This is a guest blog written by Paul Aroloye.

Are you looking for ways to streamline your sales compensation process and maximize your team’s performance? Look no further than AI-powered strategies.

Artificial Intelligence (AI) is revolutionizing the sales landscape, creating new opportunities for optimizing compensation strategies.

With its potential to analyze vast amounts of data, predict trends, and automate tasks, AI promises a future where sales compensation is fair, motivating, and conducive to business growth.

In this guide, we’ll dive into 9 AI-powered strategies that can help you optimize your sales compensation plan and propel your team toward success. Are you curious how AI could reshape your current compensation model?

Let’s dive in!

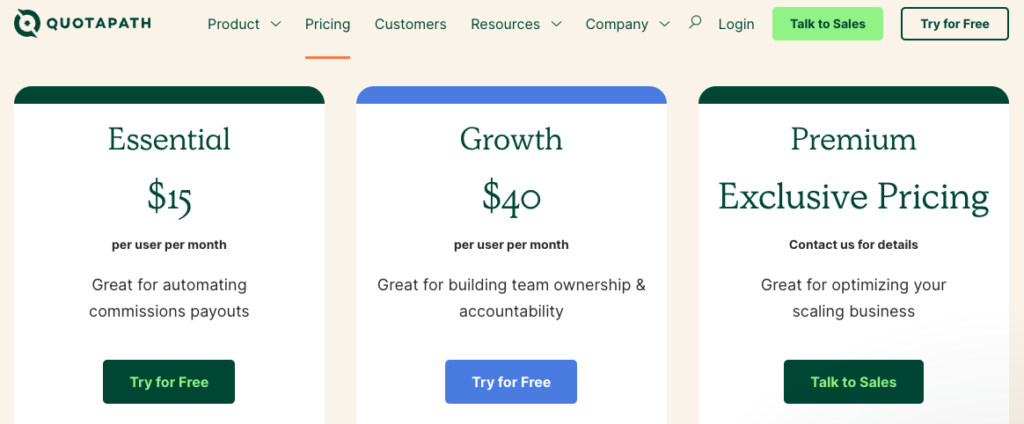

Model and Predict Compensation

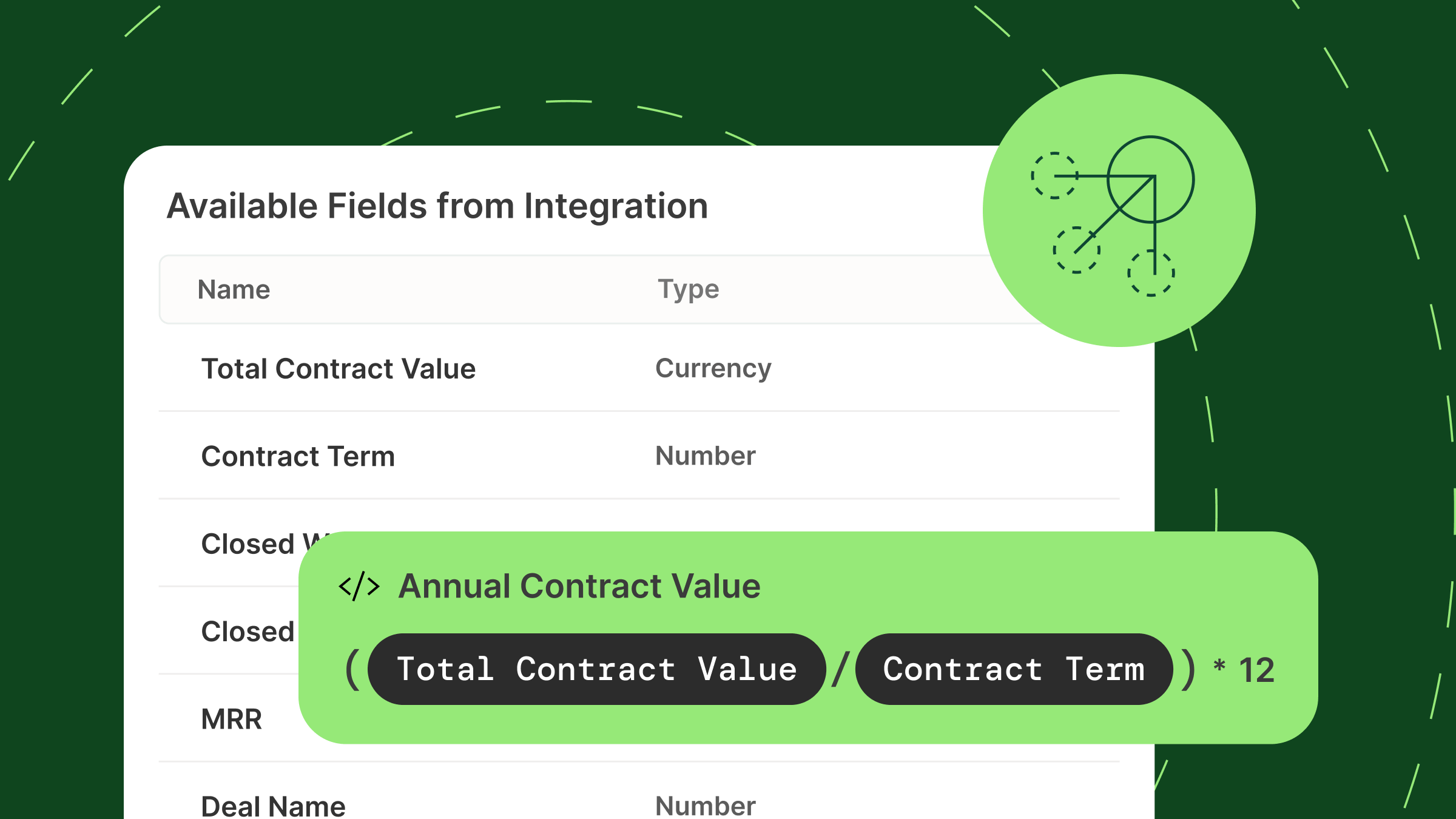

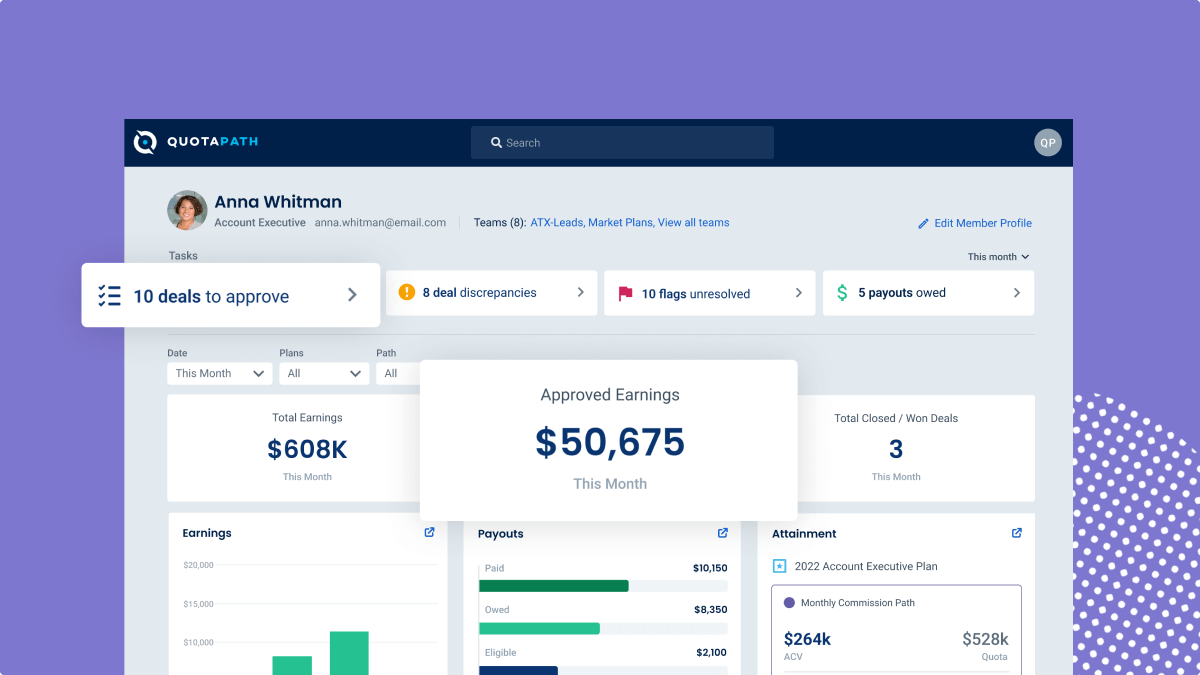

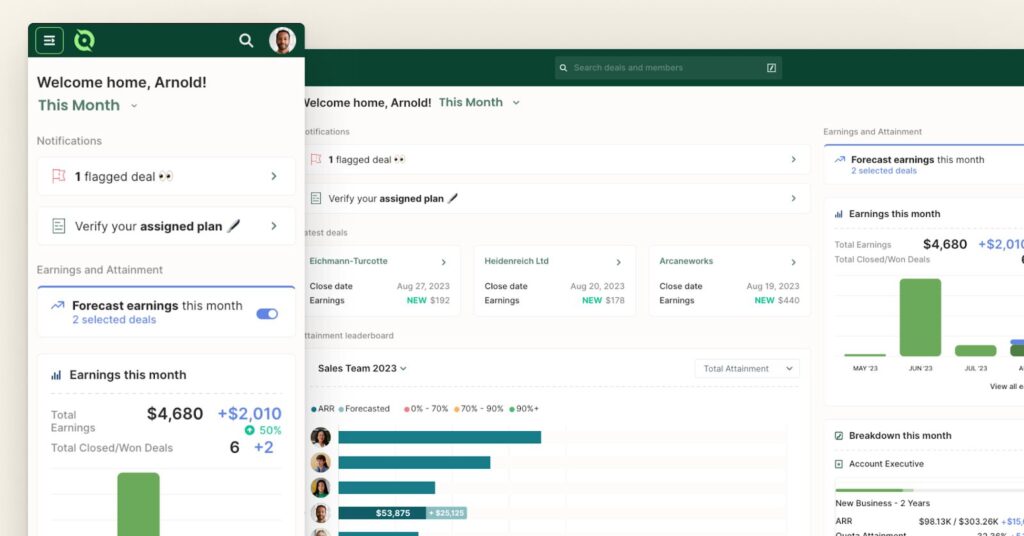

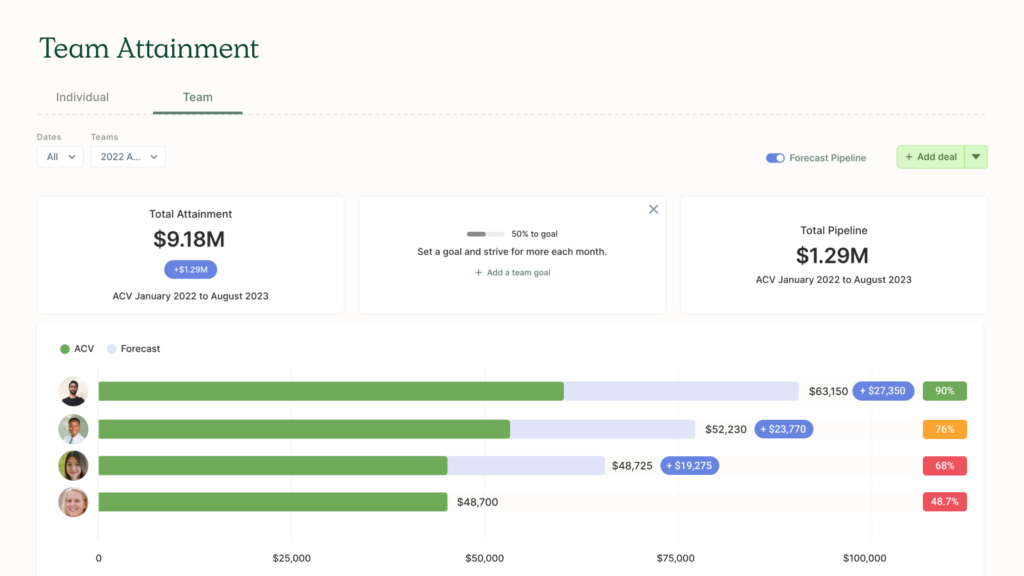

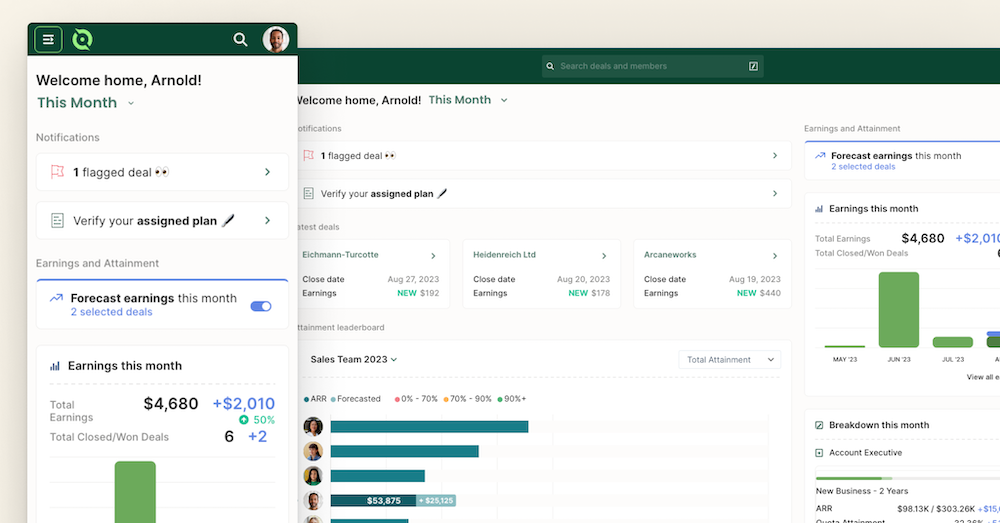

