Measuring the effectiveness of sales commissions involves analyzing key metrics like conversion rates, revenue growth, and quota attainment. It also requires tracking individual and team performance against targets and KPIs and conducting regular reviews to identify trends and areas for improvement.

Businesses can optimize commission structures and incentive programs to drive growth and performance by leveraging data analysis.

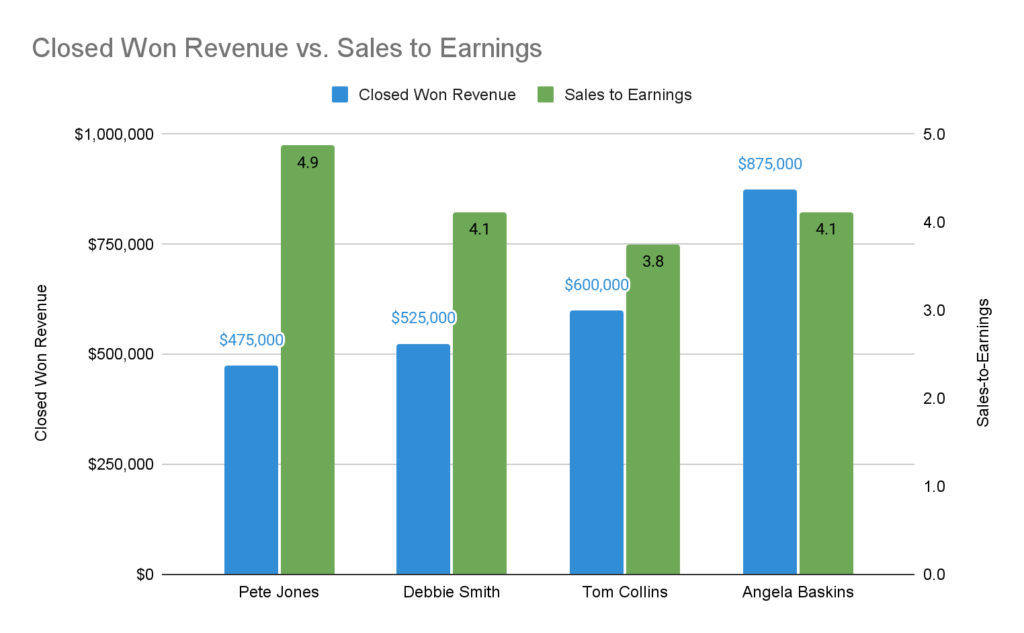

When done correctly, you can learn data points like:

- Who are my most (and least) efficient sales reps

- Are the reps earning the most also selling the most

- What seasonal trends do we face

- Am I paying too high (or too low) of total commissions per deal

- What parts of my comp plan are driving selling behaviors?

- Are high-attaining products also the most profitable?

- Identify quota consistencies and inconsistencies across performers

- Which products or services are easier or harder to sell, what is their impact on attainment levels, and does this change over time?

- The health level of our commission structures

Measure Commission Effectivness

Learn how QuotaPath can help you plan, test, model, and measure commission effectiveness and total cost of your compensation strategy.

Schedule DemoThis blog explores commission effectiveness, offering insights into essential data, alignment with overarching business goals, and the tangible impact on team performance metrics and operational efficiencies.

Buckle up, and let’s move mountains using sales commission data.

What is commission effectiveness?

Sales commission effectiveness refers to the degree to which a sales commission plan successfully motivates sales representatives to achieve or exceed KPIs for sales, aligns sales behaviors with the company’s strategic goals, and contributes to the overall profitability and growth of the business.

