QuotaPath CEO and Co-Founder AJ Bruno authored this blog on SaaS pricing transparency.

Almost all the information we need today we can access at our fingertips.

In SaaS, that means buyers have grown more sophisticated over the past several years. So much so, that we can now buy and sell cars, homes, and even commercial real estate entirely online.

As the shift to shopping for major investments online has intensified, buyers have gotten smarter too.

Modern shoppers know how to educate themselves, and they know what they’re looking for and how to get the information they need. Whether it’s via Google search, posing a question in a community forum, or seeing what their friend at a different company uses, people know how to shop. And, in most cases, the buyer doesn’t even need the help of a salesperson until they feel fully prepared to buy.

Still, despite so much of the sales process depending on the shopper’s online research, one B2B trend continues to loom that disrupts this self-buying journey.

A pricing page absent of pricing.

Non-transparent pricing in a transparent buyers era

We all know the feeling of exploring a product only to have trouble locating the actual cost. Just imagine if gated pricing came up in our day-to-day lives as much as it does in SaaS.

After days dedicated to scouring the internet for the perfect lawn mower, you finally found the one.

The only thing you don’t know is how much it costs. And, guess what? The path to find pricing is convoluted and filled with pitstops.

So you set off on a pricing expedition.

You may initially do some “sleuthing” that will lead you to the dark recesses of the internet, but alas, it seems that companies try their best to scrub this data. So, your second stop: a call with the business development representative, who has never actually used this lawn mower. Better yet, they have never mowed a lawn.

They ask you several questions to measure how likely you are to buy, despite your hours of research leading into the call.

The call concludes. Congratulations, they’ve deemed you a qualified buyer!

But sorry, to get the price, you’ll have to speak to a more senior lawn expert. On to your next stop.

After walking you through how the lawn mower works and why it’s better than the other lawn mowers, you finally arrive at pricing. The twist — it’s a number much larger than you anticipated. The rep hears the shock in your voice. You tell him this falls outside of your budget and comes in much higher than other similar lawnmowers.

“We’re willing to work with you,” he says before quoting a price much lower.

You take some time to think about it but leave the call confused. Why was it so hard to get pricing? Why did the company instantly offer a lower price? Is that the true price of the product or were they overquoting me in hopes that I would be willing to pay?

Am I being played here?

We’d all lose our minds if this is the process we endured regularly.

It’s not a great experience. It dampens the customer journey and ultimately the sales cycle.

We have to move away from gated pricing and allow people interested in our products to “qualify” themselves. I use qualify loosely because the interest in your product should be enough. If someone spent enough time exploring your product on your website, or through another avenue and landed on your pricing page, that’s intent to buy.

Clear buying decision needs to be in the product and ultimately your website.

Moreso, your website represents your number one marketing tool. Whether a visitor browses or actively explores your solution, they’re engaging with your best marketing asset. Your website should answer almost all the questions a buyer might have, especially pricing.

If you don’t want your competitors to see, or you think you need to prove the value of your product before sticker shock, re-think leaving your pricing offline.

Customer-centric and product-centric organizations provide pricing visibility. For those who don’t, I question your customer- and product-centricity.

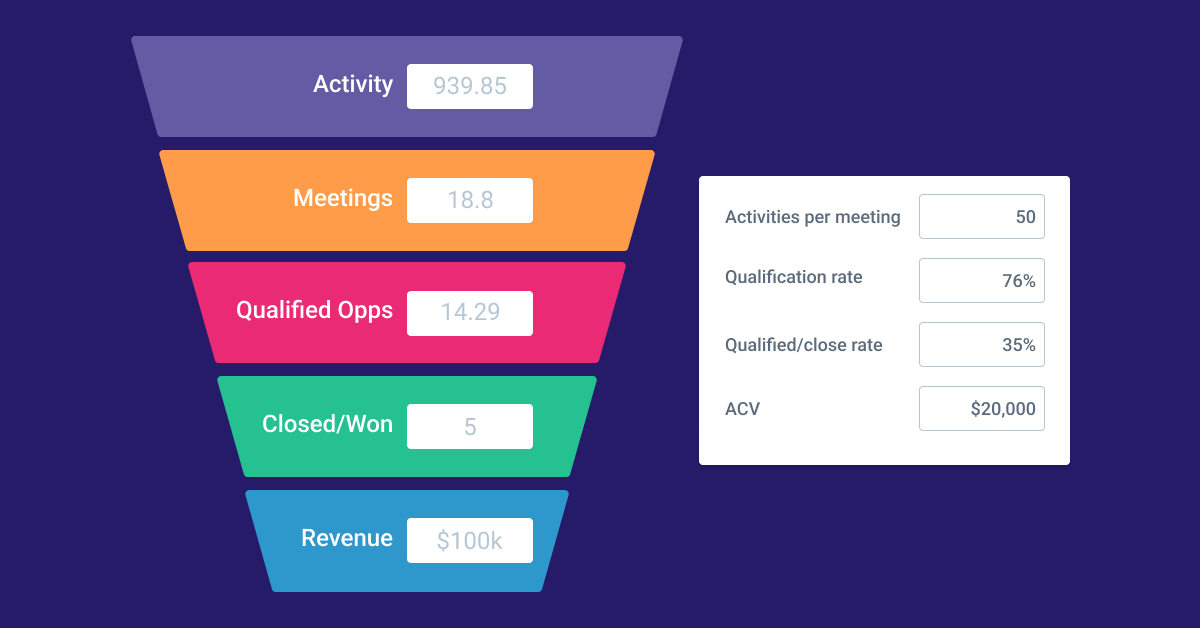

Sales Compensation Calculator

Calculate OTEs, sales quotas, and commission rates to design your sales compensation plans.

Try for FreeQuotaPath’s pricing transparency

QuotaPath provides sales compensation and commission tracking for scaling GTM organizations. Pairing an easy-to-use user experience with a highly technical backend, QuotaPath is the only solution fit to get Sales, RevOps, and Finance all on the same page.

To see how we fit into your tech stack, check out our integrations page. And, to learn more, book a time with a member of our team today. Want to know our price? Check out our pricing page, complete with prices.

Recent Comments