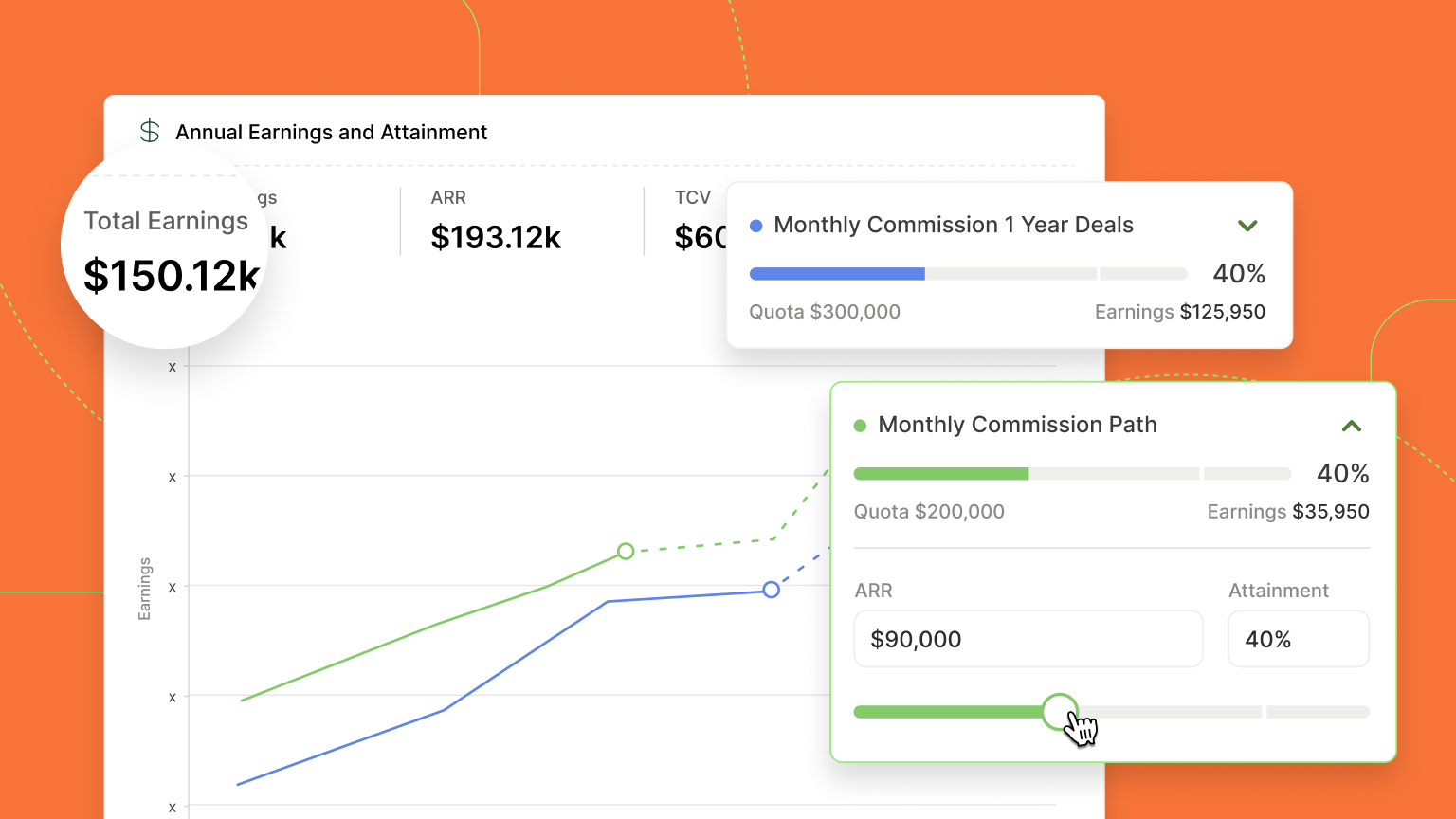

With QuotaPath, plan and predict the cost and performance of your compensation plan before putting it into effect.

Learn MoreUnderstanding AI in Sales Compensation

AI in sales compensation involves leveraging intelligent systems to manage and enhance the reward process for sales teams.