Understanding Commission Effectiveness

For individuals in RevOps, Finance, and Sales Leadership, understanding commission effectiveness is crucial for several reasons:

| Business Goal Alignment | Commissions should inspire sales productivity and align incentive plans with the business’s objectives. This alignment ensures sales activities directly contribute to the company’s growth and profitability. |

| Budgeting and Financial Planning | Finance teams must understand commission effectiveness to budget for sales expenses and predict cash flow accurately. Effective commission plans prevent overspending and ensure that payout structures are financially sustainable. |

| Sales Performance Optimization | For Sales Leadership, commission effectiveness is key to driving desired behaviors and outcomes from the sales team. Understanding which aspects of the commission structure lead to higher performance can help design incentives that maximize sales productivity. |

| Operational Efficiency | RevOps teams are tasked with smoothly executing sales operations, including commission tracking and payment. Understanding commission effectiveness helps automate processes, reduce errors, and ensure timely payouts, maintaining sales team motivation and satisfaction. |

| Data-Driven Decisions | Leveraging data to assess the effectiveness of commission structures allows all three groups—RevOps, Finance, and Sales Leadership—to make informed decisions. This includes identifying trends, forecasting future performance, and adjusting commission plans to meet changing business needs. |

| Regulatory Compliance and Fairness | Understanding commission effectiveness also involves ensuring that the commission plan complies with legal standards and is perceived as fair by the sales team. This reduces the risk of legal issues and maintains a positive sales culture. |

| Motivation and Retention | Effective commission plans are critical in motivating sales personnel and retaining top performers. RevOps, Finance, and Sales Leadership must understand what motivates their teams and how different commission structures can impact morale and turnover rates. |

Key Metrics

Analyzing key metrics related to commission effectiveness can provide businesses with valuable insights into sales performance, operational efficiency, and financial planning.

We recommend tuning in to the following data points regarding commission calculations:

Business goal alignment:

- Attainment over time: Measures how well sales commissions align with overall business goals by tracking the attainment of sales targets over periods to identify seasonality and show how consistent your reps are across periods.

- Revenue growth rate: Evaluates the impact of sales commissions on driving revenue growth and achieving business objectives.

- To calculate revenue growth rate:

- Revenue growth rate = ( Current revenue – previous revenue) x 100

Previous revenue

- Revenue growth rate = ( Current revenue – previous revenue) x 100

- To calculate revenue growth rate:

- Earnings by comp plan component: To determine if your comp plan is driving your key business objectives or North Star metrics, look at which elements of your comp plan you’re paying the most amount of commissions on.

