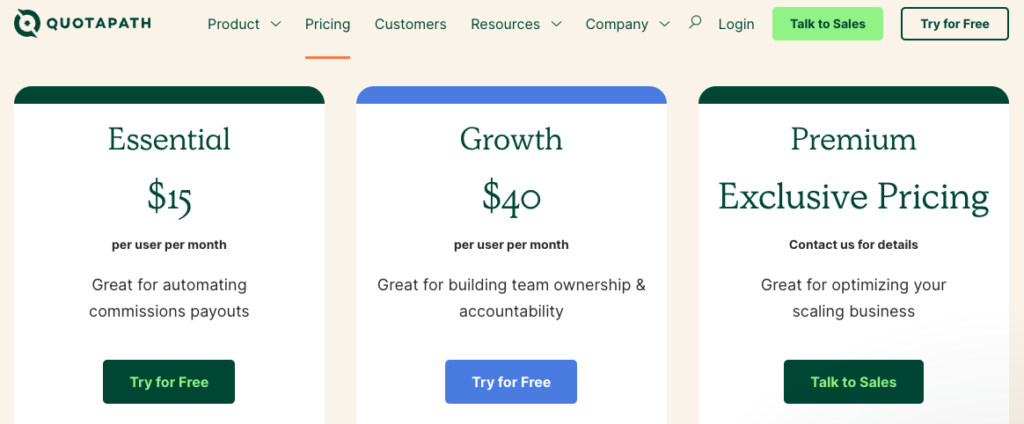

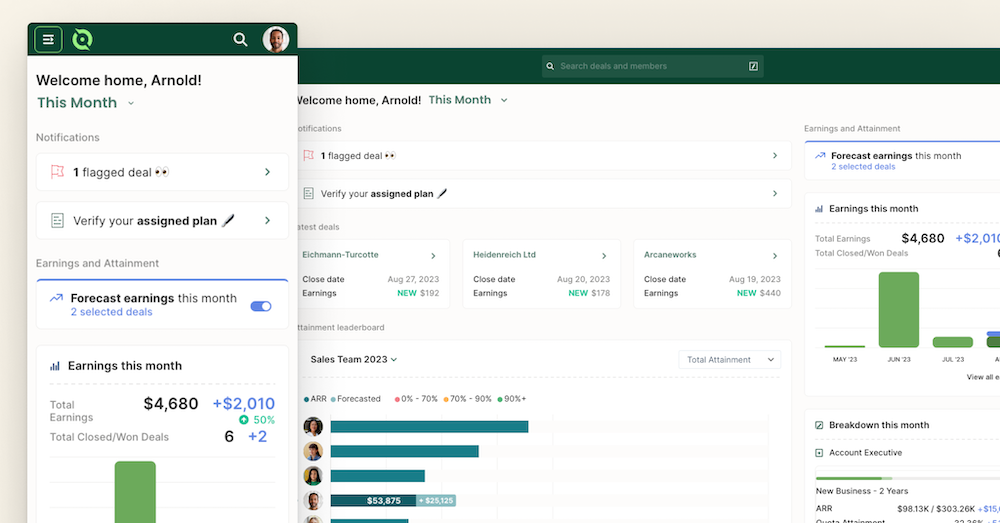

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesAnd, as the RevOps market continues upward, the number of RevOps agencies and consulting groups is keeping pace. As such, making informed decisions is essential when choosing the right agency for your company’s success.

The relationship between a business and a RevOps agency is a two-way street, like any partnership, requiring the active participation of both parties.

During selection, it’s crucial to consider the agency’s specific expertise regarding the goals you want them to help you achieve.

To learn more about when and how to hire a RevOps agency, we interviewed Joe Birkedale, the founder and CEO of Project36. This purpose-driven, strategic RevOps agency delivers transformational projects for global sales and marketing teams using HubSpot and Generative AI. They help RevOps leaders exceed revenue targets through efficiency, innovation, and alignment.

This interview aims to shed light on the dynamics of agency-client relationships, the evolving landscape, and the critical factors to consider when partnering with an agency.

Interview Highlights:

-

- The demand for agencies like Project36 has shifted, with Chief Marketing Officers (CMOs) falling into two camps: traditional CMOs who want to build large internal teams and newer CMOs who seek strategic direction and sense-checking from agencies.

-

- There’s also an increased emphasis on infrastructure and reporting to demonstrate ROI.

-

- Companies should consider working with an agency before they have an urgent demand. Agencies add the most value when involved early in the planning and strategy phase rather than just for tactical execution.

-

- A successful agency-client relationship is built on trust, mutual respect, and open communication.