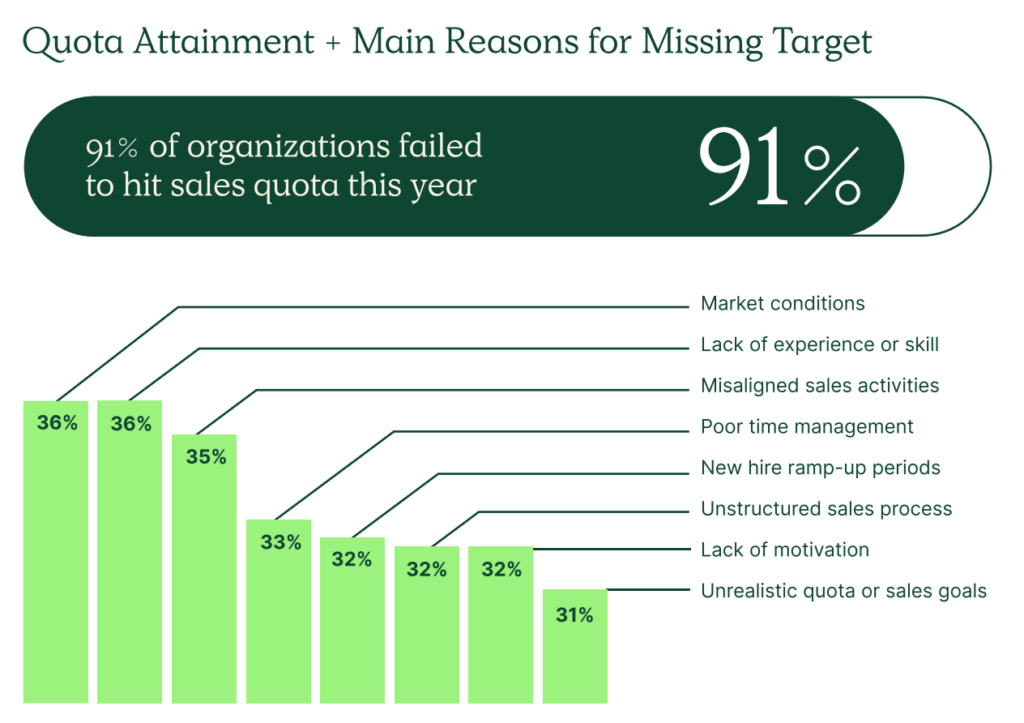

Conventional methods of sales compensation involve manual calculation and distribution, which often result in errors and bias, negatively impacting the morale of the sales personnel.

AI, however, mitigates these issues through algorithms designed to ensure precision, fairness, and adaptability. These algorithms analyze diverse data sets, including sales performance, market trends, and individual targets, to generate compensation plans that motivate and reward appropriately.

This allows AI to transform sales compensation from a mere administrative task to a strategic tool that aligns the sales team’s efforts with the company’s goals.

Why Should You Use AI-Powered Strategies for Compensation Optimization

Just like an AI comic generator saves time and resources while promoting creativity, incorporating AI into your compensation strategies can bring remarkable benefits to your sales operations.

Here are a few reasons why you should consider the shift:

- Enhanced Accuracy: With AI, you’re less likely to encounter errors in commission calculations, which are commonplace in manual processes.

- Real-time Adjustments: AI systems can analyze real-time performance data to see if you need to adjust compensation plans. You could see an immediate reward increase if you’re outperforming your targets.

- Fairness and Transparency: AI removes bias, ensuring each team member is compensated based on their performance. Tech giants like Google are already utilizing AI to analyze and rectify pay disparities.

- Scalability: As your sales team grows, manually managing compensation can become daunting. AI can effortlessly scale up, saving you from hours of administrative work.

- Informed Decision-making: AI’s predictive analytics capability can help plan future compensation strategies. Companies like Adobe use AI to forecast sales and optimize their compensation plans.

- Employee Motivation: By providing a clear and fair link between performance and reward, AI-powered compensation can significantly boost your team’s morale and motivation.

- Cost Savings: Automating tasks associated with compensation management can lead to substantial cost savings. A study by Forbes reported that AI could boost profits by 38% by 2035, partly due to reduced labor costs.

Key AI-Powered Strategies for Compensation Optimization

Now that we’ve seen the benefits of AI in sales compensation, let’s explore 9 strategies to optimize your compensation plan:

1. Predictive Analytics for Sales Performance

The first step to leveraging AI in sales compensation is analyzing your data to identify patterns and trends. By analyzing vast amounts of historical and real-time data, AI can predict future sales performance and guide your compensation strategy.

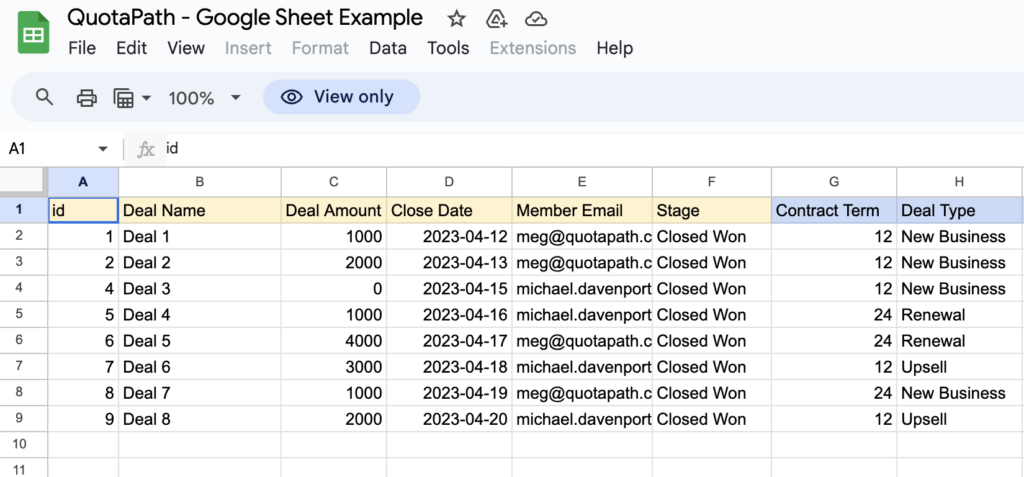

Imagine you’re no longer basing your compensation plans on guesswork and formulas in spreadsheets but on data-driven insights. This can bring a new level of fairness and transparency to your compensation structure.

Moreover, linking performance to compensation becomes seamless with AI. AI algorithms can track individual performances and tie rewards directly to outcomes.