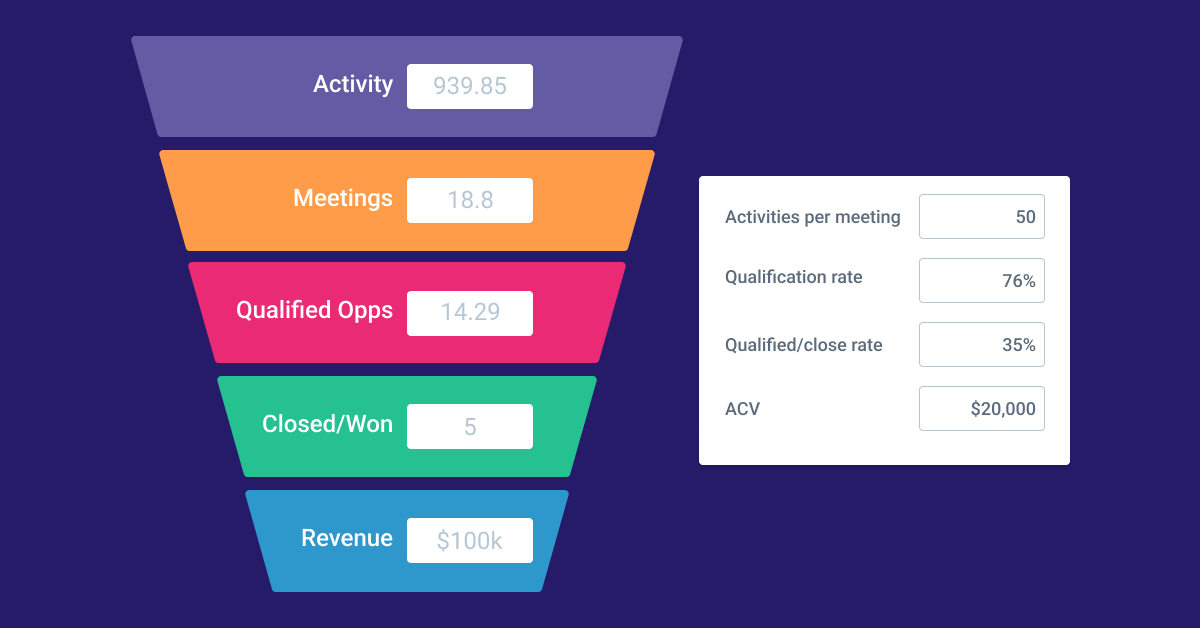

- Example: If your North Star metric is raising your ACV to $20K, and you pay an extra 3% commission rate on any deal >$40K, you’d look into how much in total commissions are you paying along that compensation path

Budgeting and financial planning:

- Commission expense ratio: Compares commission expenses to total revenue or gross margin, helping to ensure commissions are within budgetary constraints.

- Commission payout ratio: Tracks the proportion of revenue allocated to commissions, aiding in accurate financial forecasting and planning.

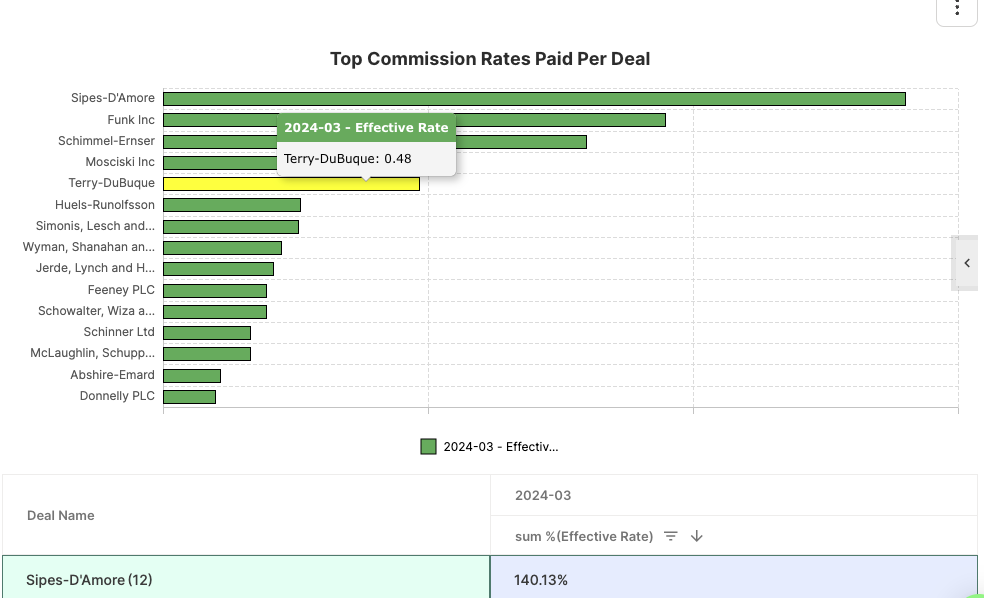

- Effective rates: Collective commission percentage per deal when factoring in every role that earns a commission of one deal.

- TIP: This should be under 25%

Sales performance optimization:

- Sales conversion rate: Indicates the effectiveness of sales efforts in converting leads into customers, reflecting the impact of commission structures on sales performance.

- Average deal size: Measures the average value of sales transactions, revealing how commission incentives influence sales representatives’ focus on high-value deals.

Operational efficiency:

- Sales cycle duration: Evaluate the efficiency of sales processes and how commission structures impact sales cycle length.

- Time to quota attainment: Indicates how quickly sales representatives reach their targets, reflecting the efficiency and effectiveness of commission plans.

Data-driven decisions:

- Commission payout variance: Tracks deviations from expected commission payouts, enabling data-driven adjustments to commission structures based on performance trends.