-

- When working with an agency, create clear and specific project briefs, address internal sales issues, and adequately qualify leads before they become opportunities. Clients should also clearly understand their goals and objectives to align effectively with the agency.

Enjoy!

Q&A with Joe Birkedale | Project36

QuotaPath: Joe, thank you for joining us today. Tell us more about your background and Project36.

Joe: For the last 18 years, I have helped companies position their products and services exactly as their prospects need to see them. I’ve helped them nurture their customers to make the right choice.

In 2016, I set the wheels in motion to create a genuinely disruptive agency with people and technology at its core. Over the following two years, I built the software stack, the sales proposition, and the brand. Today, Project356 serves clients from all sectors globally with a full-service remit.

My role as CMO is to ensure our creative team, strategists, and account directors achieve and maintain peak performance in their given specialty. Additionally, some businesses hire me as a fractional CMO.

What business types, sizes, and industries do you work with the most?

Joe: We have a clear ideal customer profile (ICP) of Series A or above funded. They’ve got to have a product in the market and investor pressure to grow and expand. That’s our sweet spot. We help these clients systematize and create an effective revenue machine. The size and stage of the companies we support is a 50/50 split regarding client volume and value. Our startups tend to spend about the same as the enterprises because they’ve got to grow as enterprises need to systemize, check, and balance what they’re currently doing aggressively.

We work globally—with the only limit being that they speak English.

When is the right time for a company to work with an agency?

Joe: Everybody comes to us with an urgent demand, but that’s slightly too late. We are an agency that adds value. You extract that value by telling us what’s going on before it has happened and what you want to achieve. Then we can shape our response, strategize, and deliver accordingly. So, bring us in earlier from a thinking point of view, and we can jump on things immediately.

“You extract that value by telling us what’s going on before it has happened and what you want to achieve. Then we can shape our response, strategize, and deliver accordingly.”

Can you provide an example of an exemplary client scenario where they came to you before the problem was too hot?

Joe: Seven months ago, a client came to us with a legacy CRM no longer fit for purpose. It did everything for them, including all their client contact and interaction and audit history as it synced to their accounts program.

They heard about HubSpot and reached out to us to find out if it would be a fit for them. We went in and effectively mapped their current setup, how it works, and the limitations. Then, we presented a better solution that included HubSpot, a migration, setup, and a training plan.

That has been fundamental to their business, adding $4.5 million net new opportunities to the pipeline, which they have begun closing in the last two months since they’ve gone live.

This relationship is strong because it’s a two-way respectful relationship where they are the product experts of what they do, and we listen to that verbatim.

Likewise, we’ve got their trust, and that makes a massive difference.

Free Sales Commission Calculator Template

A free spreadsheet to simplify the commission tracking process. Track what you or your team have earned in 4 inputs.

Download NowWhat should I look for when evaluating an agency?