This means if you’re outperforming your peers, your efforts are rewarded appropriately. This strategy motivates your team and fosters a healthy competitive environment.

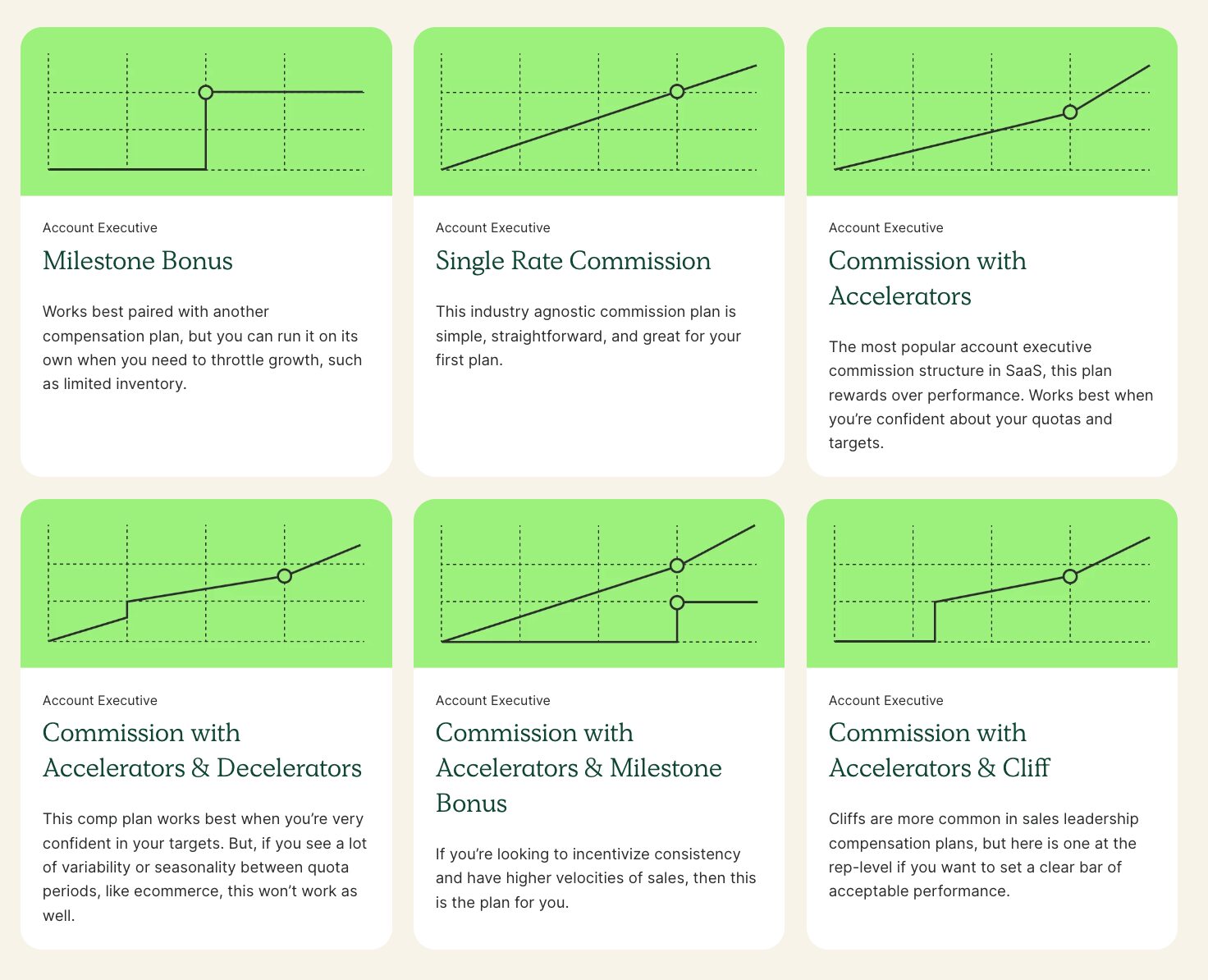

2. Dynamic Commission Structures

Thanks to AI, keeping your commission structures static is a thing of the past. With Artificial Intelligence, you can adapt your commission structures based on real-time insights.

Imagine a scenario where your sales team closes deals left and right, exceeding the targets much earlier than anticipated.

Insights from AI can help flag when it’s necessary to adjust commission rates to reward overperformance. This dynamic approach ensures that your team’s hard work is consistently recognized and rewarded, driving a more productive and motivated sales force.

3. AI-Enhanced Sales Quotas

The third strategy involves leveraging AI to set and adjust sales quotas. Traditional quotas are often based on past performance, industry benchmarks, or guesswork.

AI can offer a more accurate approach by analyzing historical data, current market trends, and individual team members’ capabilities to set realistic, challenging targets.

This strategy ensures that your team is consistently challenged and sets them up for success by providing attainable goals.

4. Real-Time Performance Feedback

Embracing the power of AI doesn’t just enhance your compensation strategies; it also revolutionizes how you give feedback.