- Sales performance analytics: Utilizes data on individual and team sales performance to inform commission adjustments and optimize incentive structures.

Regulatory compliance and fairness:

- Commission payout accuracy: Measures the accuracy of commission calculations to ensure compliance with regulatory requirements and fairness in compensation

- Commission dispute resolution time: Tracks the time taken to resolve commission disputes, ensuring fairness and compliance with regulatory standards.

- Discrepancy/resolution count: Shows number of pay inconsistencies or questions per pay period to show how well your reps understand how they are paid and how accurate (or inaccurate) your compensation calculations and data are.

Motivation and Retention:

- Sales team turnover rate: Indicates the rate at which sales representatives leave the organization, reflecting the effectiveness of commission structures in motivating and retaining talent.

- Employee satisfaction with commission plans: Gauges the level of satisfaction among sales representatives with their commission structures, which correlates with motivation and retention levels.

- SPIF success: Measures the impact of sales performance incentive fund or special performance incentive fund (SPIF) to see how well these drive selling behaviors and if it’s worth considering implementing full-time in your compensation plan

- Read more: Learning Center article on implementing successful SPIFs in sales

By monitoring these key metrics, organizations can assess the effectiveness of their sales commission plans in driving business goals, optimizing sales performance, ensuring financial stability, maintaining operational efficiency, making data-driven decisions, complying with regulations (ASC606), and fostering motivation and retention among sales teams.

Aligning sales commissions with business goals

Sales commission effectiveness begins with how you structure your sales compensation plan.

Aligning your commission strategy to business goals is the most important foundational piece.

“Compensation plans should be the caboose, not the engine,” said Pablo Dominguez, Operating Partner, Sales & Customer Success at Insight Partners.

Most revenue leaders would agree.