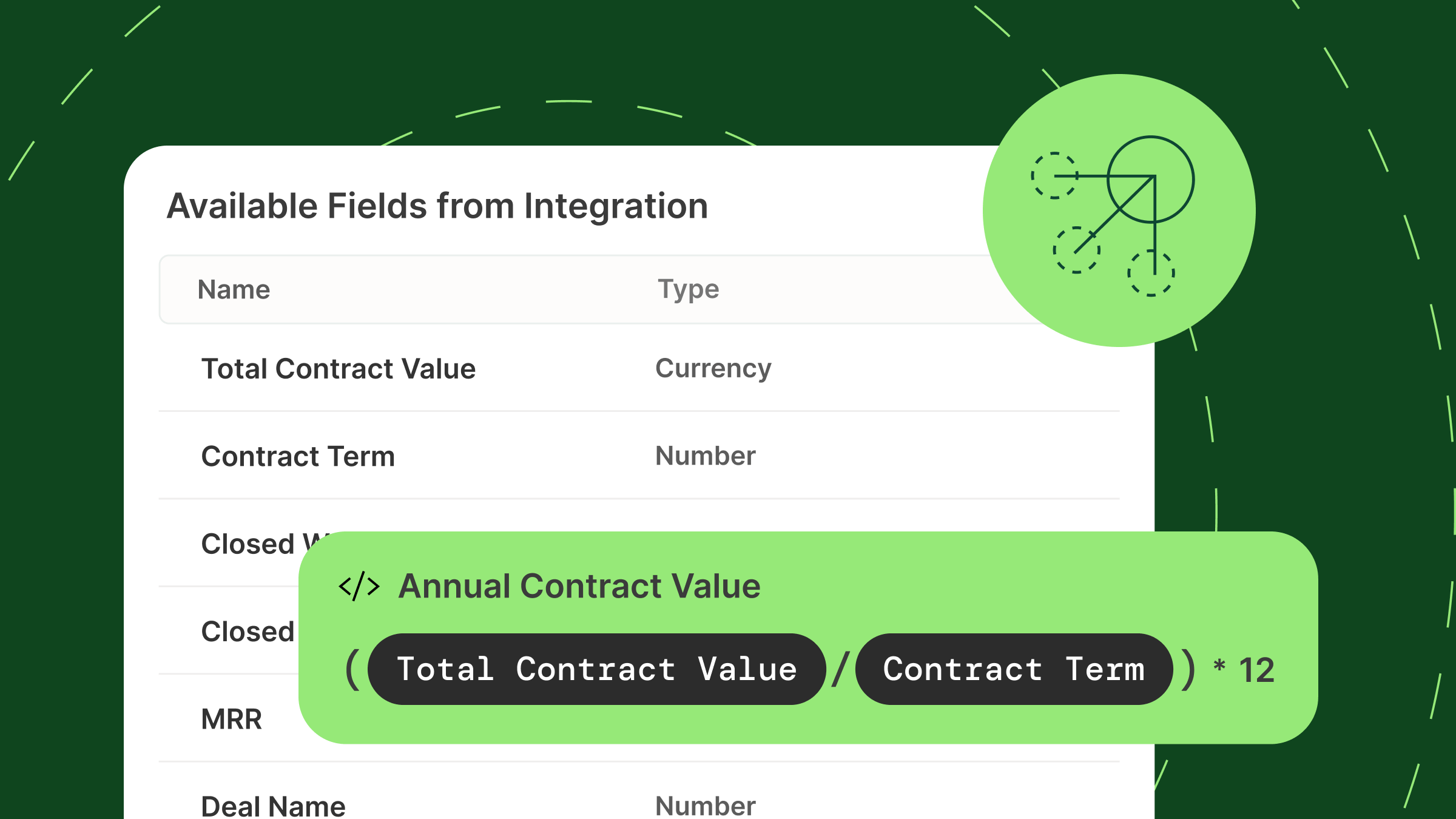

Joe: A partner agency should be certified and tiered and provide customized HubSpot onboarding unique to you. It should include proper pipeline management, customization of fields to match your lifecycle stages, and training on how to use all of it. There are two benefits to this:

1. The HubSpot product gets properly adopted and absorbed into the company, becoming the system of record.

2. If the implementation period is quick, well done, and delivered on budget, then that opens the door to do more with the agency, such as content marketing, inbound marketing, account-based marketing (ABM), advertising, pay-per-click, and SEO.

So, the implementation is where you’ll get a good feel for the agency.

Is there anything you’d like to add about evaluating agencies in terms of having access to the team?

Joe: International clients need to consider the impact of any time difference with an agency so they aren’t left eight hours behind. For example, we can “race the sun.” If a job comes out of the East Coast, we can send it West and get it done by the time the client wakes up.

You should have direct access to the agency team through a centralized communication platform. This keeps communication clean by eliminating the back-and-forth of email and the risk of requests or input being lost in the shuffle.

For instance, we have an internal project management platform to enable two-way live communication with our clients. They can log in anywhere in the world at any time to see the status of any task and comment directly on it. They can also add a task, review the tasks, see the status, get an update, see the artwork, and review the latest revision, and nothing gets lost because it’s all on a live dashboard.

Another thing to remember is how the agency handles unused time on a retainer. For example, we offer rollover on our retainer. If the client doesn’t use time, it can roll over into the next period, so they don’t lose it. We can also adjust the retainer accordingly.

How should companies identify what to lean on an agency for?

Joe: Agencies help accelerate the learning curve and can supplement the capacity of internal teams. For instance, internal teams can learn HubSpot, but it takes months of trial and error. This costs the company time and salary during the learning period.

Plus, the internal team already has its day job. Something has to give when a new campaign comes along and adds to the existing day job. This adds pressure on the internal teams, and people leave when they get fed up because they’re constantly getting dumped on. An agency can take up the overflow and alleviate this pressure. The experience and capacity of an agency mean that more gets done in a shorter period.

“An agency can take up the overflow and alleviate this pressure. The experience and capacity of an agency mean that more gets done in a shorter period.”

What other things stand out to you regarding a healthy agency partnership between a client and agency?

Joe: Mutual respect is essential in valuing the agency’s input and vice versa. Everybody’s an equal and brings their expertise. This also means respecting each other’s time.

For example, just because something’s urgent for the client doesn’t mean it should be urgent for the agency. The client needs to do their part too. If the client is disorganized and not doing their part of a project, the agency will help where they can, but there will come a point where they won’t want to work with that client.