Gone are the days of waiting for quarterly or annual reviews. With AI analytics, you can provide your team with real-time performance feedback.

Think of it this way: you are not just telling your team how they’re doing but showing them with tangible data. This enables them to see where they excel and where they can improve, facilitating continuous growth and learning.

Plus, with instant feedback, your team can immediately adjust their strategies and efforts for better results. So, you’re not just motivating with rewards but also encouraging self-improvement

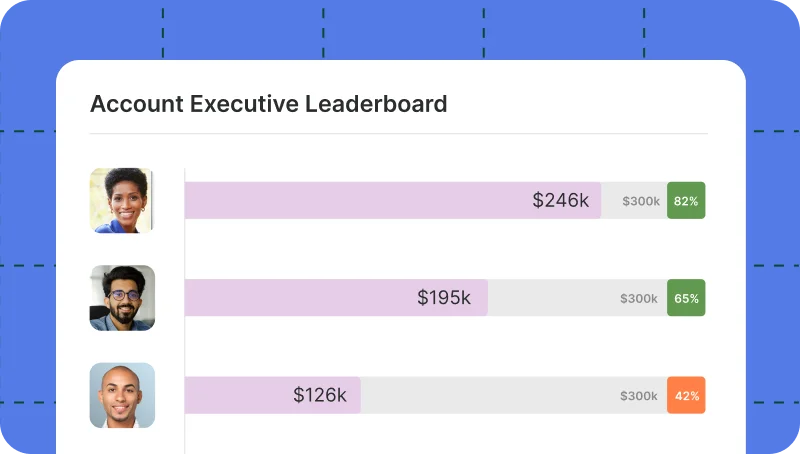

5. Sales Gamification with AI

Sales gamification with AI is another strategy on our list. By incorporating elements of game design, such as competition, challenges, and rewards, into your sales compensation plan, you can significantly boost motivation and engagement levels.

Picture this: your sales reps accumulate points for every customer interaction, deal closed, or target achieved. These points could be redeemed for rewards or recognition, feeding into your compensation plan.

The competitive element also fuels the drive to perform and score higher points. AI comes into play by tracking performance, tallying points, and even offering real-time leaderboards.

Integrating gaming elements into your compensation strategy can keep motivation high and make achieving sales targets more fun!

6. Customer Segmentation for Targeted Sales

In the world of sales, understanding your customers is paramount. But how do you identify your most valuable customer segments? Here’s where AI comes to your rescue.

AI algorithms sift through mountains of customer data, analyzing patterns and behaviors to identify high-value customer segments.

These customers bring the most profit and are most likely to remain loyal. Suddenly, you’re not just shooting in the dark; you’re targeting your efforts where they’ll make the most impact. Your sales outreach and cold emails can be more targeted than ever.

By focusing on high-value customers, you ensure your sales efforts – and subsequently, your sales compensation – are invested wisely. So, you’re not just rewarding sales but smart sales.

7. Adaptive Pricing Strategies

Dynamic pricing, guided by AI algorithms, is another sales game-changer.

Picture this: instead of having fixed prices for your products or services, the prices fluctuate based on various factors such as demand, customer behavior, or even time of day. Sounds complex? Well, that’s where AI steps in.

AI algorithms can analyze these factors in real-time and adjust your pricing strategy accordingly, ensuring you’re always pricing your products competitively. This gives you an edge in the market and maximizes your profits.

So, you’re not just making sales; you’re making smart, profitable sales. And the best part? AI handles all the heavy lifting, so you can focus on what you do best – selling.

8. AI-Powered Sales Coaching

This is one of the most exciting applications of AI in sales compensation. With AI-powered coaching, your team can always access personalized training and guidance on their performance.

By analyzing data from customer interactions, deals closed, and more, AI can identify areas where each needs improvement and provide tailored training modules to help them grow.

This boosts overall team performance and motivation and ensures that each team member has the necessary skills to succeed.

With AI-powered coaching, you’re not just compensating for sales but investing in your team’s growth and development.

9. Better Sales Forecasting

Last but certainly not least, AI can significantly improve sales forecasting. AI algorithms can provide accurate predictions for future sales performance by analyzing past sales data and current market trends.

This enables you to set realistic targets and quotas, adjust your resources and strategies accordingly, and make informed decisions about your sales compensation plan.

With better forecasting comes more precise budgeting and more efficient utilization of resources, leading to better overall results.

So, by integrating AI into your sales compensation plan, you’re not just rewarding for current performance; you’re setting your team up for future success.

Ethical Considerations in AI-Driven Compensation

While AI-driven sales compensation has numerous benefits, it is crucial to consider its ethical implications.

- Transparency: Communicate how the AI assesses performance and determines compensation. This helps to maintain trust and fairness in the system.

- Data Privacy: Ensure that the data used by the AI system is managed responsibly and not used for ulterior motives. Be clear about what data is being collected and how it is used.