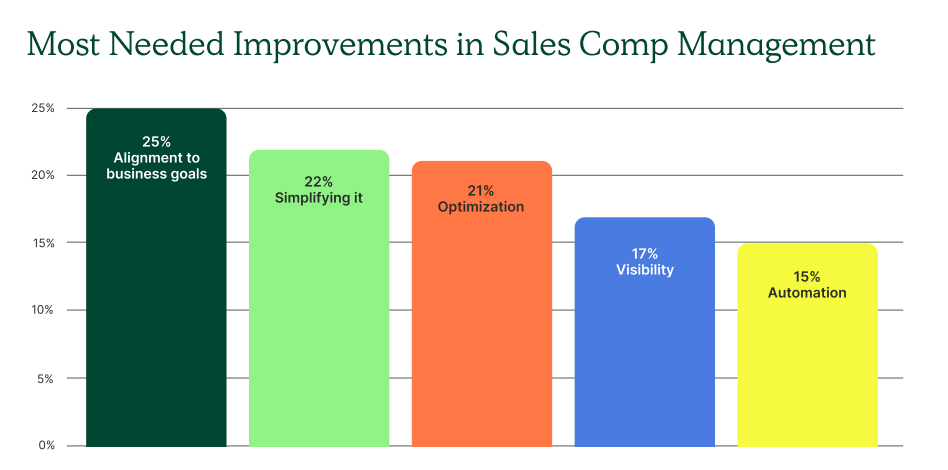

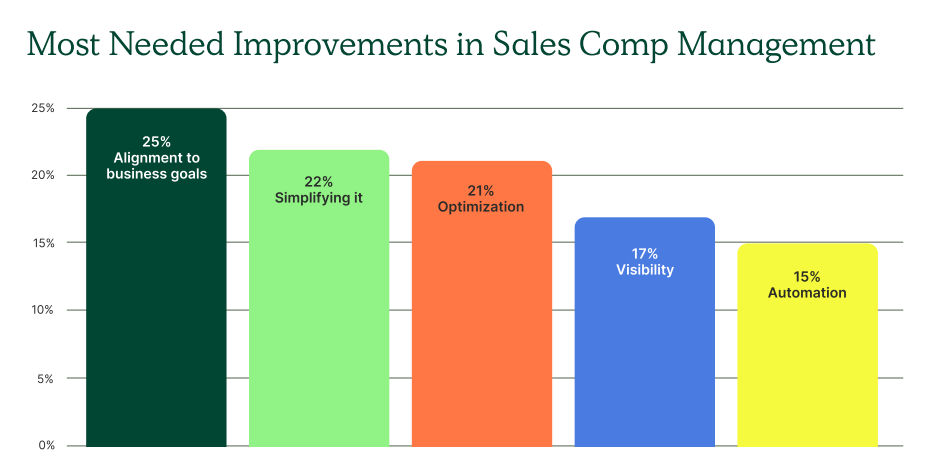

However, in our 2024 Compensation Trends Report, more than 450 Revenue, Sales, and Finance leaders reported that alignment to business goals was the most needed improvement in sales compensation management.

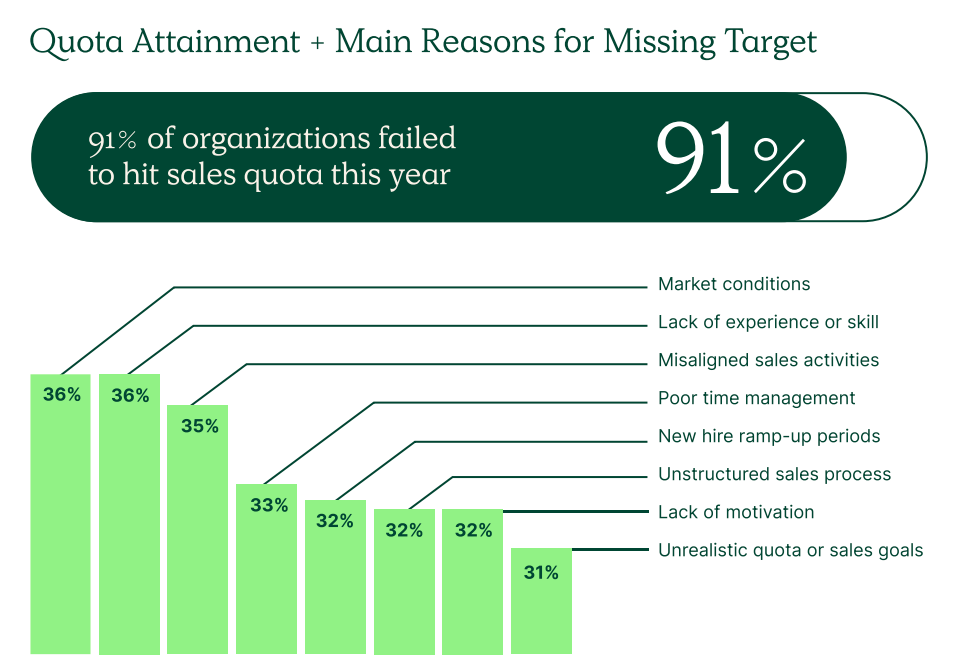

The result of this mismatch? 91% of companies reported that less than 80% of their sales reps achieved quotas.

Moreover, leaders pointed to misaligned sales activities as a leading factor in these significant misses, which fall to poorly designed compensation structures.

Steps to align comp plans to business goals:

- Clearly define the overarching business goals and objectives. These may include revenue targets, market share expansion, customer acquisition, or product penetration goals.

- Identify key performance indicators (KPIs) that directly correlate with those goals.These may include metrics such as sales revenue, profit margins, customer retention rates, or new product adoption rates.

“Then ask, can any of those priorities be reinforced with sales compensation design?” said Mark Roberge, Managing Director at Stage 2 Capital. - Design a commission structure that incentivizes behaviors aligned with those objectives. Determine which sales activities and outcomes are most critical to achieving the desired business results and assign appropriate commission rates or incentives. For example, if increasing market share is a crucial goal, structure a higher commission rate to reward acquiring new customers or expanding existing accounts.