Is it time to hire a RevOps agency?

Thanks for sharing these insights about partnering with a RevOps agency, Joe!

According to Joe:

- Engaging with an agency is best before you have an urgent request.

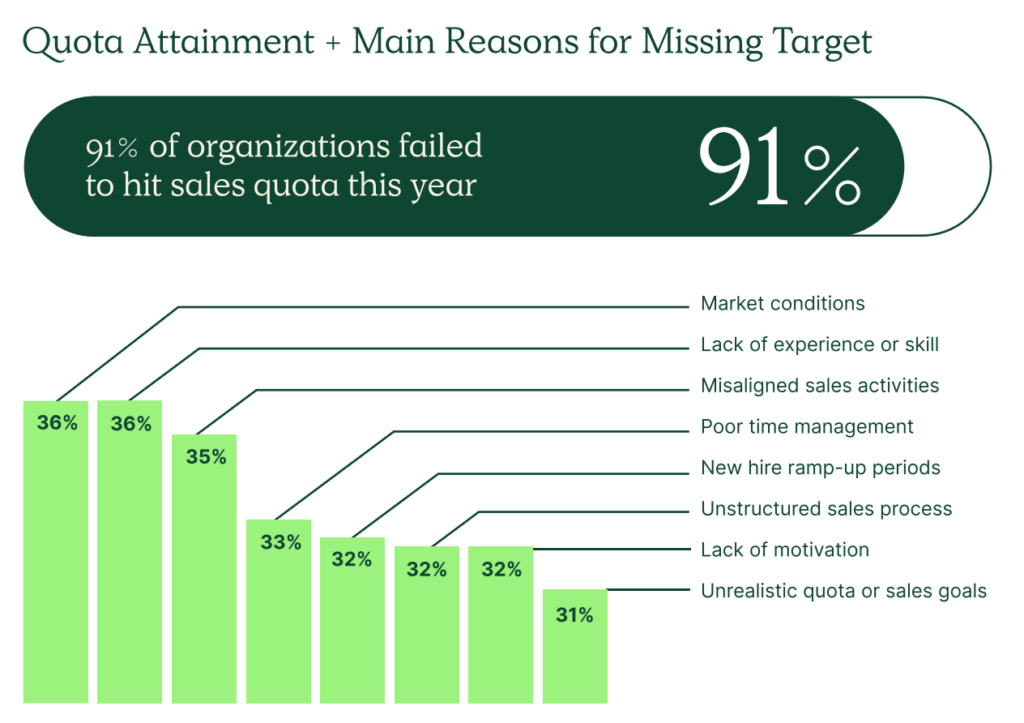

- Agencies bring expertise, experience, and additional bandwidth to accelerate revenue goal attainment.

- An agency and client partnership is a two-way street where parties are accountable and respect one another’s expertise.

- When selecting an agency, identify what you want the agency to help you achieve, then choose one best suited to help you reach your goal.

- Consider geographic time differences and communications when selecting an agency.

RevOps can be complex to implement. Is it time for you to hire a RevOps agency to help accelerate the attainment of your revenue goals?

Contact Project36 to discuss your upcoming RevOps needs.

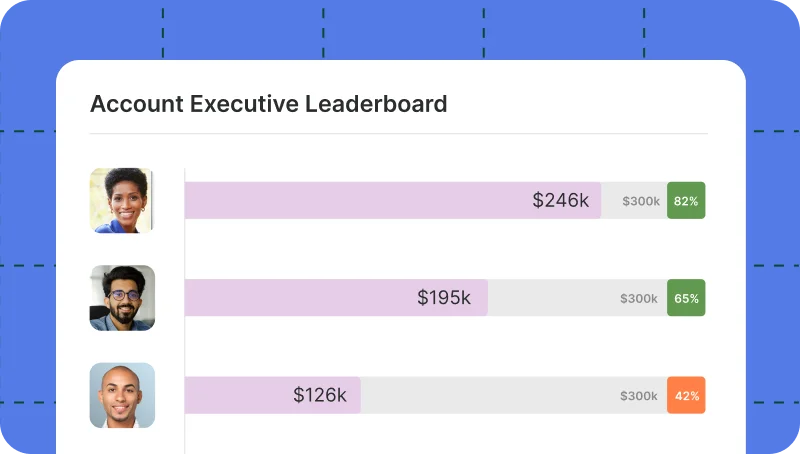

QuotaPath supports revenue leaders with resources and solutions that automate sales commissions, provide past, present, and future visibility into compensation performance, and drive revenue.

Chat with our team, or try QuotaPath by signing up for a free trial to learn more.

Recent Comments