- Bias and Discrimination: AI systems are not immune to bias. It is crucial to regularly check and correct any biases in the AI algorithms to avoid unfair treatment or discrimination.

- Responsibility and Accountability: Ultimately, the responsibility for fair and ethical compensation lies with the organization. While AI can aid in objective decision-making, human judgment must be the final determinant in sensitive matters like compensation.

Implementation Challenges and Considerations

Transitioning to AI-driven sales compensation is no small venture, and it comes with its fair share of challenges. It’s important to tread carefully and consider these potential roadblocks:

- Technological Constraints: Does your organization have the necessary technological infrastructure and expertise to implement an AI-powered compensation system? If not, are you ready to make that investment?

- Resistance to Change: People are often wary of changes, especially when it involves something as critical as their compensation. Managing this change effectively is essential, communicating the benefits clearly and providing necessary training and support.

- Complexity of AI: AI algorithms can be complex and sometimes incomprehensible. It’s essential to understand how the AI system works to ensure it’s making fair decisions and to be able to explain it to your team.

- Legal and Regulatory Compliance: Depending on your industry and location, specific legal and regulatory requirements may be related to AI and data usage. Make sure your AI-driven sales compensation system meets these requirements.

Implementing AI in sales compensation requires careful planning and consideration. But the right approach can be a powerful tool to motivate your team, maximize profits, and drive your business forward.

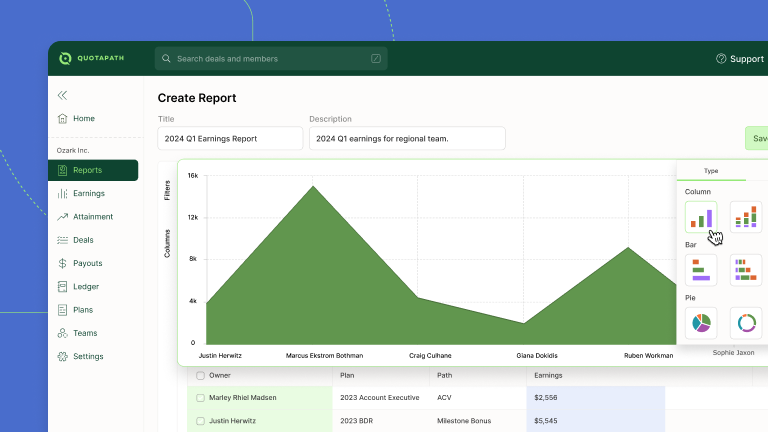

Design, track, and manage variable incentives with QuotaPath. Give your RevOps, finance, and sales teams transparency into sales compensation.

Talk to SalesFuture Trends of AI in Sales Compensation Optimization

As we gaze into the crystal ball, specific trends in AI-enhanced sales compensation start to take shape.

First and foremost, we’re likely to see an ever-increasing adoption of AI across diverse industries. This technology isn’t just a flashy new tool; it’s a game-changer that can boost profitability and productivity like never before.

Secondly, we can expect AI systems to become more intricate and sophisticated; they’ll likely be able to analyze a broader spectrum of data and factors, providing even more precise, tailored compensation strategies.

Lastly, there’s a strong possibility we’ll see a shift towards more transparency in AI operations. As people become more AI-literate, they’ll want to understand how these systems make critical compensation decisions.

Embracing this trend will be vital to maintaining trust and engagement within your team. The future of sales compensation is undeniably tied to AI, and it’s a future that looks bright indeed.

FAQs

Can You Use AI to Set Sales Targets and Quotations?

Yes, AI can set sales targets and quotas by analyzing past sales data and current market trends to provide accurate predictions for future performance. This helps organizations set realistic goals and allocate resources effectively.

Furthermore, AI can continuously analyze performance data to make adjustments in real time as needed. Overall, this results in better forecasting accuracy and improved overall performance.

How Can You Ensure the Ethical Use of AI in Sales Compensation?

To ensure the ethical use of AI in sales compensation, organizations should prioritize transparency and communication about how the system works and its decision-making process. Additionally, responsible data management and regular checks for bias are crucial.

Does Implementing AI in Sales Compensation Require a Lot of Technological Expertise?

It depends on the specific AI system being implemented. Some may require more technological expertise than others, but organizations must have the infrastructure and support to implement and maintain an AI-powered compensation system effectively.

Takeaway

In conclusion, integrating AI in sales compensation holds untold potential to revolutionize your business’s performance and profitability.

It is more than a trend; it’s an actionable strategy that can deliver precise forecasting, efficient resource allocation, and an overall boost in your sales team’s performance.

With its ability to tailor compensation strategies, AI brings fairness, motivation, and transparency into your sales compensation plan.

But remember, this transformation requires careful planning, ethical considerations, and an aptitude for change management.

So, are you ready to redefine your sales compensation strategy with the power of AI? Take the decisive step today – embrace AI and witness a paradigm shift in your sales performance.

Author’s Bio

Paul Aroloye owns the #1 AI Review Blog and helps websites rank on Google. You can reach out to him here.

Recent Comments