- Monitor the effectiveness of your sales compensation plan using the metrics listed above to ensure ongoing alignment between sales commissions and business goals. You can do this by regularly reviewing sales performance data against KPIs to assess the effectiveness of the commission structure in driving desired outcomes.

Lastly, identify areas where incentives may be misaligned or adjustments are needed to better align sales activities with business objectives. By maintaining flexibility and adapting the commission structure as business goals evolve, you can ensure sales incentives align closely with the company’s overarching strategic priorities.

The impact on team performance

Sales commission effectiveness is pivotal in shaping team performance within a sales organization.

This is because the commission structure directly influences the behavior and motivation of sales representatives. When you design commissions to reward desired actions and outcomes, such as closing high-value or multi-year contracts, salespeople are incentivized to focus on activities that contribute to those goals.

This alignment between commissions and desired behaviors fosters a high-performing sales culture and motivates your revenue teams to overachieve. Moreover, sales commission effectiveness impacts team morale and cohesion.

When commission structures are perceived as fair and transparent, they cultivate a sense of equity among team members and minimize potential conflicts or resentment.

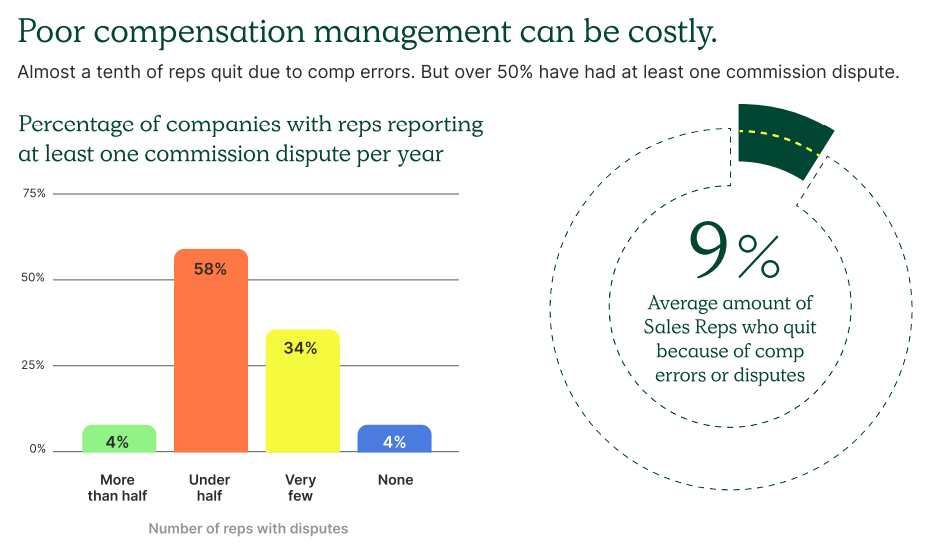

Conversely, if commissions are perceived as arbitrary or inequitable, it can lead to demotivation, disengagement, and even discord within the team. In fact, our trends report revealed that 9% of reps quit because of compensation errors or disputes.

Therefore, sales leaders must ensure that commission plans are carefully crafted to incentivize desired behaviors while fostering a collaborative and supportive team environment.

Additionally, sales commission effectiveness directly influences overall team performance and productivity. A well-designed commission structure can drive higher levels of sales activity, improve sales conversion rates, and ultimately contribute to achieving or exceeding revenue targets.

By continuously evaluating and refining the commission structure based on performance data and feedback from the sales team, sales leaders can optimize sales commission effectiveness and maximize team performance, driving sustainable growth and success for the organization.

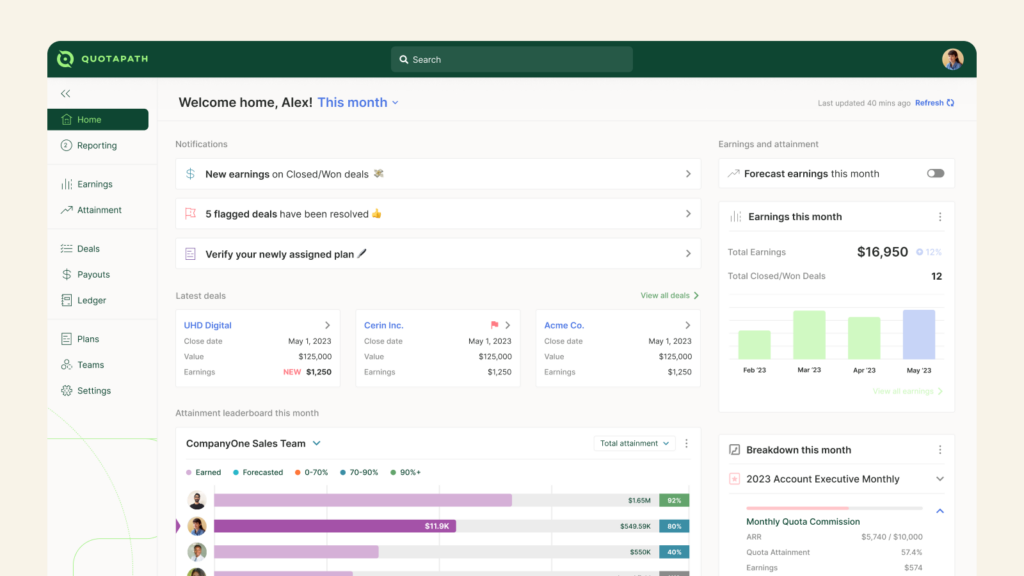

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesBest practices for setting up sales commissions

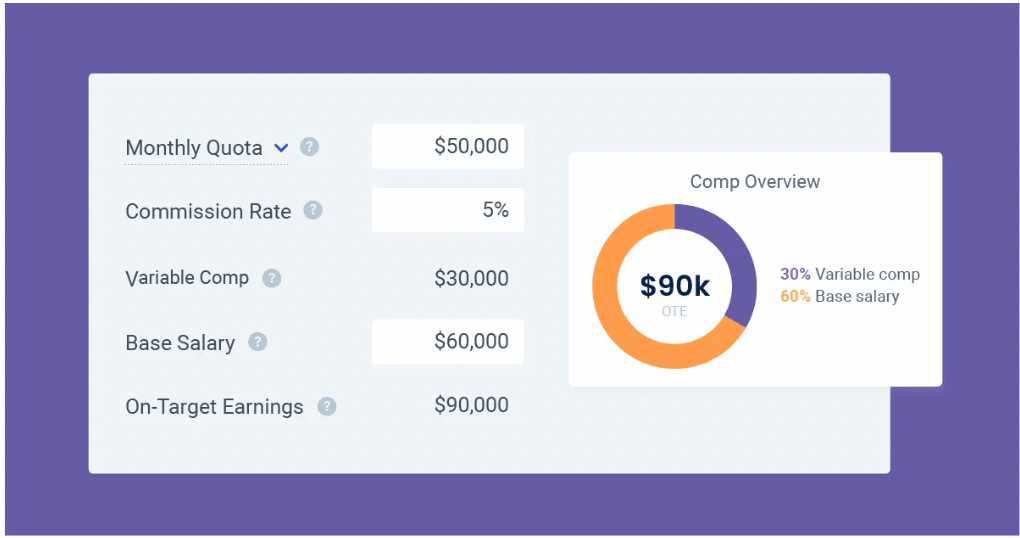

What are the best practices for setting up sales commissions? Automate the process by using commission tracking and commission management software.

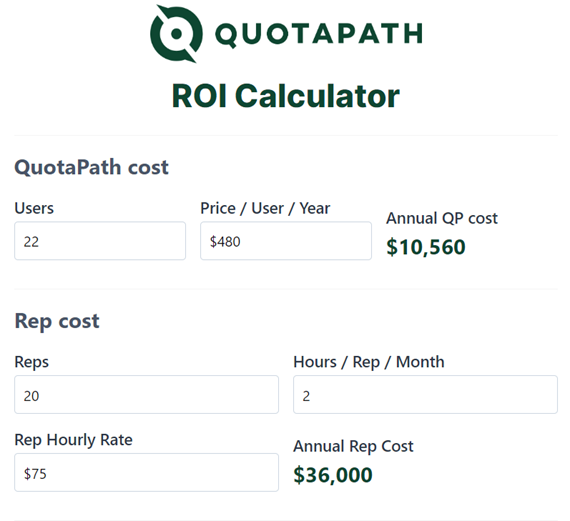

Doing so does more than just streamline the process for your team, which we’ve found typically dreads commission payout periods because of the onslaught of rep questions that follow. Automating it with a tool like QuotaPath increases calculation accuracy visibility into compensation (and accountability across your team as a result), and makes it easier to measure the efficacy of your compensation strategy.

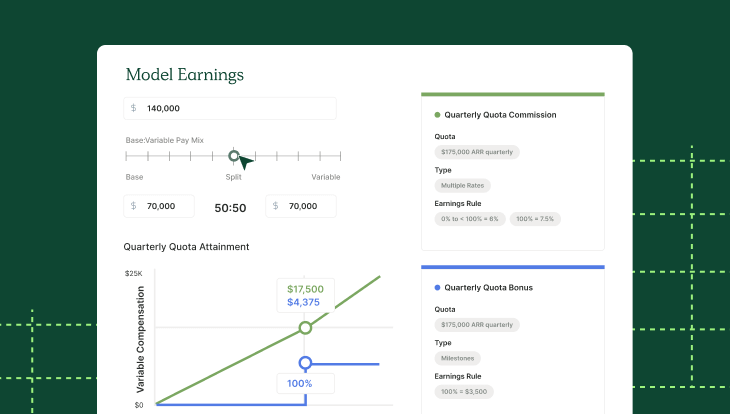

With QuotaPath’s new modeling tool, you can also predict the performance and cost of your incentive structures by running attainment scenarios to see how much you would pay before implementing a plan.

However, if you’re not ready to automate this process yet, here are some best practices for setting up sales commissions that anyone can benefit from.

- Align with Business Objectives: Support your commission structure directly to your overarching business objectives and sales strategy. Identify specific goals such as revenue targets, market share expansion, or product penetration, and design commission plans that incentivize behaviors aligned with these objectives.

- Maintain Transparency and Clarity: Communicate the commission structure, including the calculation methodology, payout thresholds, and any performance metrics or KPIs used to determine commissions. Avoid ambiguity or complexity that could lead to confusion or misunderstandings among sales representatives.

- Fairness and Equity: Ensure commission plans are fair and equitable across the sales organization. Avoid favoritism or bias in commission allocation by establishing consistent criteria and performance metrics for all sales representatives. Consider factors such as territory size, account complexity, and sales cycle length when determining commission rates to ensure fairness in compensation.

- Regular Review and Adjustment: We don’t recommend changing your plan every quarter, but you should monitor and evaluate the effectiveness of commission plans based on sales performance data and feedback from the sales team. Identify areas where the commission structure may be misaligned with business objectives or adjustments are needed to optimize incentives. Review commission rates, payout thresholds, and performance metrics to ensure they remain relevant and competitive in the evolving market landscape. Then, don’t be afraid to adapt once you’ve got the data that demands changes.

- Incentivize Desired Behaviors: Design commission plans to incentivize desired behaviors that contribute to long-term sales success and customer satisfaction. Consider incorporating incentives for prospecting, lead generation, customer retention, and upselling to encourage a holistic approach to sales excellence. Rewarding behaviors that align with the sales process and customer-centric values drive short-term results and foster sustainable growth and customer loyalty over time.

To learn more about QuotaPath, schedule time with our team or tour the platform with a free trial.

Recent Comments